Risk-adjusted metrics

Financial Analytics in Google Sheets

David Ardia

Professor in Quantitative Methods for Finance

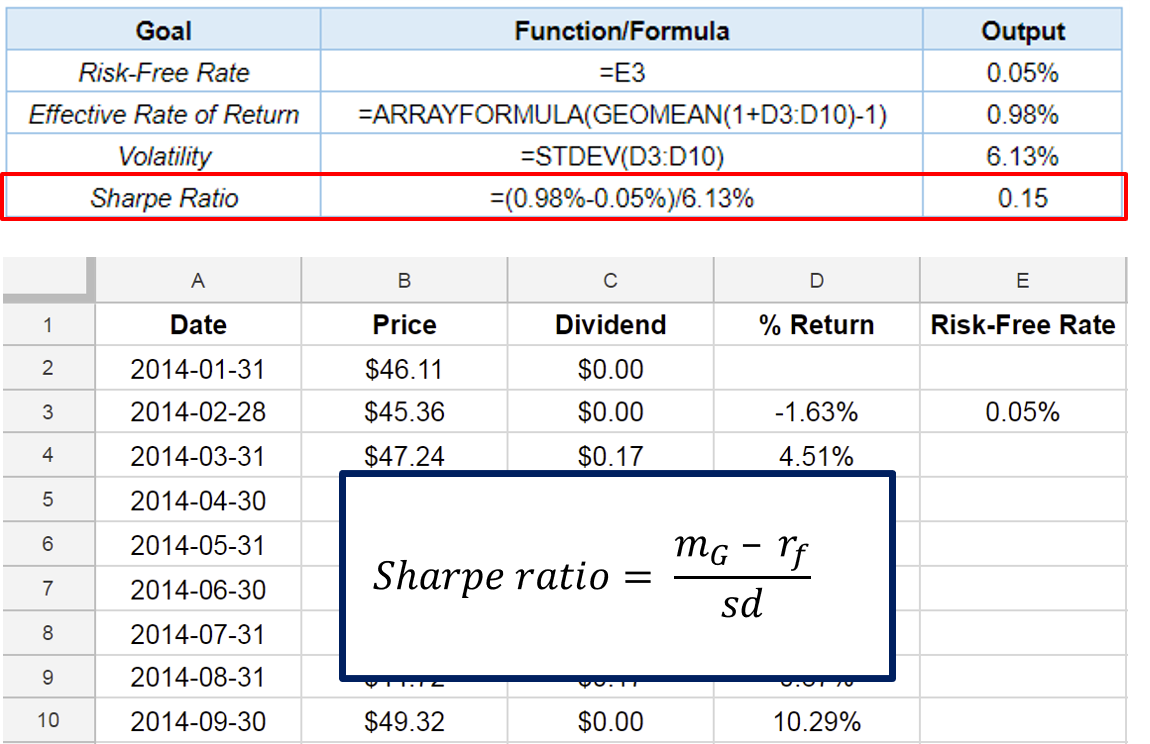

Sharpe ratio

Most popular risk-adjusted metric

Excess reward divided by volatility:

$$Sharpe\,\,ratio = \frac{m_G - r_f}{sd}$$

Effective rate of return: $m_G$

Risk-free rate: $r_f$

Volatility of the returns: $sd$

Sharpe ratio

Most popular risk-adjusted metric

Excess reward divided by volatility:

$$Sharpe\,\,ratio = \frac{m_G - r_f}{sd}$$

Effective rate of return: $m_G$

Risk-free rate: $r_f$ → Interest rate of the US Treasury Bill

Volatility of the returns: $sd$

Sharpe ratio

$R_1=50\%,R_2=-20\%,R_3=5\%,R_4=-3\%$

- Effective rate of return: $m_G = 5\%$

- Volatility of the returns: $sd = 30\%$

- Assume risk-free rate: $r_f = 1\%$

$$Sharpe\,\,ratio = \frac{m_G - r_f}{sd} = \frac{5\% - 1\%}{30\%} = 0.13$$

Sharpe ratio with Google Sheets

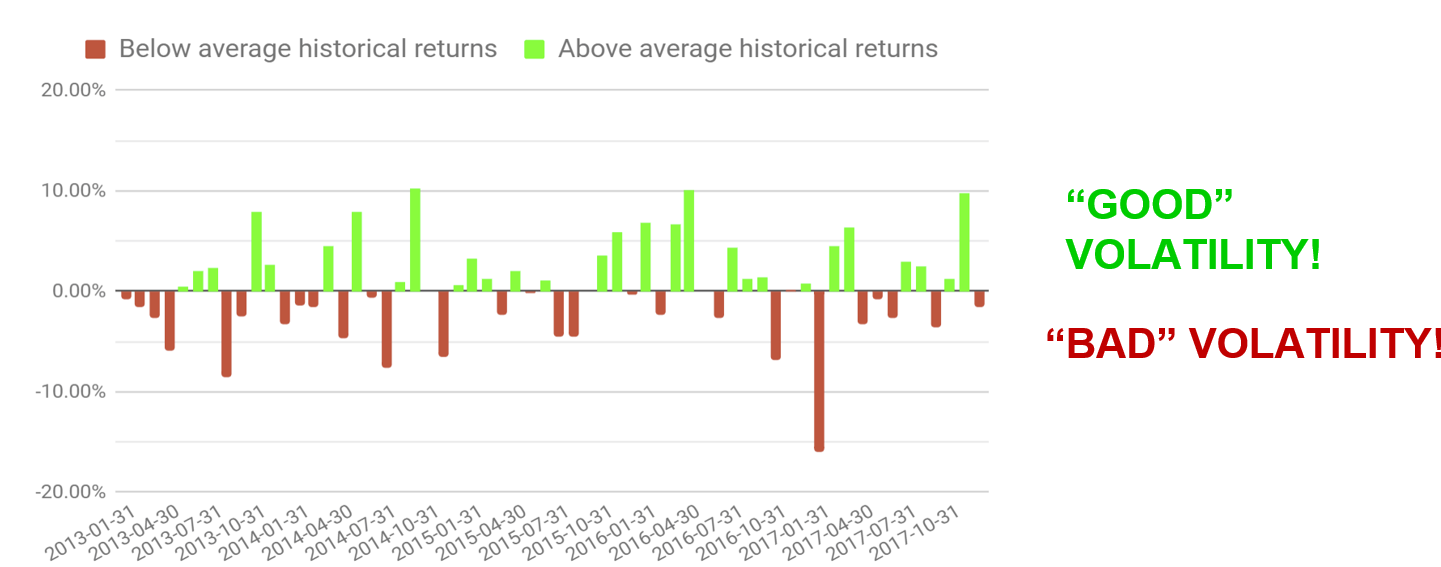

Volatility and Sharpe ratio

- High volatility penalizes the Sharpe ratio

- Is volatility bad for investors?

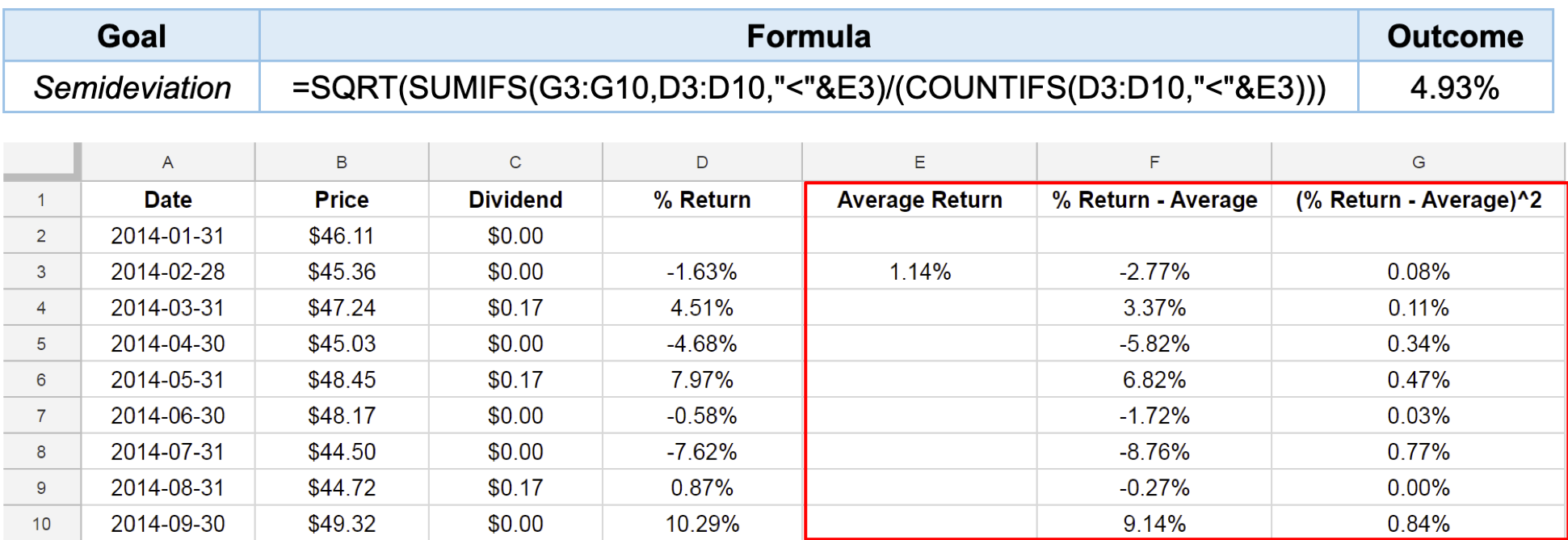

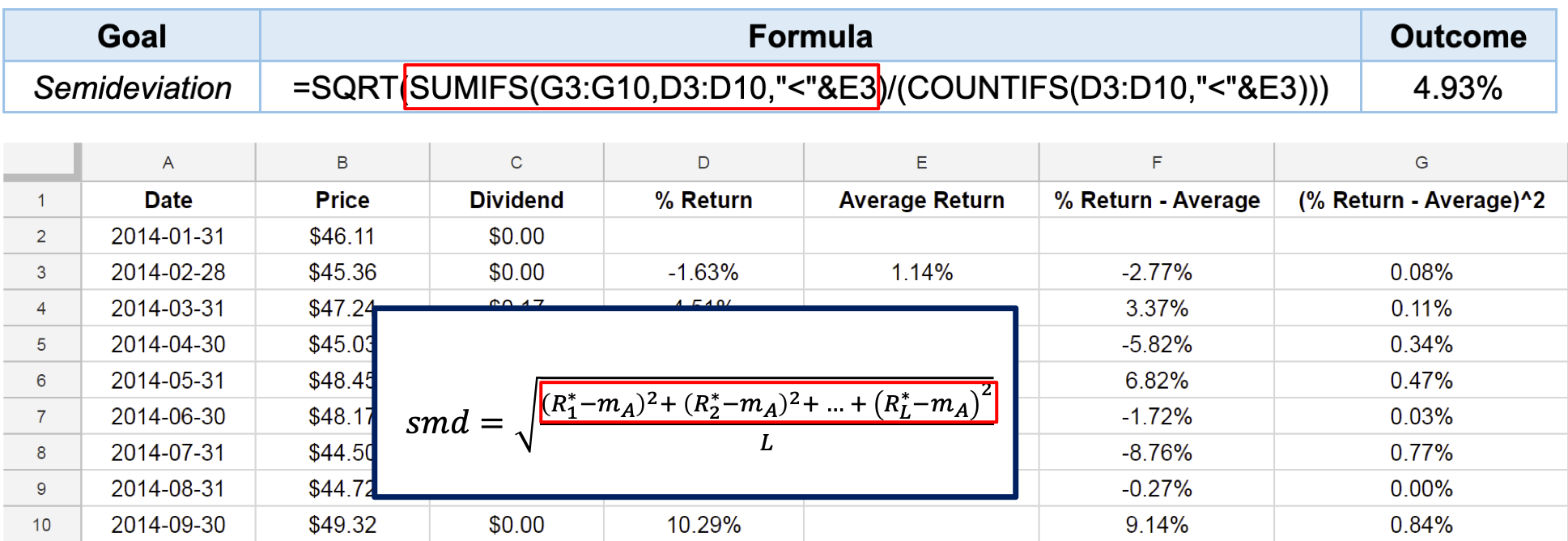

Semideviation and Sortino ratio

- The semideviation is a measurement of dispersion of the returns which are below the average return:

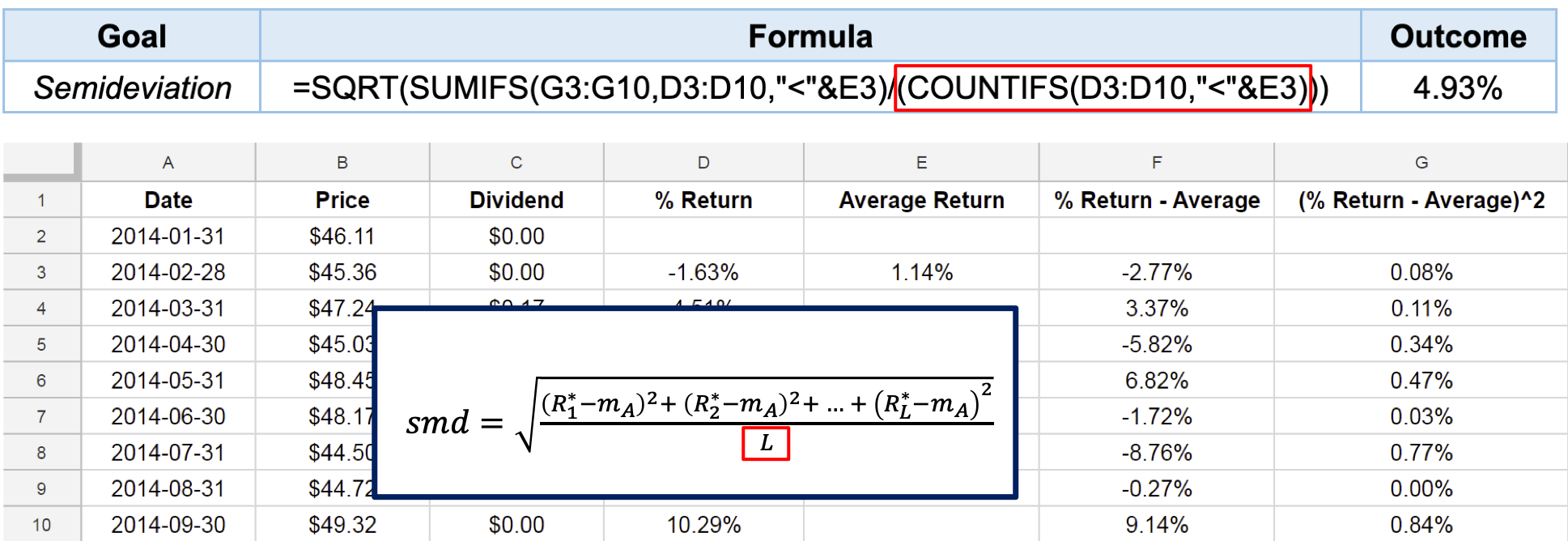

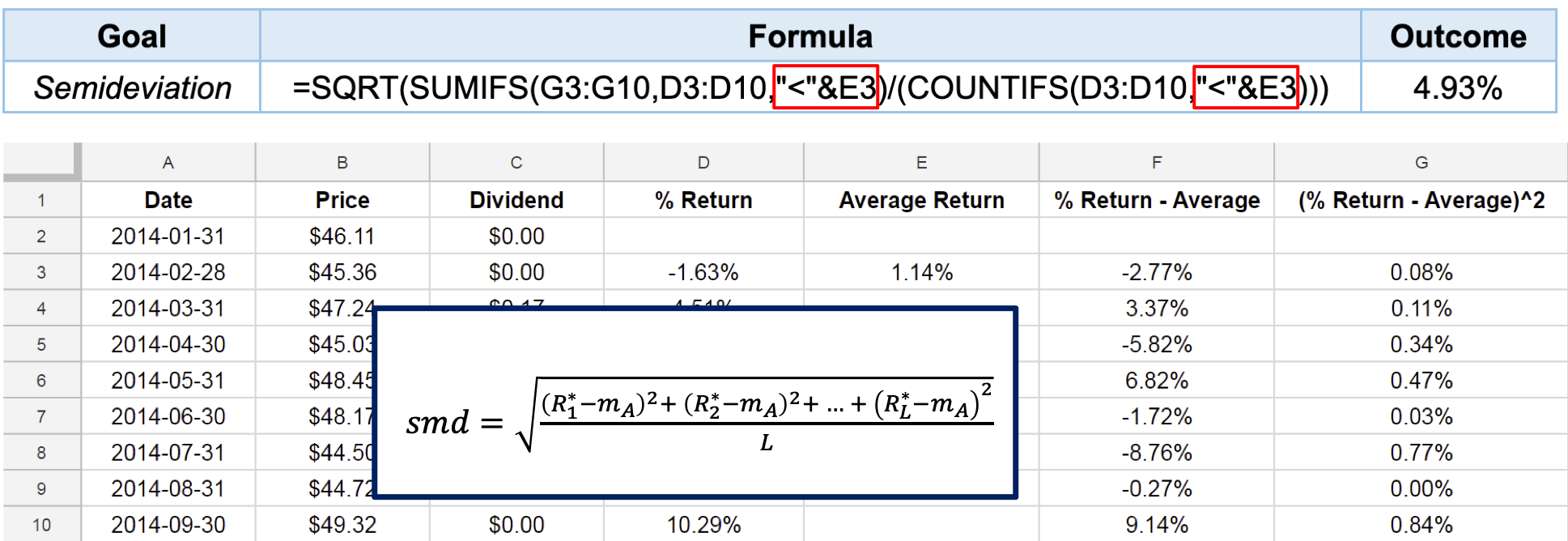

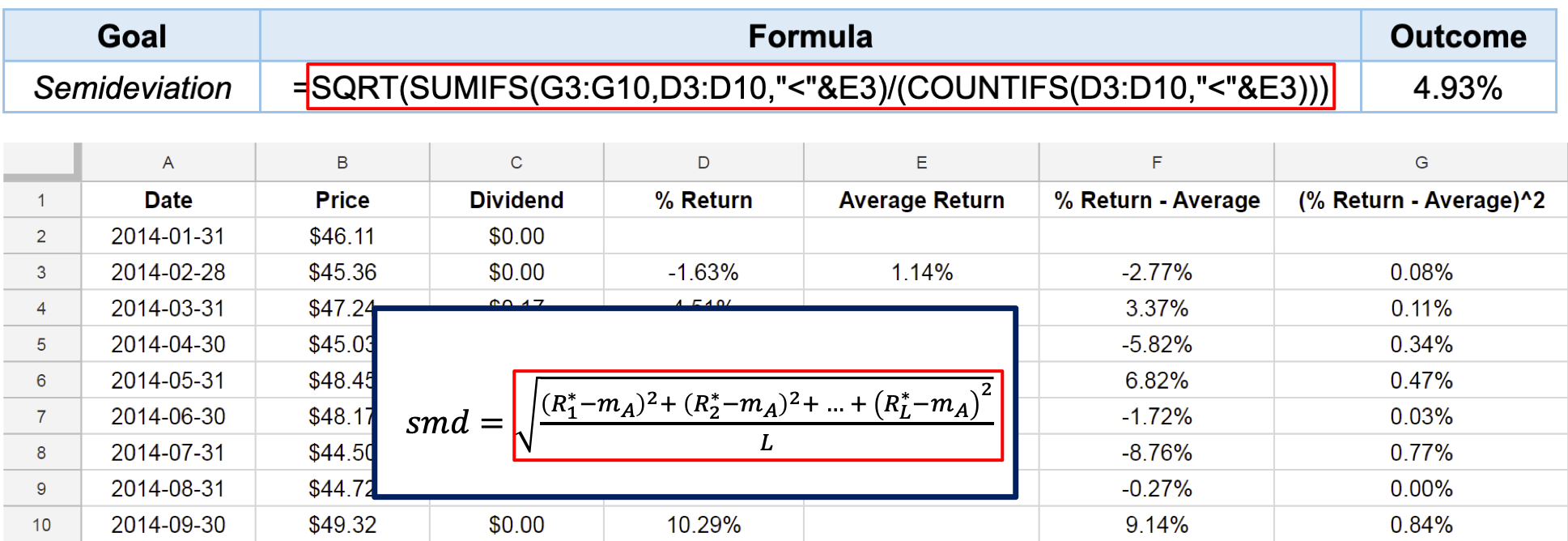

$$smd=\sqrt{\frac{(R_1^\star-m_A)^2+(R_2^\star-m_A)^2+\cdots+(R_L^\star-m_A)^2}{L}}$$

where $R_1^\star, R_2^\star,\ldots,R_L^\star$ are the $L$ historical returns which are below $m_A$

- The Sortino ratio replaces the volatility in the Sharpe ratio:

$$Sortino\,\,ratio = \frac{m_G - r_f}{ smd}$$

Semideviation and Sortino ratio

$R_1=50\%,R_2=-20\%,R_3=5\%,R_4=-3\%$

Average return: $m_A=8\%$

Semideviation:

$$smd=\sqrt{\frac{(-20\%-8\%)^2+(5\%-8\%)^2+(-3\%-8\%)^2}{3}}=17\%$$

Semideviation and Sortino ratio

$R_1=50\%,R_2=-20\%,R_3=5\%,R_4=-3\%$

- Effective rate of return: $m_G=5\%$

- Semideviation: $smd=17\%$

- Assume risk-free rate: $r_f=1\%$

$$Sortino\,\,ratio = \frac{m_G - r_f}{smd} = \frac{5\% - 1\%}{17\%} = 0.23 $$

Semideviation with Google Sheets

Semideviation with Google Sheets

Semideviation with Google Sheets

Semideviation with Google Sheets

Semideviation with Google Sheets

It's time to practice!

Financial Analytics in Google Sheets