sigThreshold

Financial Trading in R

Ilya Kipnis

Professional Quantitative Analyst and R programmer

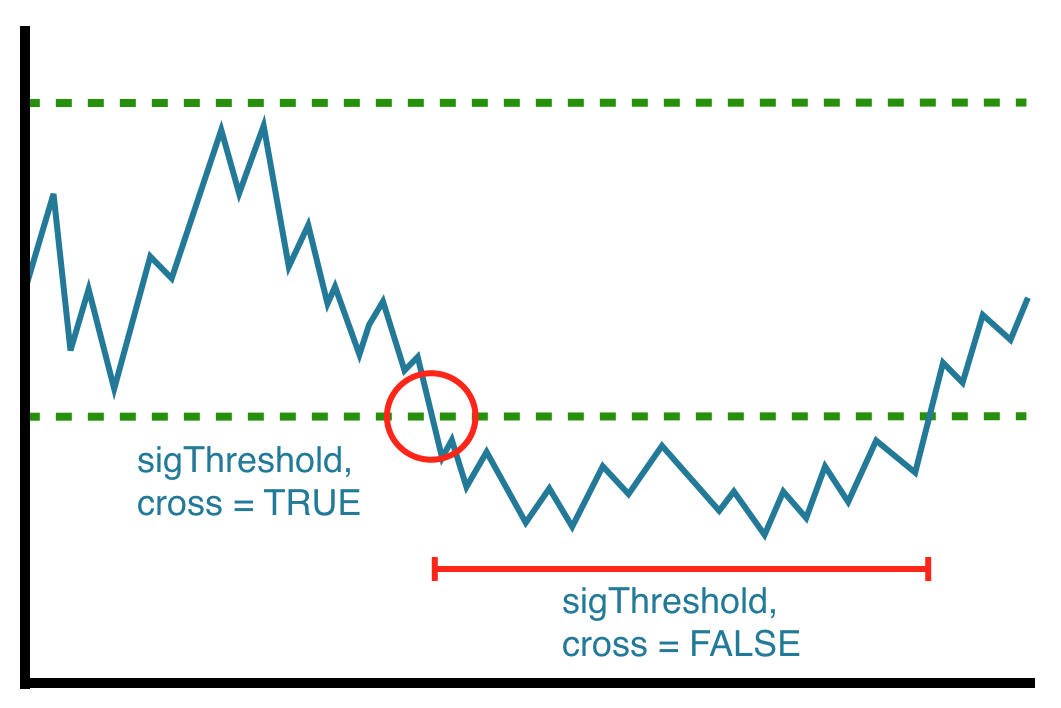

About sigThreshold

deals with bounded indicators interacting with critical (and usually fixed) values

Examples:

- when the DVO crosses under 20

- on indicator with running probability value (between 0 and 1)

- on rolling ratio’s that center on 0

Structure

add.signal(strategy.st, name = “sigThreshold",

arguments = list(column = "str1",

threshold = 20,

cross = TRUE,

relationship = "lt" ),

label = "siglabel")

cross = TRUE mimics

sigCrossovercross = FALSE mimics

sigComparison

Examples

add.signal(strategy.st, name = “sigThreshold",

arguments = list(column = "DVO_2_126",

threshold = 20,

cross = FALSE,

relationship = “lt"),

label = "thresholdfilter")

add.signal(strategy.st, name = “sigThreshold",

arguments = list(column = "DVO_2_126",

threshold = 80,

cross = TRUE,

relationship = "gt"),

label = "thresholdfilter")

Examples

Let's practice!

Financial Trading in R