Introduction and data structure

Credit Risk Modeling in R

Lore Dirick

Manager of Data Science Curriculum at Flatiron School

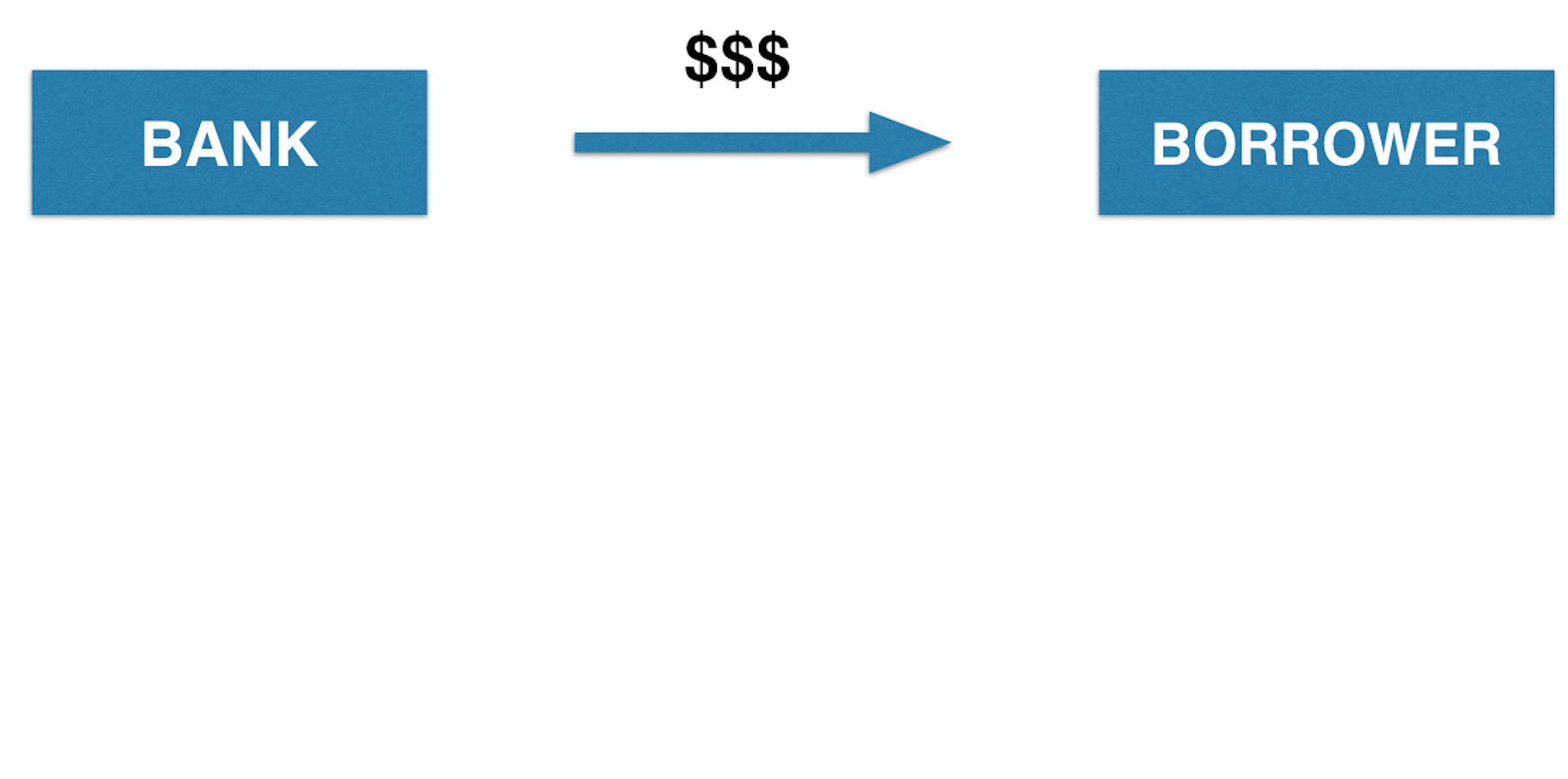

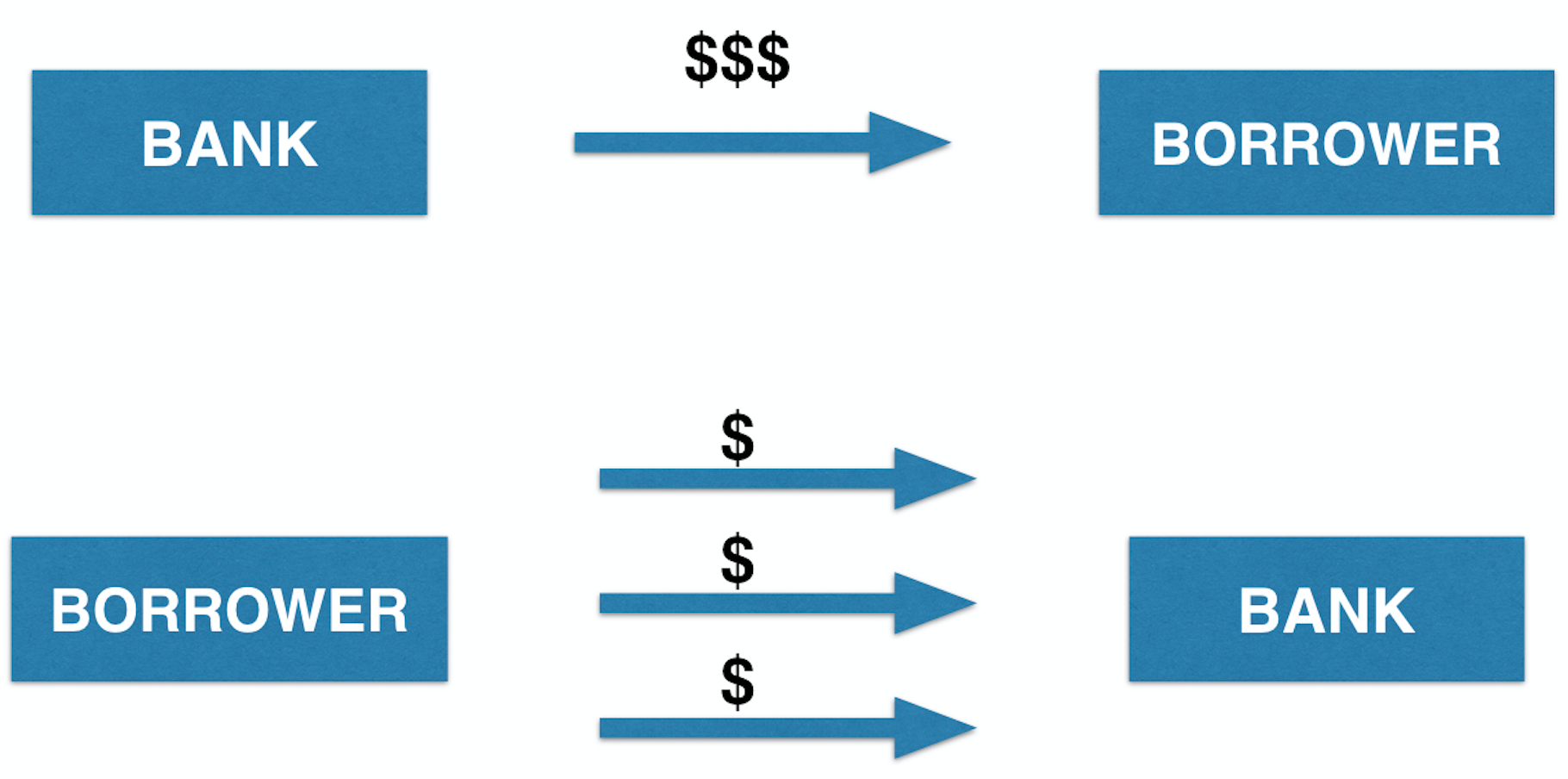

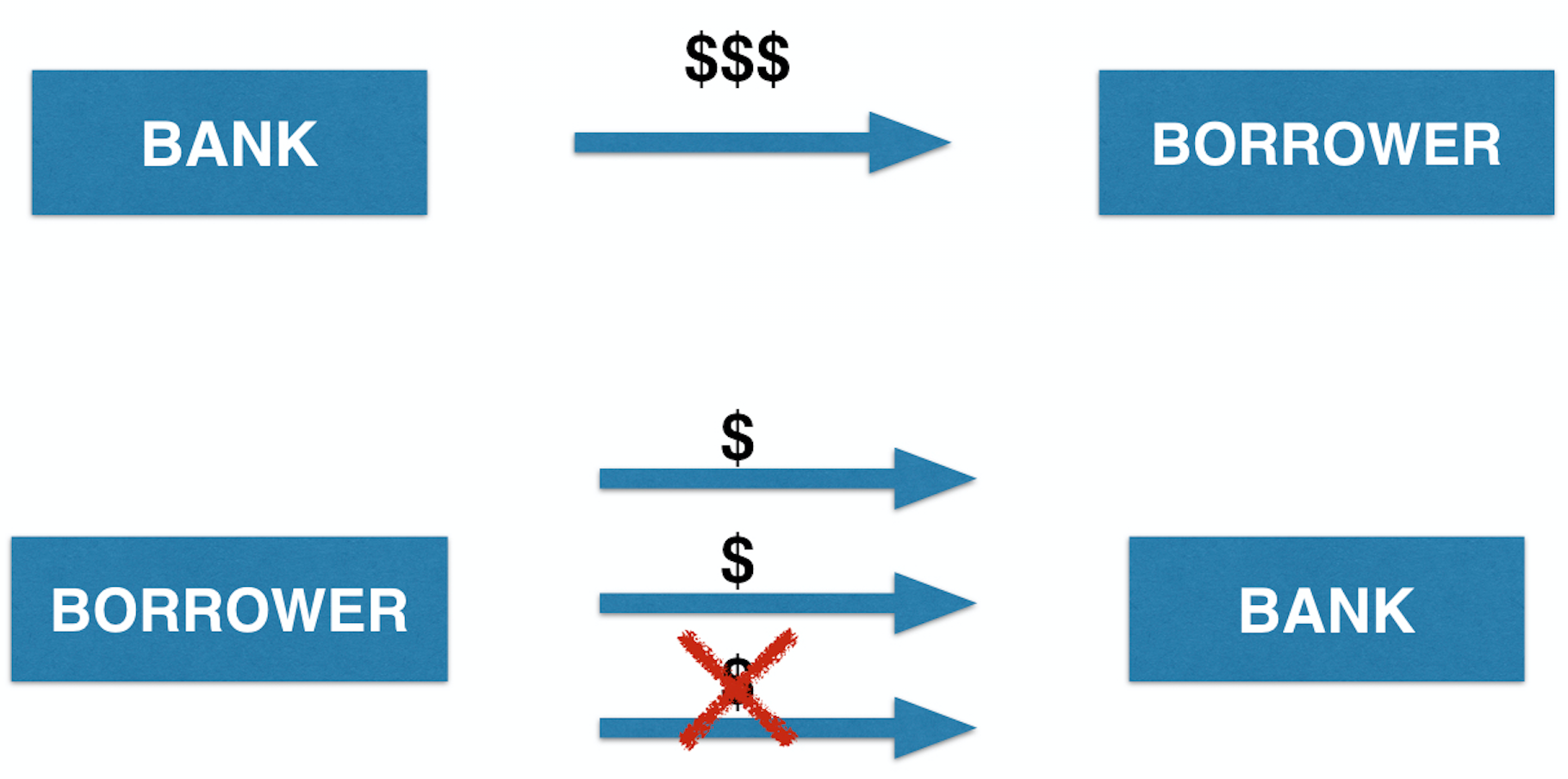

What is loan default?

What is loan default?

What is loan default?

Components of expected loss (EL)

- Probability of default (

PD) - Exposure at default (

EAD) - Loss given default (

LGD)

$$

$$\text{EL}= \text{PD} \times \text{EAD} \times \text{LGD}$$

Components of expected loss (EL)

- Probability of default (

PD) - Exposure at default (

EAD) - Loss given default (

LGD)

$$

$$\text{EL}= \text{PD} \times \text{EAD} \times \text{LGD}$$

Information used by banks

- Application information:

- Income

- Marital status

- ...

- Behavioral information

- Current account balance

- Payment arrears in account history

- ...

head(loan_data, 10)

loan_status loan_amnt int_rate grade emp_length home_ownership annual_inc age

1 0 5000 10.65 B 10 RENT 24000 33

2 0 2400 NA C 25 RENT 12252 31

3 0 10000 13.49 C 13 RENT 49200 24

4 0 5000 NA A 3 RENT 36000 39

5 0 3000 NA E 9 RENT 48000 24

6 0 12000 12.69 B 11 OWN 75000 28

7 1 9000 13.49 C 0 RENT 30000 22

8 0 3000 9.91 B 3 RENT 15000 22

9 1 10000 10.65 B 3 RENT 100000 28

10 0 1000 16.29 D 0 RENT 28000 22

library(gmodels)

CrossTable(loan_data$home_ownership)

Cell Contents

|-------------------------|

| N |

| N / Table Total |

|-------------------------|

Total Observations in Table: 29092

| MORTGAGE | OTHER | OWN | RENT |

|-----------|-----------|-----------|-----------|

| 12002 | 97 | 2301 | 14692 |

| 0.413 | 0.003 | 0.079 | 0.505 |

|-----------|-----------|-----------|-----------|

CrossTable(loan_data$home_ownership, loan_data$loan_status, prop.r = TRUE,

prop.c = FALSE, prop.t = FALSE, prop.chisq = FALSE)

| loan_data$loan_status

loan_data$home_ownership | 0 | 1 | Row Total |

------------------------|-----------|-----------|-----------|

MORTGAGE | 10821 | 1181 | 12002 |

| 0.902 | 0.098 | 0.413 |

------------------------|-----------|-----------|-----------|

OTHER | 80 | 17 | 97 |

| 0.825 | 0.175 | 0.003 |

------------------------|-----------|-----------|-----------|

OWN | 2049 | 252 | 2301 |

| 0.890 | 0.110 | 0.079 |

------------------------|-----------|-----------|-----------|

RENT | 12915 | 1777 | 14692 |

| 0.879 | 0.121 | 0.505 |

------------------------|-----------|-----------|-----------|

Column Total | 25865 | 3227 | 29092 |

Let's practice!

Credit Risk Modeling in R