Covariance and correlation

Time Series Analysis in R

David S. Matteson

Associate Professor at Cornell University

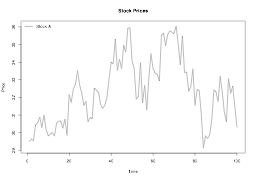

Stock prices for stock A

mean(stock_A)

32.36

sd(stock_A)

1.83

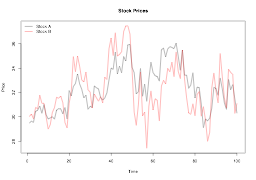

Stock prices for stock B

mean(stock_B)

32.30

sd(stock_B)

2.17

Covariance of stock A and B

cov(stock_A, stock_B)

2.86

Correlations

- Standardized version of covariance

- +1: perfectly positive linear relationship

- -1: perfectly negative linear relationship

- 0: no linear association

Correlation of stock A and B

cor(stock_A, stock_B)

0.71

cov(stock_A, stock_B) /

(sd(stock_A) * sd(stock_B))

0.71

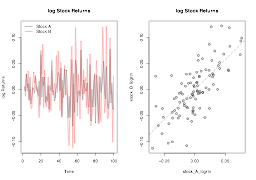

Covariance and correlation: log returns

cov(stock_A_logreturn, stock_B_logreturn)

0.001

cor(stock_A_logreturn, stock_B_logreturn)

0.74

Covariance and correlation: log returns

Let's practice!

Time Series Analysis in R