What is a decision tree?

Credit Risk Modeling in R

Lore Dirick

Manager of Data Science Curriculum at Flatiron School

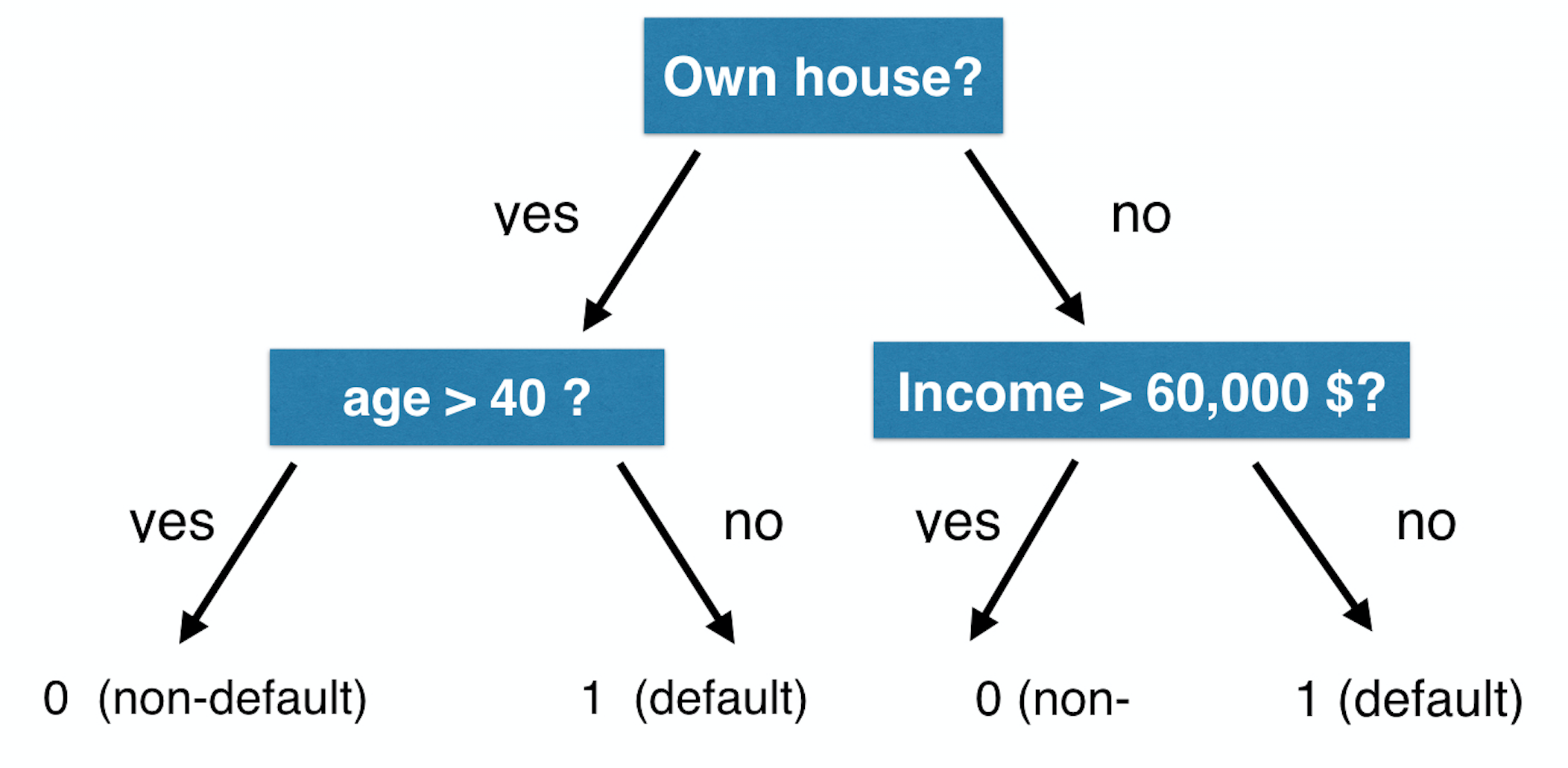

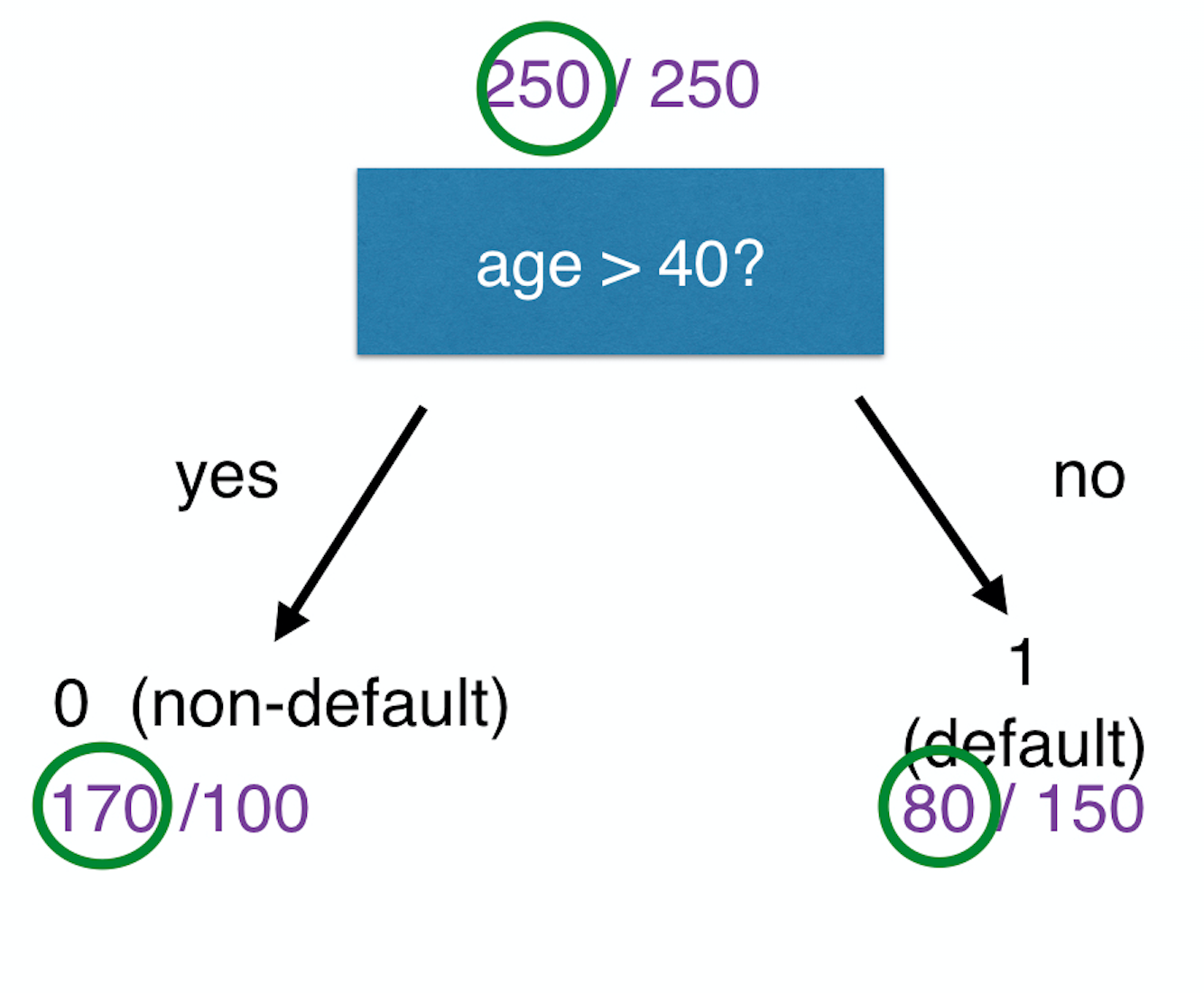

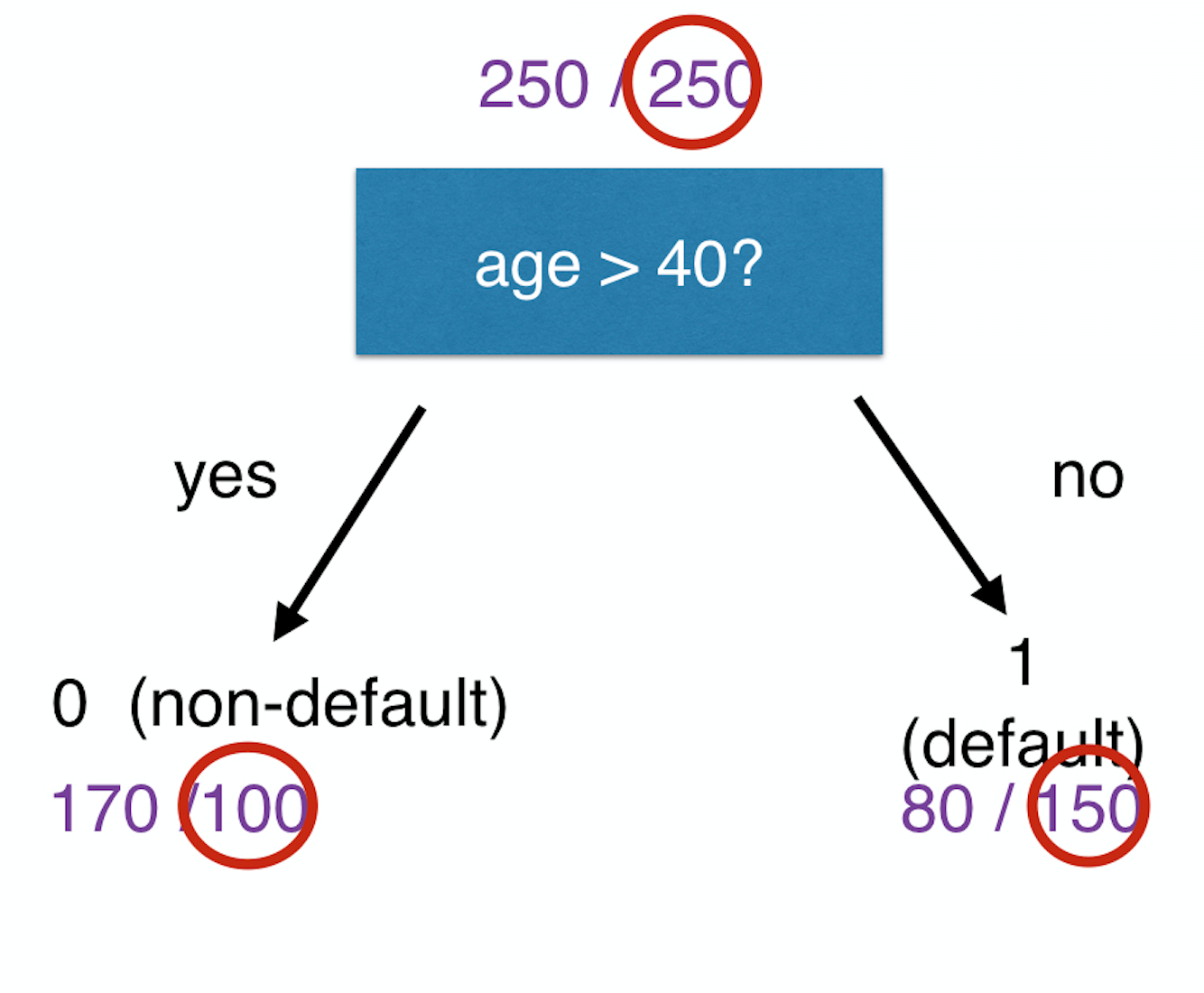

Decision tree example

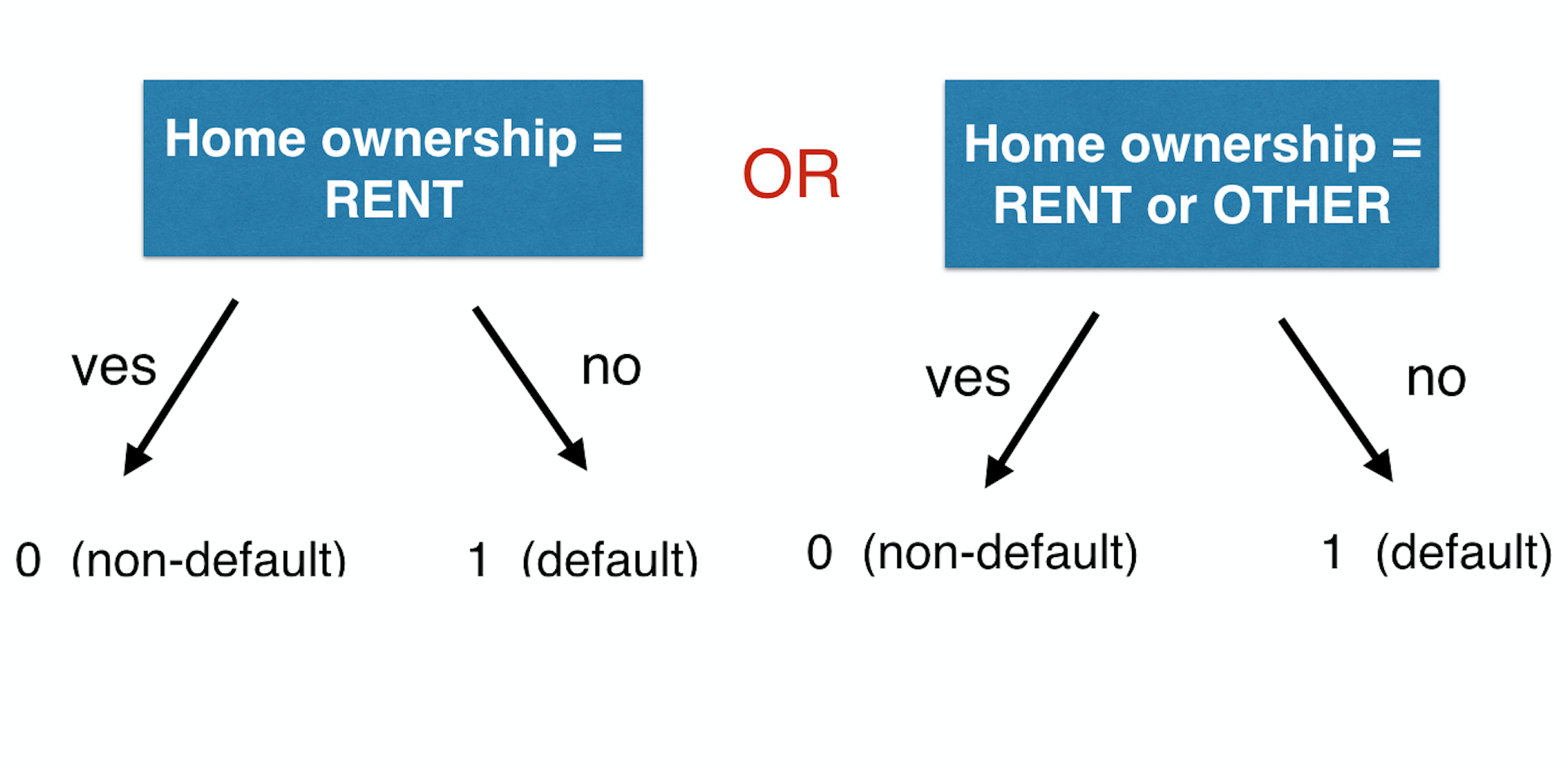

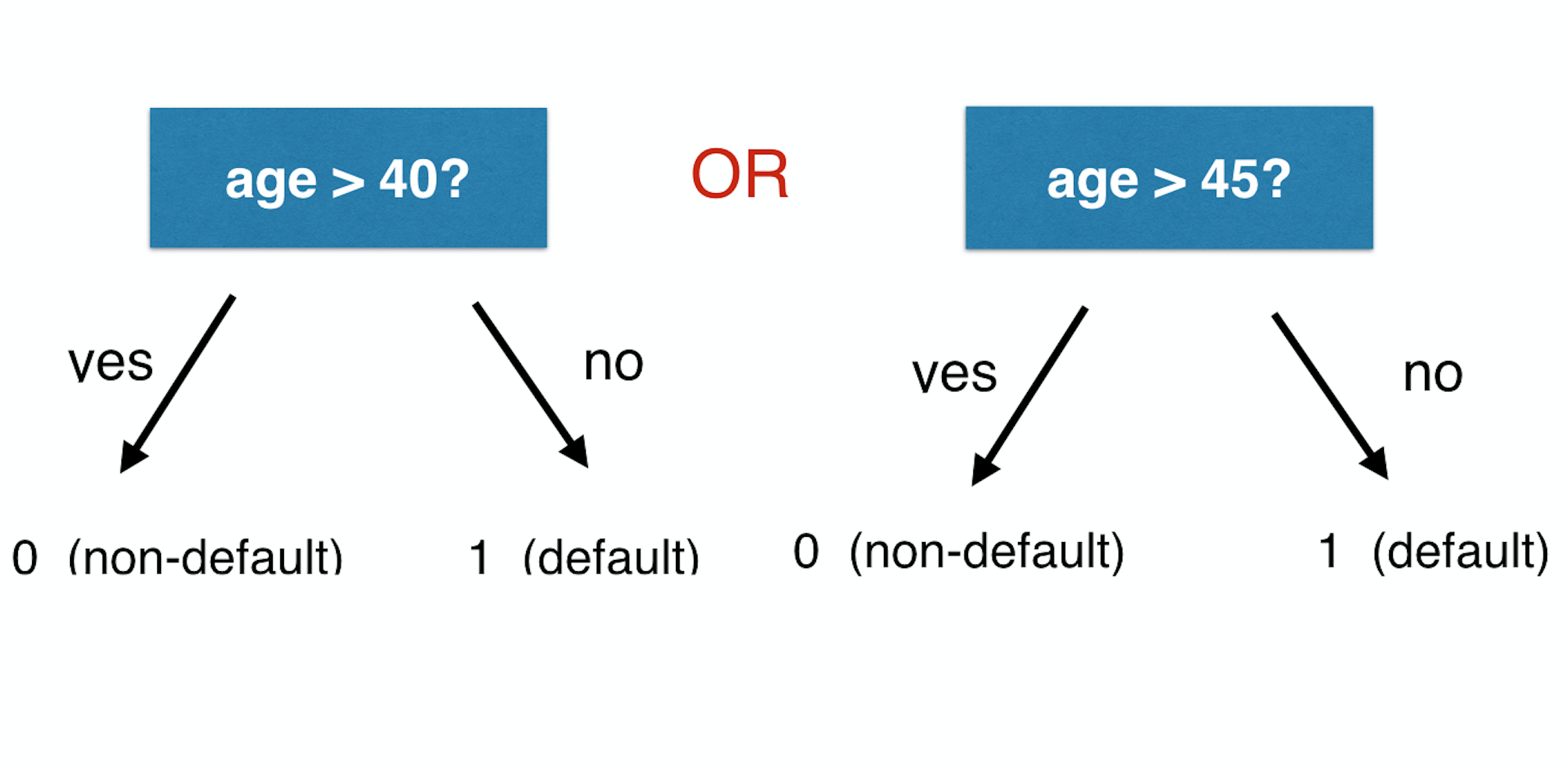

How to make splitting decision?

How to make splitting decision?

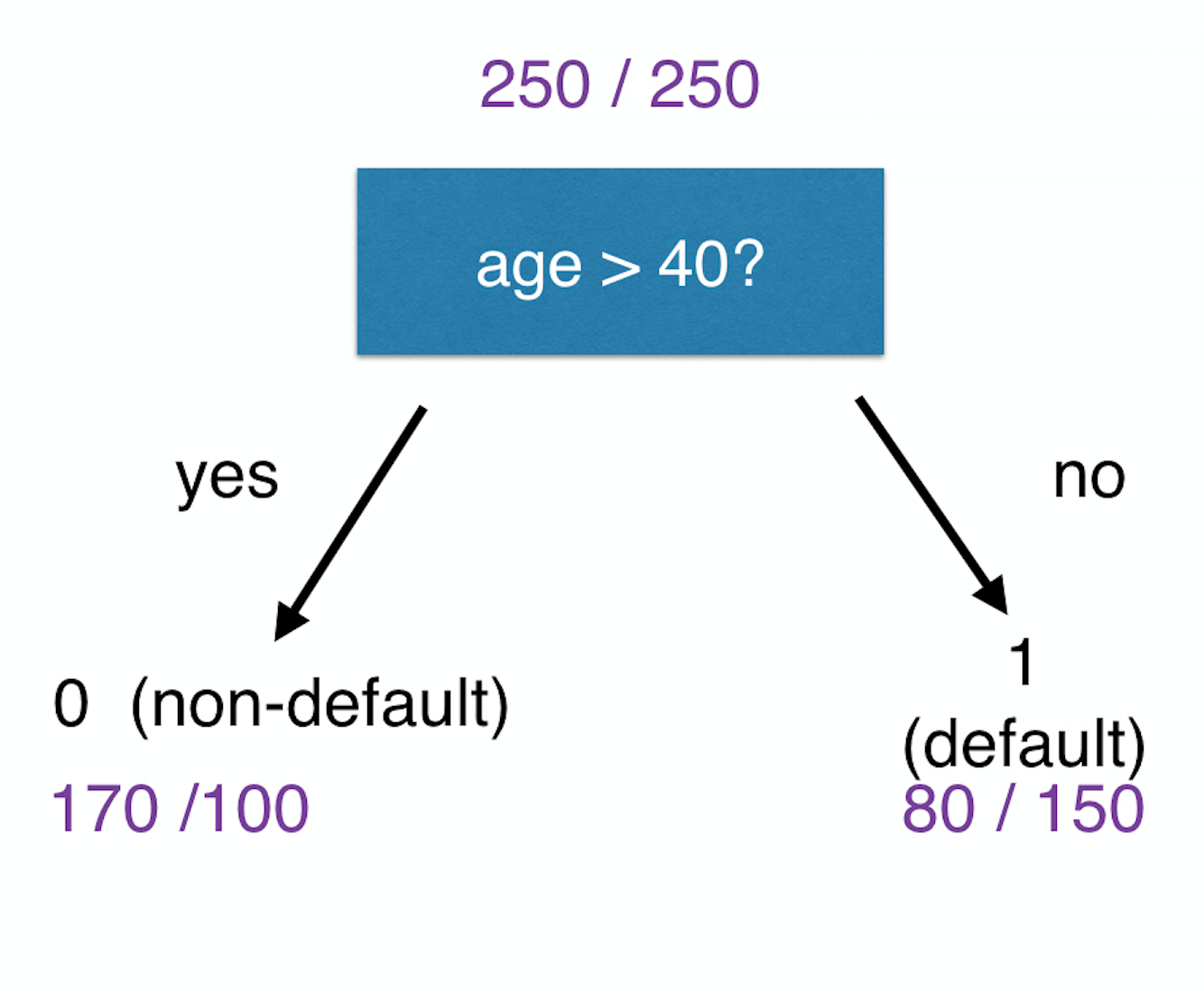

Example

Example

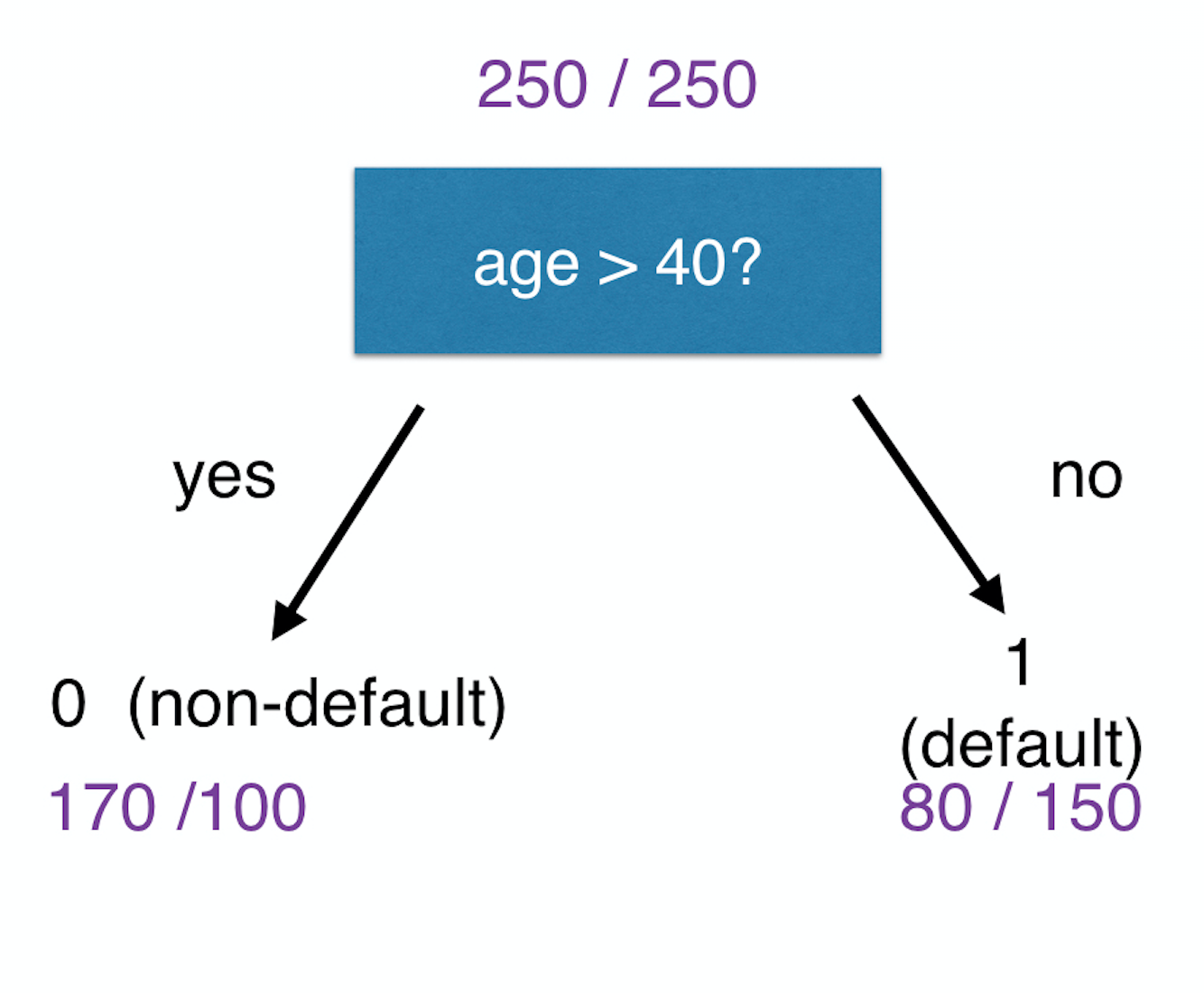

- Actual non-defaults in this node using this split

Example

- Actual defaults in this node using this split

Example

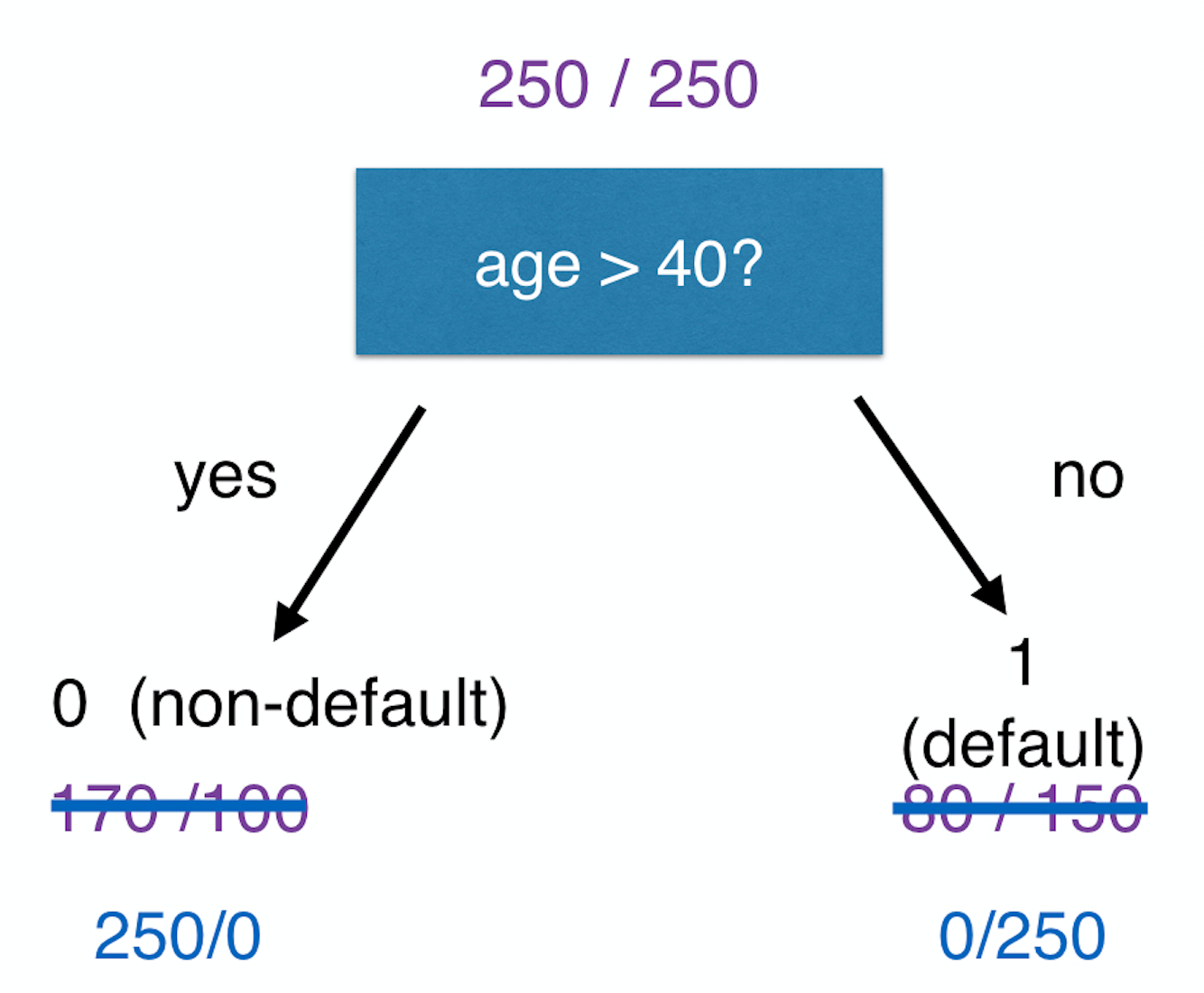

Ideal scenario

Example

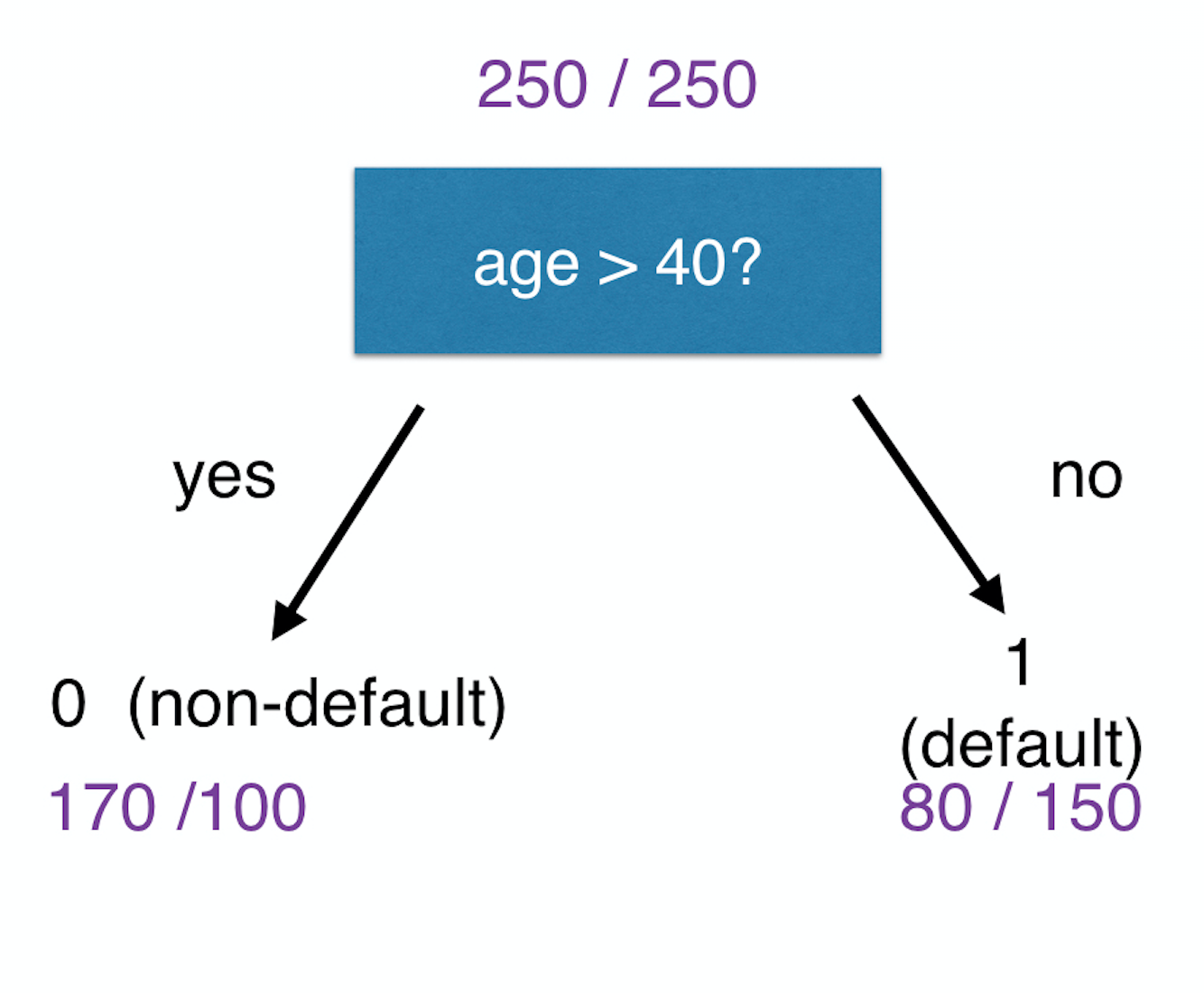

Gini = 2*prop(default)*prop(non-default)

Gini_R = 2*(250/500)*(250/500) = 0.5

Gini_N2 = 2*(80/230)*(150/230) = 0.4536

Gini_N1 = 2*(170/270)*(100/270) = 0.4664

Example

Gain

= Gini_R-prop(cases in N1)*Gini_N1 - prop(cases in N2) * Gini_N2

= 0.5 - 270/500 * 0.4664 - 230/500 * 0.4536

= 0.039488

- Maximum gain

Let's practice!

Credit Risk Modeling in R