Pruning the decision tree

Credit Risk Modeling in R

Lore Dirick

Manager of Data Science Curriculum at Flatiron School

Problems with large decision trees

- Too complex: not clear anymore

- Overfitting when applying to test set

- Solution: use

printcp(),plotcp()for pruning purposes

Printcp and tree_undersample

printcp(tree_undersample)

Classification tree:

rpart(formula = loan_status ~ ., data = undersampled_training_set, method = "class",

control = rpart.control(cp = 0.001))

Variables actually used in tree construction:

age annual_inc emp_cat grade home_ownership ir_cat loan_amnt

Root node error: 2190/6570 = 0.33333

n= 6570

CP nsplit rel error xerror xstd

1 0.0059361 0 1.00000 1.00000 0.017447

2 0.0044140 4 0.97443 0.99909 0.017443

3 0.0036530 7 0.96119 0.98174 0.017366

4 0.0031963 8 0.95753 0.98904 0.017399

...

16 0.0010654 76 0.84247 1.02511 0.017554

17 0.0010000 79 0.83927 1.02511 0.017554

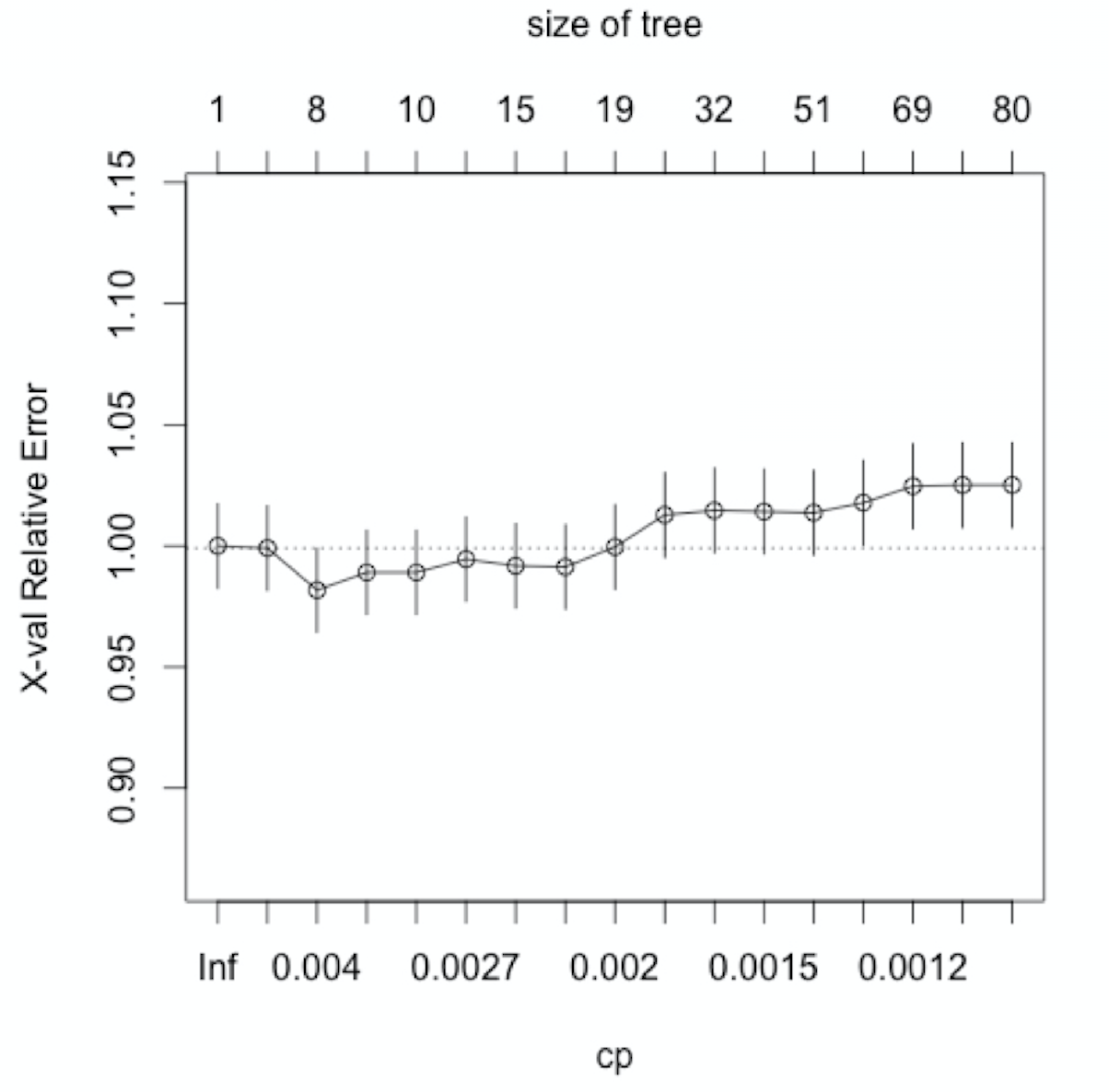

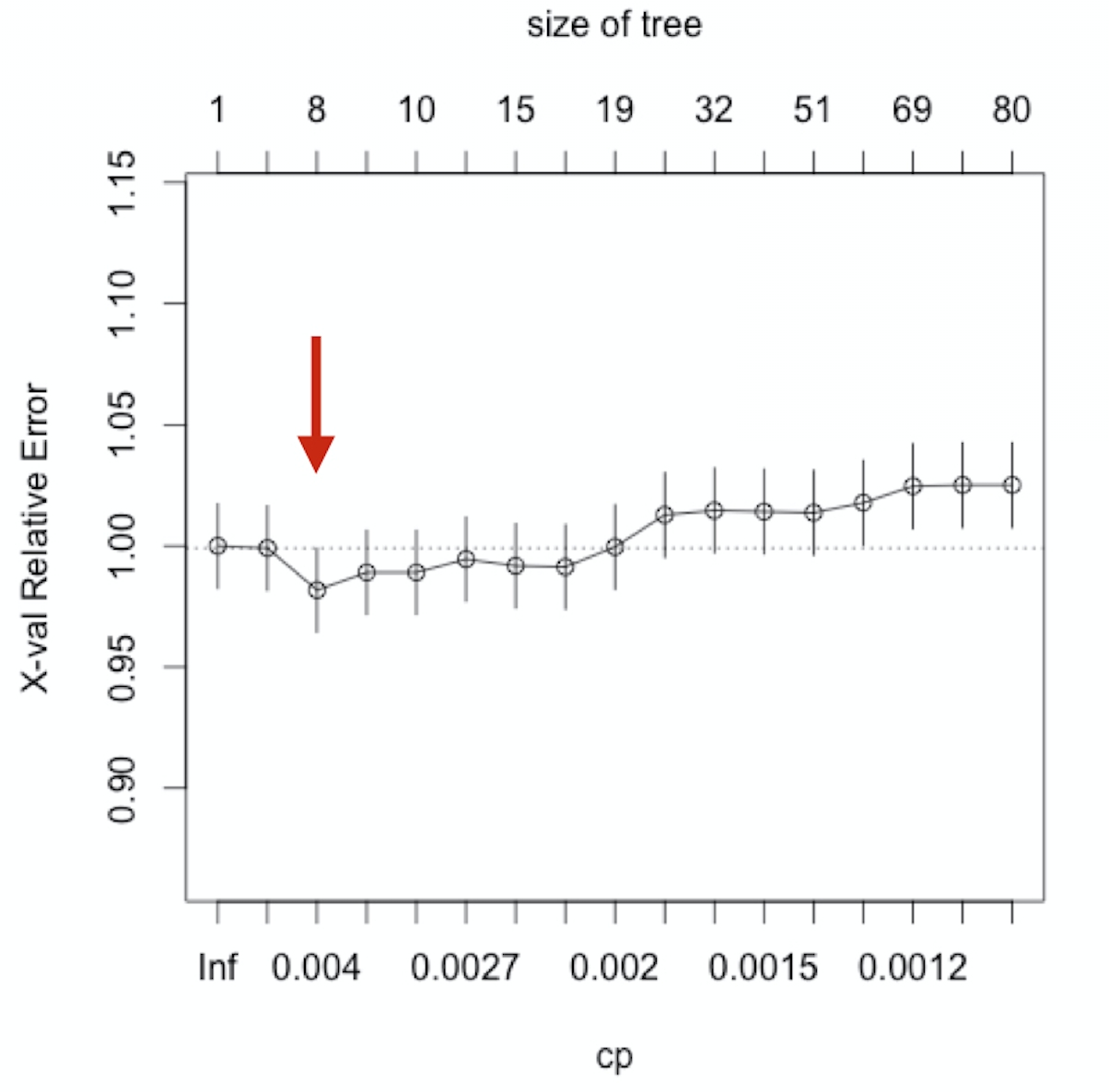

Plotcp and tree_undersample

Plotcp and tree_undersample

$$

$CP = 0.003653$

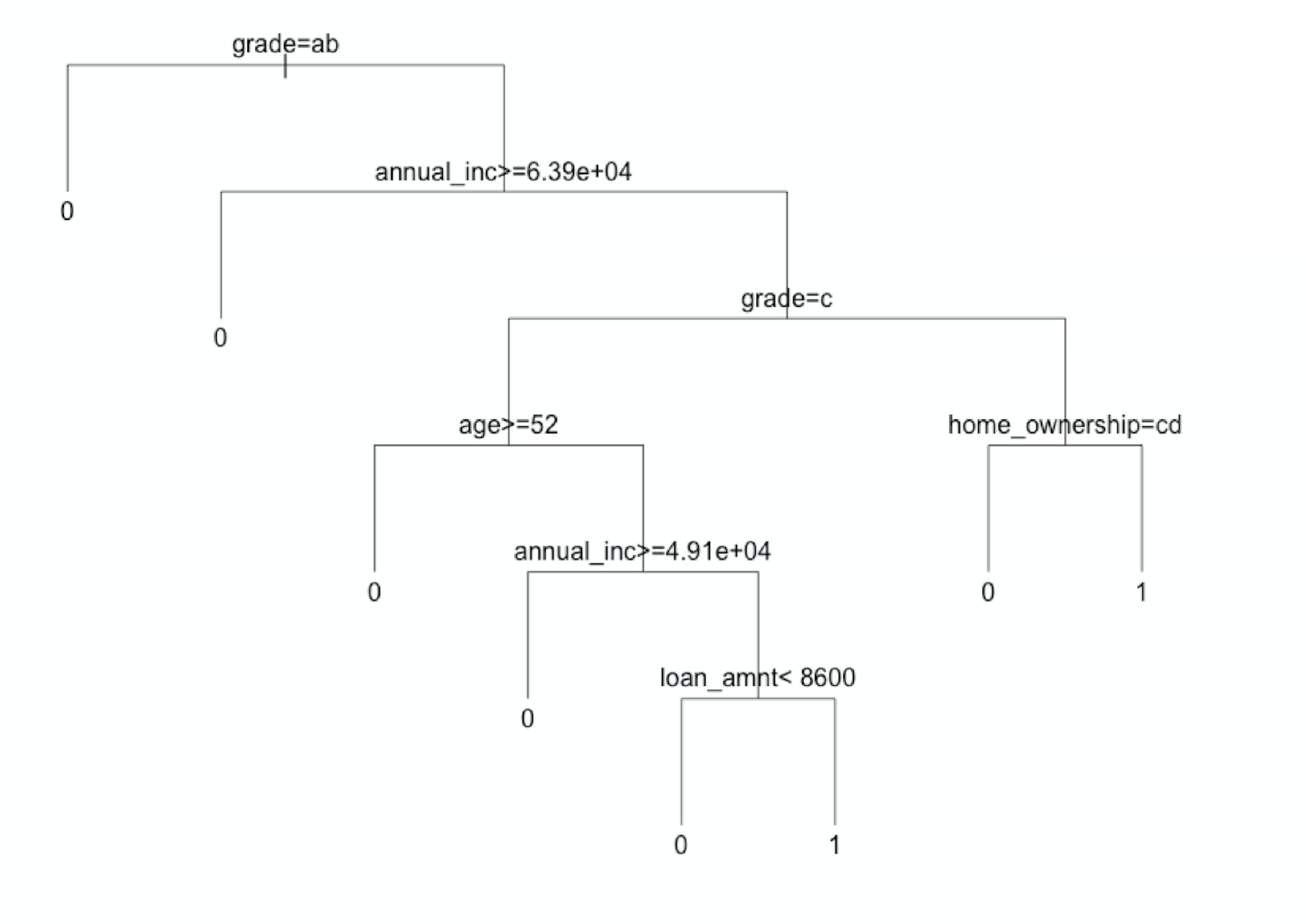

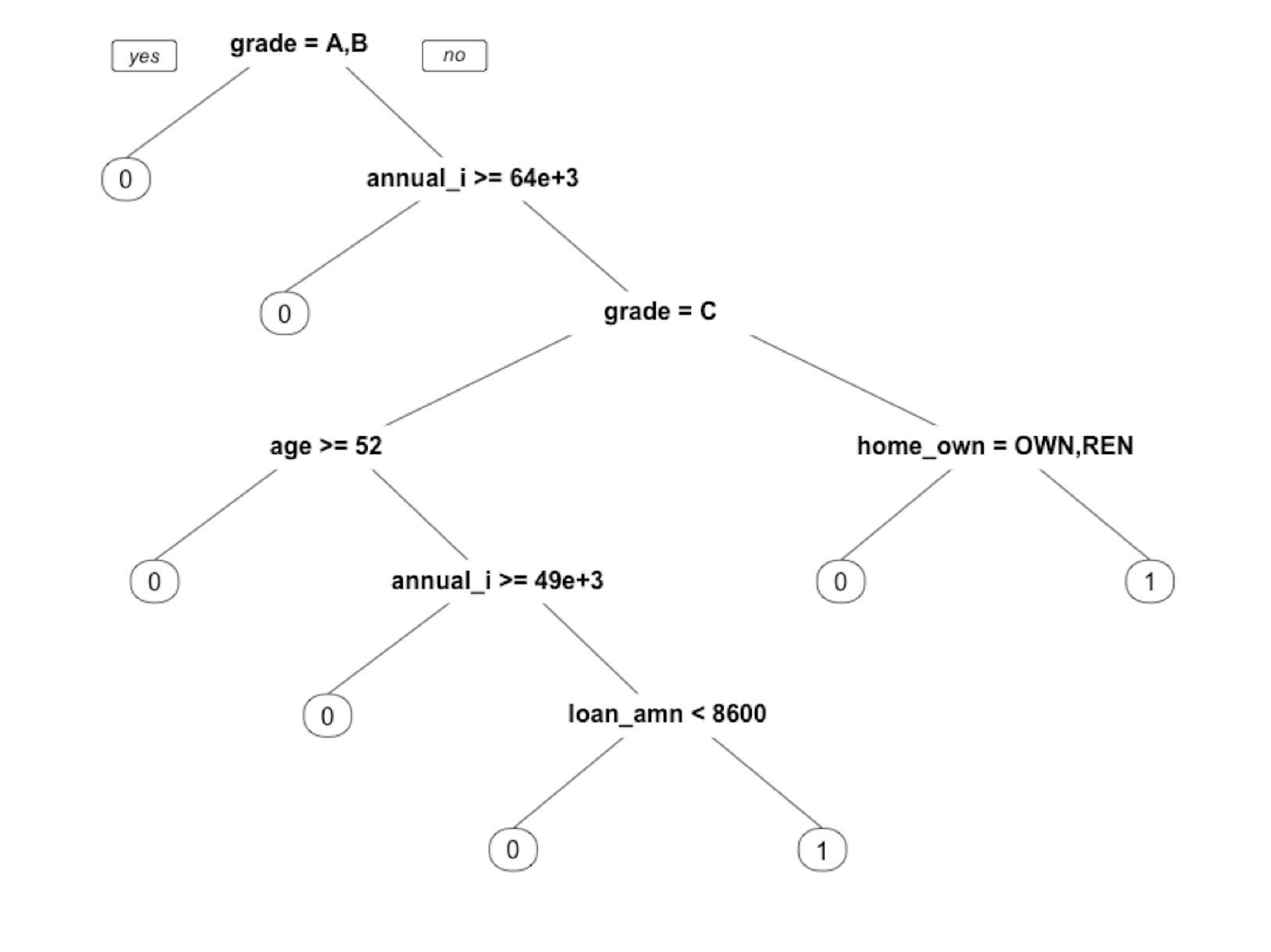

Plot the pruned tree

ptree_undersample=prune(tree_undersample,

cp = 0.003653)

plot(ptree_undersample,

uniform=TRUE)

text(ptree_undersample)

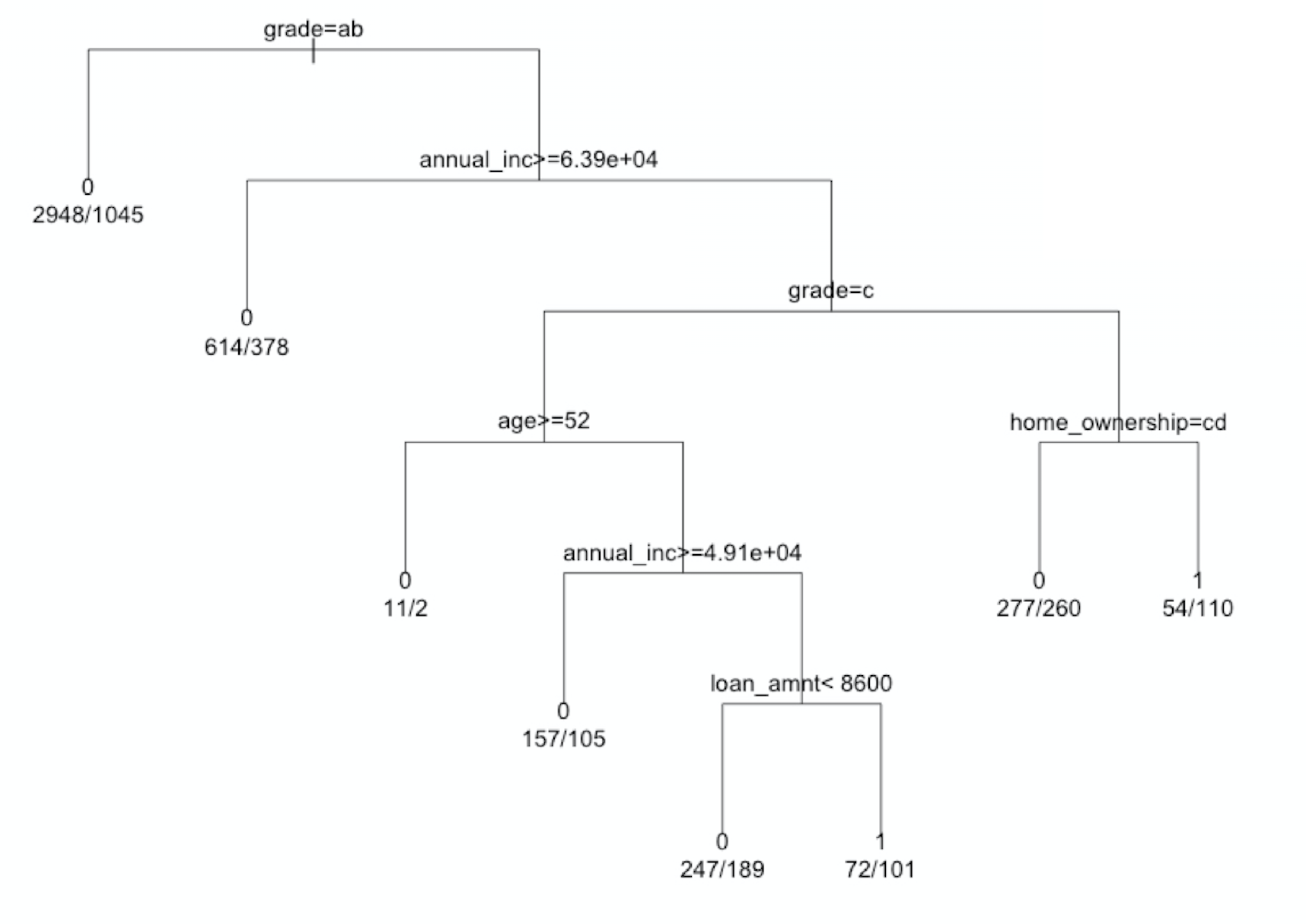

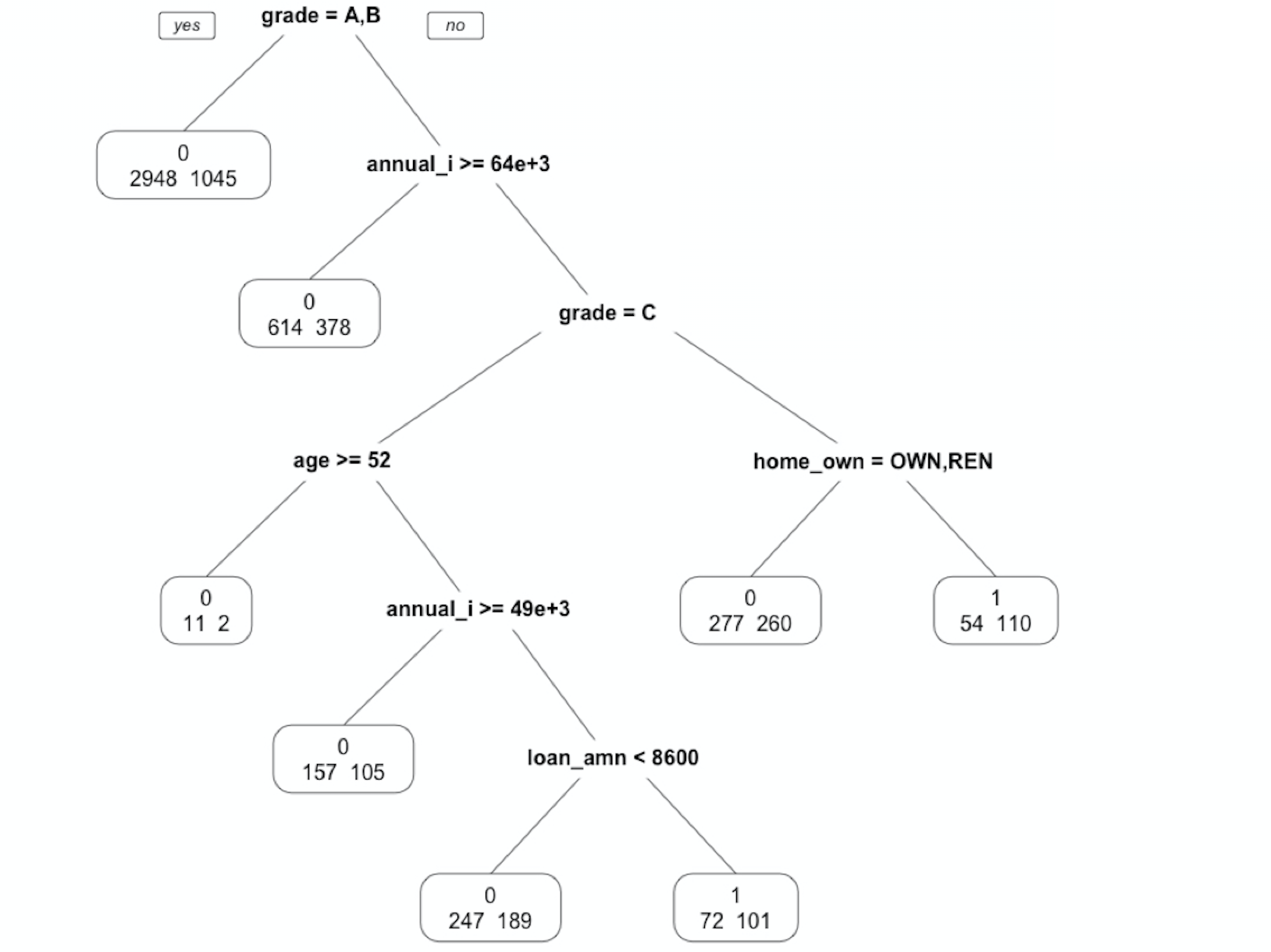

Plot the pruned tree

ptree_undersample=prune(tree_undersample,

cp = 0.003653)

plot(ptree_undersample,

uniform=TRUE)

text(ptree_undersample,

use.n=TRUE)

prp() in the rpart.plot-package

library(rpart.plot)

prp(ptree_undersample)

prp() in the part.plot-package

library(rpart.plot)

prp(ptree_undersample, extra = 1)

Let's practice!

Credit Risk Modeling in R