AR model estimation and forecasting

Time Series Analysis in R

David S. Matteson

Associate Professor at Cornell University

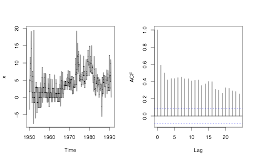

AR processes: inflation rate

- One-month US inflation rate (in percent, annual rate).

- Monthly observations from 1950 through 1990

data(Mishkin, package = "Ecdat")inflation <- as.ts(Mishkin[, 1])ts.plot(inflation) ; acf(inflation)

$$ (Today - Mean) = Slope * (Yesterday - Mean) + Noise $$

$$Y_t - \mu = \phi(Y_{t-1} - \mu) + \epsilon_t $$

$$\epsilon_t~ WhiteNoise(0, \sigma_{\epsilon}^2)$$

AR_inflation <- arima(inflation, order = c(1, 0, 0))print(AR_inflation)

Coefficients:

ar1 intercept

0.5960 3.9745

s.e. 0.0364 0.3471

sigma^2 estimated as 9.713

ar1 = $ \hat{\phi}$, intercept = $ \hat{\mu} $, sigma^2 = $\hat{\sigma}^2_{\epsilon}$

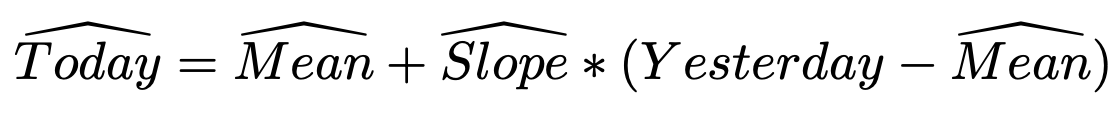

AR processes: fitted values - I

- AR fitted values:

$$\hat{Y_t} = \hat{\mu} + \hat{\phi}(Y_{t-1} - \hat{\mu})$$

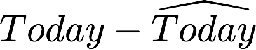

- Residuals =

$$ \hat{\epsilon_t} = Y_t - \hat{Y_t}$$

AR processes: fitted values - II

ts.plot(inflation)AR_inflation_fitted <- inflation - residuals(AR_inflation)points(AR_inflation_fitted, type = "l" col = "red", lty = 2)

Forecasting

- 1-step ahead forecasts

predict(AR_inflation)$pred

Jan

1991 1.605797

predict(AR_inflation)$se

Jan

1991 3.116526

Forecasting (cont.)

- h-step ahead forecasts

predict(AR_inflation, n.ahead = 6)$pred

Jan Feb Mar Apr May Jun

1991 1.605797 2.562810 3.133165 3.473082 3.675664 3.796398

predict(AR_inflation, n.ahead = 6)$se

Jan Feb Mar Apr May Jun

1991 3.116526 3.628023 3.793136 3.850077 3.870101 3.877188

Let's practice!

Time Series Analysis in R