Adjusting for corporate actions

Importing and Managing Financial Data in R

Joshua Ulrich

Quantitative Analyst & quantmod Co-Author and Maintainer

Adjust for stock splits and dividends (1)

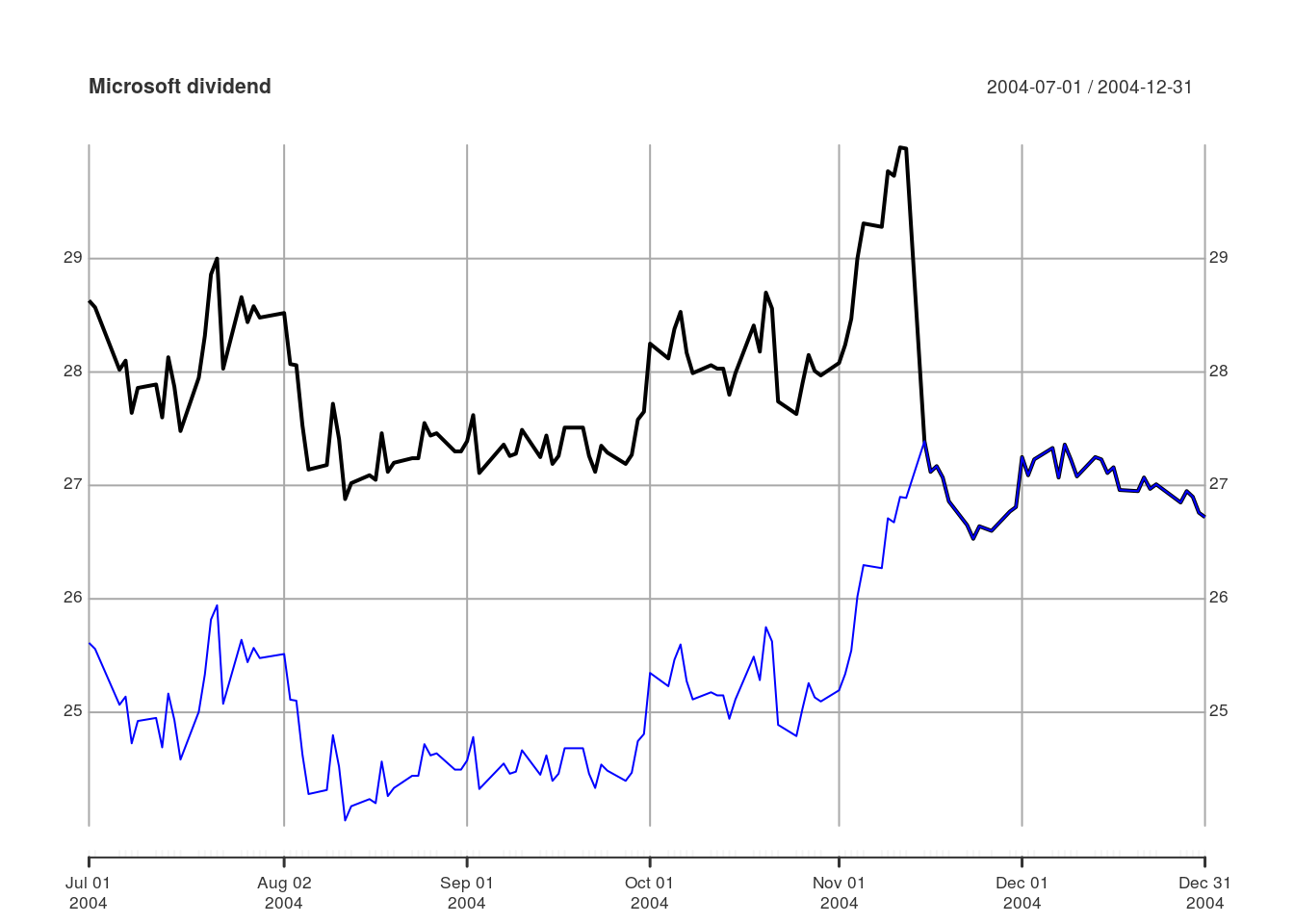

getSymbols("MSFT", from = "2004-07-01", to = "2004-12-31")

"MSFT"

# Adjust data for splits and dividends

msft_adjusted <- adjustOHLC(MSFT)

# Object name is not ticker symbol

my_data <- MSFT

# Use symbol.name argument

my_data_adjusted <- adjustOHLC(my_data, symbol.name = "MSFT")

Adjust for stock splits and dividends (2)

# Download split data from Yahoo Finance

splits <- getSplits("GE")

head(splits, n = 4)

GE.spl

1971-06-08 0.5

1983-06-02 0.5

1987-05-26 0.5

1994-05-16 0.5

# Download split-adjusted dividend data from Yahoo Finance

dividends <- getDividends("GE")

head(dividends, n = 4)

GE.div

1970-03-03 0.00677

1970-06-11 0.00677

1970-09-21 0.00677

1970-12-07 0.00677

Download unadjusted dividends

# Download unadjusted dividend data from Yahoo Finance

dividends_raw <- getDividends("GE", split.adjust = FALSE)

# Compare adjusted and unadjusted dividends

head(merge(dividends, dividends_raw))

GE.div GE.div.1

1970-03-03 0.00677 0.64992

1970-06-11 0.00677 0.64992

1970-09-21 0.00677 0.64992

1970-12-07 0.00677 0.64992

1971-03-03 0.00677 0.64992

1971-06-17 0.00729 0.34992

adjRatios()

- Back-adjust any series for splits, dividends, or both

- Has 3 arguments:

splitsdividendsclose

- Returns

xtsobject with 2 columns:Splitand Div

Adjust univariate series for splits and dividends

getSymbols("GE", from = "2000-01-01")

"GE"

close <- Cl(GE)

splits <- getSplits("GE")

dividends_raw <- getDividends("GE", split.adjust = FALSE)

# Pass splits, unadjusted dividends, and unadjusted close

ratios <- adjRatios(splits = splits,

dividends = dividends_raw,

close = close)

Adjust univariate series for splits and dividends

# Multiply unadjusted close by split and dividend ratios

close_adjusted <- close * ratios[, "Split"] * ratios[, "Div"]

head(merge(close, close_adjusted, Ad(GE)), n = 4)

GE.Close GE.Close.1 GE.Adjusted

2000-01-03 150.0000 29.50422 29.44630

2000-01-04 144.0000 28.32405 28.26845

2000-01-05 143.7500 28.27488 28.21937

2000-01-06 145.6718 28.65289 28.59664

Let's practice!

Importing and Managing Financial Data in R