The ROC-curve

Credit Risk Modeling in R

Lore Dirick

Manager of Data Science Curriculum at Flatiron School

Until now

- Strategy table/curve : still make assumption

- What is "overall" best model?

Confusion matrix

$$

Actual loan status v. Model prediction

| No default (0) | Default (1) | |

|---|---|---|

| No default (0) | TN | FP |

| Default (1) | FN | TP |

$$

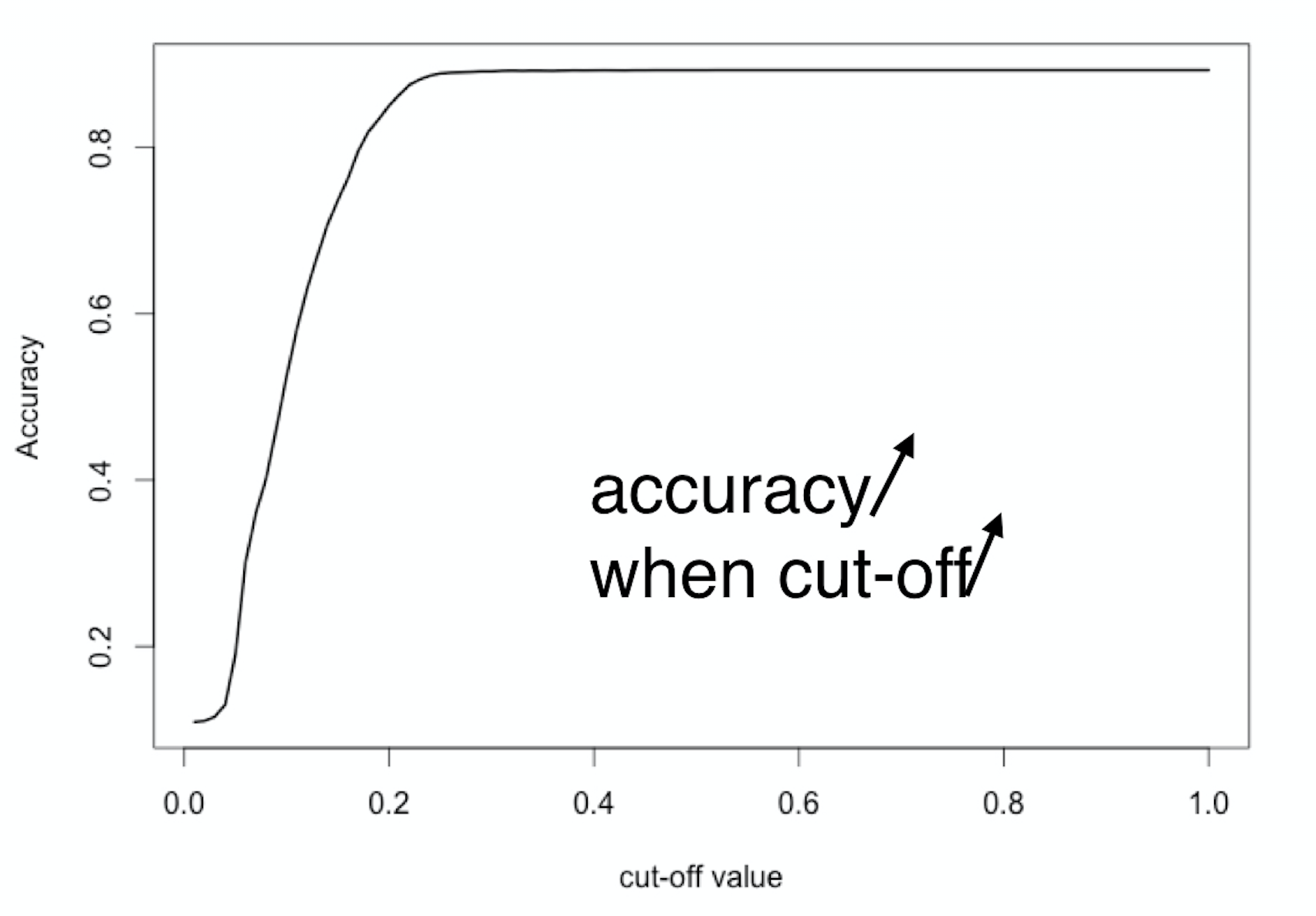

$\text{Accuracy} = \frac{TP +TN}{TP + FP + TN + FN}$

$\text{Sensitivity} = \frac{TP}{TP + FN}$

$\text{Specificity} = \frac{TN}{TN + FP}$

Accuracy?

$$

$$

$\text{Sensitivity} = \frac{TP}{TP + FN}$

$\text{Specificity} = \frac{TN}{TN + FP}$

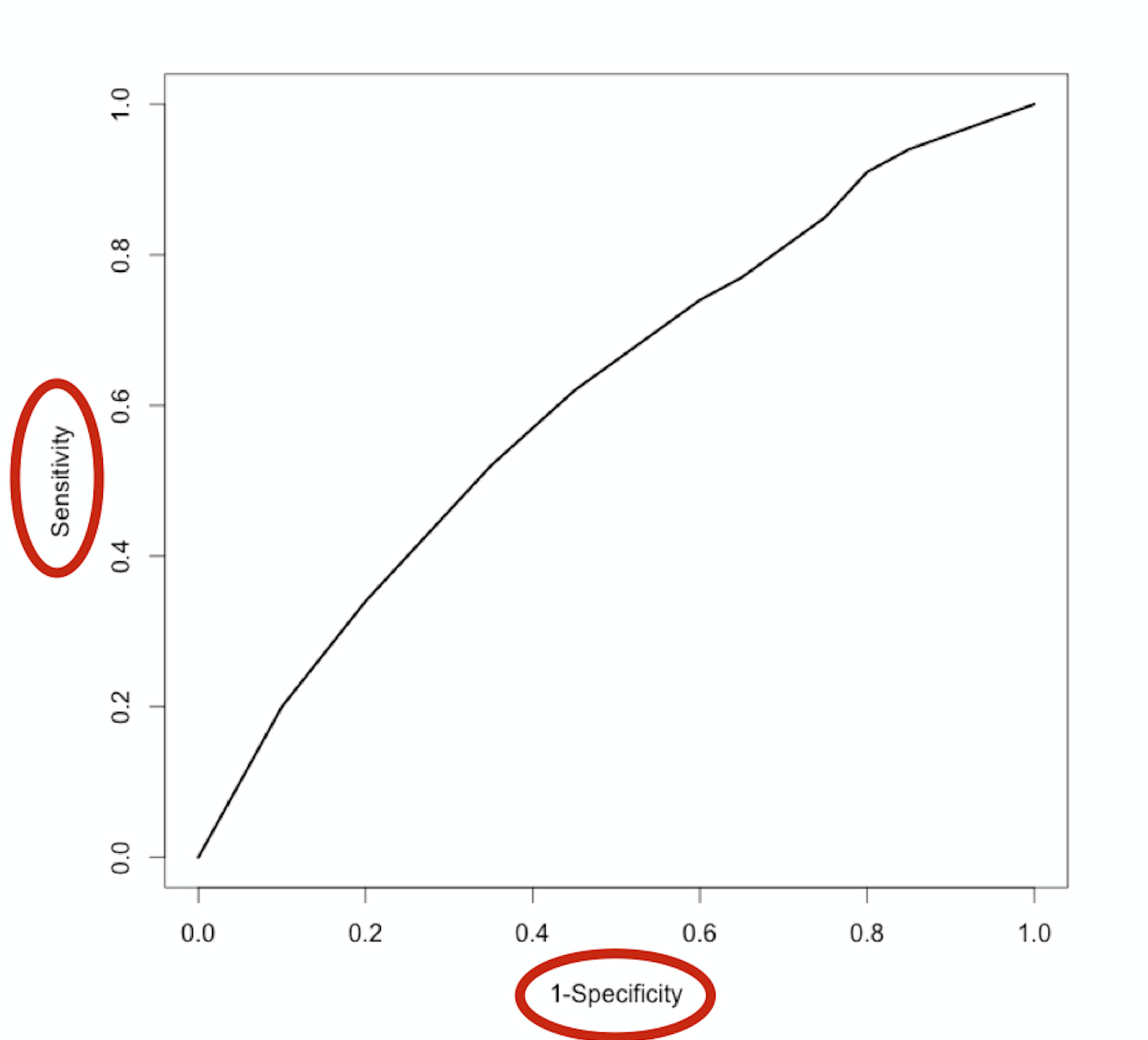

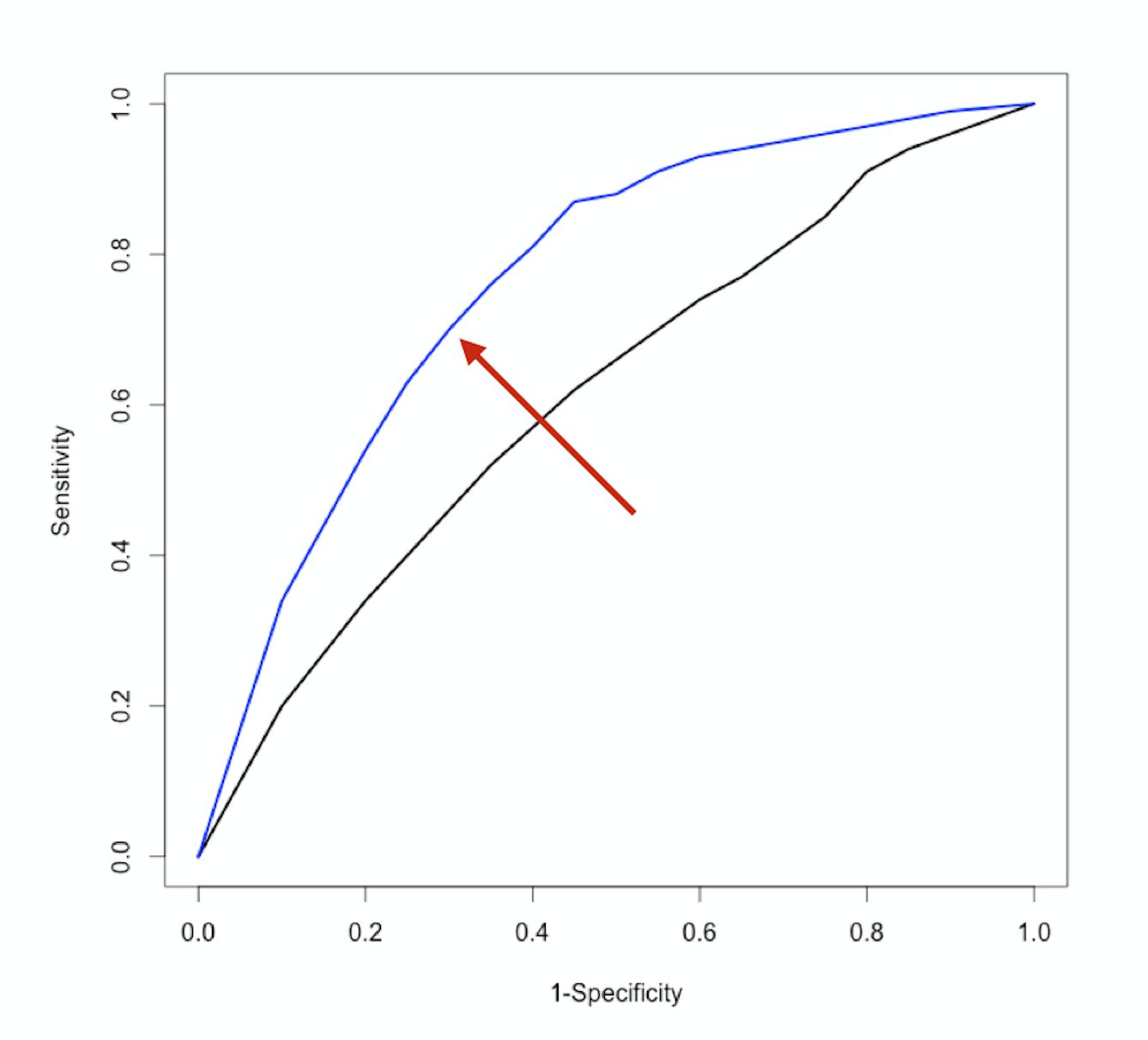

The ROC-curve

$$

$\text{Sensitivity} = \frac{TP}{TP + FN}$

$\text{Specificity} = \frac{TN}{TN + FP}$

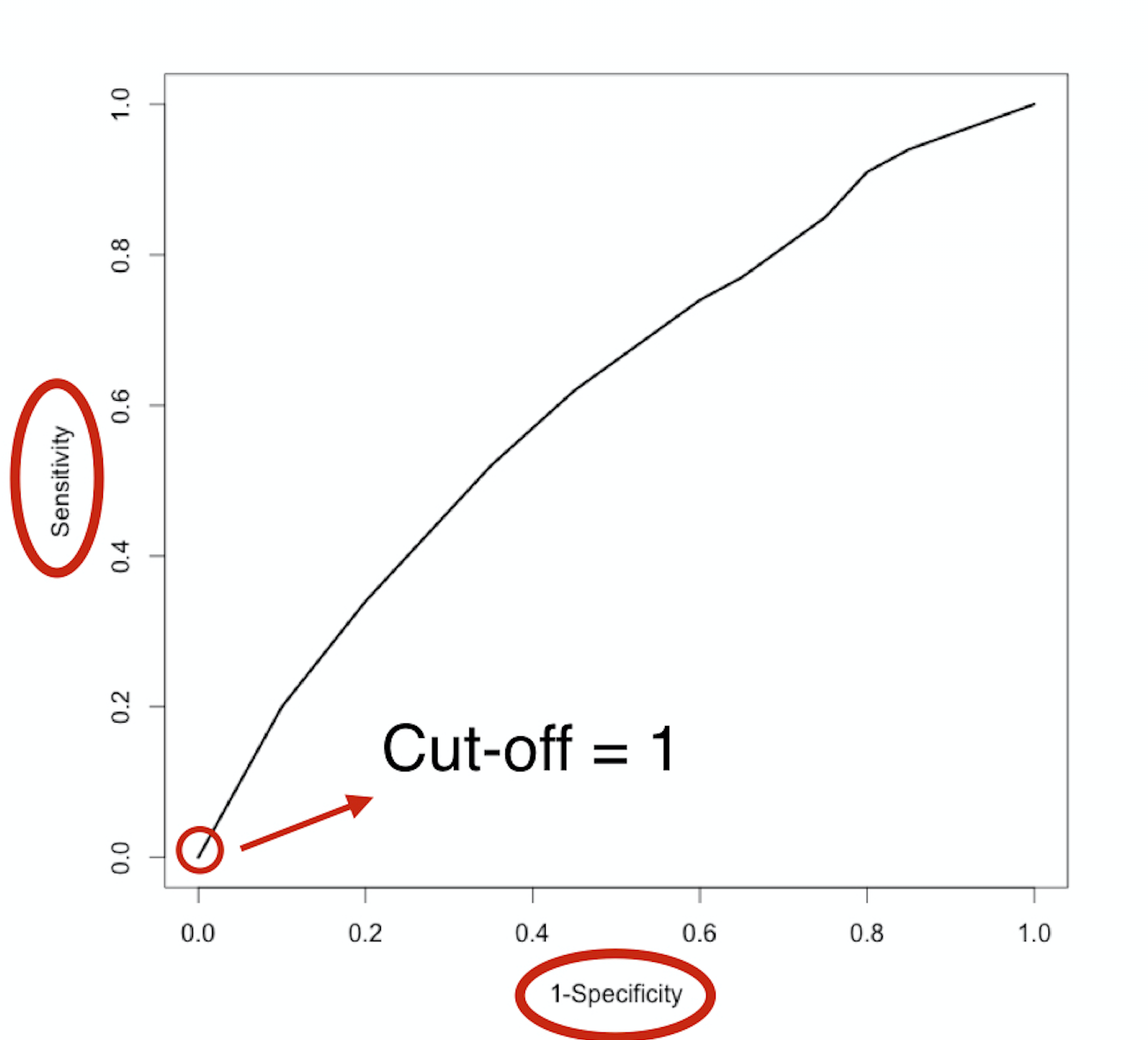

The ROC-curve

$$

$\text{Sensitivity} = \frac{TP}{TP + FN}$

$\text{Specificity} = \frac{TN}{TN + FP}$

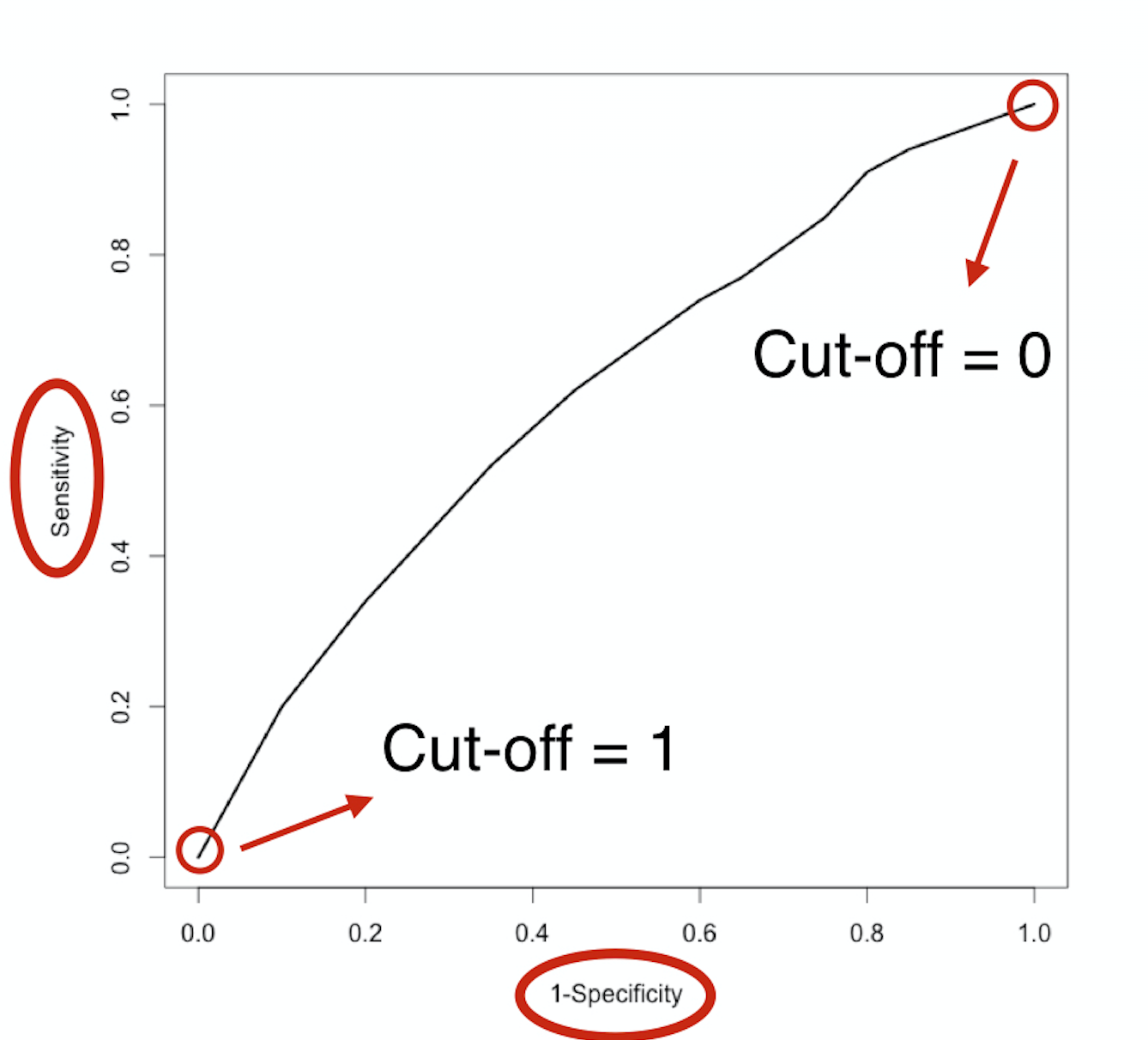

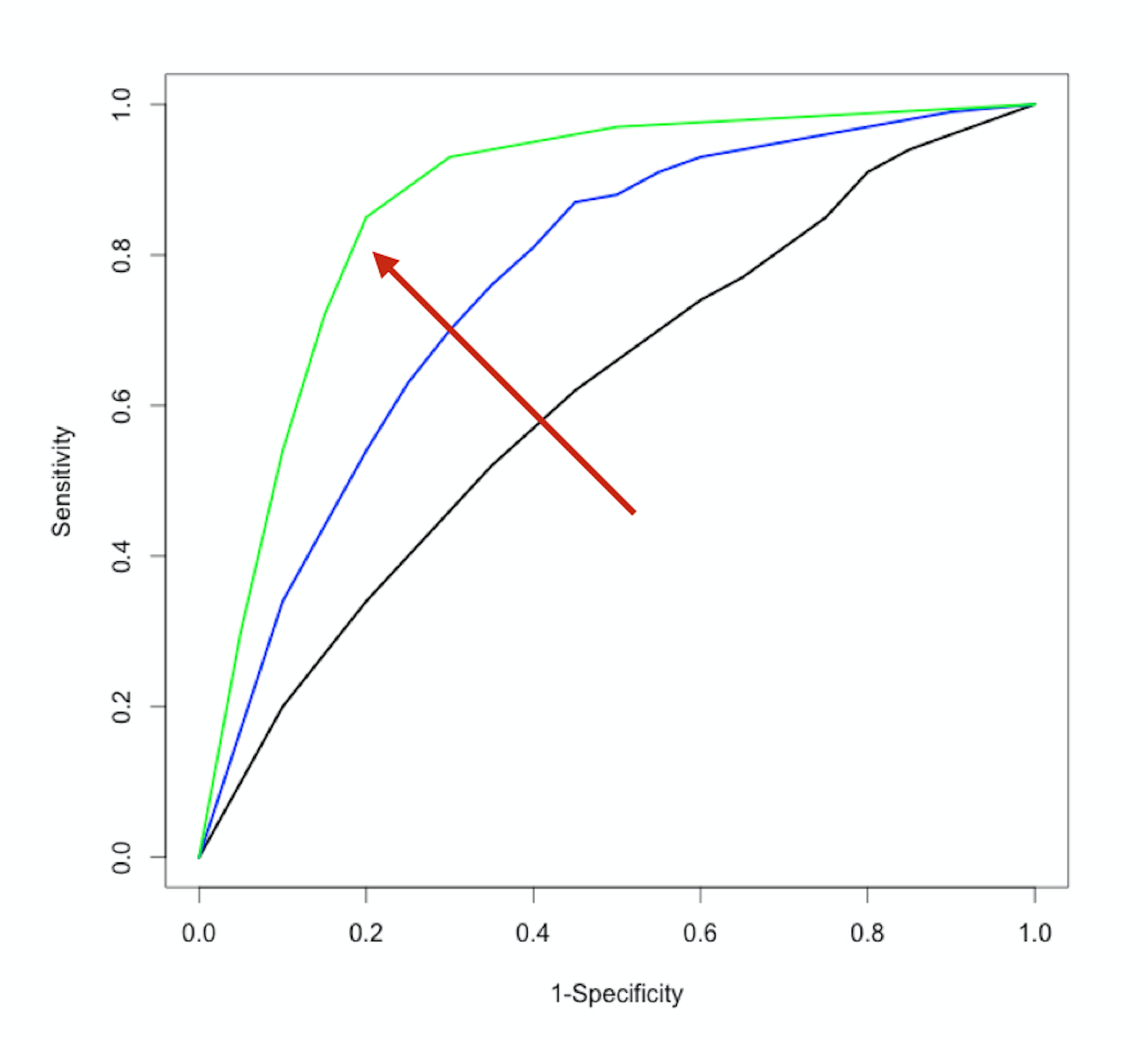

The ROC-curve

$$

$\text{Sensitivity} = \frac{TP}{TP + FN}$

$\text{Specificity} = \frac{TN}{TN + FP}$

The ROC-curve

$$

$\text{Sensitivity} = \frac{TP}{TP + FN}$

$\text{Specificity} = \frac{TN}{TN + FP}$

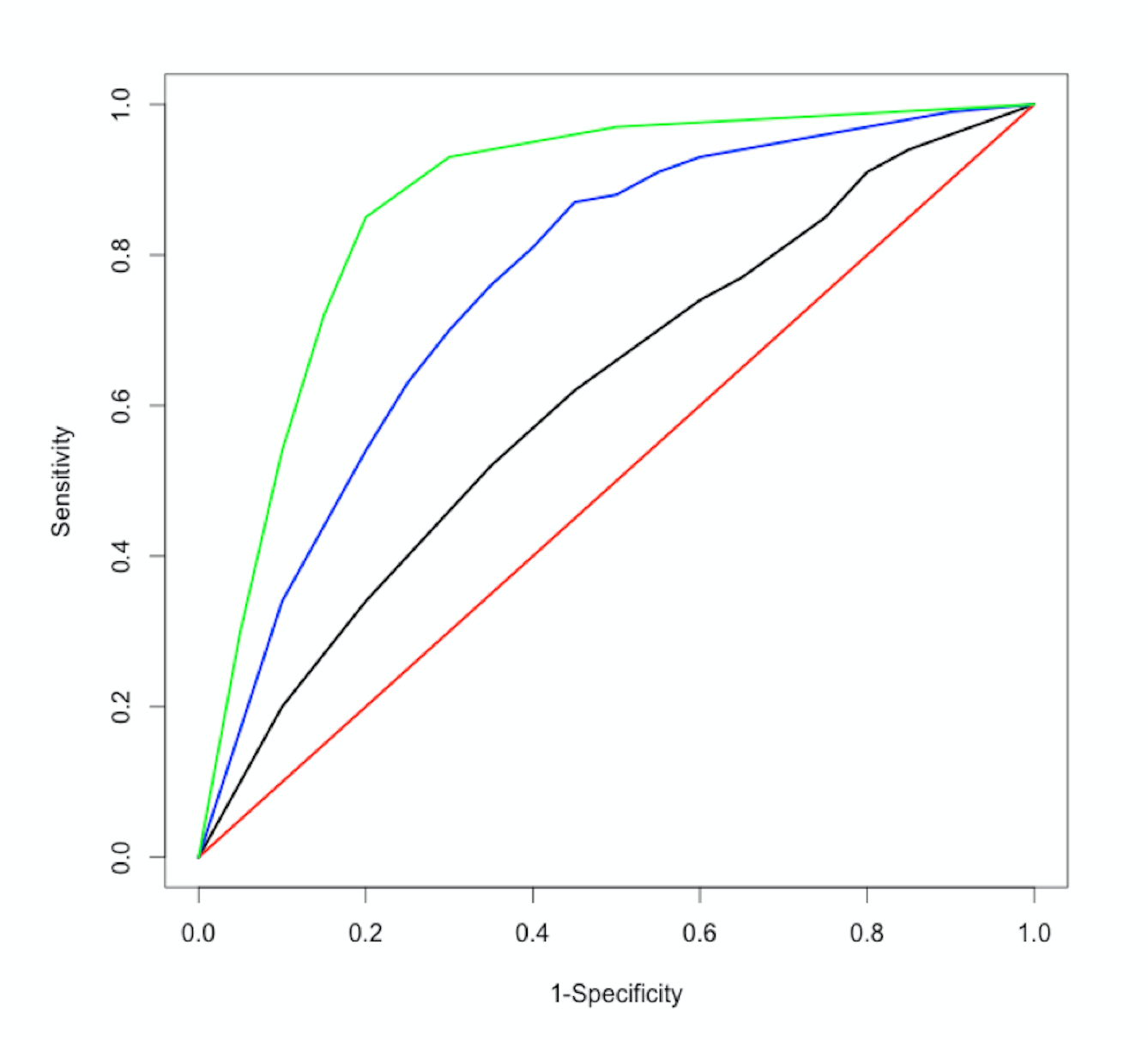

The ROC-curve

$$

$\text{Sensitivity} = \frac{TP}{TP + FN}$

$\text{Specificity} = \frac{TN}{TN + FP}$

The ROC-curve

$$

$\text{Sensitivity} = \frac{TP}{TP + FN}$

$\text{Specificity} = \frac{TN}{TN + FP}$

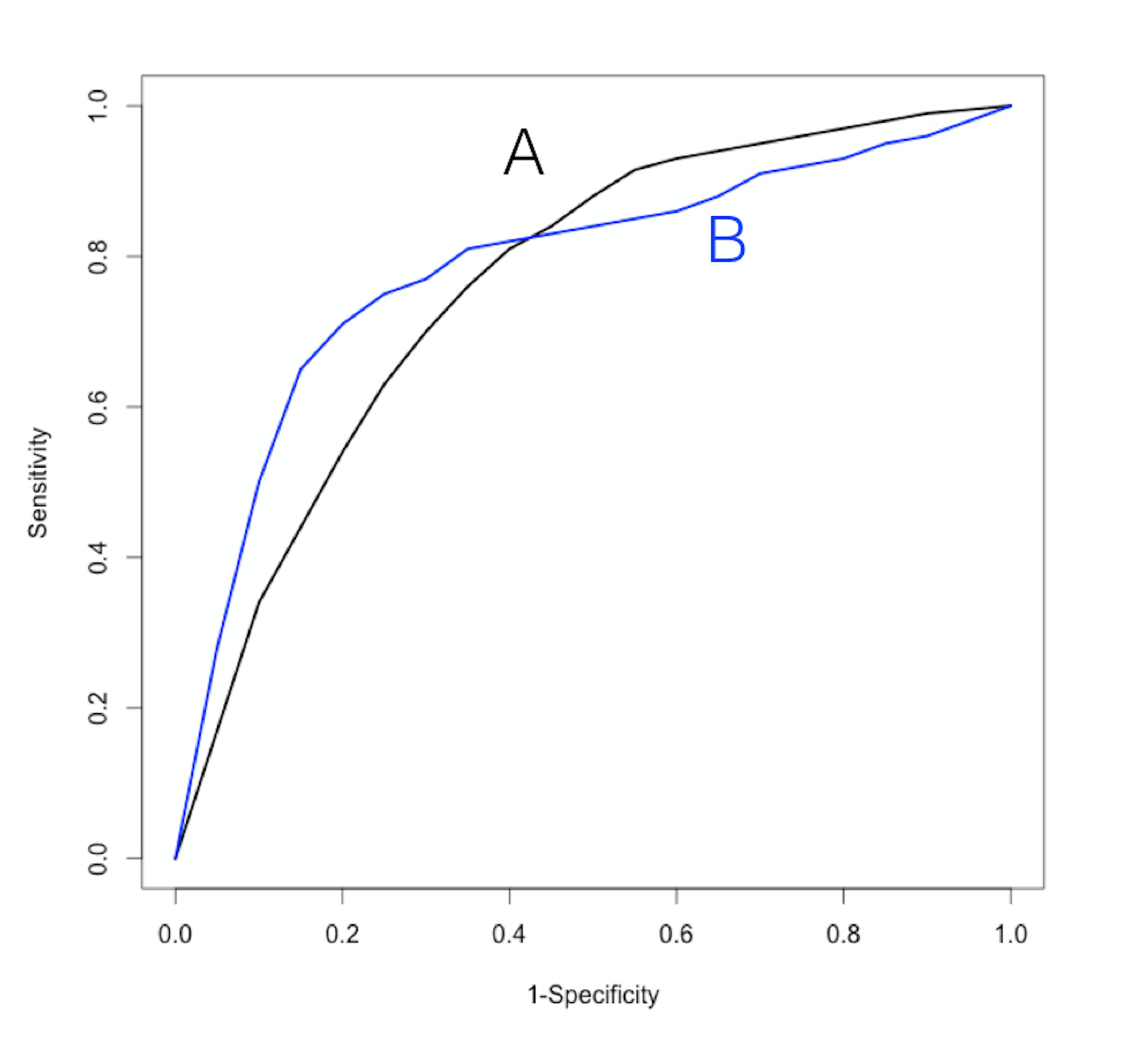

Which one is better?

- AUC ROC-curve

A = 0.75 - AUC ROC-curve

B = 0.78

Let's practice!

Credit Risk Modeling in R