Limitations of the Gaussian model

Financial Analytics in Google Sheets

David Ardia

Professor of Quantitative Methods for Finance

Deviations from the Gaussian model

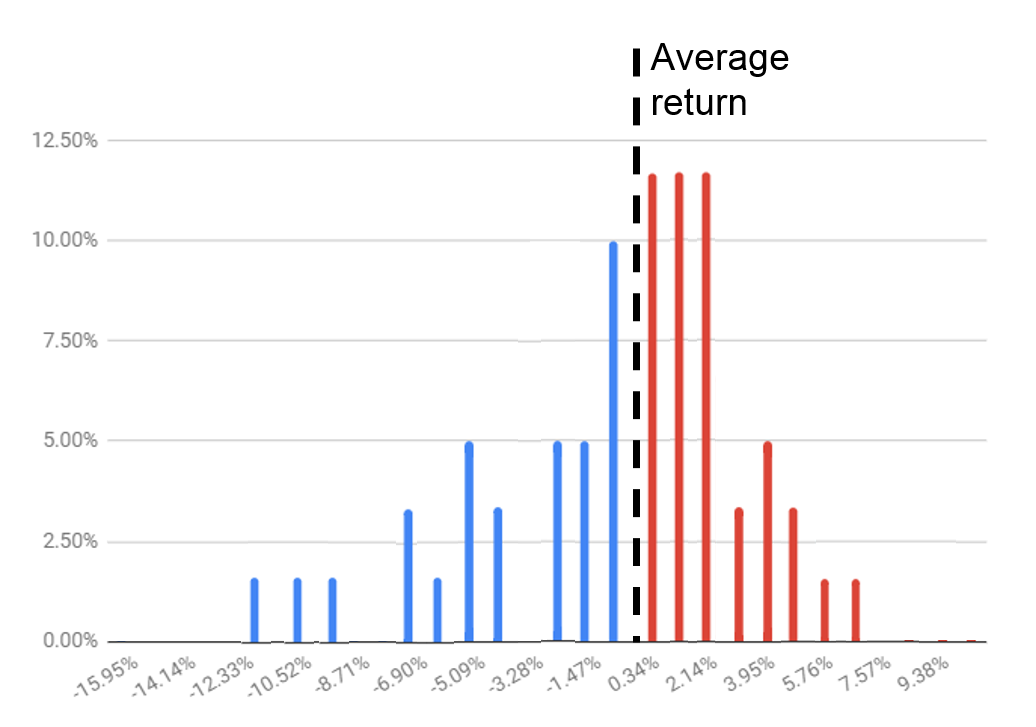

Returns are not symmetrically distributed

Deviations from the Gaussian model

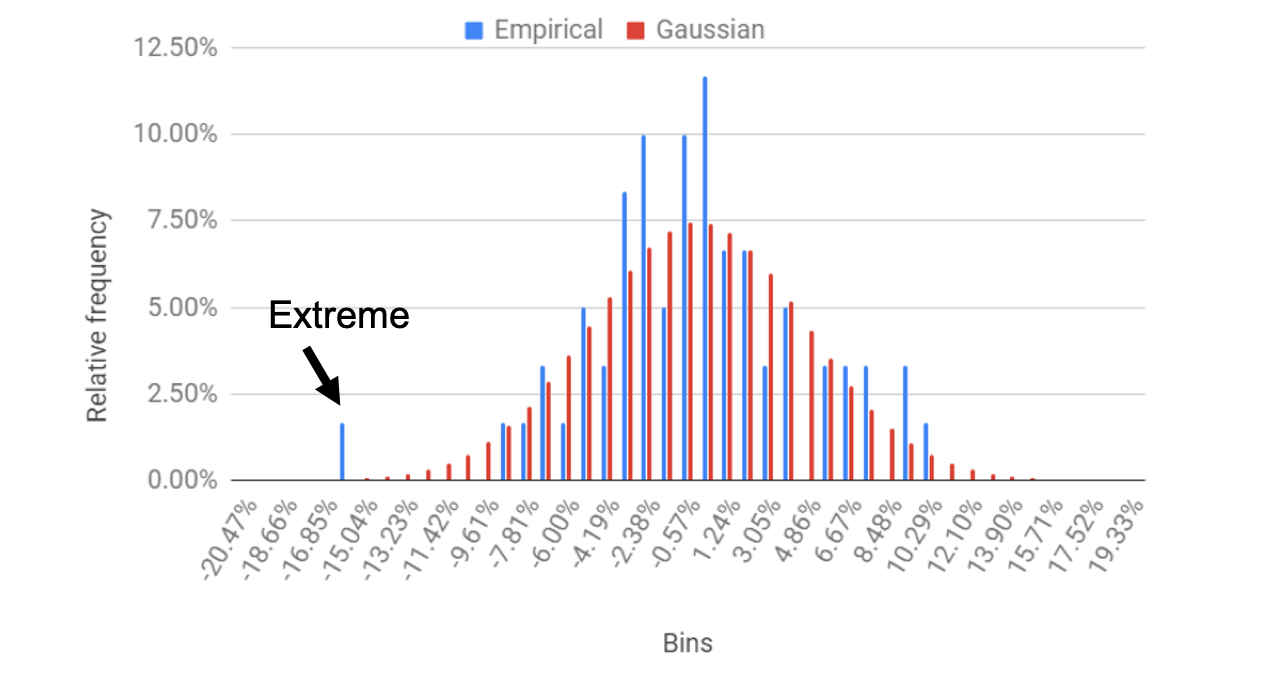

Very large returns are not captured by the Gaussian model

Metrics for asymmetry and extremes

- We can measure asymmetry and extremes:

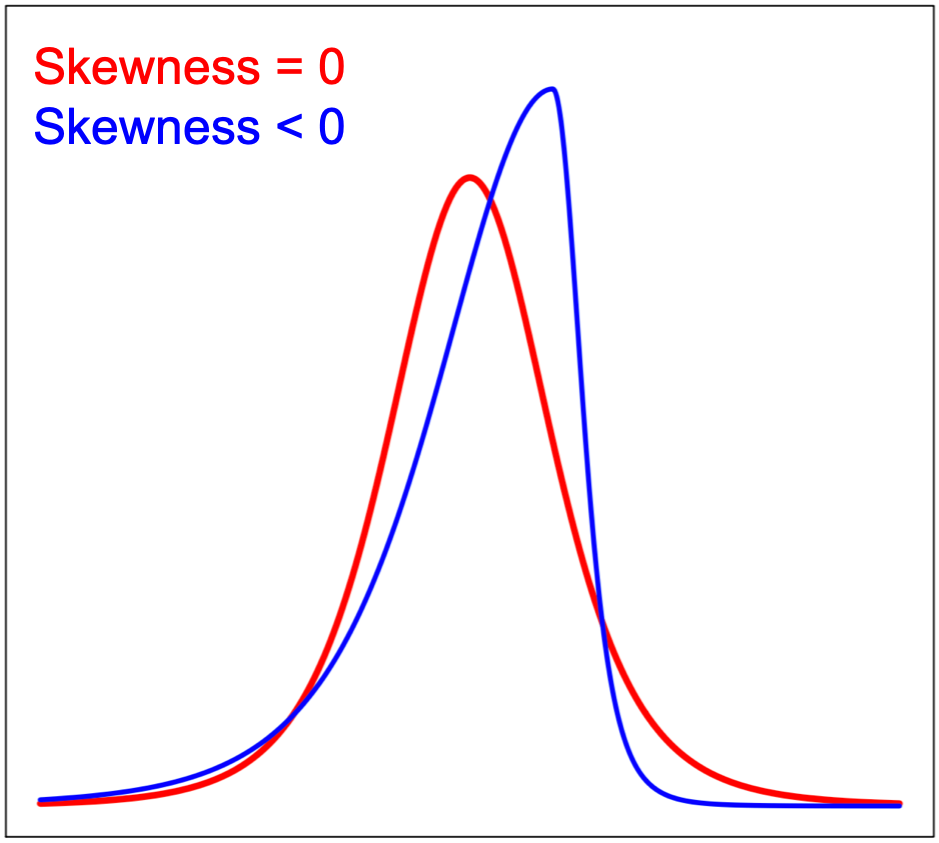

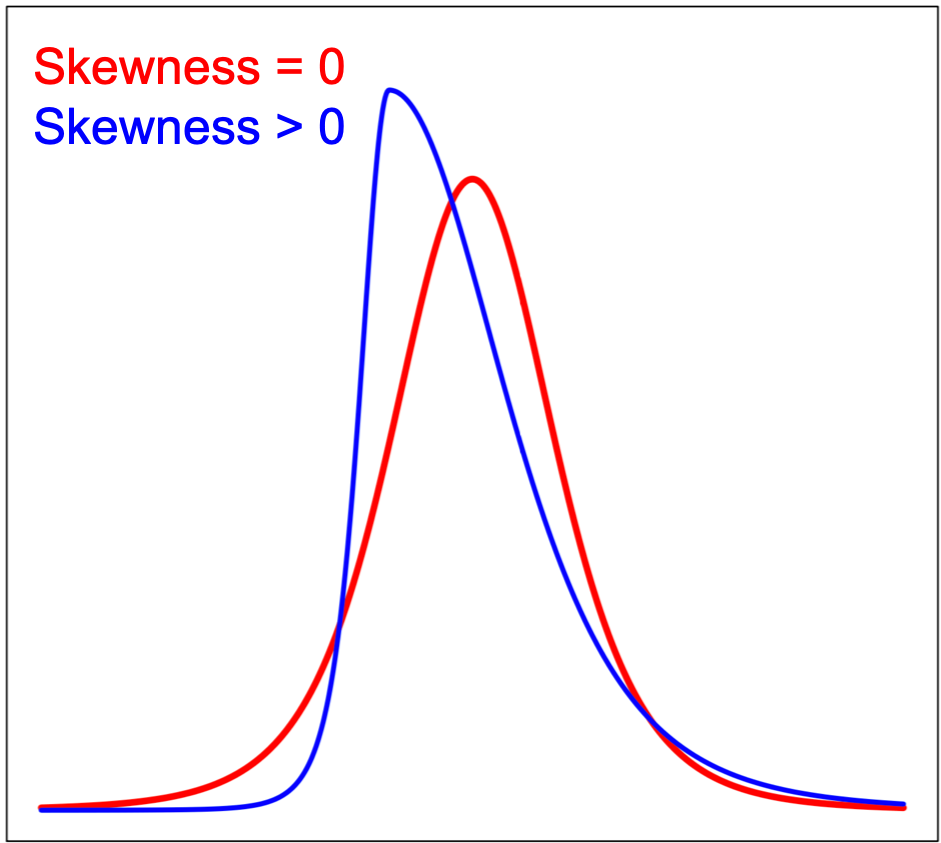

- Asymmetry measured with skewness coefficient

- Extremes measured with kurtosis coefficient

Skewness coefficient

Left-skewed

Right-skewed

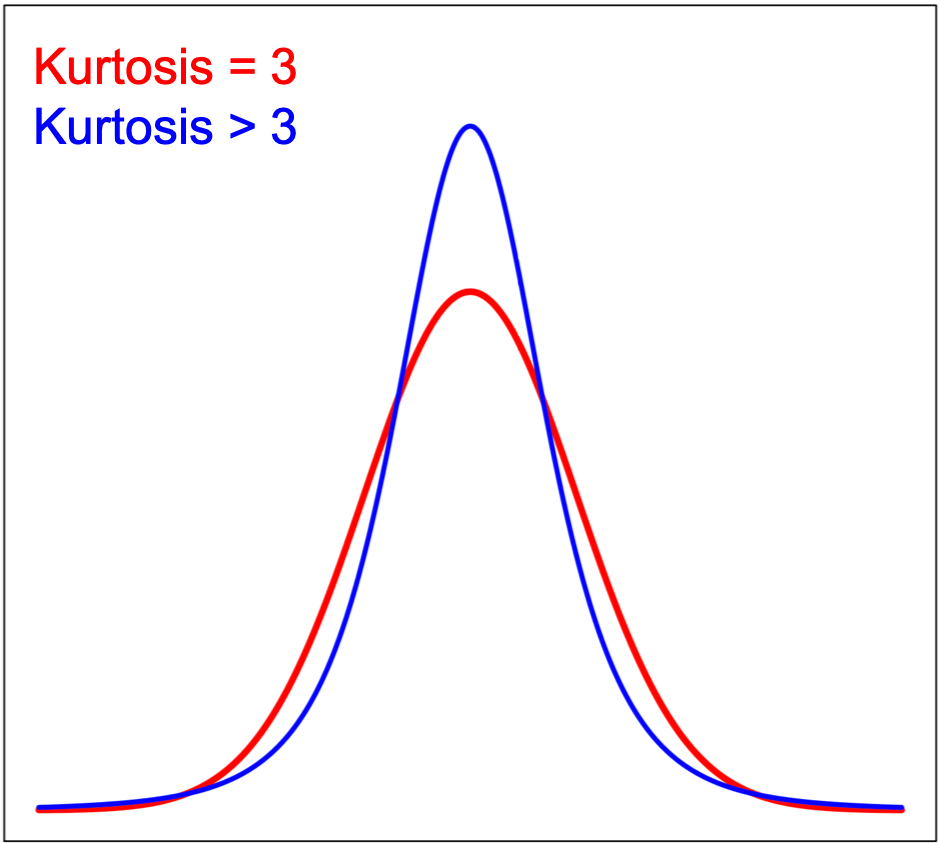

Kurtosis coefficient

Excess kurtosis = kurtosis - 3

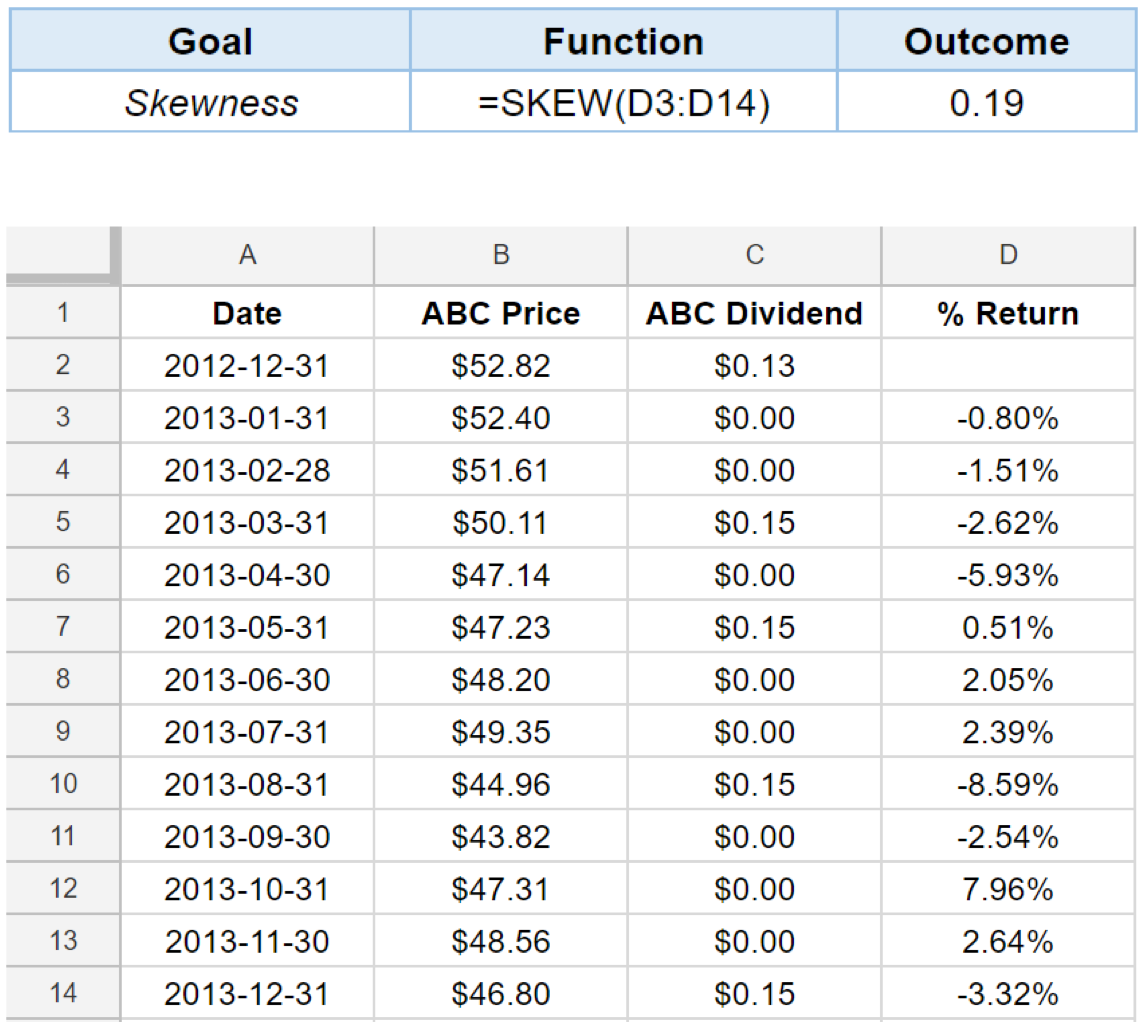

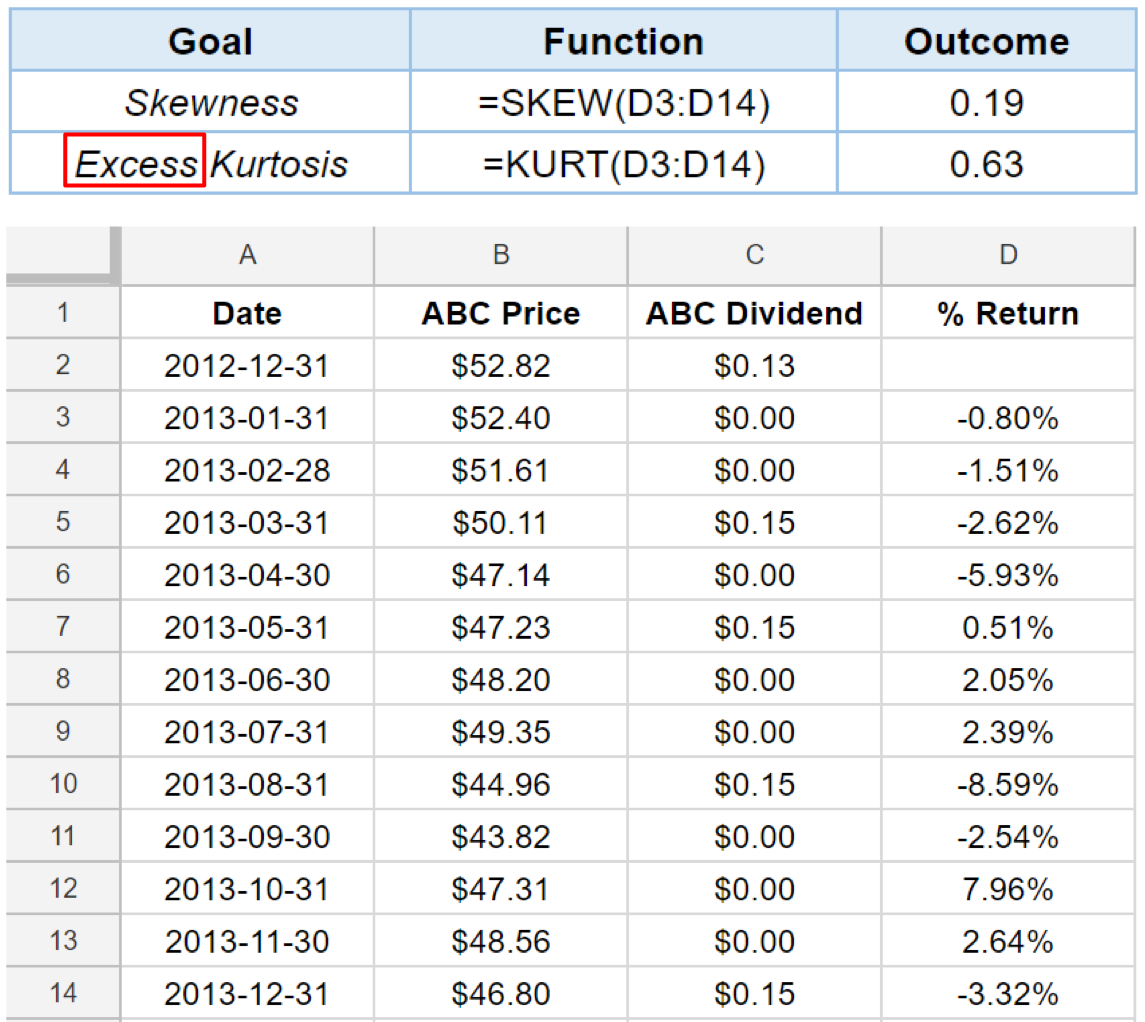

Skewness and kurtosis with Google Sheets

Skewness and kurtosis with Google Sheets

Pros and cons

- The Gaussian model is great!

- Simple to estimate and easy to interpret

- It has limitations that you must be careful of!

- Returns are not symmetrically distributed

- Extreme returns are observed

It's time to practice!

Financial Analytics in Google Sheets