Risk metrics

Financial Analytics in Google Sheets

David Ardia

Professor in Quantitative Methods for Finance

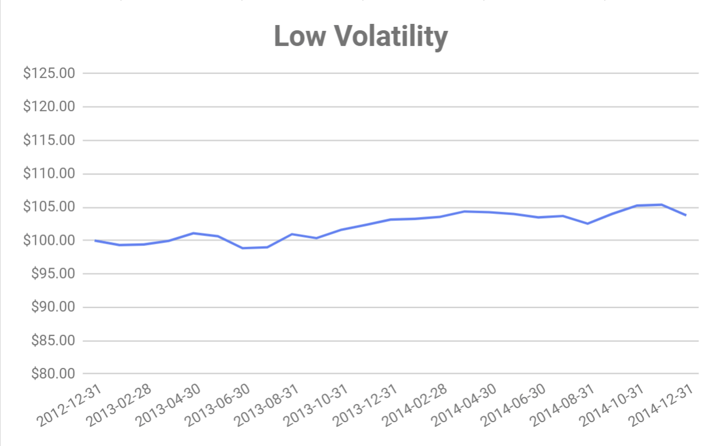

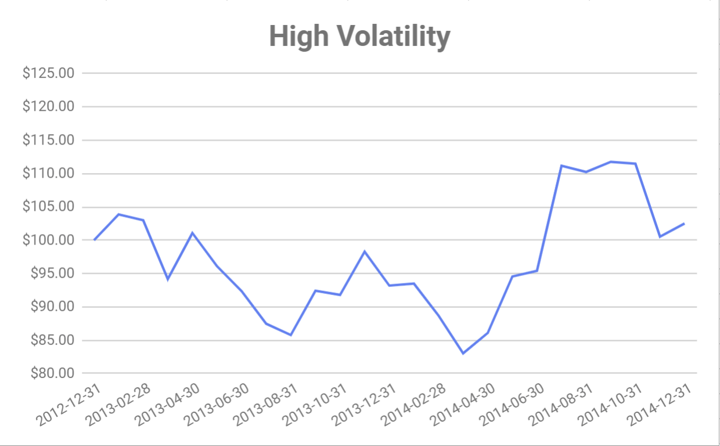

Volatility

Volatility is widely used by practitioners

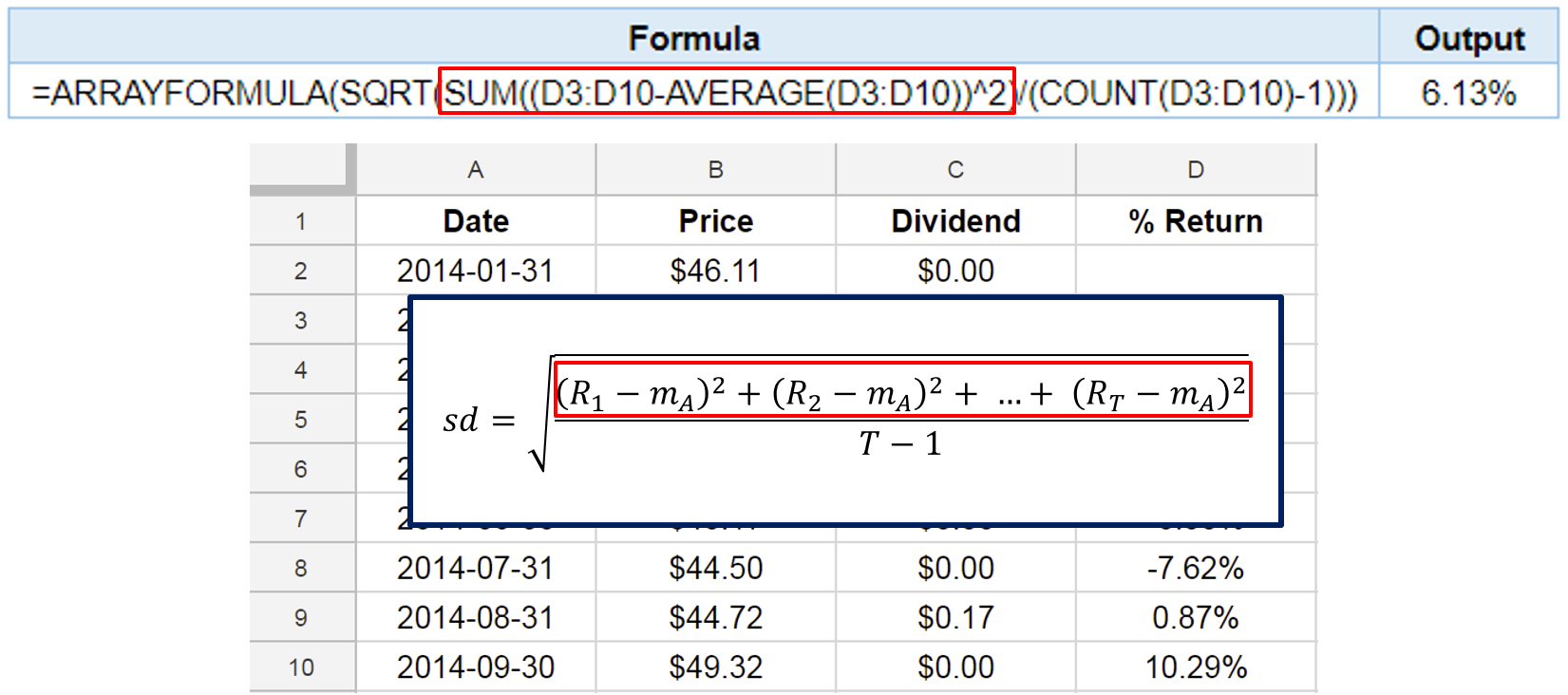

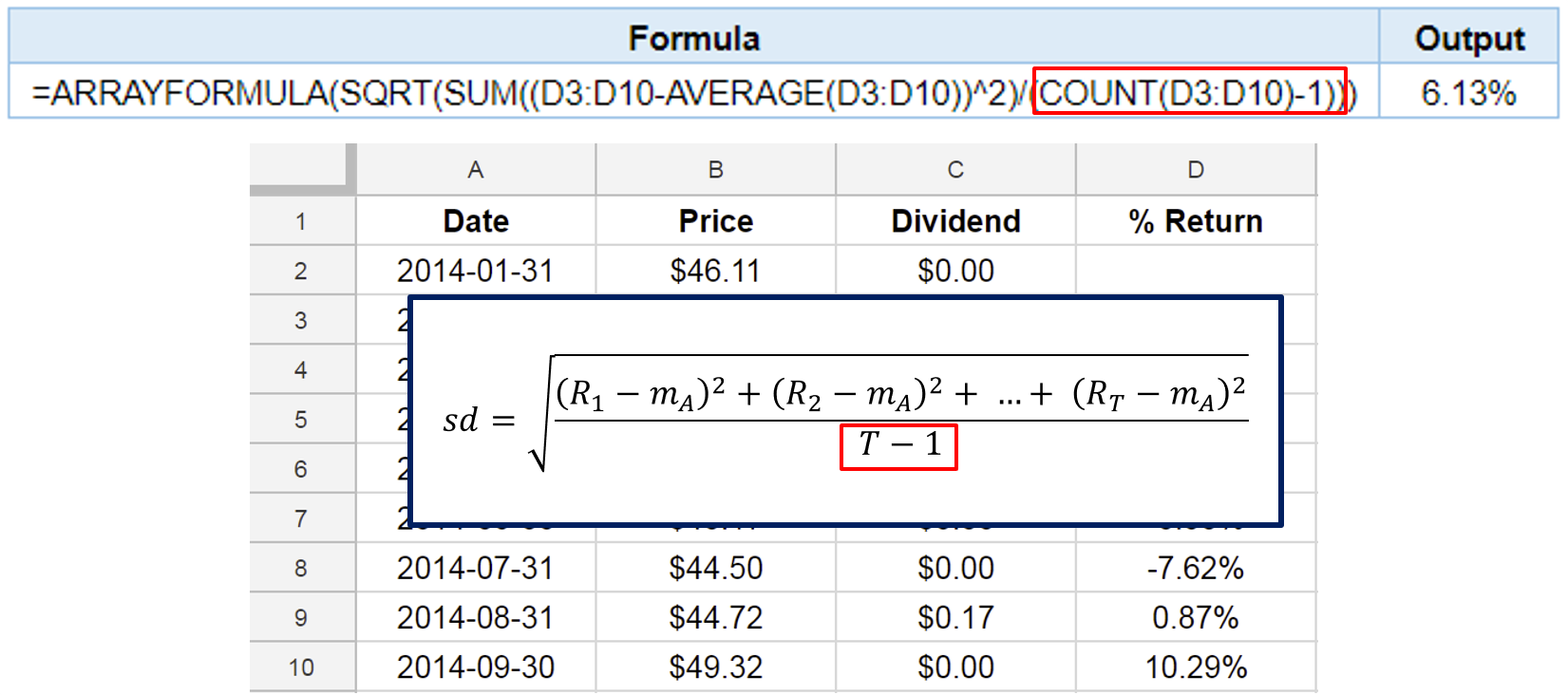

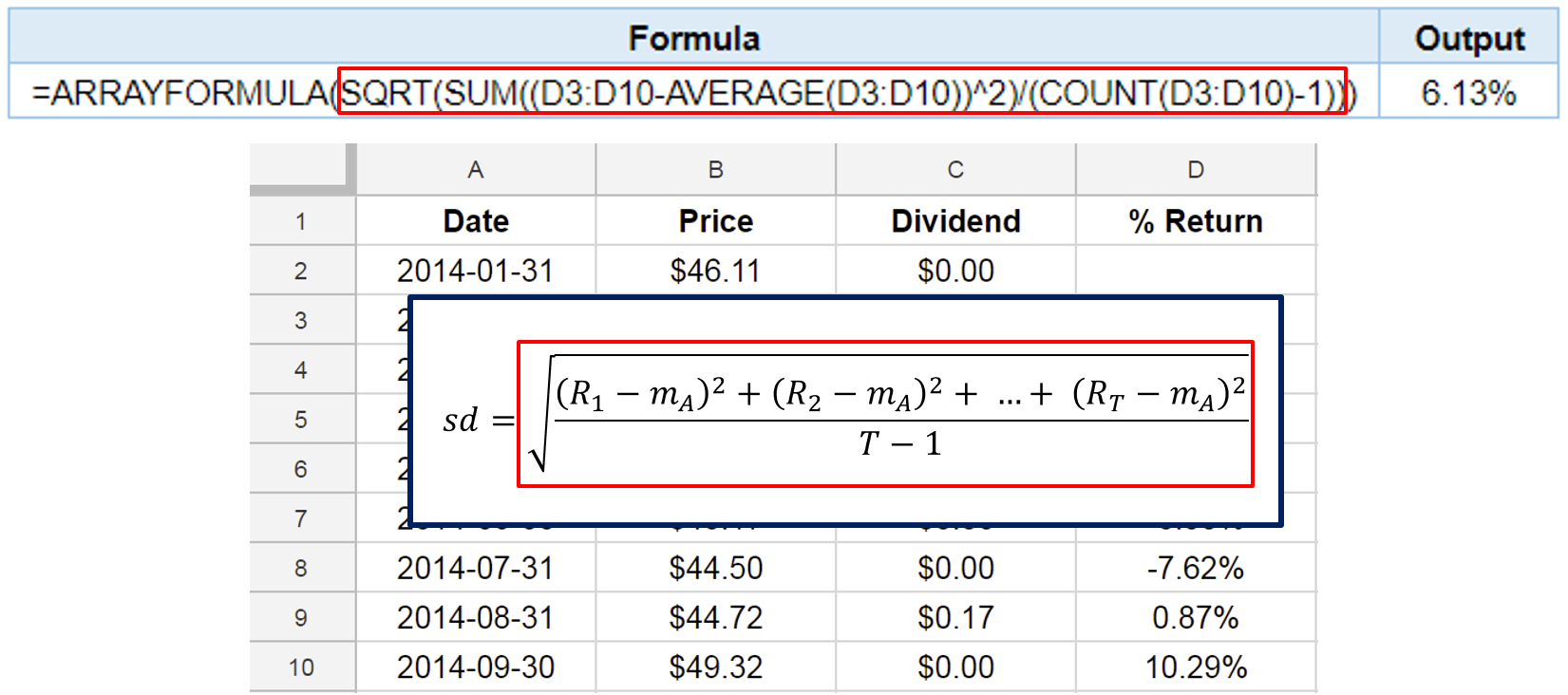

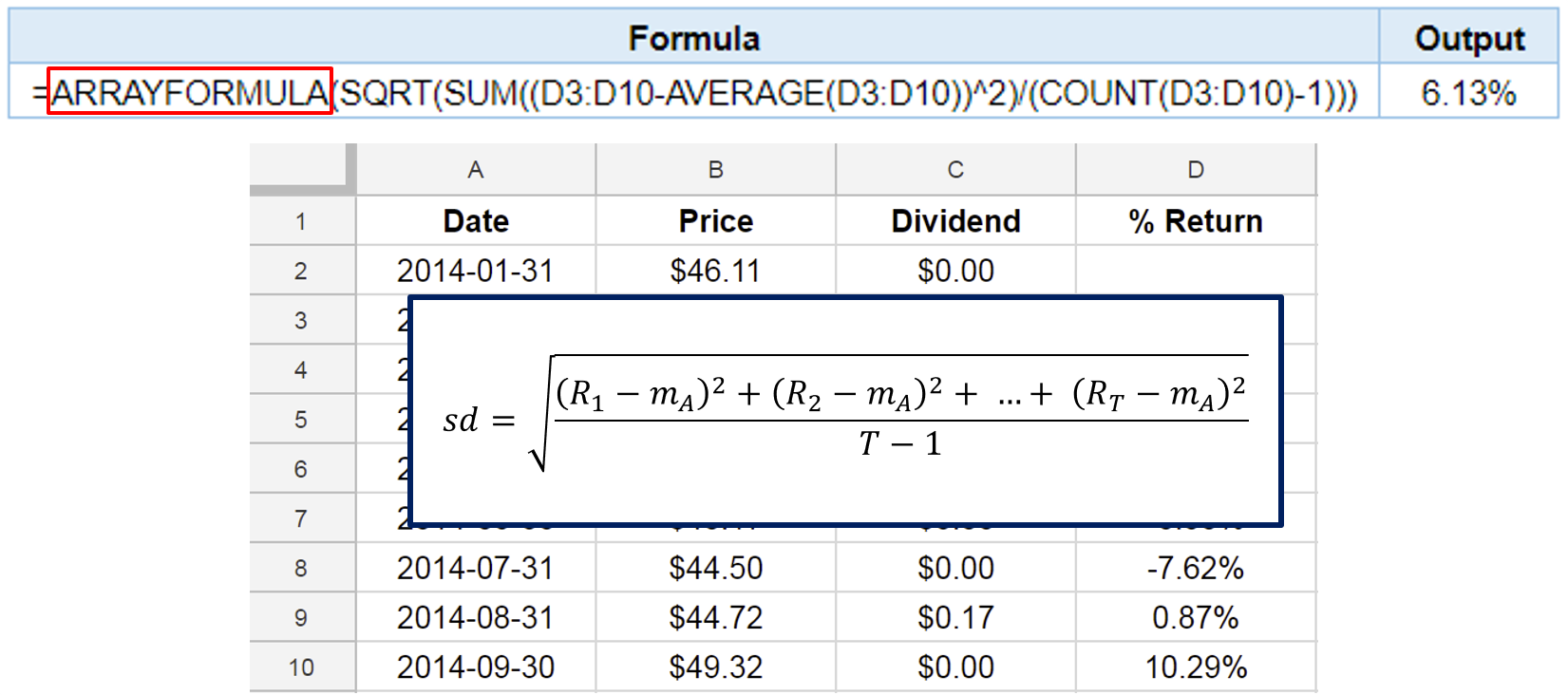

Simply the standard deviation of the returns $R_1,R_2,\ldots,R_T$:

$$sd=\sqrt{\frac{(R_1-m_A)^2+(R_2-m_A)^2+\cdots+(R_T-m_A)^2}{T-1}}$$

with $m_A$ the arithmetic mean return

Volatility

Volatility

$R_1=50\%,R_2=-50\%,R_3=25\%,R_4=-25\%$

Average return: $m_A = 0\%$

Volatility:

$$sd=\sqrt{\frac{(50\%-0\%)^2+(-50\%-0\%)^2+(25\%-0\%)^2+(-25\%-0\%)^2}{3}}=46\%$$

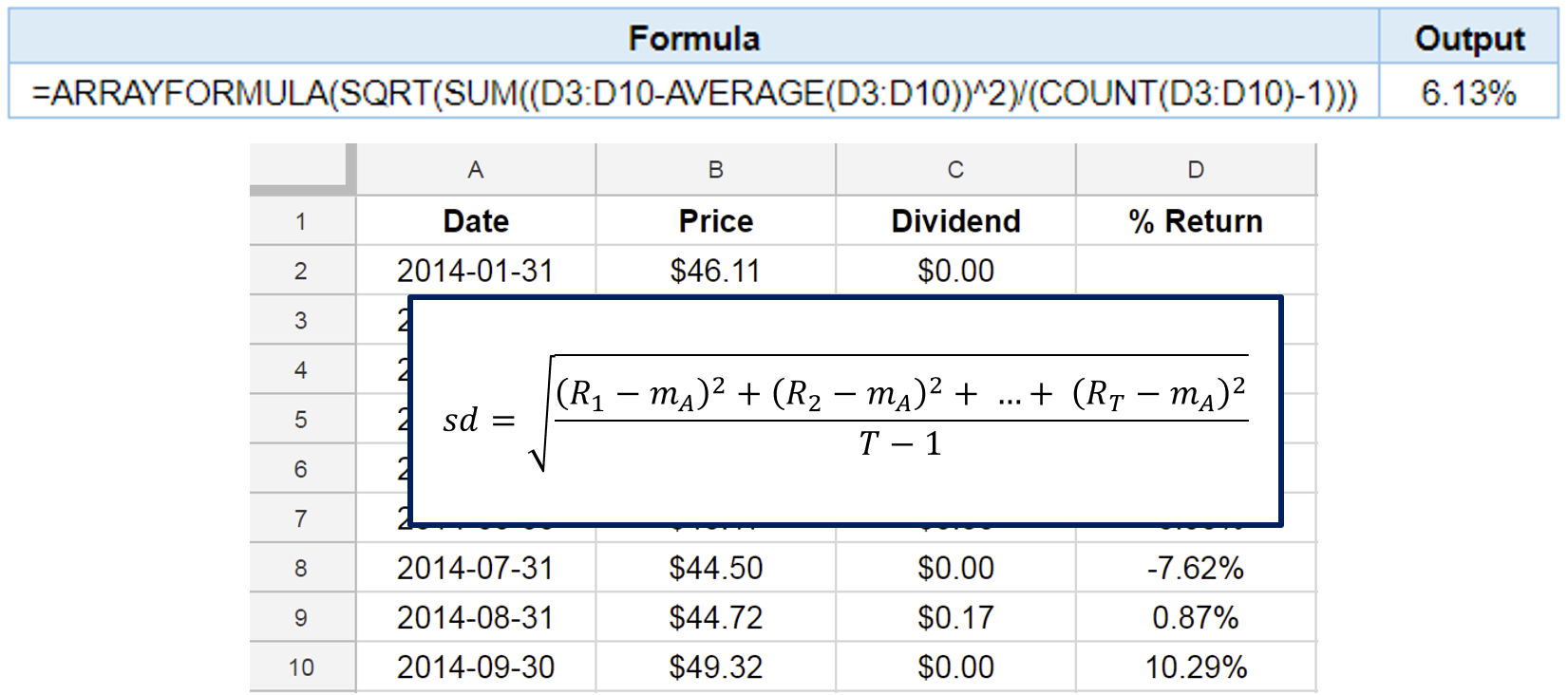

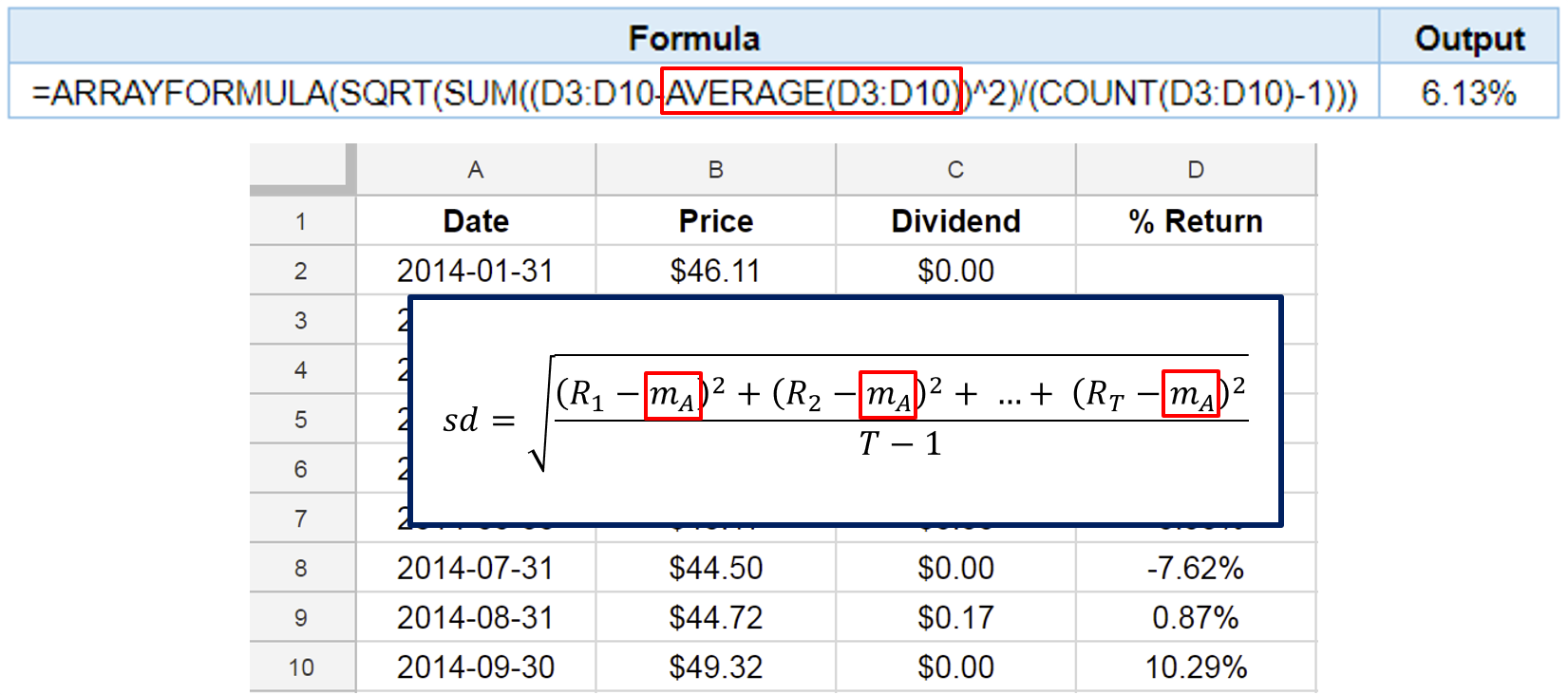

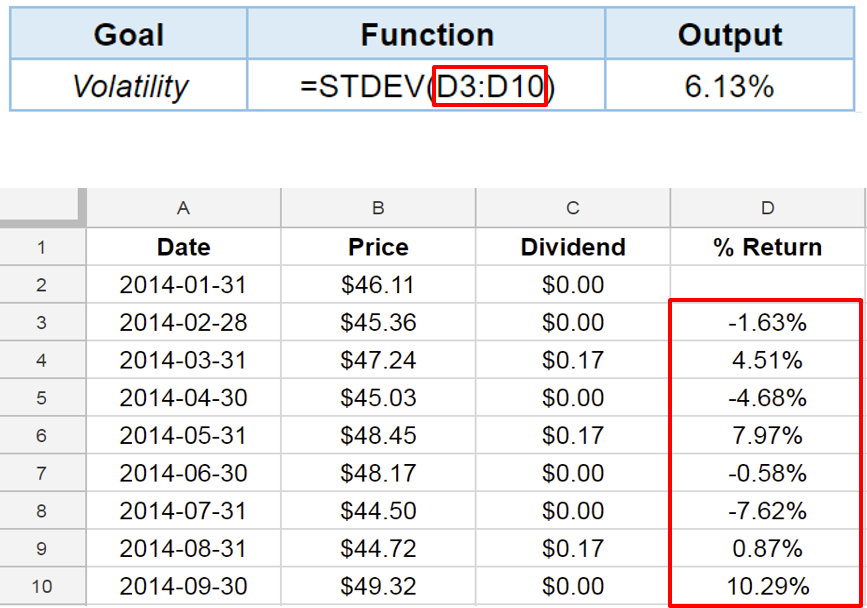

Volatility with Google Sheets

Volatility with Google Sheets

Volatility with Google Sheets

Volatility with Google Sheets

Volatility with Google Sheets

Volatility with Google Sheets

Function STDEV()

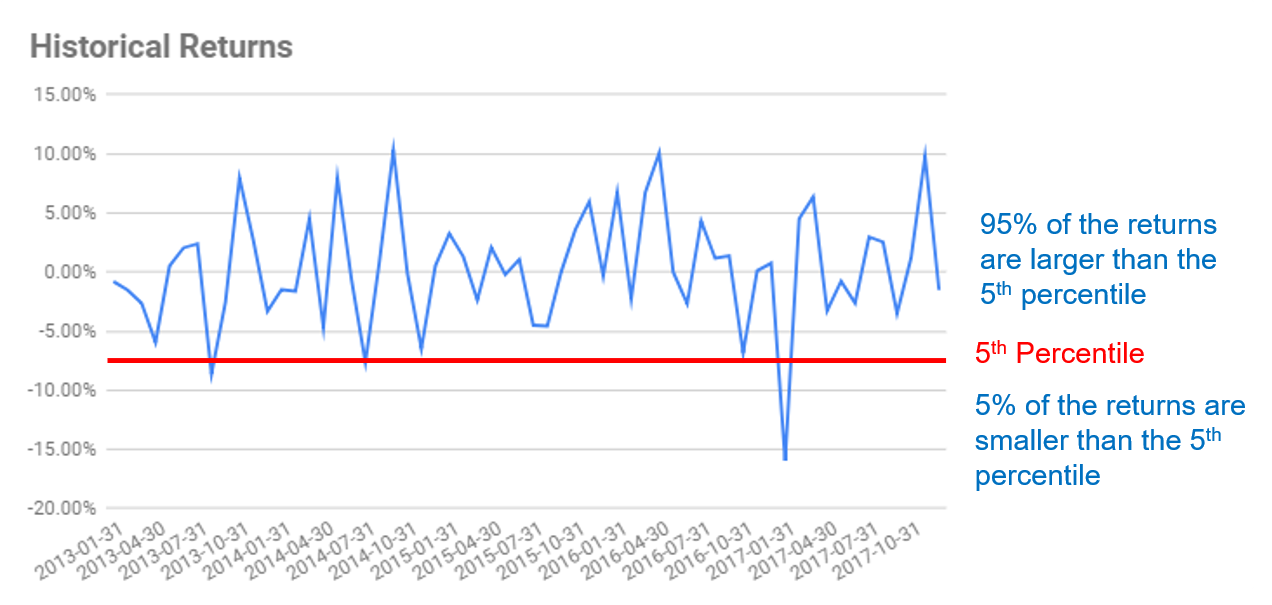

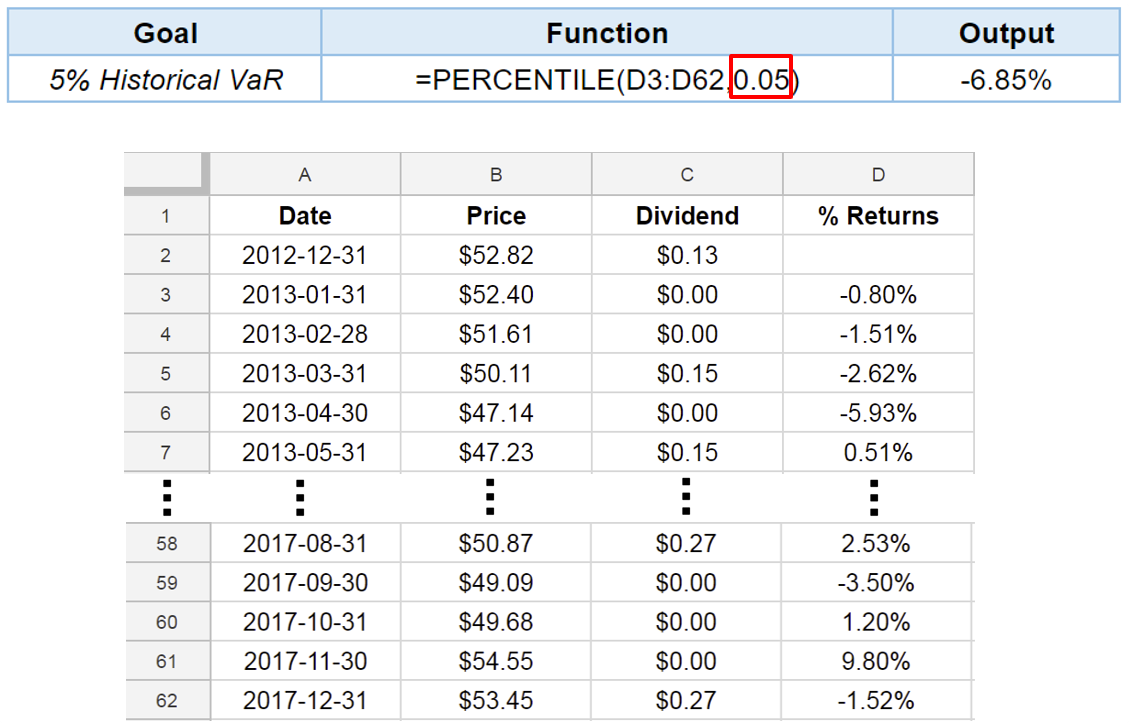

Historical value-at-risk (VaR)

Indicator of the major historical losses of your investment

Obtained as a low-level percentile of past returns

Intuition behind the value-at-risk

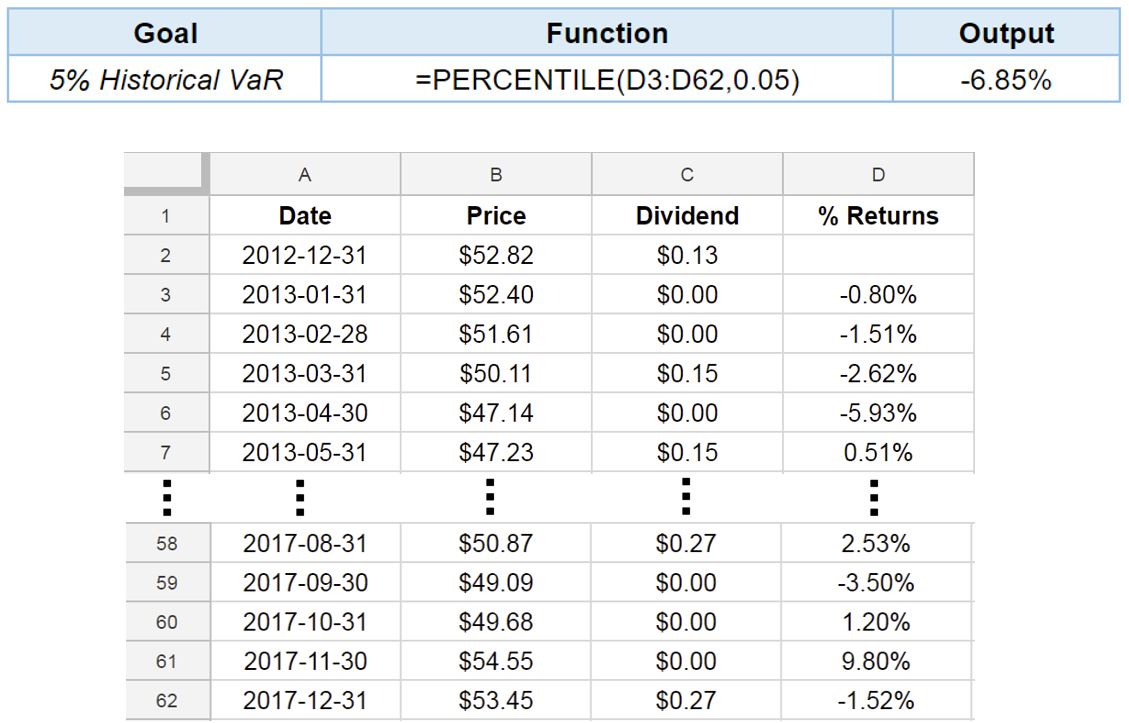

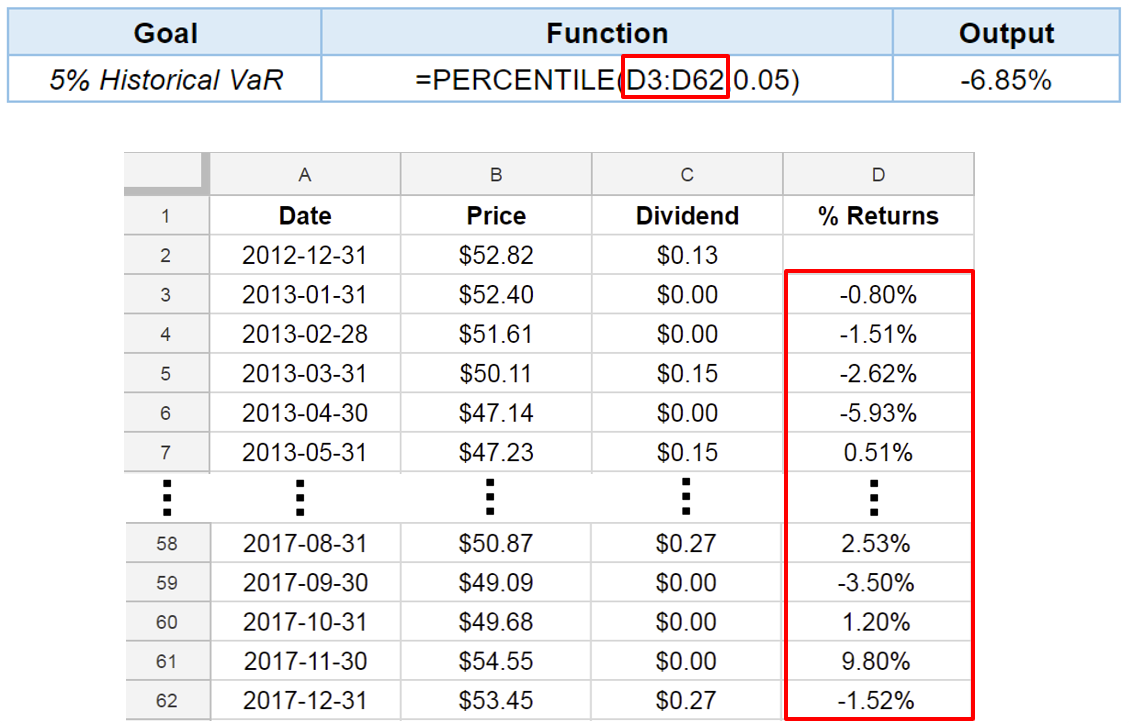

5% Historical VaR with function PERCENTILE()

5% Historical VaR with function PERCENTILE()

5% Historical VaR with function PERCENTILE()

It's time to practice!

Financial Analytics in Google Sheets