Missing data and coarse classification

Credit Risk Modeling in R

Lore Dirick

Manager of Data Science Curriculum at Flatiron School

Outlier deleted

loan_status loan_amnt int_rate grade emp_length home_ownership annual_inc age

0 5000 12.73 C 12 MORTGAGE 6000000 144

Missing inputs

loan_status loan_amnt int_rate grade emp_length home_ownership annual_inc age

... ... ... ... ... ... ... ... ...

125 0 6000 14.27 C 14 MORTGAGE 94800 23

126 1 2500 7.51 A NA OWN 12000 21

127 0 13500 9.91 B 2 MORTGAGE 36000 30

128 0 25000 12.42 B 2 RENT 225000 30

129 0 10000 NA C 2 RENT 45900 65

130 0 2500 13.49 C 4 RENT 27200 26

... ... ... ... ... ... ... ... ...

2108 0 8000 7.90 A 8 RENT 64000 24

2109 0 12000 8.90 A 0 RENT 38400 26

2110 0 4000 NA A 7 RENT 48000 30

2111 0 7000 9.91 B 20 MORTGAGE 130000 30

2112 0 7600 6.03 A 41 MORTGAGE 70920 28

2113 0 10000 11.71 B 5 RENT 48132 22

2114 0 8000 6.62 A 17 OWN 42000 24

2115 0 4475 NA B NA OWN 15000 23

2116 0 5750 8.90 A 3 RENT 17000 21

2117 0 4900 6.03 A 12 MORTGAGE 77000 27

… … … … … … … … …

Missing inputs

summary(loan_data$emp_length)

Min. 1st Qu. Median Mean 3rd Qu. Max. NA's

0.000 2.000 4.000 6.145 8.000 62.000 809

Missing inputs: strategies

- Delete row/column

- Replace

- Keep

Delete rows

index_NA <- which(is.na(loan_data$emp_length)

loan_data_no_NA <- loan_data[-c(index_NA), ]

loan_status loan_amnt int_rate grade emp_length home_ownership annual_inc age

... ... ... ... ... ... ... ... ...

125 0 6000 14.27 C 14 MORTGAGE 94800 23

126 1 2500 7.51 A NA OWN 12000 21

127 0 13500 9.91 B 2 MORTGAGE 36000 30

128 0 25000 12.42 B 2 RENT 225000 30

129 0 10000 NA C 2 RENT 45900 65

130 0 2500 13.49 C 4 RENT 27200 26

... ... ... ... ... ... ... ... ...

2112 0 7600 6.03 A 41 MORTGAGE 70920 28

2113 0 10000 11.71 B 5 RENT 48132 22

2114 0 8000 6.62 A 17 OWN 42000 24

2115 0 4475 NA B NA OWN 15000 23

2116 0 5750 8.90 A 3 RENT 17000 21

... ... ... ... ... ... ... ... ...

Delete column

loan_data_delete_employ <- loan_data

loan_data_delete_employ$emp_length <- NULL

loan_status loan_amnt int_rate grade home_ownership annual_inc age

... ... ... ... ... ... ... ...

125 0 6000 14.27 C MORTGAGE 94800 23

126 1 2500 7.51 A OWN 12000 21

127 0 13500 9.91 B MORTGAGE 36000 30

128 0 25000 12.42 B RENT 225000 30

129 0 10000 NA C RENT 45900 65

130 0 2500 13.49 C RENT 27200 26

... ... ... ... ... ... ... ...

2112 0 7600 6.03 A MORTGAGE 70920 28

2113 0 10000 11.71 B RENT 48132 22

2114 0 8000 6.62 A OWN 42000 24

2115 0 4475 NA B OWN 15000 23

2116 0 5750 8.90 A RENT 17000 21

... ... ... ... ... ... ... ...

Replace: median imputation

index_NA <- which(is.na(loan_data$emp_length)

loan_data_replace <- loan_data

loan_data_replace$emp_length[index_NA] <- median(loan_data$emp_length, na.rm = TRUE)

loan_status loan_amnt int_rate grade emp_length home_ownership annual_inc age

... ... ... ... ... ... ... ... ...

125 0 6000 14.27 C 14 MORTGAGE 94800 23

126 1 2500 7.51 A NA OWN 12000 21

127 0 13500 9.91 B 2 MORTGAGE 36000 30

128 0 25000 12.42 B 2 RENT 225000 30

129 0 10000 NA C 2 RENT 45900 65

130 0 2500 13.49 C 4 RENT 27200 26

... ... ... ... ... ... ... ... ...

2112 0 7600 6.03 A 41 MORTGAGE 70920 28

2113 0 10000 11.71 B 5 RENT 48132 22

2114 0 8000 6.62 A 17 OWN 42000 24

2115 0 4475 NA B NA OWN 15000 23

2116 0 5750 8.90 A 3 RENT 17000 21

... ... ... ... ... ... ... ... ...

Replace: median imputation

index_NA <- which(is.na(loan_data$emp_length)

loan_data_replace <- loan_data

loan_data_replace$emp_length[index_NA] <- median(loan_data$emp_length, na.rm = TRUE)

loan_status loan_amnt int_rate grade emp_length home_ownership annual_inc age

... ... ... ... ... ... ... ... ...

125 0 6000 14.27 C 14 MORTGAGE 94800 23

126 1 2500 7.51 A 4 OWN 12000 21

127 0 13500 9.91 B 2 MORTGAGE 36000 30

128 0 25000 12.42 B 2 RENT 225000 30

129 0 10000 NA C 2 RENT 45900 65

130 0 2500 13.49 C 4 RENT 27200 26

... ... ... ... ... ... ... ... ...

2112 0 7600 6.03 A 41 MORTGAGE 70920 28

2113 0 10000 11.71 B 5 RENT 48132 22

2114 0 8000 6.62 A 17 OWN 42000 24

2115 0 4475 NA B 4 OWN 15000 23

2116 0 5750 8.90 A 3 RENT 17000 21

... ... ... ... ... ... ... ... ...

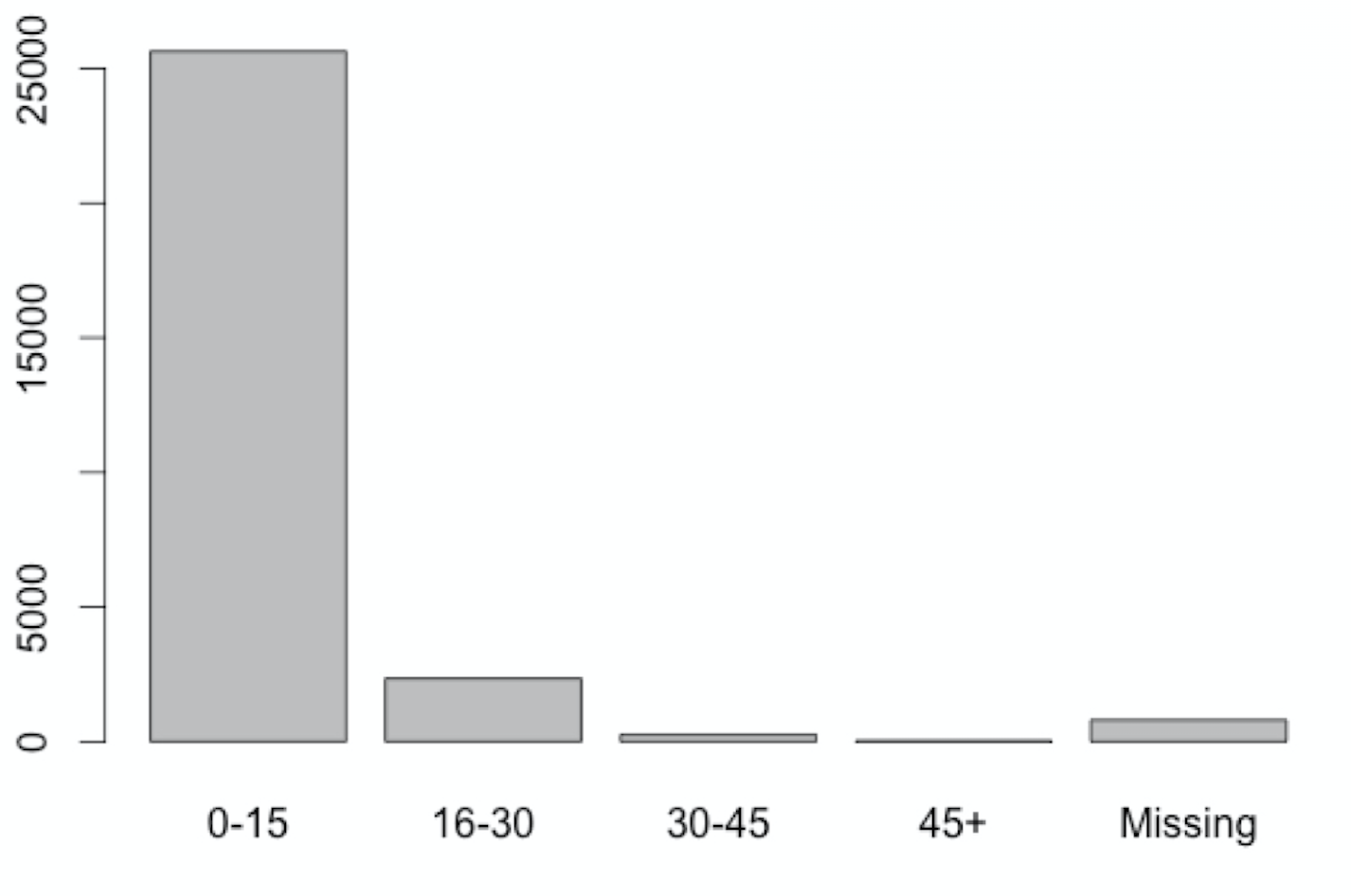

Keep

- Keep

NA - Problem: will cause row deletions for many models

- Solution: coarse classification, put variable in "bins"

- New variable

emp_cat - Range: 0-62 years → make bins of +/- 15 years

- Categories: "0-15", "15-30", "30-45", "45+", "missing"

- New variable

Keep: coarse classification

loan_status loan_amnt int_rate grade emp_length home_ownership annual_inc age

... ... ... ... ... ... ... ... ...

125 0 6000 14.27 C 14 MORTGAGE 94800 23

126 1 2500 7.51 A NA OWN 12000 21

127 0 13500 9.91 B 2 MORTGAGE 36000 30

128 0 25000 12.42 B 2 RENT 225000 30

129 0 10000 NA C 2 RENT 45900 65

130 0 2500 13.49 C 4 RENT 27200 26

... ... ... ... ... ... ... ... ...

2112 0 7600 6.03 A 41 MORTGAGE 70920 28

2113 0 10000 11.71 B 5 RENT 48132 22

2114 0 8000 6.62 A 17 OWN 42000 24

2115 0 4475 NA B NA OWN 15000 23

2116 0 5750 8.90 A 3 RENT 17000 21

... ... ... ... ... ... ... ... ...

Keep: coarse classification

loan_status loan_amnt int_rate grade emp_cat home_ownership annual_inc age

... ... ... ... ... ... ... ... ...

125 0 6000 14.27 C 0-15 MORTGAGE 94800 23

126 1 2500 7.51 A Missing OWN 12000 21

127 0 13500 9.91 B 0-15 MORTGAGE 36000 30

128 0 25000 12.42 B 0-15 RENT 225000 30

129 0 10000 NA C 0-15 RENT 45900 65

130 0 2500 13.49 C 0-15 RENT 27200 26

... ... ... ... ... ... ... ... ...

2112 0 7600 6.03 A 30-45 MORTGAGE 70920 28

2113 0 10000 11.71 B 0-15 RENT 48132 22

2114 0 8000 6.62 A 15-30 OWN 42000 24

2115 0 4475 NA B Missing OWN 15000 23

2116 0 5750 8.90 A 0-15 RENT 17000 21

... ... ... ... ... ... ... ... ...

Bin frequencies

plot(loan_data$emp_cat)

emp_cat

...

0-15

Missing

0-15

0-15

0-15

0-15

...

30-45

0-15

15-30

Missing

0-15

...

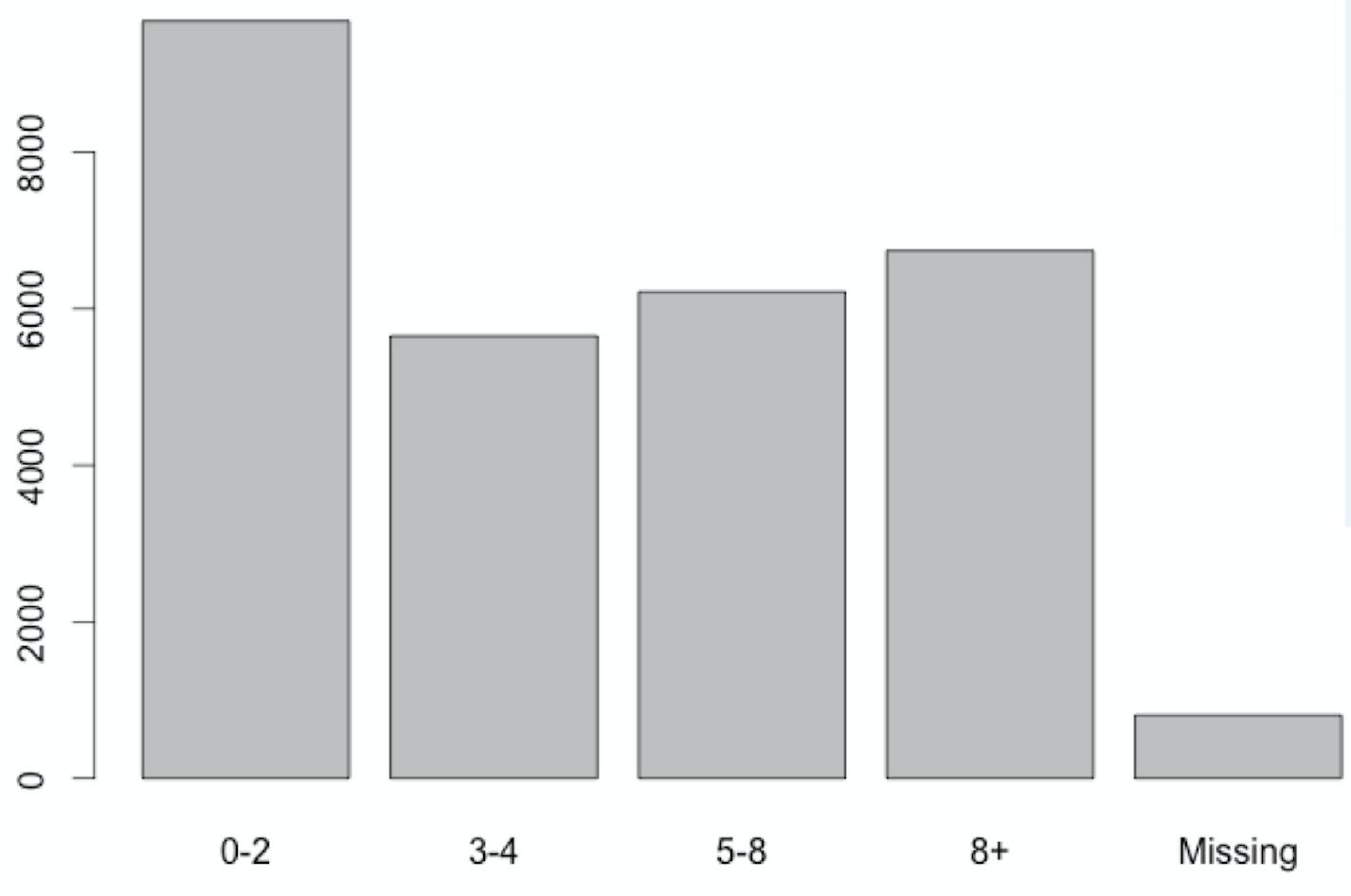

Bin frequencies

plot(loan_data$emp_cat)

emp_cat

...

8+

Missing

0-2

0-2

0-2

3-4

...

8+

5-8

8+

Missing

3-4

...

Final remarks

- Treat outliers as

NAs

Final remarks

- Treat outliers as

NAs

$$

| CONTINUOUS | CATEGORICAL | |

|---|---|---|

| DELETE | Delete rows (observations with NAs) Delete column (entire variable) |

Delete rows (observations with NAs) Delete column (entire variable) |

| REPLACE | Replace using median | Replace using most frequent category |

| KEEP | Keep as NA (not always possible) Keep using coarse classification |

NA category |

Let's practice!

Credit Risk Modeling in R