Histograms and outliers

Credit Risk Modeling in R

Lore Dirick

Manager of Data Science Curriculum at Flatiron School

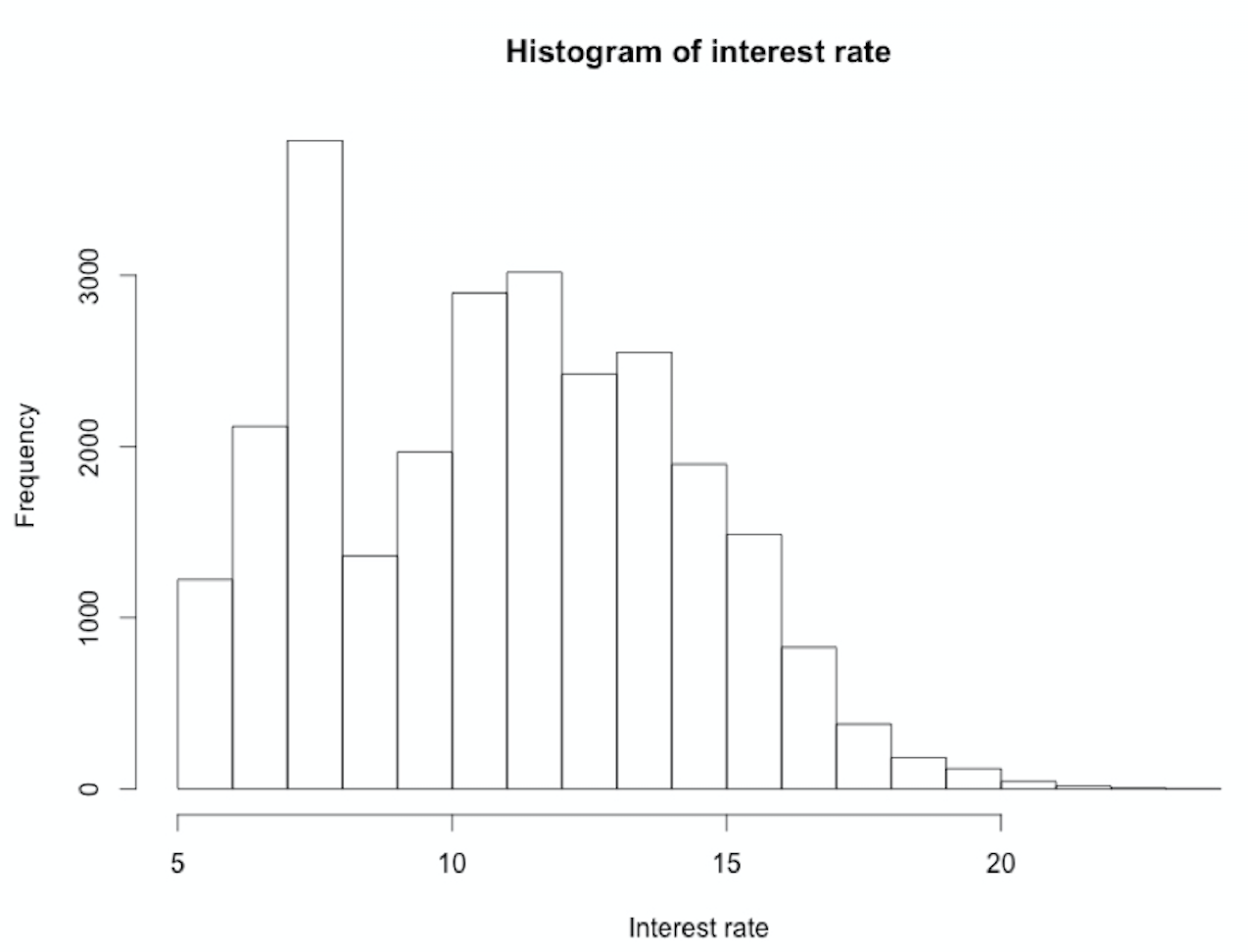

Using function hist()

hist(loan_data$int_rate)

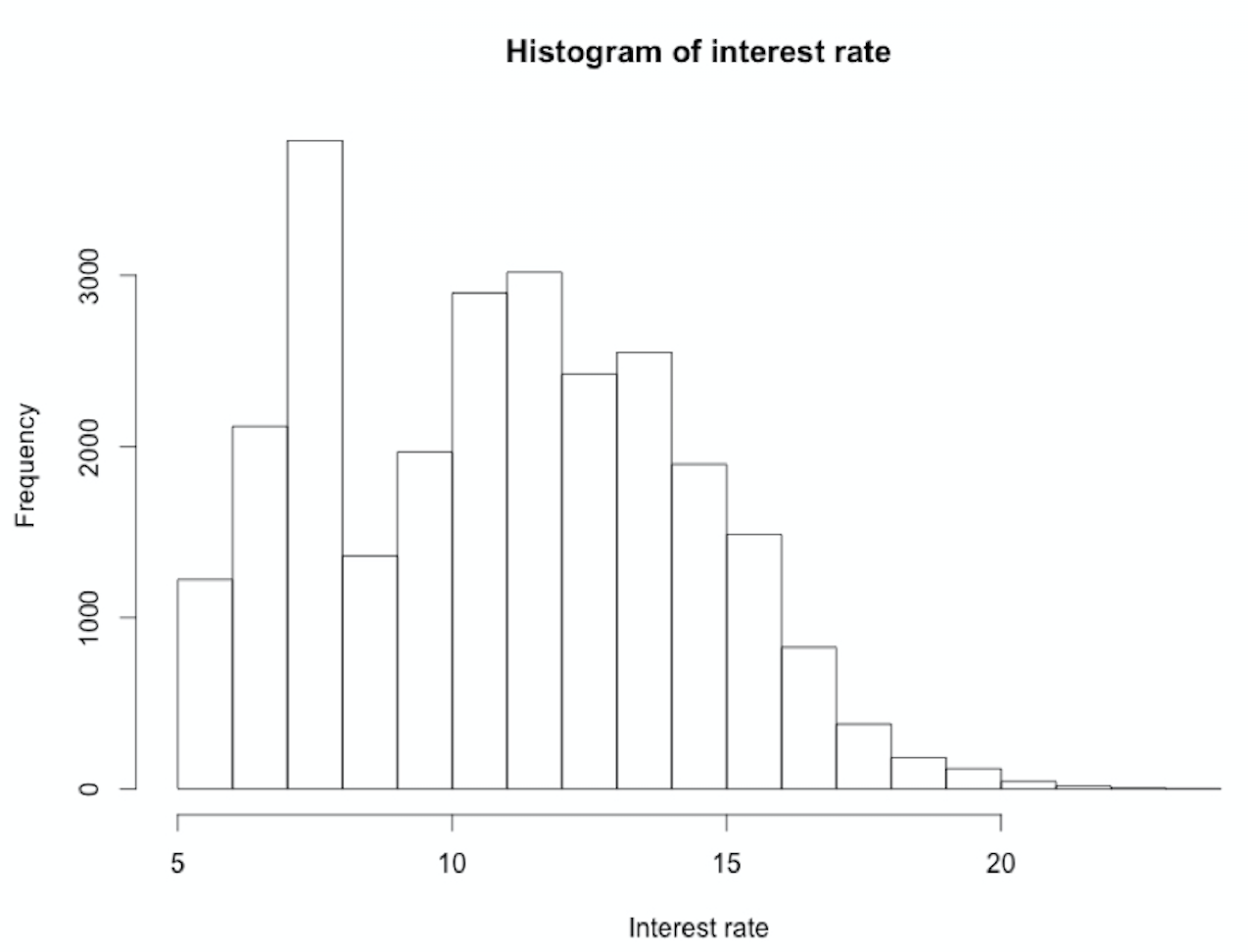

Using function hist()

hist(loan_data$int_rate, main = "Histogram of interest rate", xlab = "Interest rate")

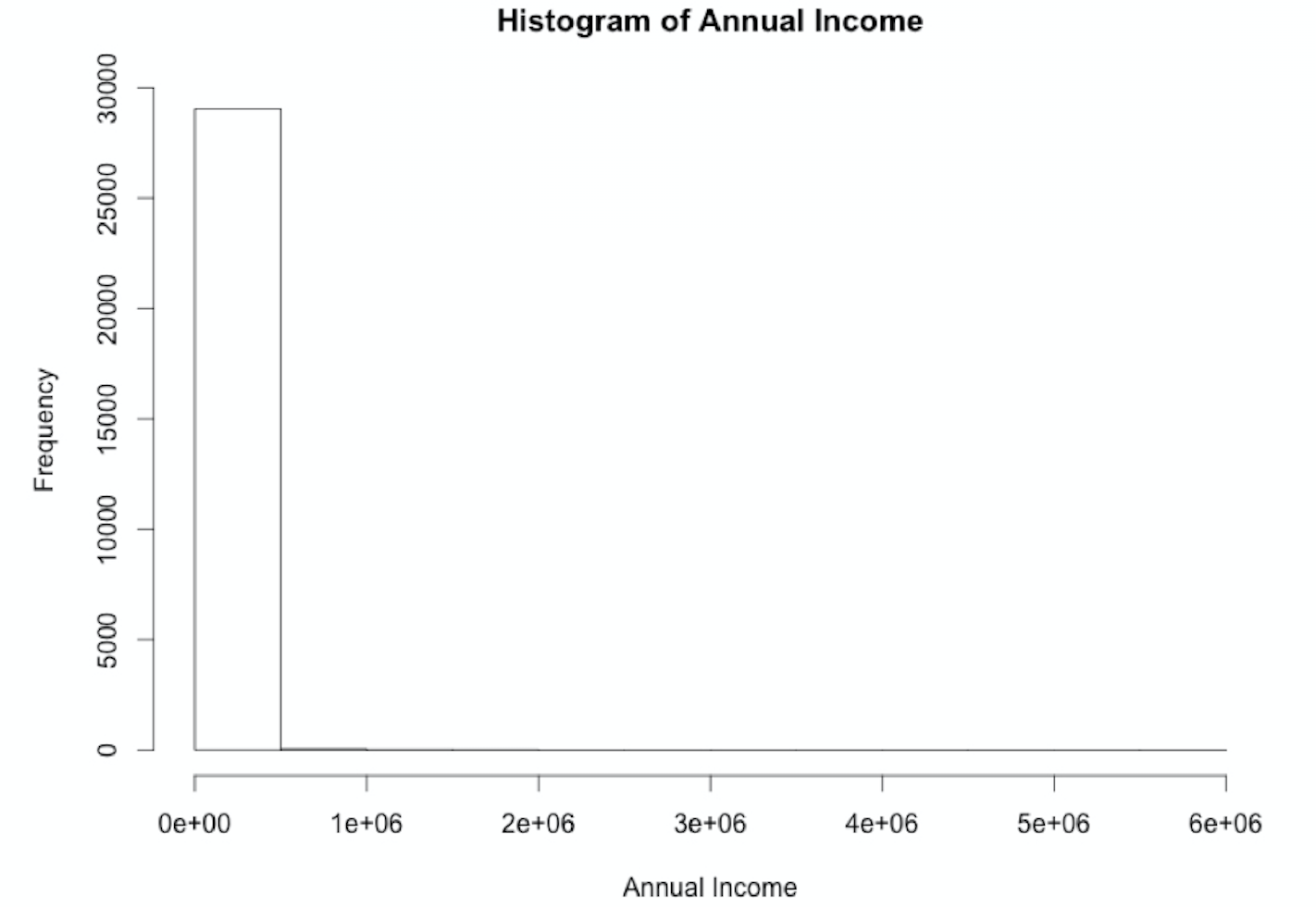

Using function hist() on annual_inc

hist(loan_data$annual_inc, xlab = "Annual Income", main = "Histogram of Annual Income")

Using function hist() on annual_inc

hist_income <- hist(loan_data$annual_inc,

xlab = "Annual Income",

main = "Histogram of Annual Income")

hist_income$breaks

0 500000 1000000 1500000 2000000 2500000 3000000 3500000 4000000 4500000 ...

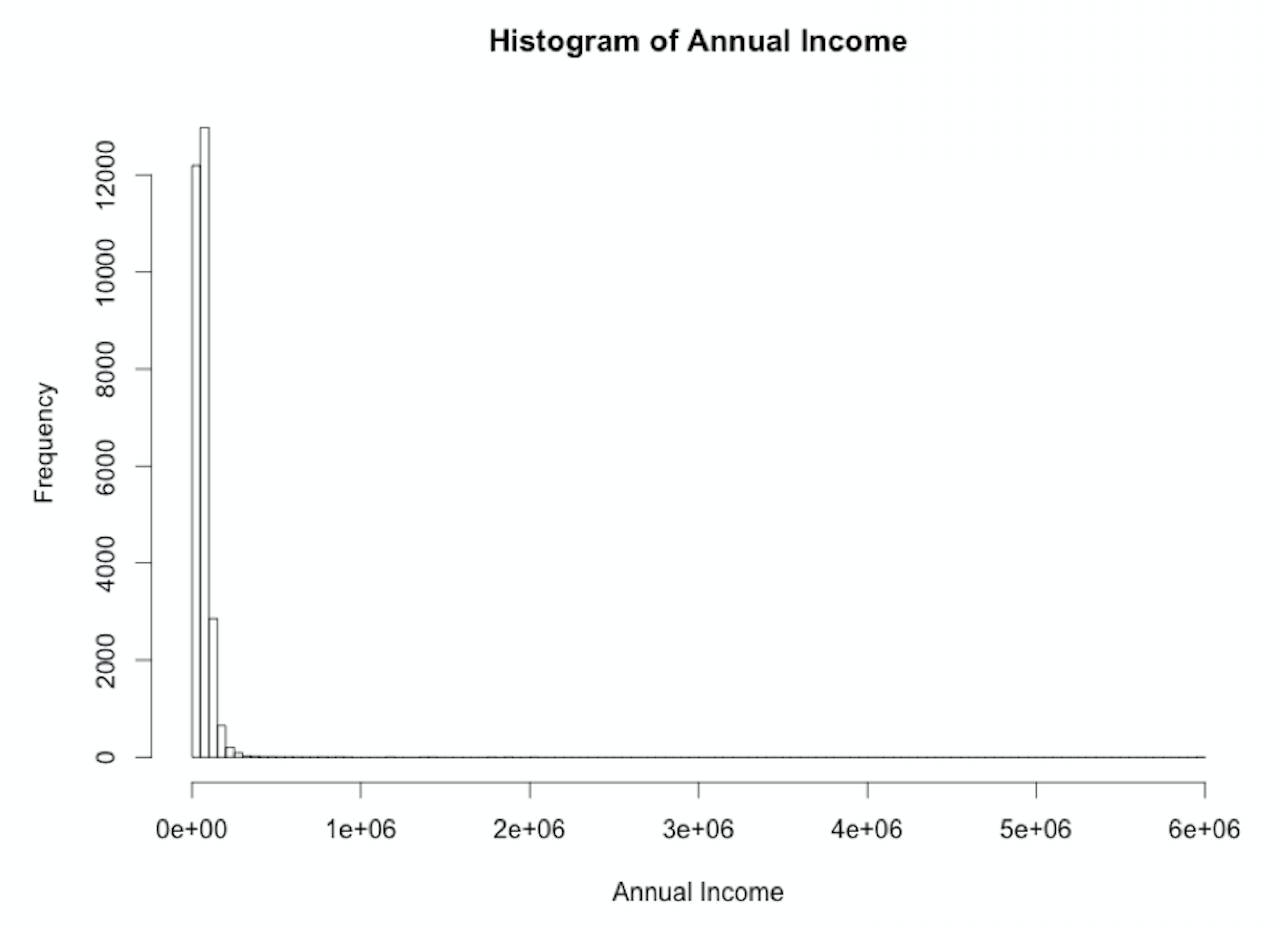

The breaks-argument

n_breaks <- sqrt(nrow(loan_data)) # n_breaks = 170.5638

hist_income_n <- hist(loan_data$annual_inc, breaks = n_breaks,

xlab = "Annual Income", main = "Histogram of Annual Income")

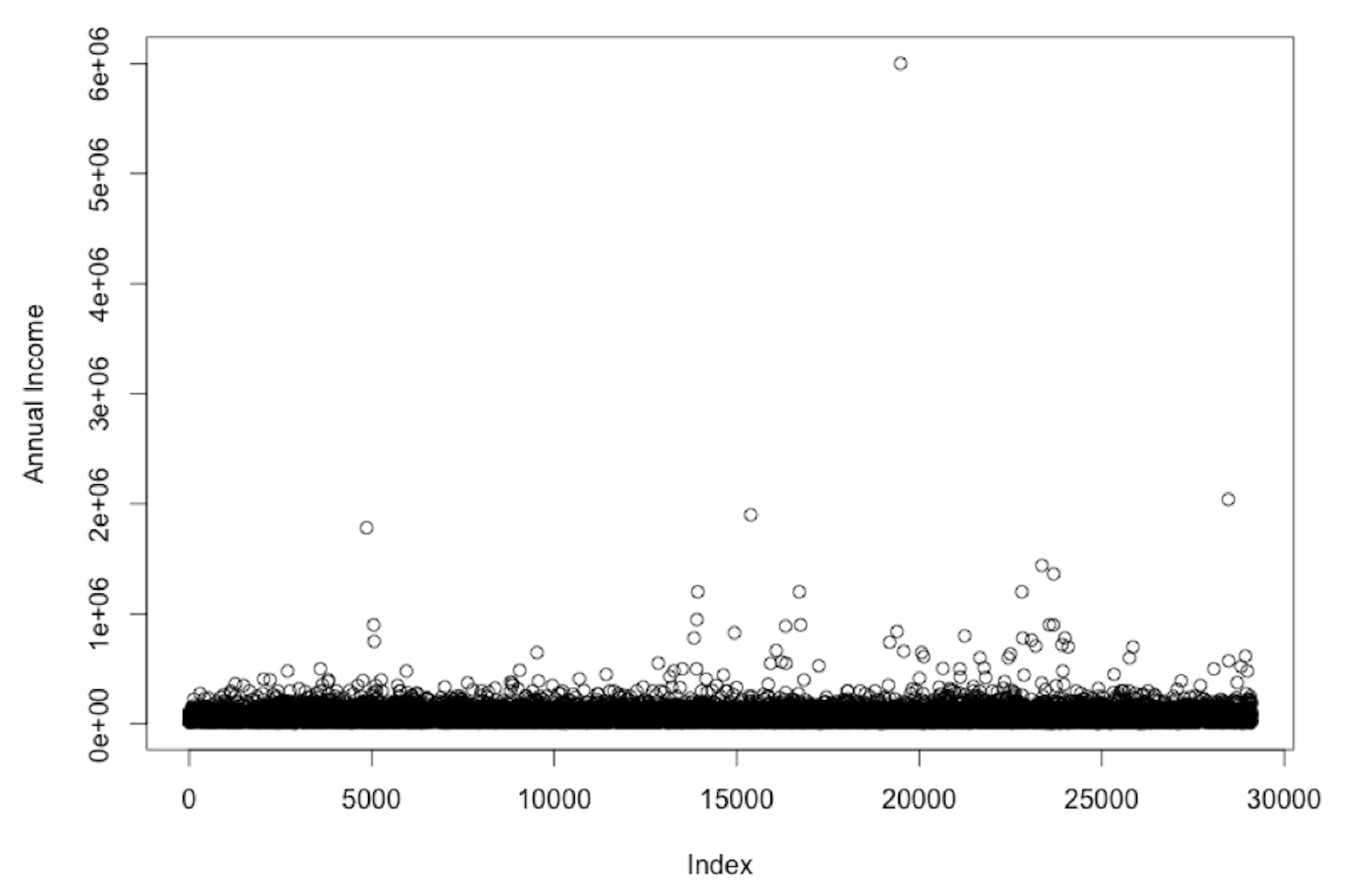

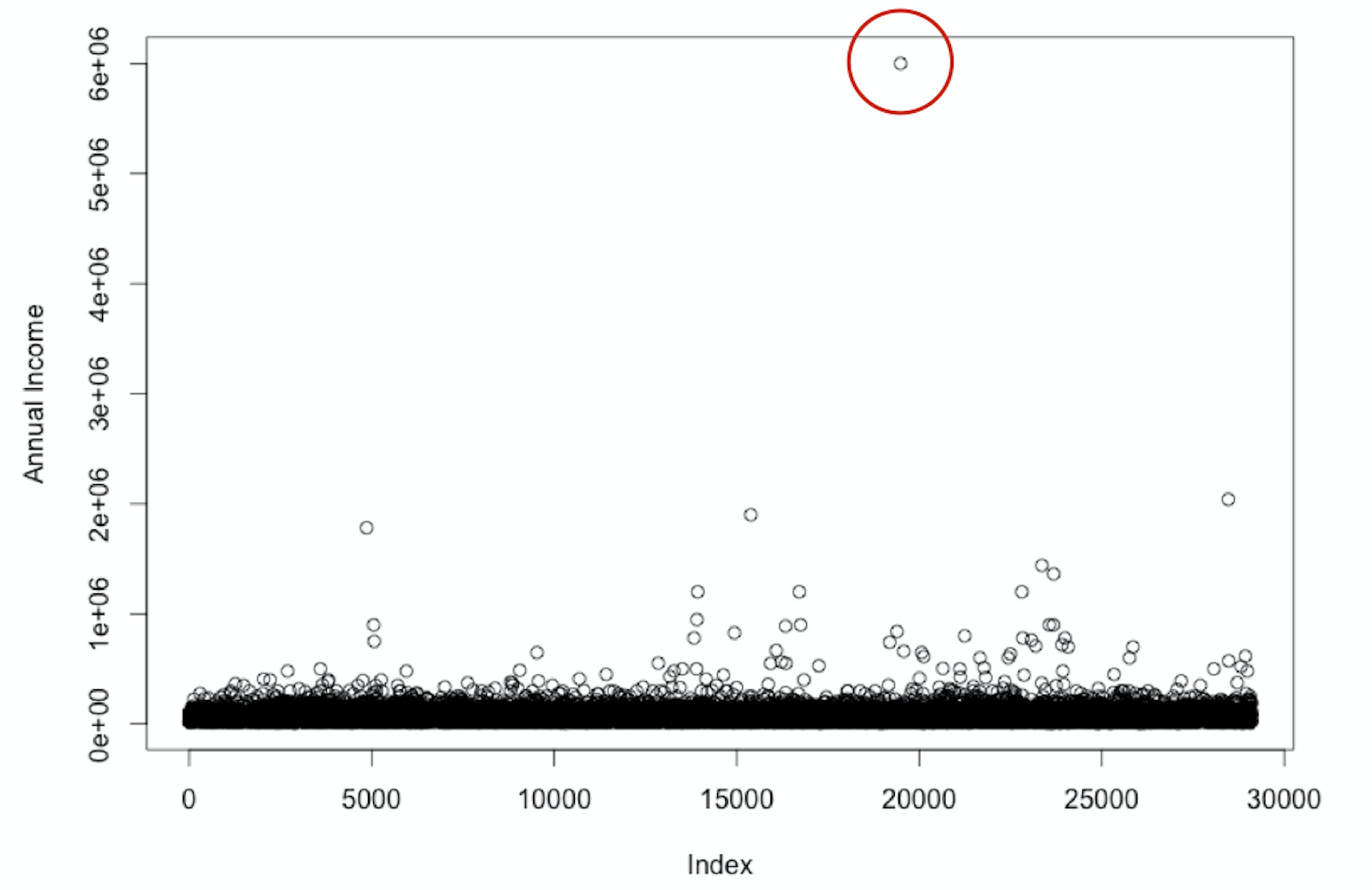

annual_inc

plot(loan_data$annual_inc, ylab = "Annual Income")

annual_inc

plot(loan_data$annual_inc, ylab = "Annual Income")

Outliers

When is a value an outlier?

- Expert judgment

Rule of thumb, e.g.,

- Q1 - 1.5 * IQR

- Q3 + 1.5 * IQR

- Mostly: combination of both

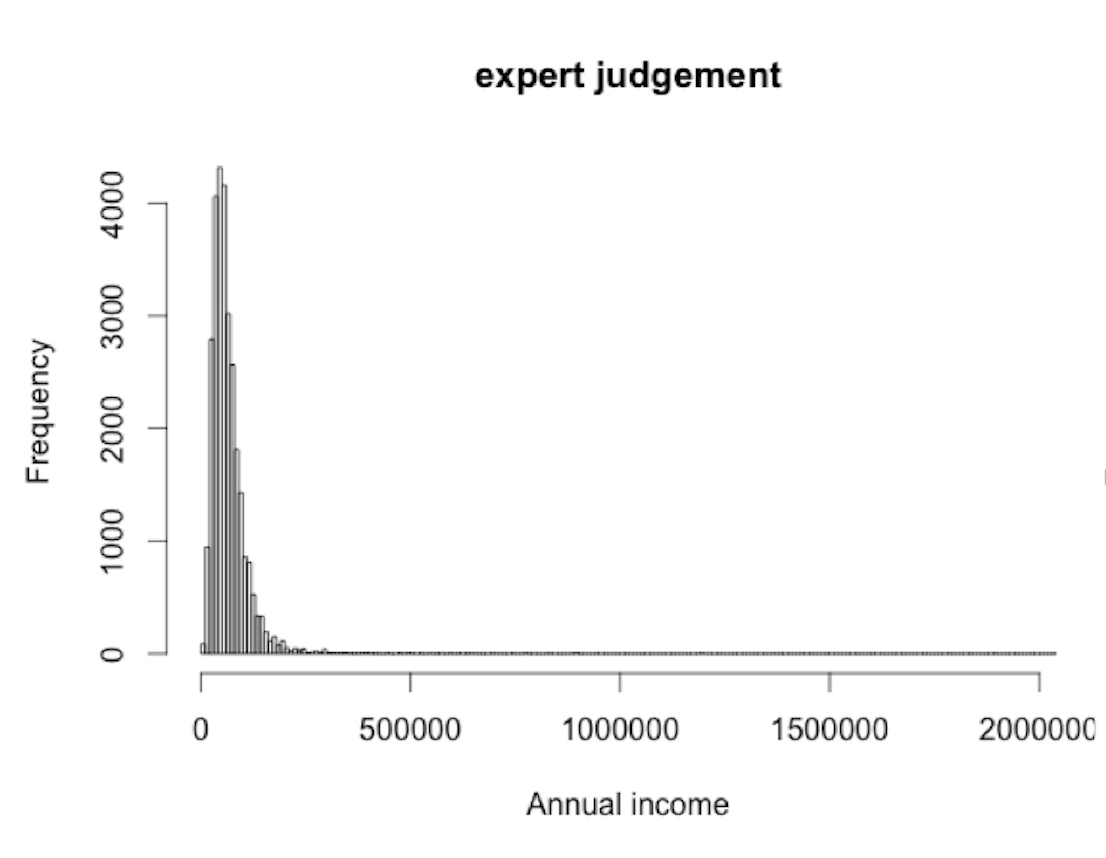

Expert judgment

"Annual salaries > $3 million are outliers"

$$

# Find outlier

index_outlier_expert <- which(loan_data$annual_inc > 3000000)

# Remove outlier from dataset

loan_data_expert <- loan_data[-index_outlier_expert, ]

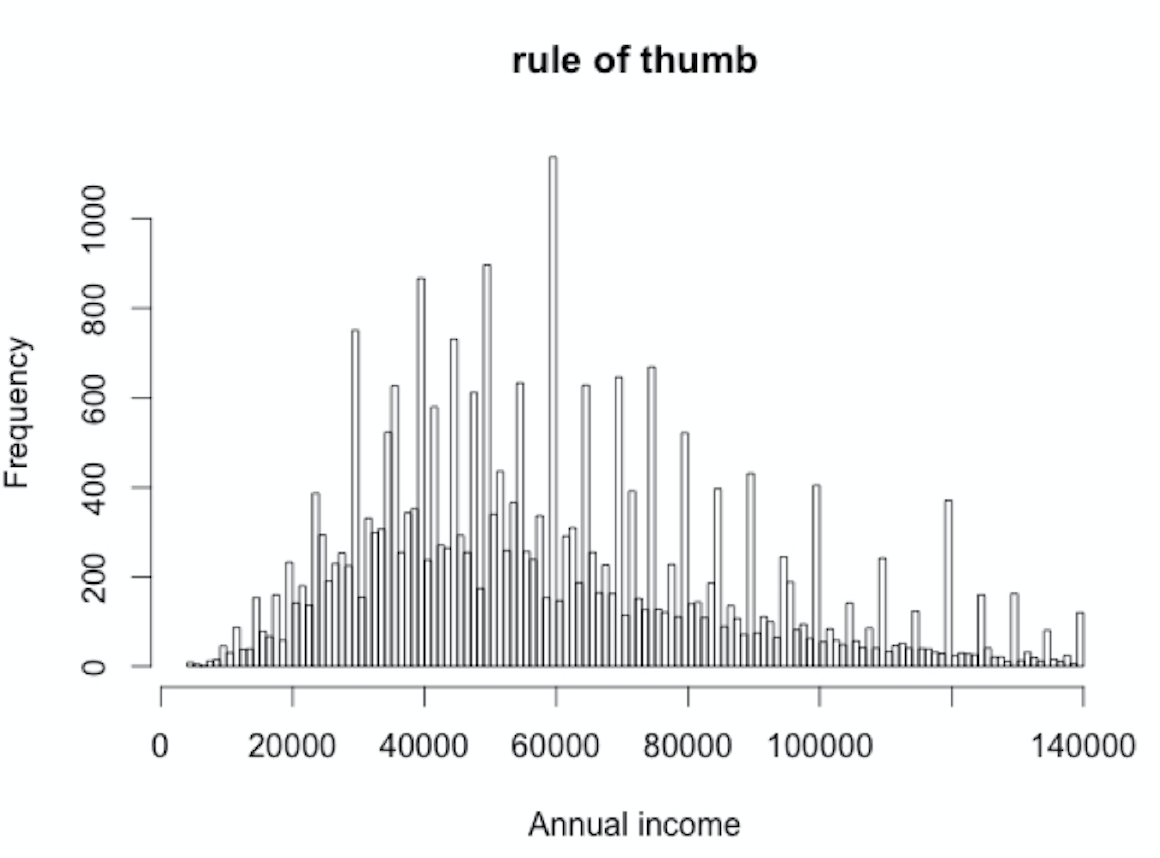

Rule of thumb

Outlier if bigger than Q3 + 1.5 * IQR

$$

# Calculate Q3 + 1.5 * IQR outlier_cutoff <- quantile(loan_data$annual_inc, 0.75) + 1.5 * IQR(loan_data$annual_inc)# Identify outliers index_outlier_ROT <- which(loan_data$annual_inc > outlier_cutoff)# Remove outliers loan_data_ROT <- loan_data[-index_outlier_ROT, ]

hist(loan_data_expert$annual_inc,

sqrt(nrow(loan_data_expert)),

xlab = "Annual income")

hist(loan_data_ROT$annual_inc,

sqrt(nrow(loan_data_ROT)),

xlab = "Annual income")

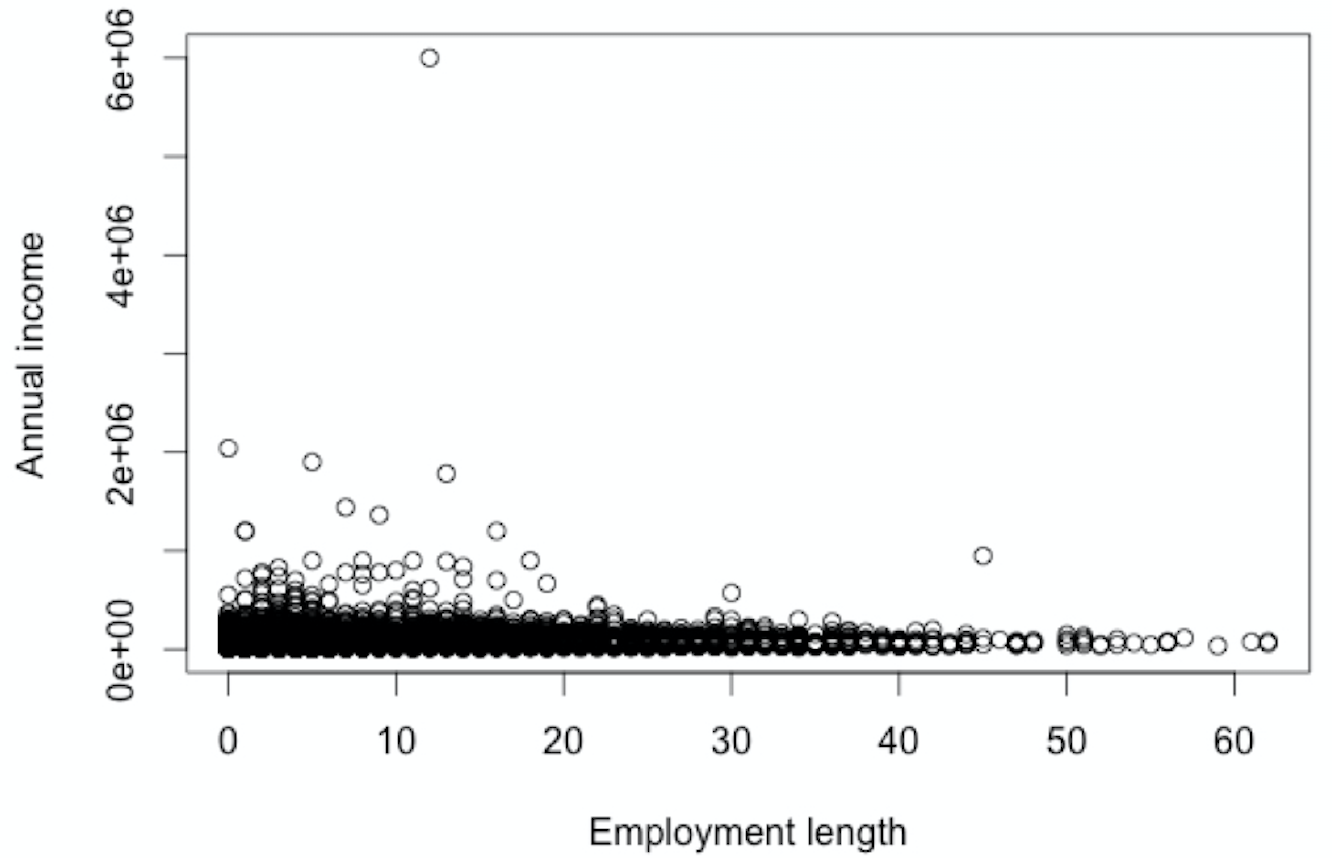

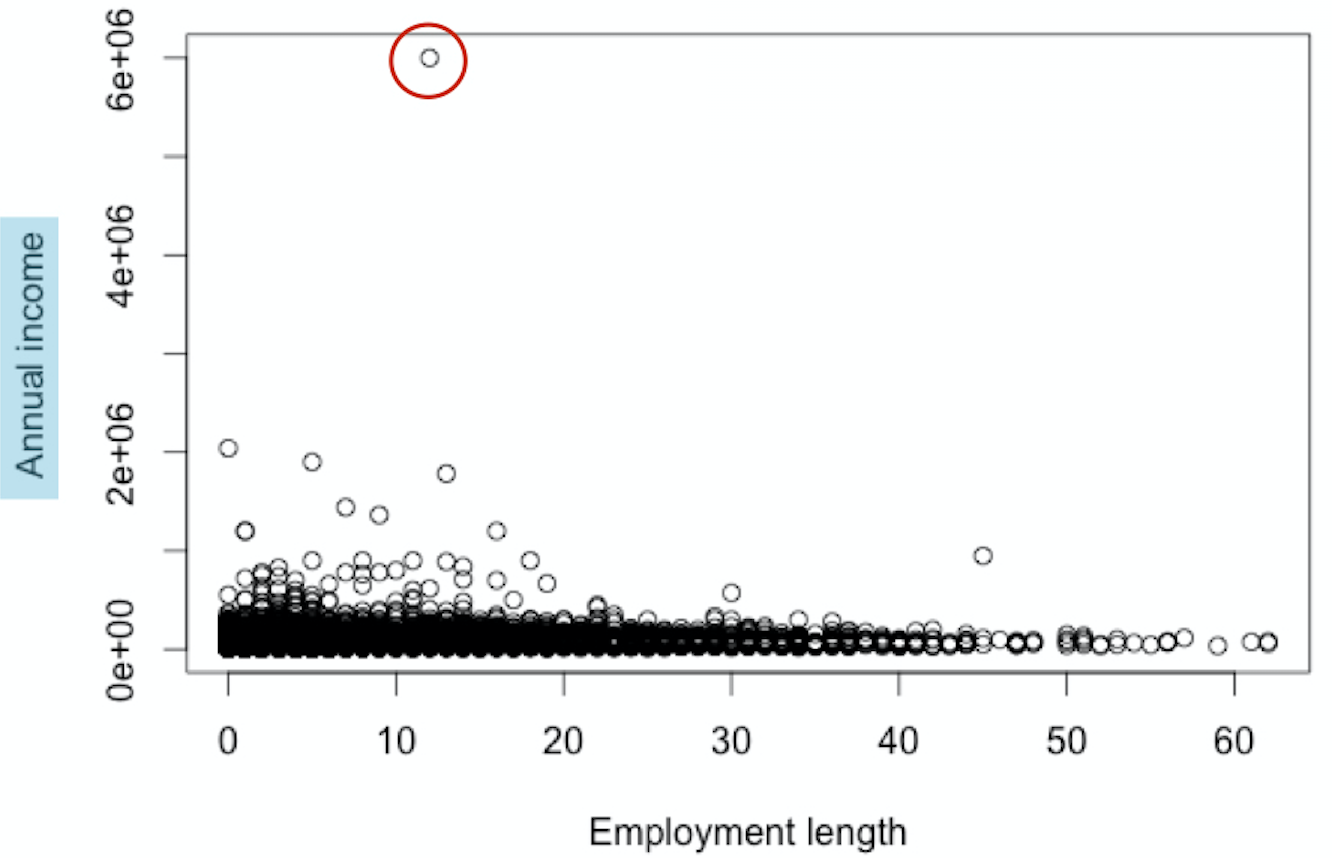

Bivariate plot

plot(loan_data$emp_length, loan_data$annual_inc,

xlab= "Employment length", ylab= "Annual income")

Bivariate plot

plot(loan_data$emp_length, loan_data$annual_inc,

xlab= "Employment length", ylab= "Annual income")

Let's practice!

Credit Risk Modeling in R