Data splitting and confusion matrices

Credit Risk Modeling in R

Lore Dirick

Manager of Data Science Curriculum at Flatiron School

Start analysis

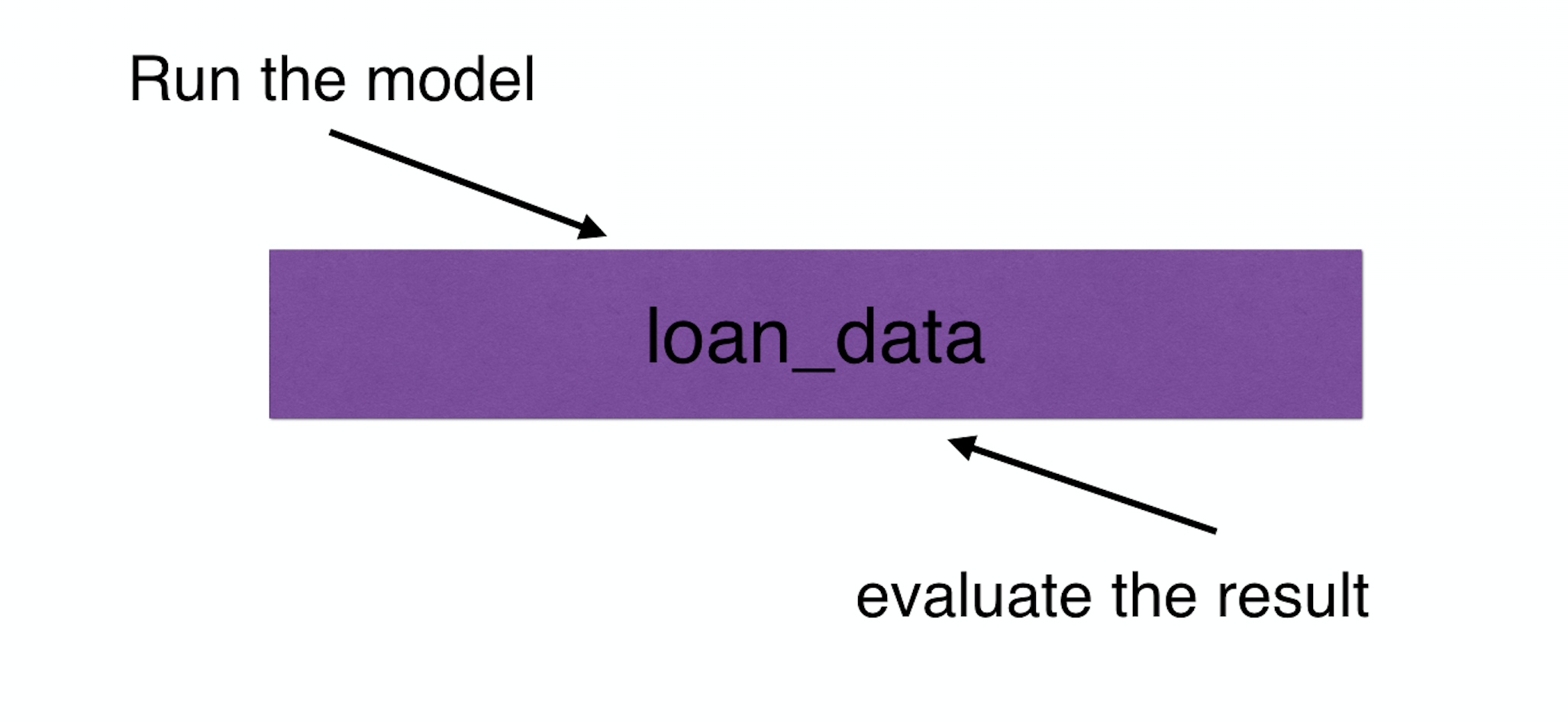

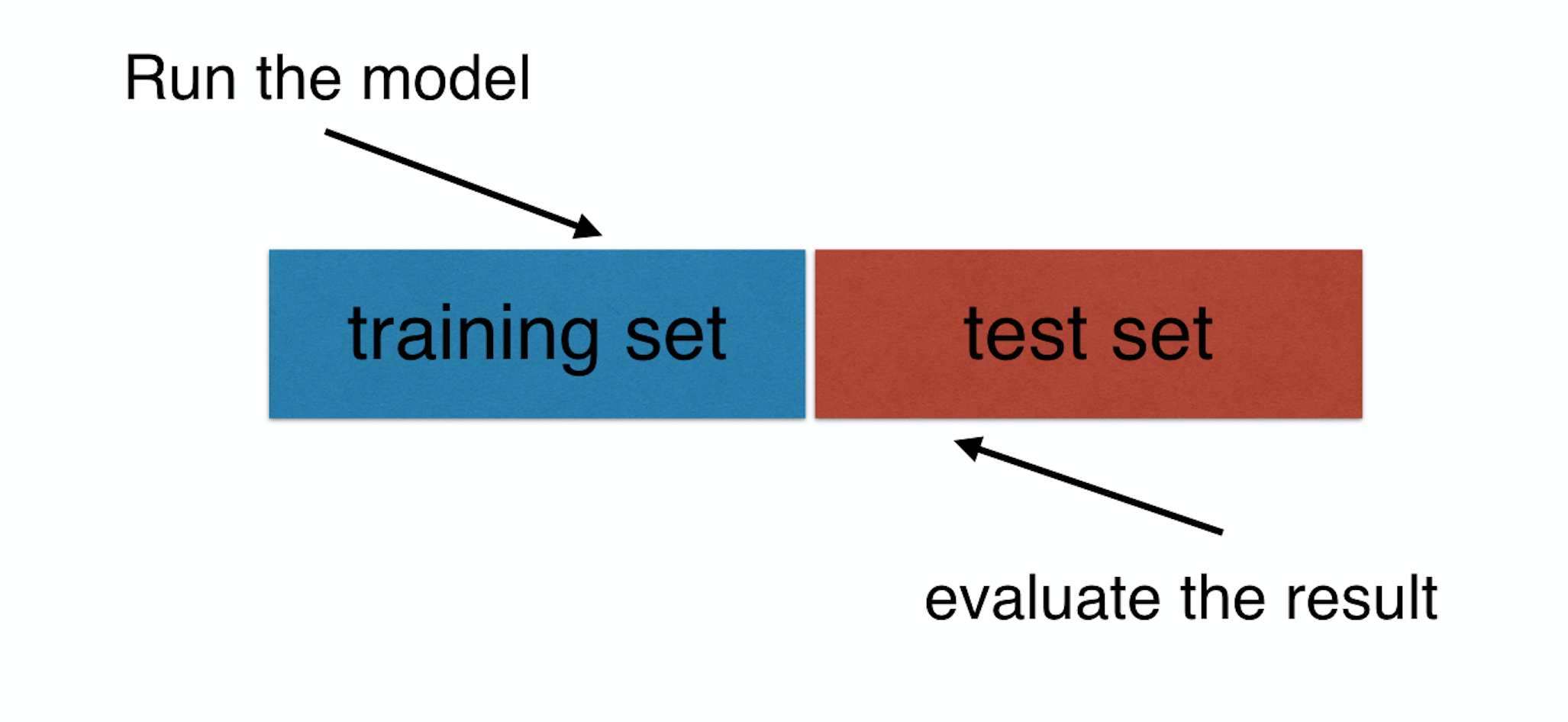

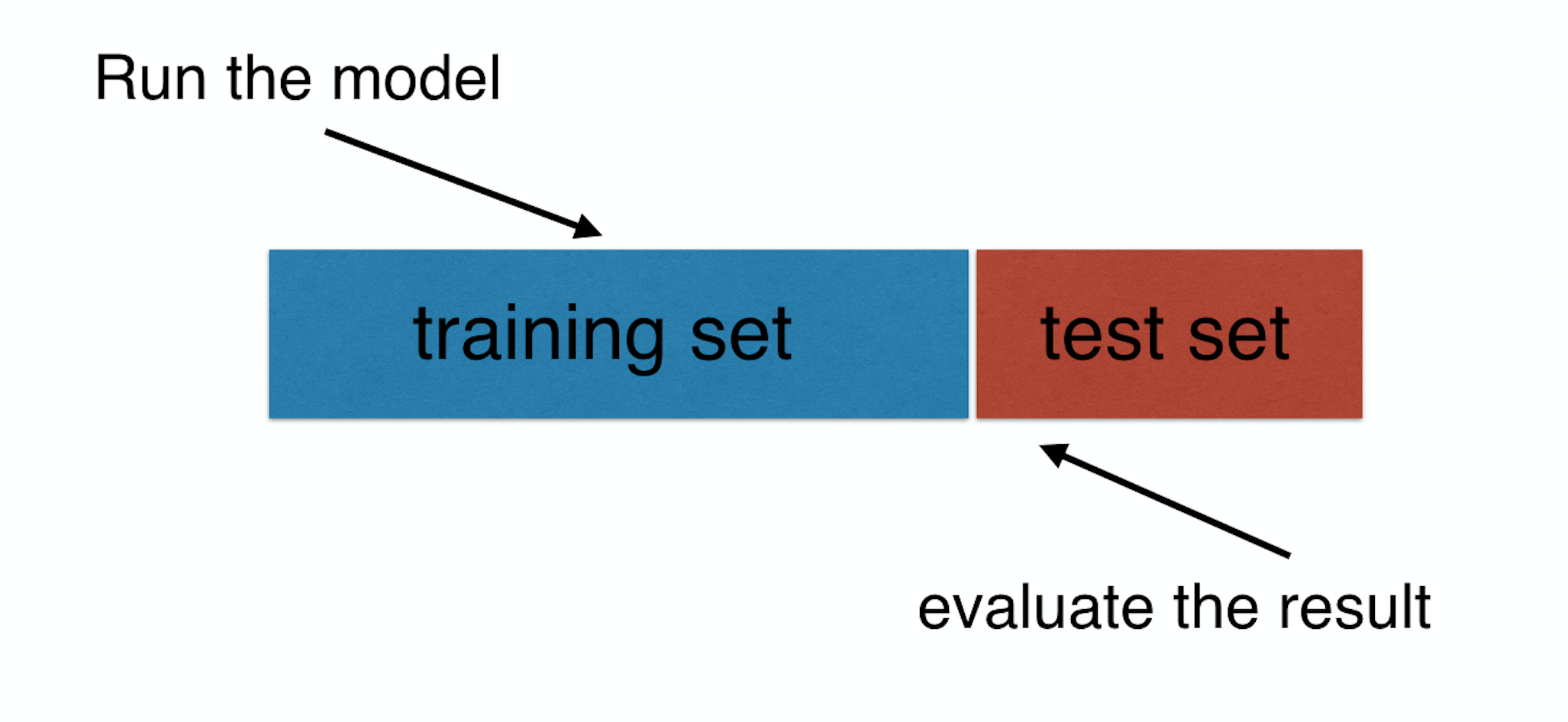

Training and test set

Training and test set

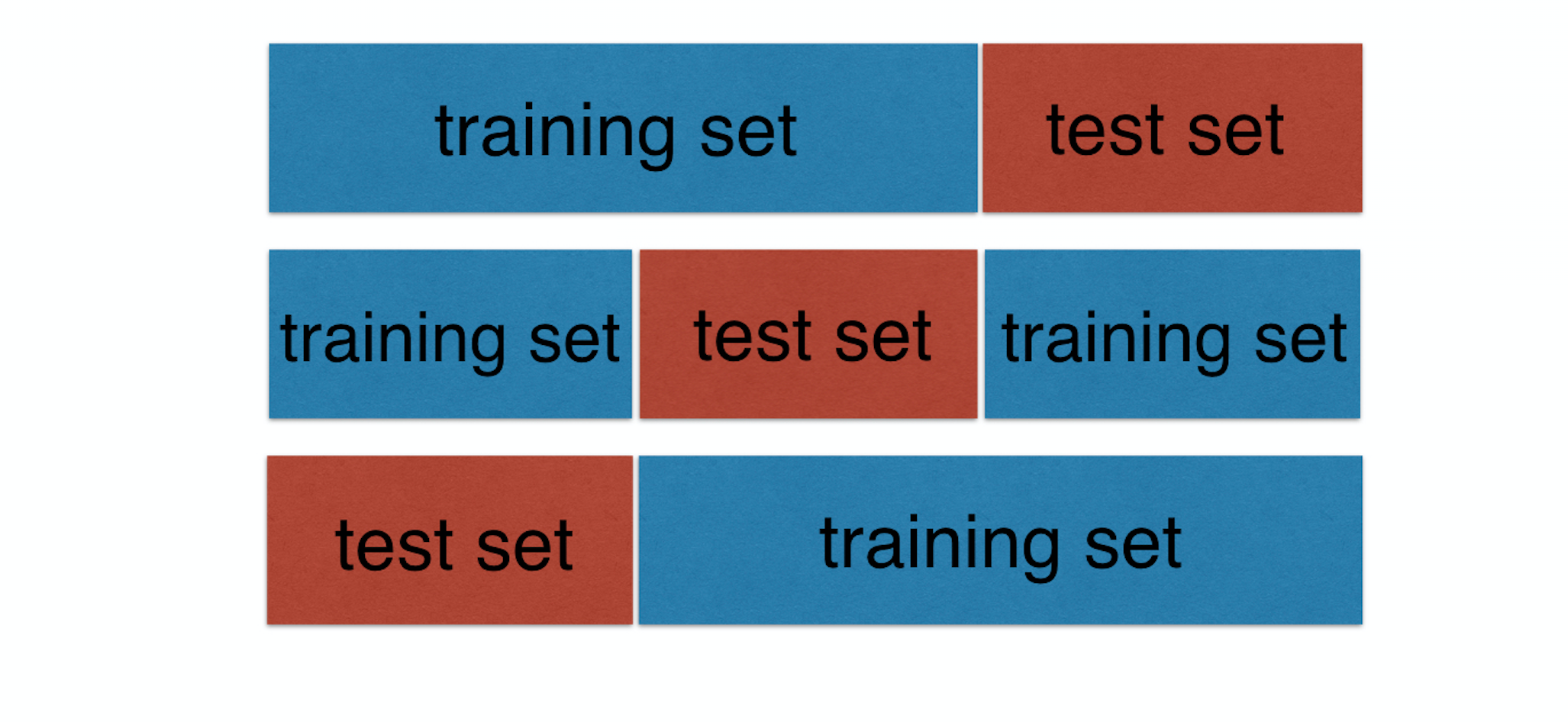

Cross-validation

Evaluate a model

test_set$loan_status model_prediction

... ...

[8066,] 1 1

[8067,] 0 0

[8068,] 0 0

[8069,] 0 0

[8070,] 0 0

[8071,] 0 1

[8072,] 1 0

[8073,] 1 1

[8074,] 0 0

[8075,] 0 0

[8076,] 0 0

[8077,] 1 1

[8078,] 0 0

... ...

Evaluate a model

test_set$loan_status model_prediction

... ...

[8066,] 1 1

[8067,] 0 0

[8068,] 0 0

[8069,] 0 0

[8070,] 0 0

[8071,] 0 1

[8072,] 1 0

[8073,] 1 1

[8074,] 0 0

[8075,] 0 0

[8076,] 0 0

[8077,] 1 1

[8078,] 0 0

[8079,] 0 1

... ...

Actual loan status v. Model prediction

| No default (0) | Default (1) | |

|---|---|---|

| No default (0) | 8 | 2 |

| Default (1) | 1 | 3 |

Evaluate a model

test_set$loan_status model_prediction

... ...

[8066,] 1 1

[8067,] 0 0

[8068,] 0 0

[8069,] 0 0

[8070,] 0 0

[8071,] 0 1

[8072,] 1 0

[8073,] 1 1

[8074,] 0 0

[8075,] 0 0

[8076,] 0 0

[8077,] 1 1

[8078,] 0 0

[8079,] 0 1

... ...

Actual loan status v. Model prediction

| No default (0) | Default (1) | |

|---|---|---|

| No default (0) | TN | FP |

| Default (1) | FN | TP |

Some measures...

Accuracy $$\frac{(8+3)}{14} = 78.57\%$$

Sensitivity $$\frac{3}{(1+3)} = 75\%$$

Specificity $$\frac{8}{(8+2)} = 80\%$$

Actual loan status v. Model prediction

| No default (0) | Default (1) | |

|---|---|---|

| No default (0) | 8 | 2 |

| Default (1) | 1 | 3 |

Let's practice!

Credit Risk Modeling in R