Checking for weirdness

Importing and Managing Financial Data in R

Joshua Ulrich

Quantitative Analyst & quantmod Co-Author and Maintainer

Visualize Data

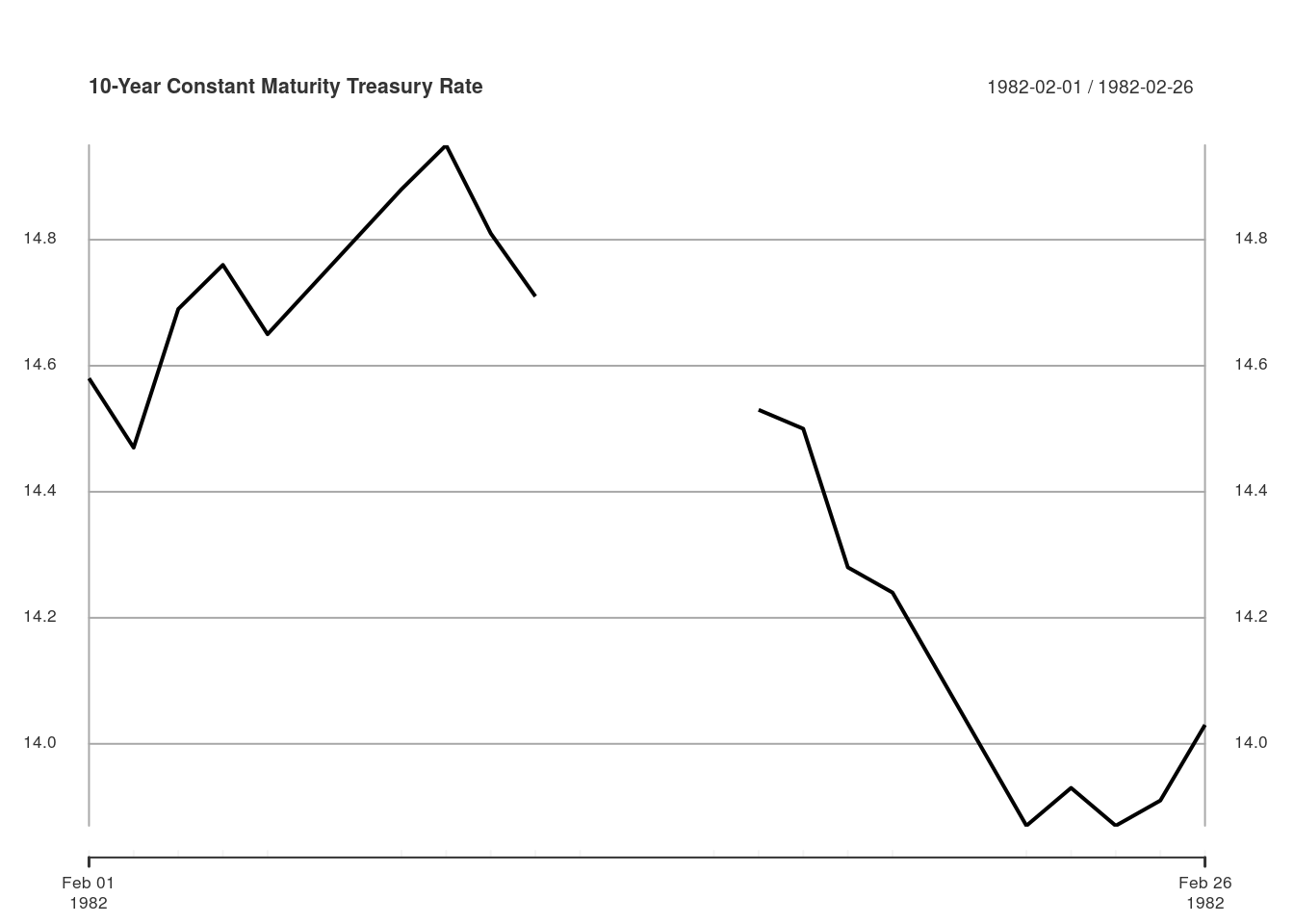

getSymbols("DGS10", src = "FRED")

"DGS10"

treasury_10 <- DGS10["1982-02"]

plot(treasury_10, main = "10-Year Constant Maturity Treasury Rate")

Handle missing values

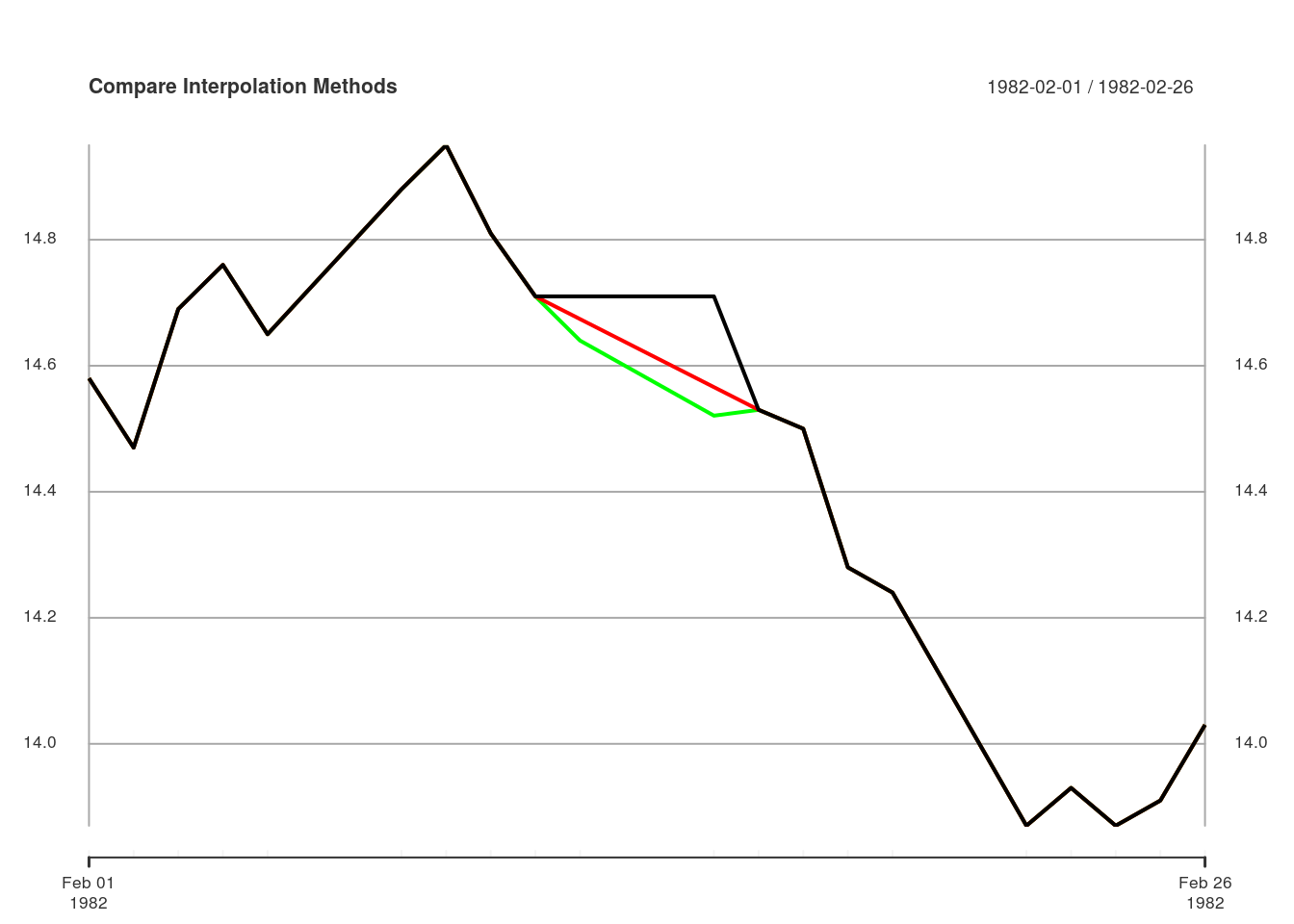

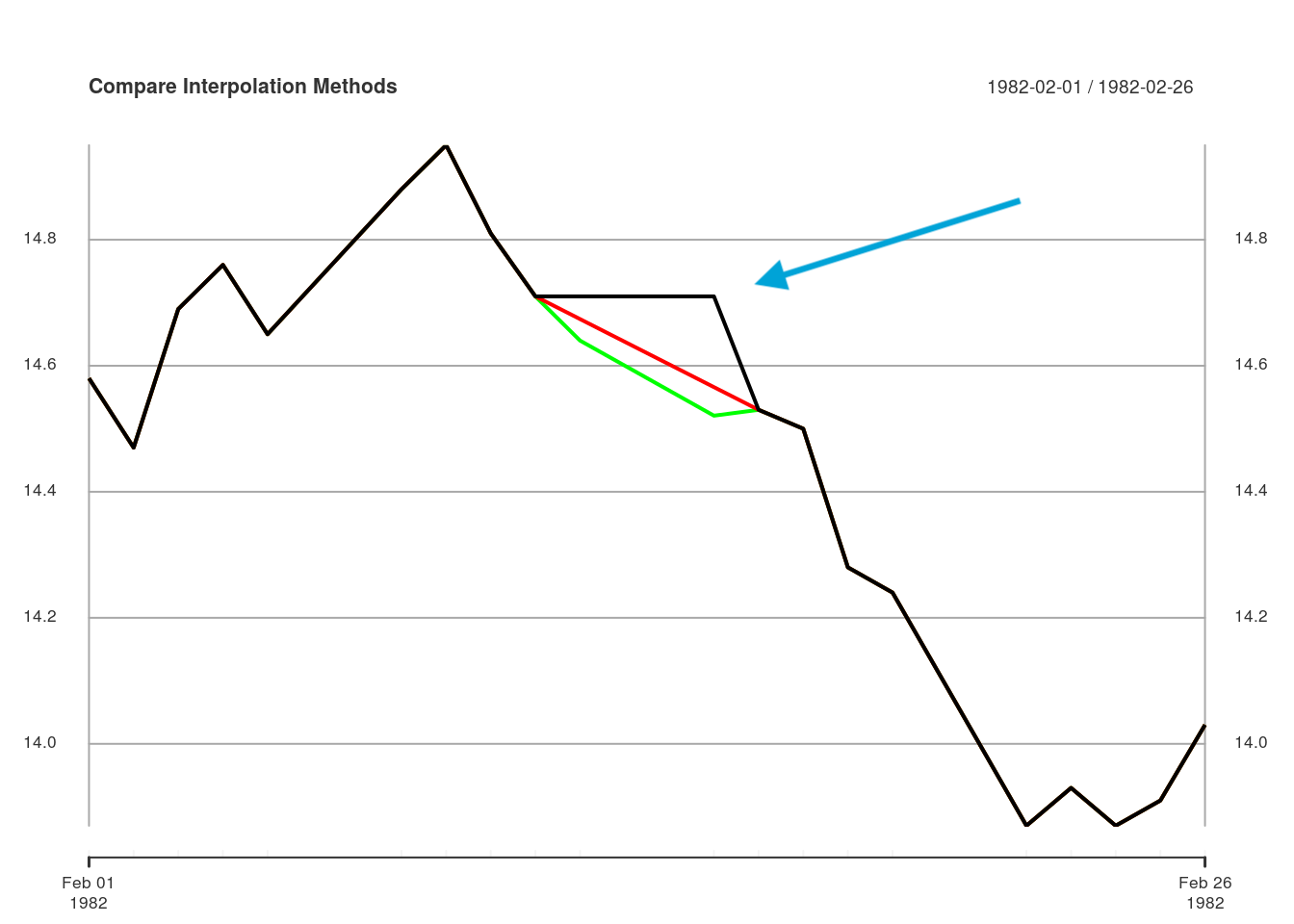

# Fill NA using last observation carried forward

locf <- na.locf(treasury_10)

# Fill NA using linear interpolation

approx <- na.approx(treasury_10)

# Fill NA using spline interpolation

spline <- na.spline(treasury_10)

# Merge into one object na_filled <- merge(locf, approx, spline)# Plot combined object plot(na_filled, col = c("black", "red", "green"), main = "Compare Interpolation Methods")

Handle missing values

Handle missing values

Visualize data

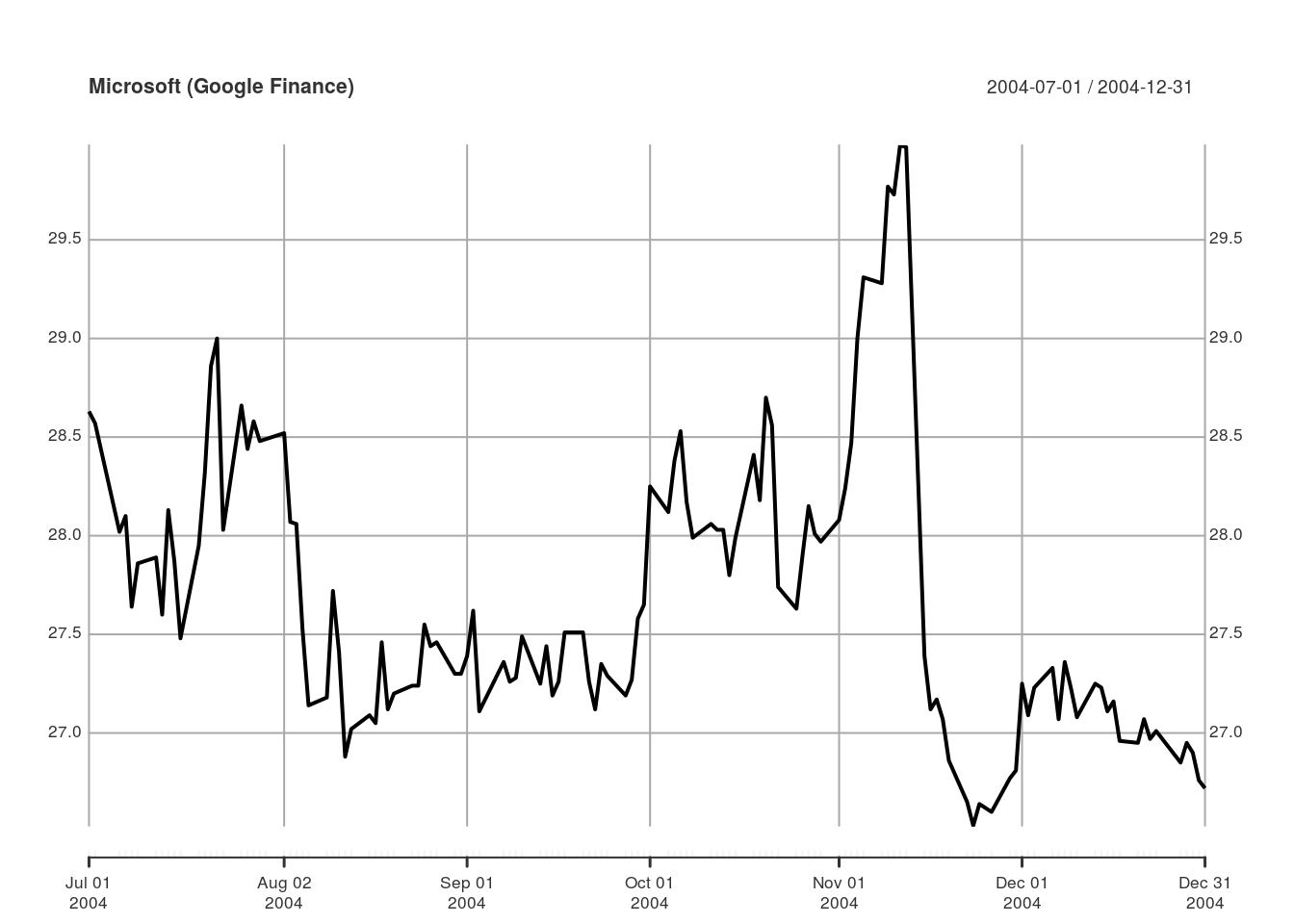

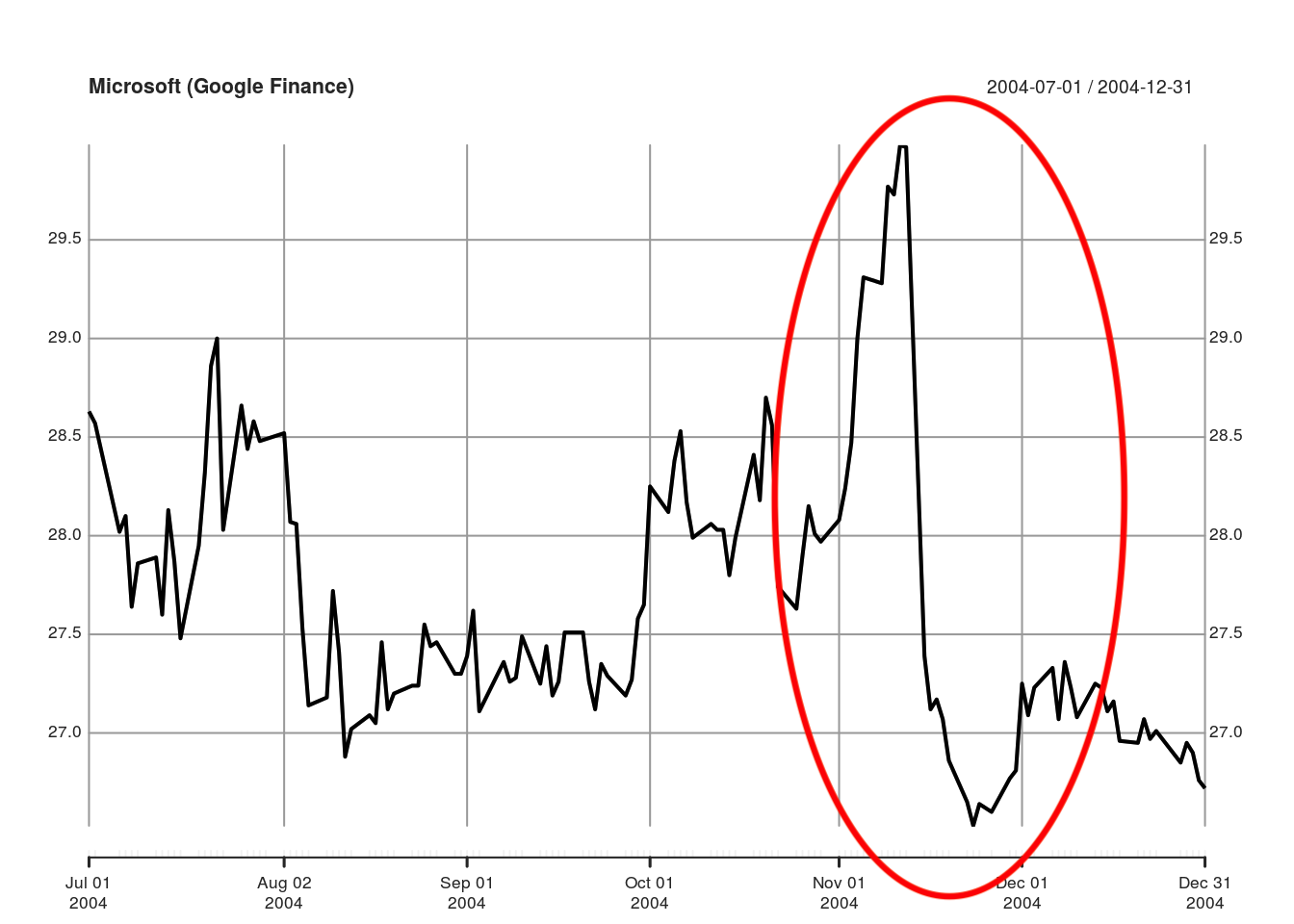

getSymbols("MSFT", from = "2004-07-01", to = "2004-12-31", src = "google")

"MSFT"

plot(Cl(MSFT), main = "Microsoft (Google Finance)")

Visualize data

getSymbols("MSFT", from = "2004-07-01", to = "2004-12-31", src = "google")

"MSFT"

plot(Cl(MSFT), main = "Microsoft (Google Finance)")

Cross-reference sources

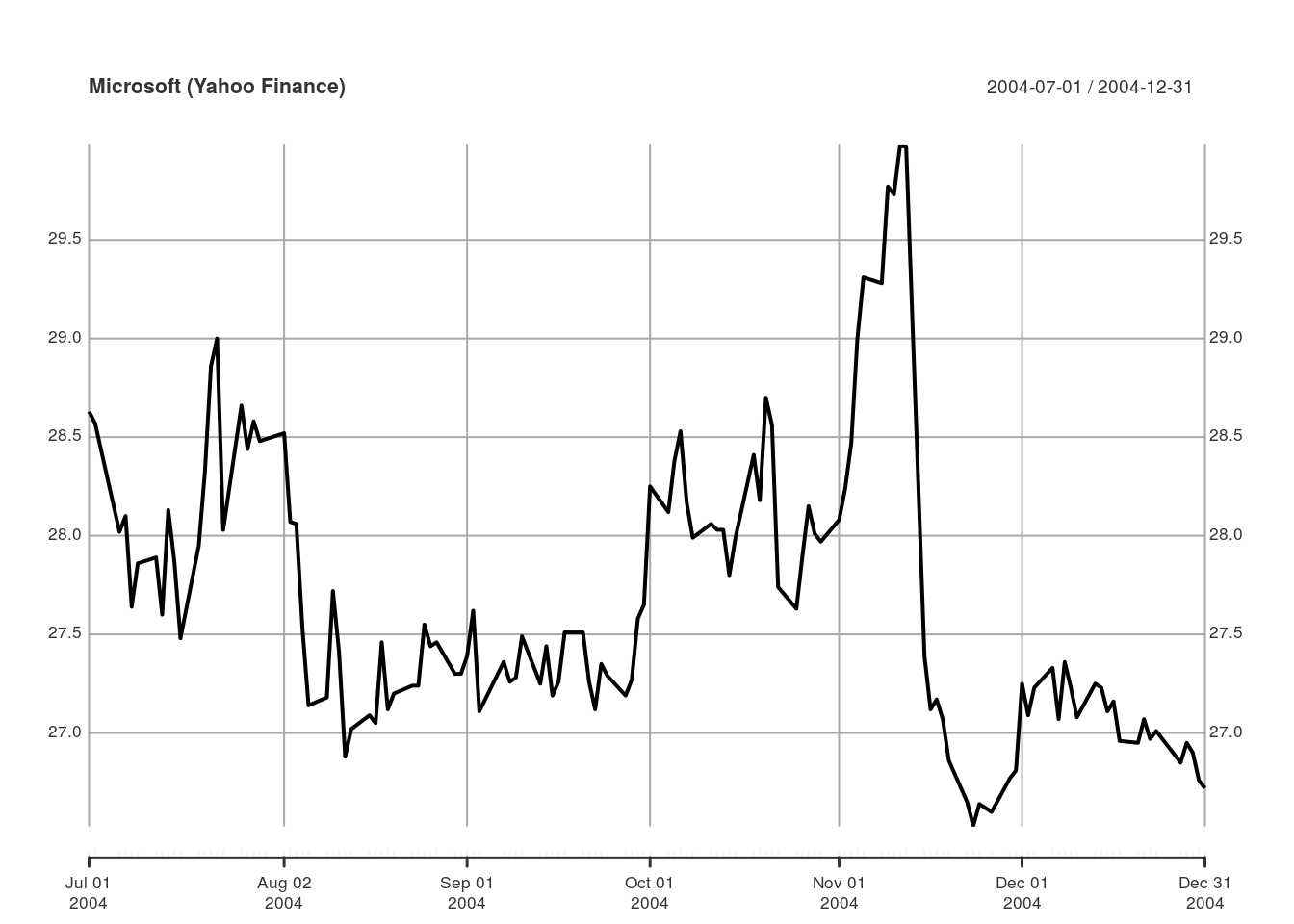

getSymbols("MSFT", from = "2004-07-01", to = "2004-12-31")

"MSFT"

plot(Cl(MSFT), main = "Microsoft (Yahoo Finance)")

Cross-reference sources

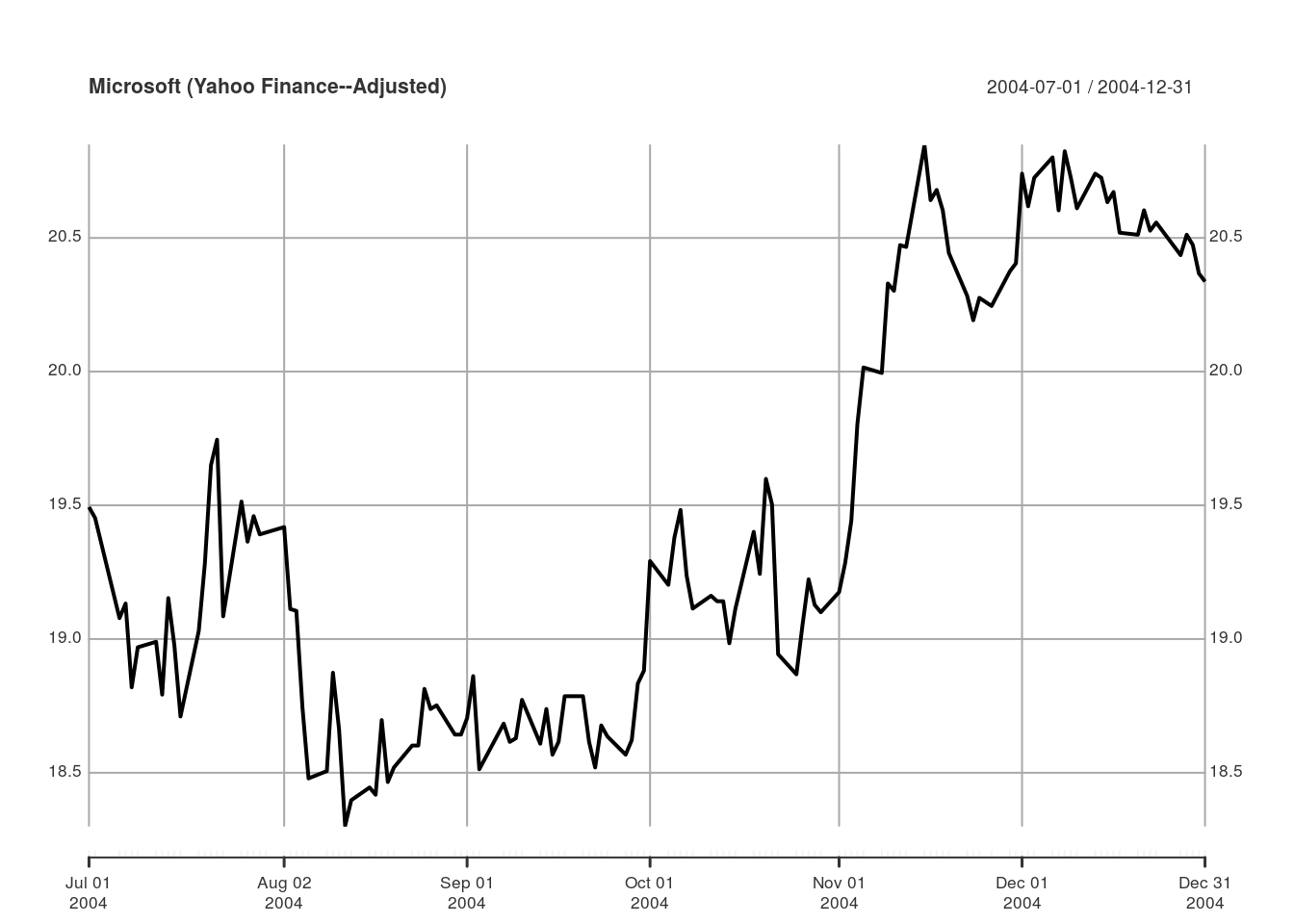

getSymbols("MSFT", from = "2004-07-01", to = "2004-12-31")

"MSFT"

plot(Ad(MSFT), main = "Microsoft (Yahoo Finance-Adjusted)")

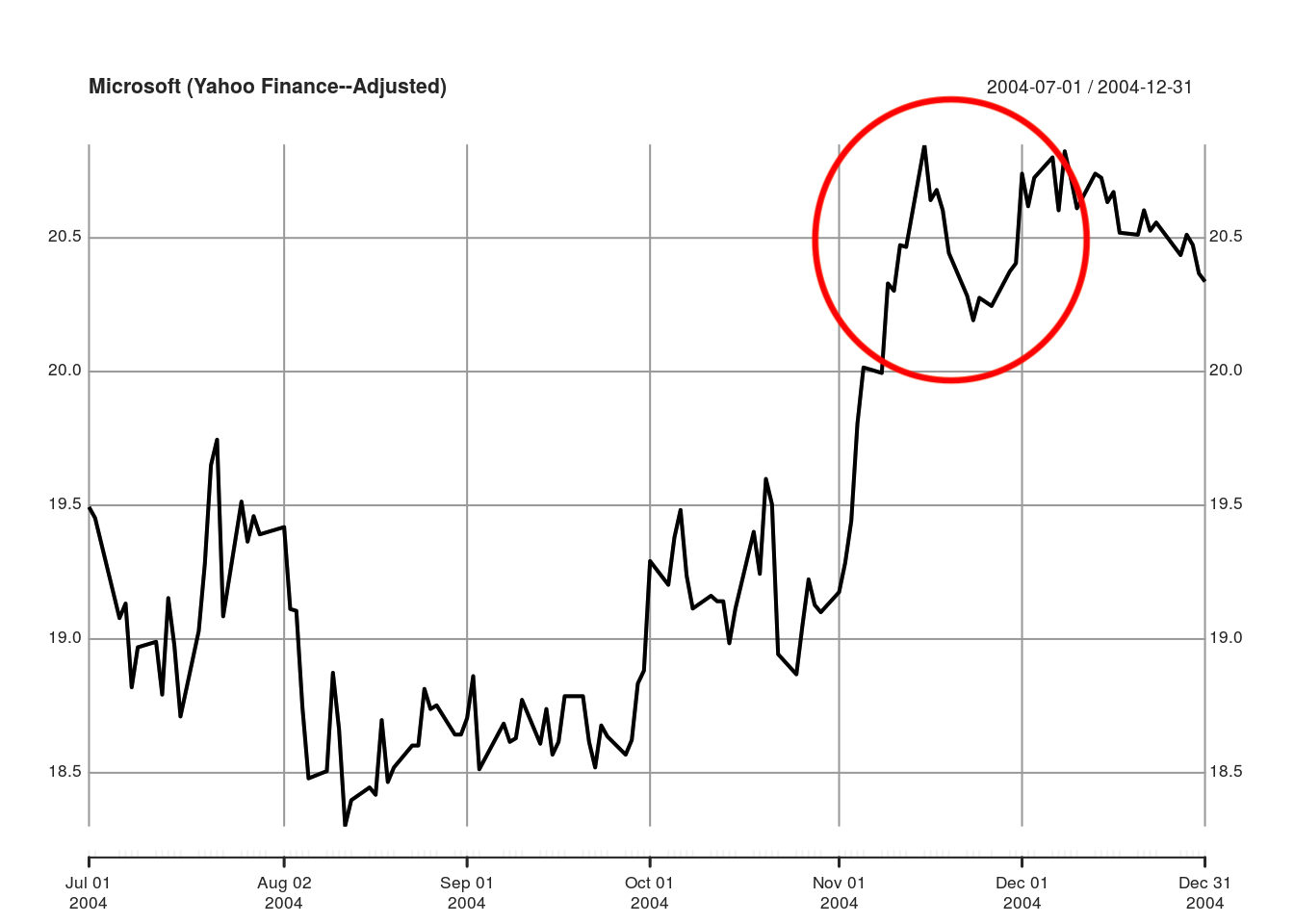

Cross-reference sources

getSymbols("MSFT", from = "2004-07-01", to = "2004-12-31")

"MSFT"

plot(Ad(MSFT), main = "Microsoft (Yahoo Finance—Adjusted)")

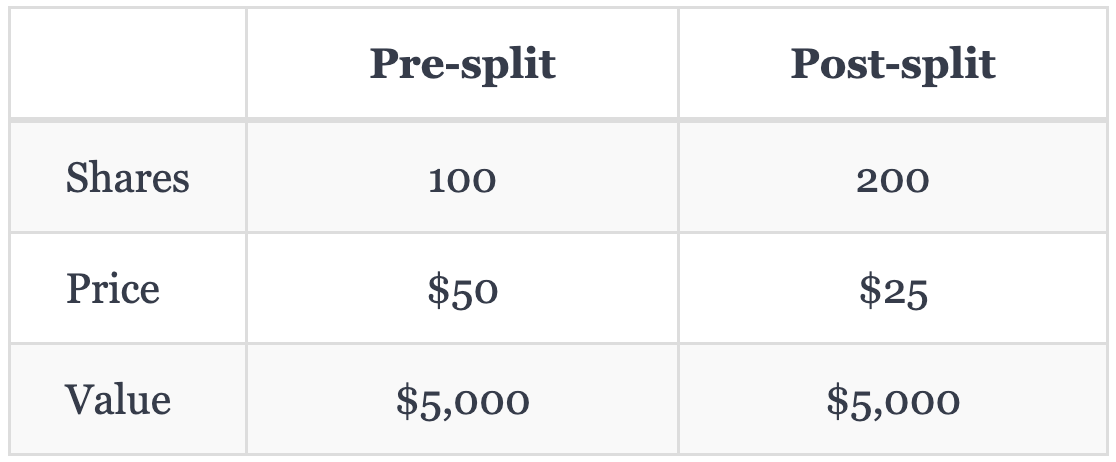

Stock split example

- MSFT stock splits 2-for-1

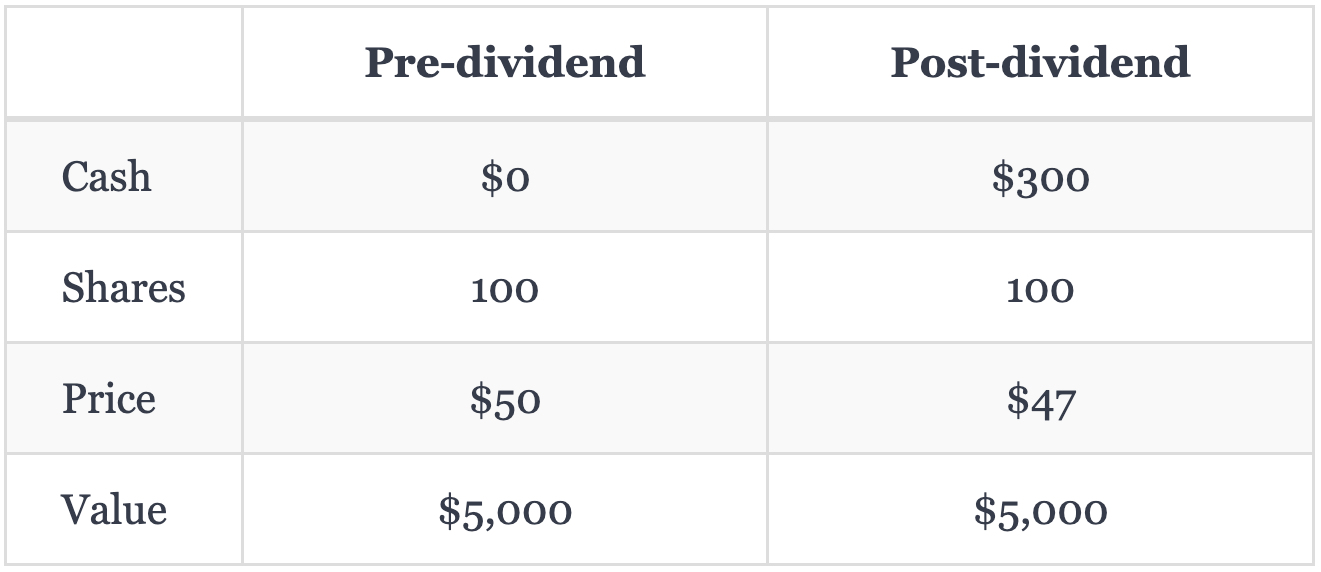

Stock dividend example

- MSFT issues a $3 per share dividend

Data source differences

- Yahoo Finance:

- Raw OHLC prices

- Split- and dividend-adjusted close

- Google Finance:

- Split-adjusted OHLC prices

Let's practice!

Importing and Managing Financial Data in R