Compare AR and MA models

Time Series Analysis in R

David S. Matteson

Associate Professor at Cornell University

MA and AR processes

MA model: $Today = Mean + Noise + Slope * (Yesterday's Noise)$ $$Y_t = \mu + \epsilon_t + \theta\epsilon_{t-1}$$

AR model:

$(Today - Mean) = Slope*(Yesterday - Mean)$ $$+ Noise$$ $$Y_t - \mu = \phi(Y_{t-1} - \mu) +\epsilon_t$$

- Where:

$$\epsilon_t \sim WhiteNoise(0, \sigma^2_t)$$

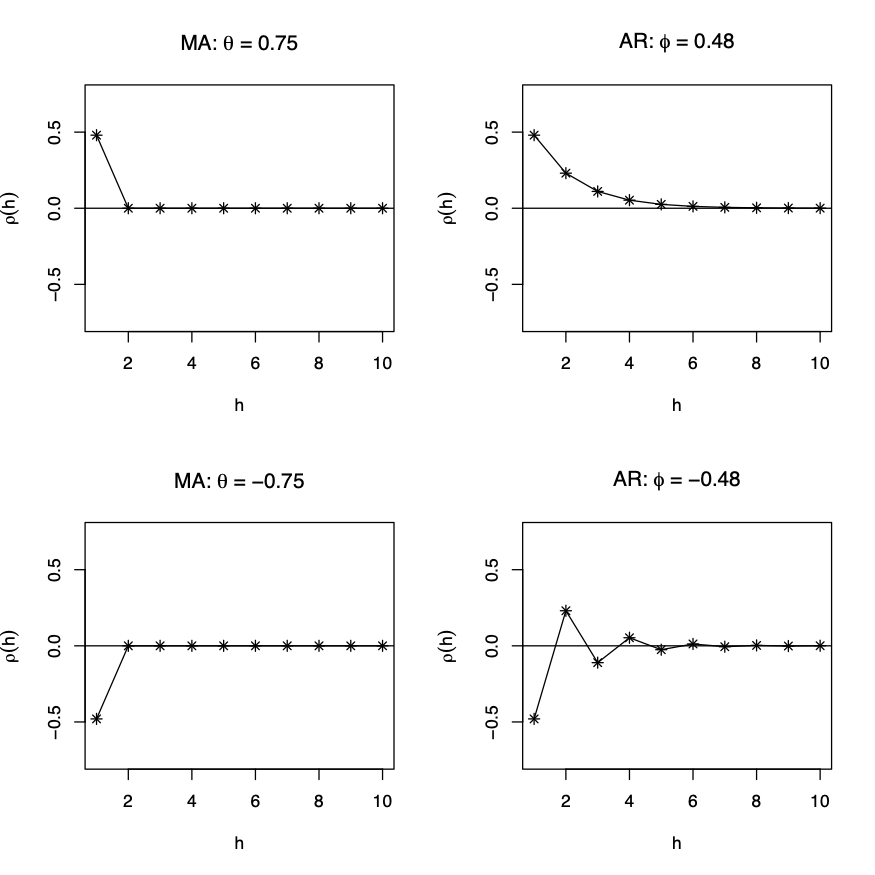

MA and AR processes: autocorrelations

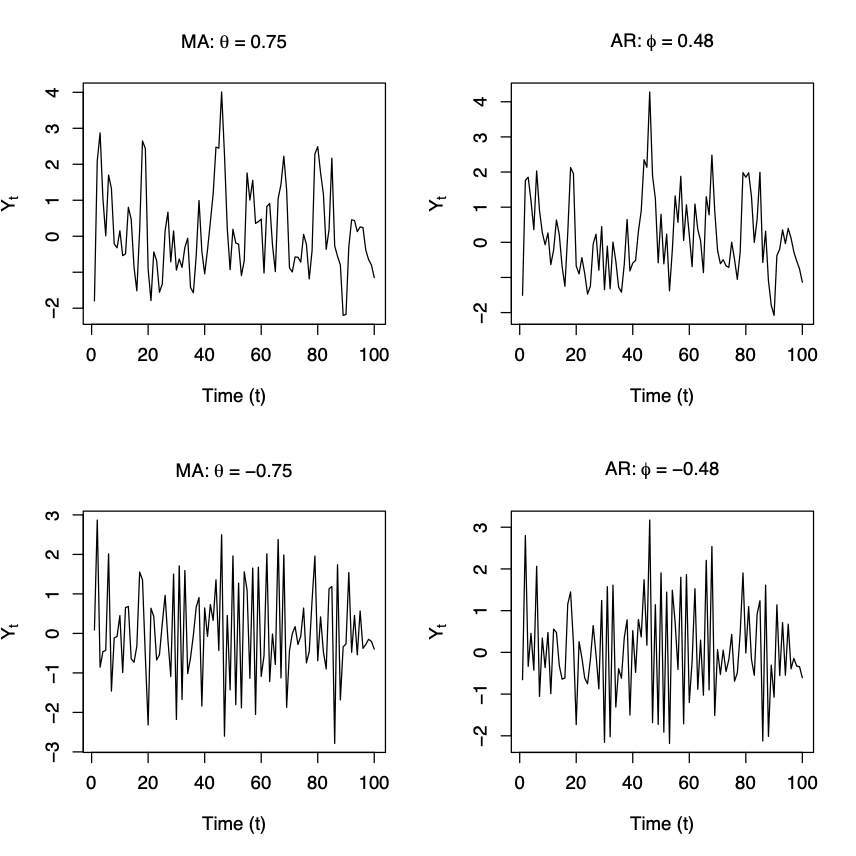

MA and AR processes: simulations

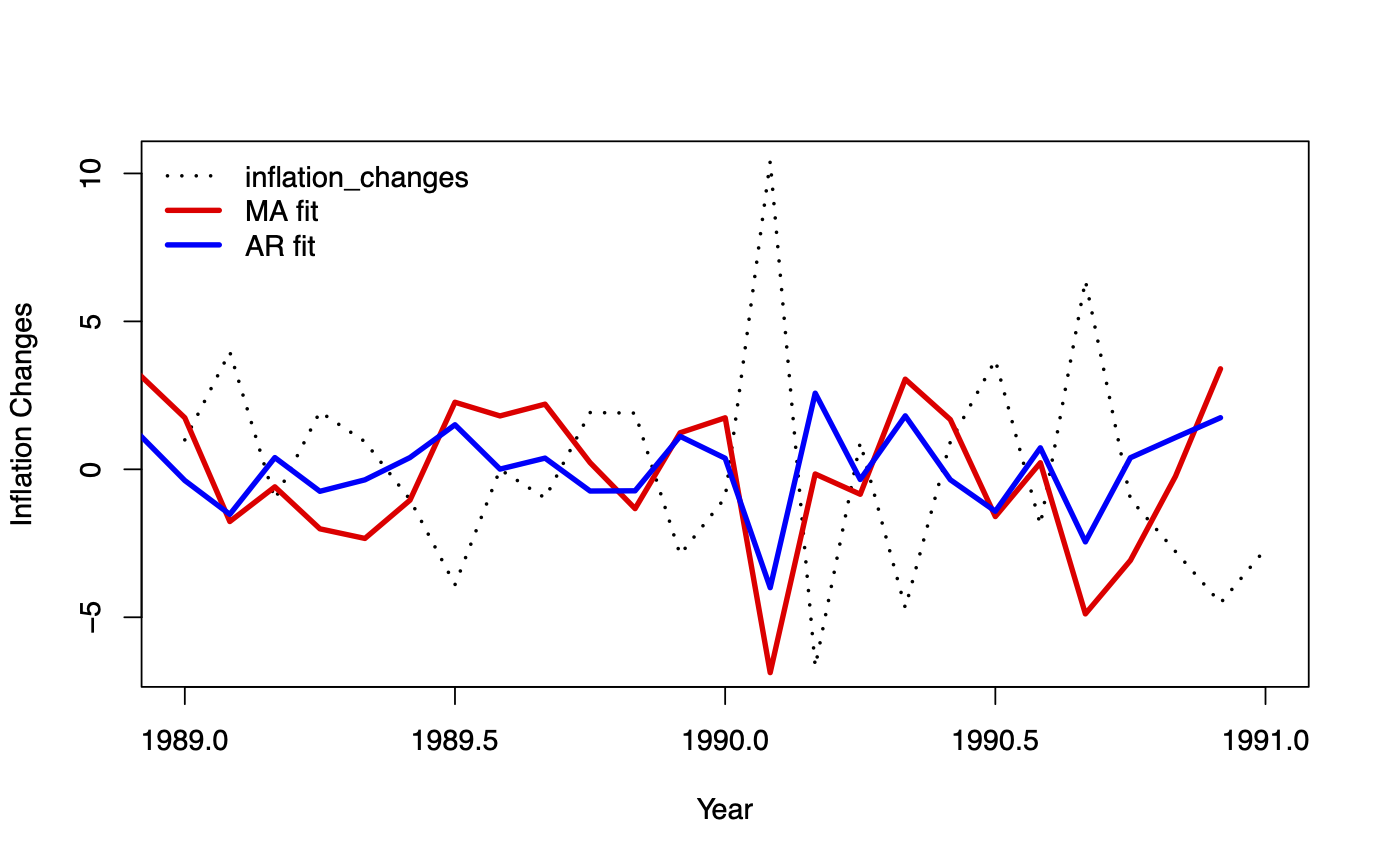

MA and AR processes: fitted values

- Changes in one-month US inflation rate

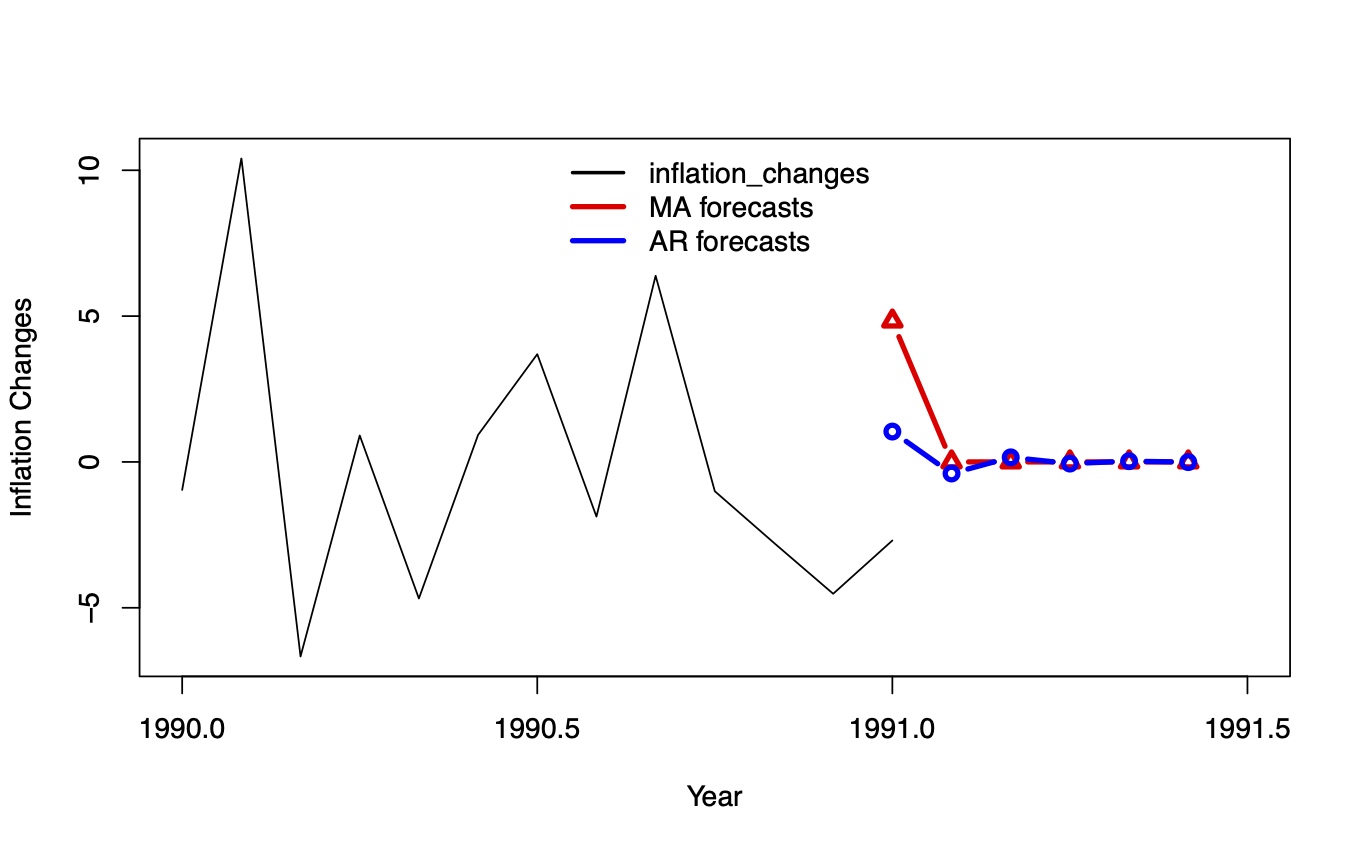

MA and AR processes: forecasts

- Changes in one-month US inflation rate

MA_inflation_changes <-

arima(inflation_changes,

order = c(0,0,1))

ma1 intercept

-0.7932 0.0010

s.e. 0.0355 0.0281

sigma^2 estimated as 8.882:

log likelihood = -1230.85,

aic = 2467.7

AIC(MA_inflation_changes)

BIC(MA_inflation_changes)

2467.703

2480.286

AR_inflation_changes <-

arima(inflation_changes,

order = c(1,0,0))

ar1 intercept

-0.3849 0.0038

s.e. 0.0420 0.1051

sigma^2 estimated as 10.37:

log likelihood = -1268.34,

aic = 2542.68

AIC(AR_inflation_changes)

BIC(AR_inflation_changes)

2542.679

2555.262

Let's practice!

Time Series Analysis in R