Finding the right cut-off: the strategy curve

Credit Risk Modeling in R

Lore Dirick

Manager of Data Science Curriculum at Flatiron School

Constructing a confusion matrix

predict(log_reg_model, newdata = test_set, type = "response")

1 2 3 4 5 ...

0.08825517 0.3502768 0.28632298 0.1657199 0.11264550 ...

predict(class_tree, new data = test_set)

0 1

1 0.7873134 0.2126866

2 0.6250000 0.3750000

3 0.6250000 0.3750000

4 0.7873134 0.2126866

5 0.5756867 0.4243133

Cut-off?

pred_log_regression_model <- predict(log_reg_model,

newdata = test_set,

type = "response")

cutoff <- 0.14

class_pred_logit <- ifelse(pred_log_regression_model > cutoff, 1, 0)

A certain strategy

log_model_full <- glm(loan_status ~ ., family = "binomial", data = training_set)

predictions_all_full <- predict(log_reg_model, newdata = test_set, type = "response")

cutoff <- quantile(predictions_all_full, 0.8)

cutoff

80%

0.1600124

pred_full_20 <- ifelse(predictions_all_full > cutoff, 1, 0)

true_and_predval <- cbind(test_set$loan_status, pred_full_20)

true_and_predval

test_set$loan_status pred_full_20

1 0 0

2 0 0

3 0 1

4 0 0

5 0 1

... ... ...

accepted_loans <- true_and_predval[pred_full_20 == 0,1]

bad_rate <- sum(accepted_loans)/length(accepted_loans)

bad_rate

0.08972541

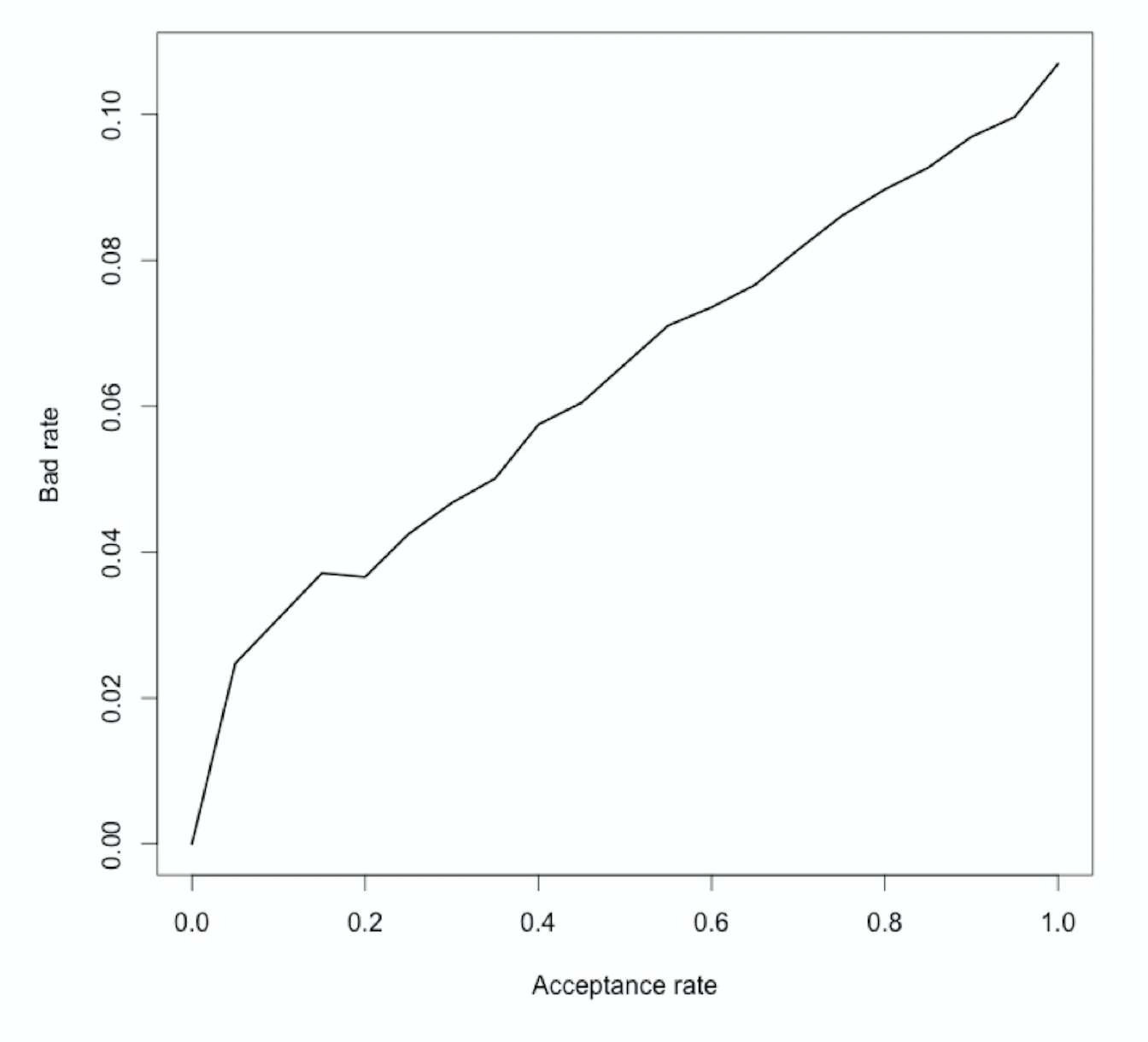

accept_rate cutoff bad_rate

[1,] 1.00 0.5142 0.1069

[2,] 0.95 0.2122 0.0997

[3,] 0.90 0.1890 0.0969

[4,] 0.85 0.1714 0.0927

[5,] 0.80 0.1600 0.0897

[6,] 0.75 0.1471 0.0861

[7,] 0.70 0.1362 0.0815

[8,] 0.65 0.1268 0.0766

... ... ... ...

[16,] 0.25 0.0644 0.0425

[17,] 0.20 0.0590 0.0366

[18,] 0.15 0.0551 0.0371

[19,] 0.10 0.0512 0.0309

[20,] 0.05 0.0453 0.0247

[21,] 0.00 0.0000 0.0000

The strategy curve

Let's practice!

Credit Risk Modeling in R