Reward metrics

Financial Analytics in Google Sheets

David Ardia

Professor in Quantitative Methods for Finance

Return on investment

Effective rate of return

- Series of $T$ returns: $R_1,R_2,\ldots,R_T$

- Capital invested: $C$

- Effective rate of return: $R_E$

$$C(1+R_1)(1+R_2)\cdots(1+R_T)=C(1+R_E)^T$$

Effective rate of return

- After a bit of algebra:

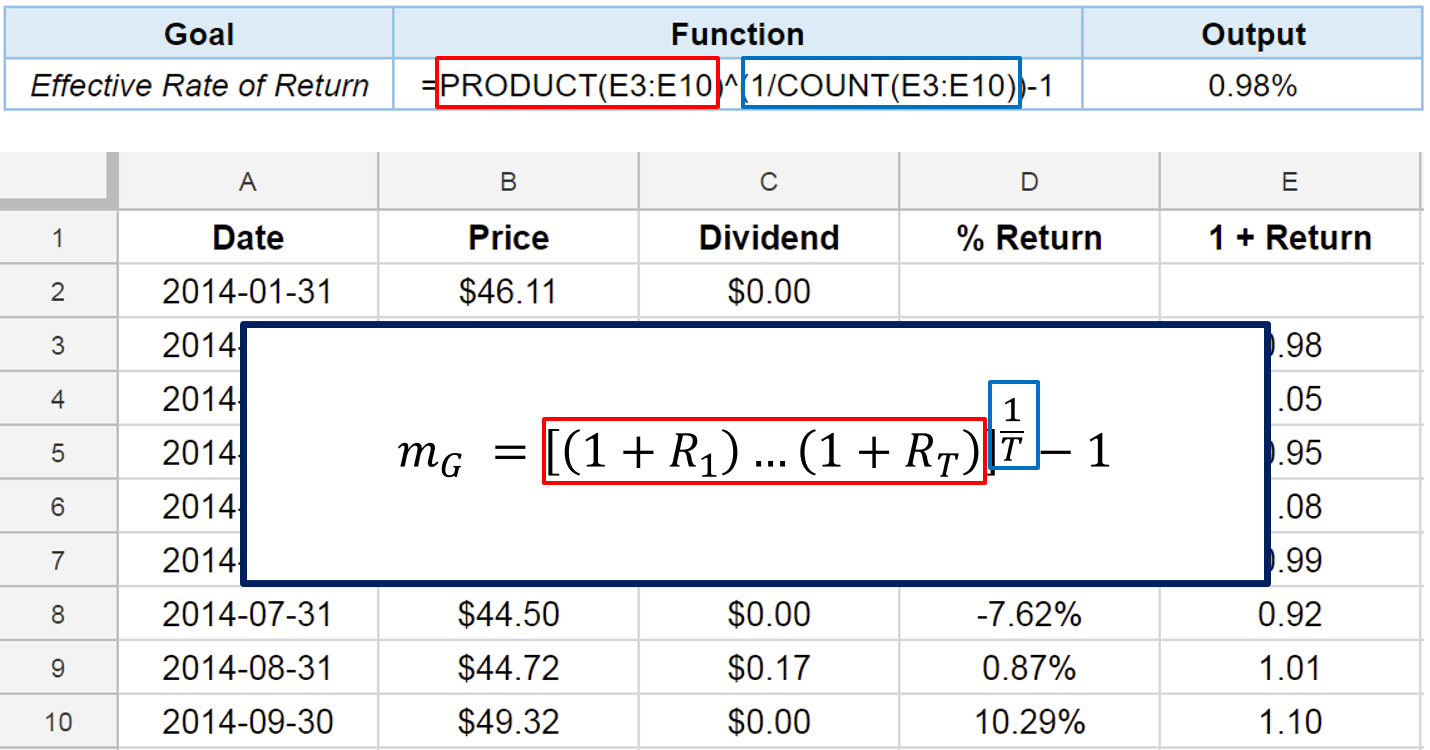

$$R_E=[(1+R_1)\cdots(1+R_T)]^{1/T} -1$$

- Geometric mean of the series $(1+R_1),(1+R_2),\ldots,(1+R_T)$:

$$m_G=[(1+R_1)\cdots(1+R_T)]^{1/T} -1$$

Effective rate of return

$\$100$ → $\$150$ → $\$75$

$50\%$ → $-50\%$

$$m_G=[(1+50\%)(1+(-50\%))]^{1/2} -1 = -0.134=-13.4\%$$

$\$100(1+(-13.4\%))(1+(-13.4\%)) = \$75$

Average return

A popular metric to infer the expected reward is the average return:

$$m_A=\frac{R_1+R_2+\ldots+R_T}{T}$$

Average return

$\$100$ → $\$150$ → $\$75$

$50\%$ → $-50\%$

$$m_A=\frac{50\% + (-50\%)}{2}=0\%$$

Difference between effective and average return

$\$100$ → $\$150$ → $\$75$

$50\%$ → $-50\%$

- Average return: $m_A = 0\%$

→ Returns not linked to one another!

- Effective rate of return: $m_G = -13.4\%$

→ Compounding effect taken into account!

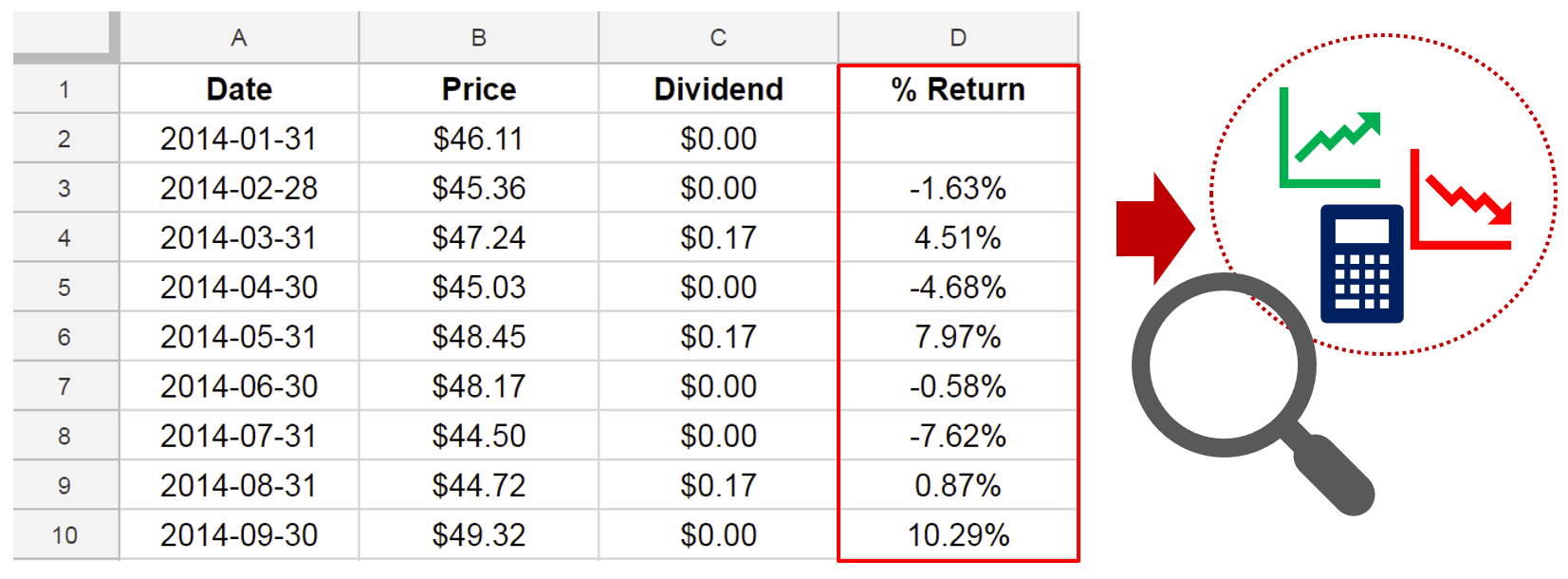

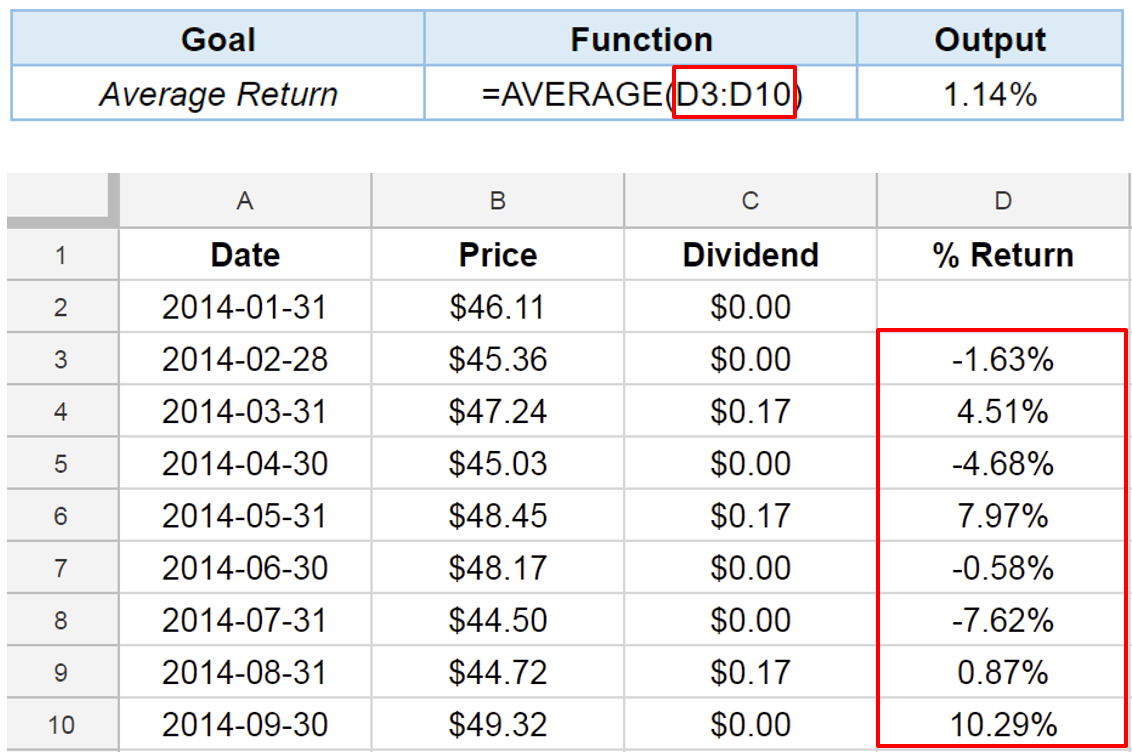

Function AVERAGE()

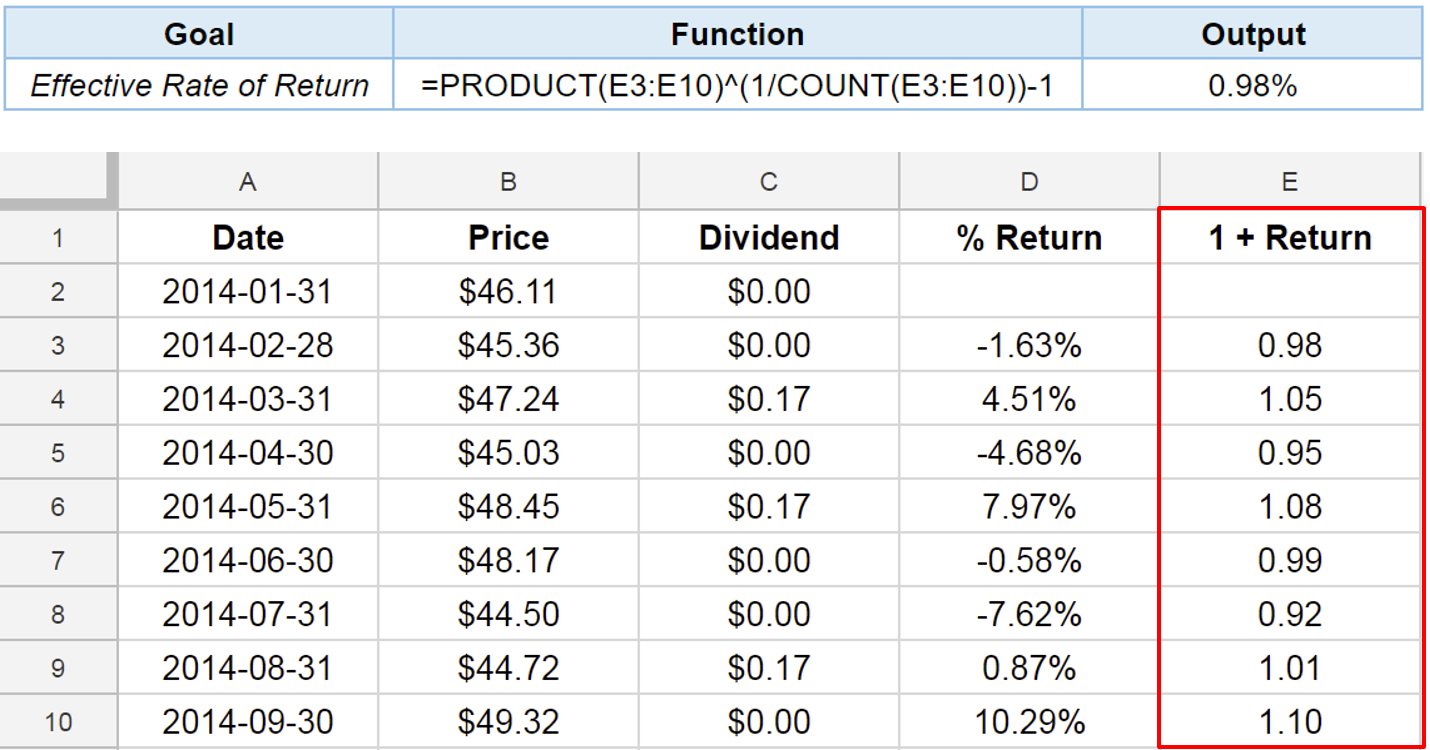

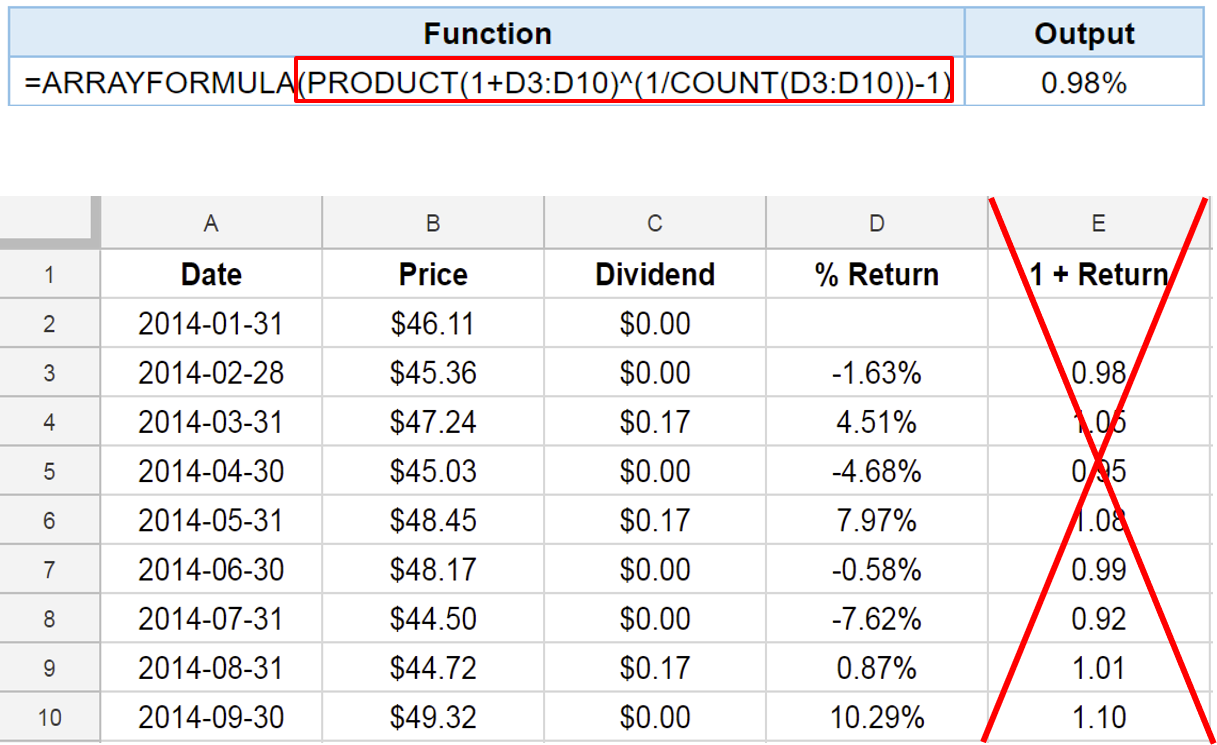

Effective rate of return: first approach

Effective rate of return: first approach

Function ARRAYFORMULA()

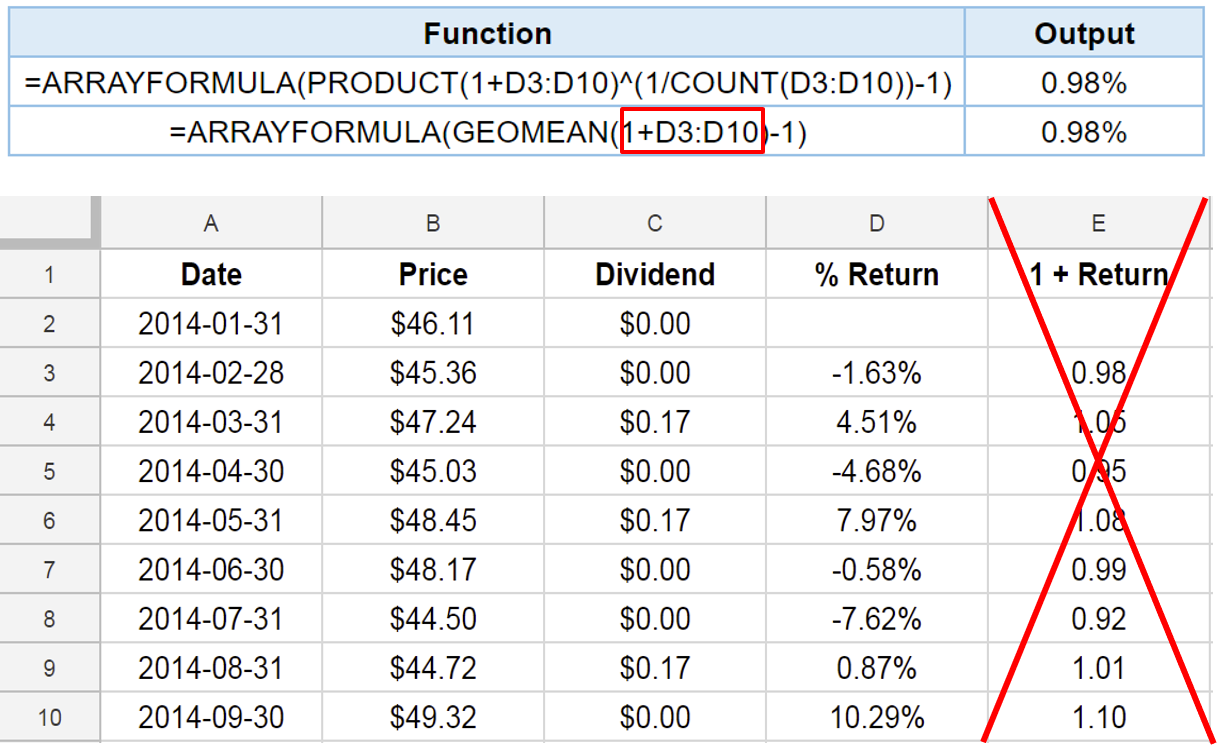

Functions ARRAYFORMULA() and GEOMEAN()

It's time to practice!

Financial Analytics in Google Sheets