Retirement planning in nominal dollars 1

Financial Modeling in Google Sheets

Erin Buchanan

Professor

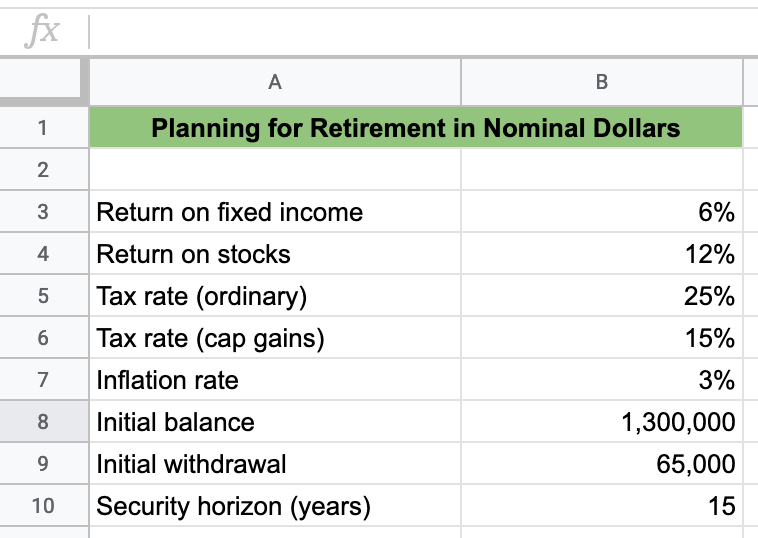

Nominal dollars

Real dollar planning assumes uniform stock returns

Nominal dollars are the amount of money you have now

Nominal dollar planning incorporates a security horizon

Model will sell enough stock to maintain expenses through the security horizon

Fixed information

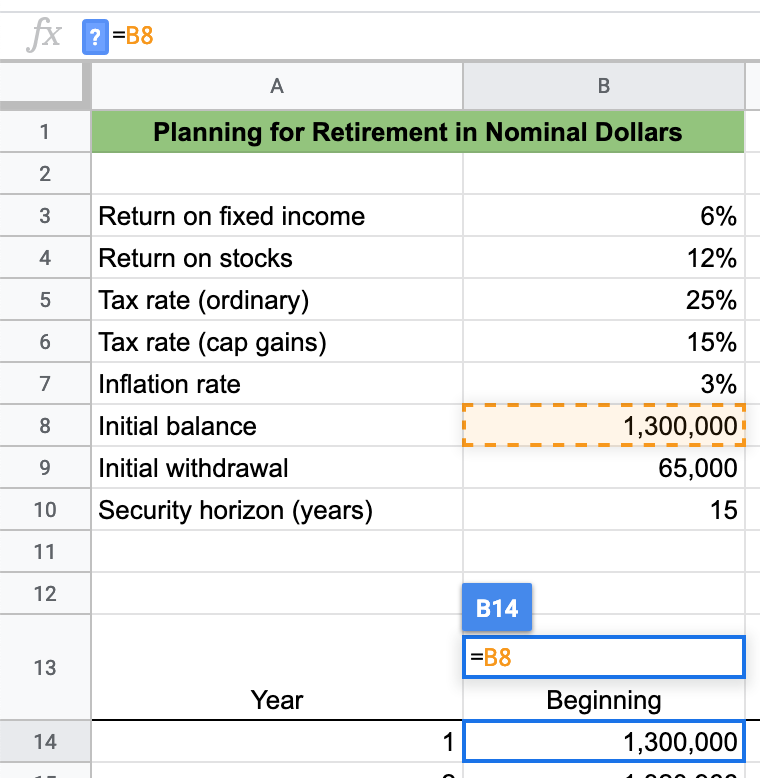

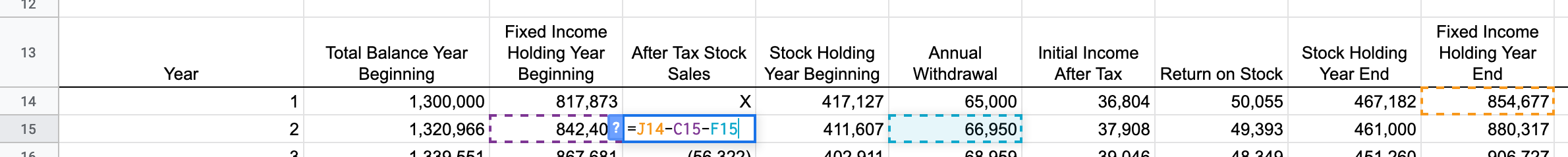

Yearly information

= Initial balance cell

= Fixed Income Year Beginning +

Stock Holding Year Beginning +

Annual Withdrawal

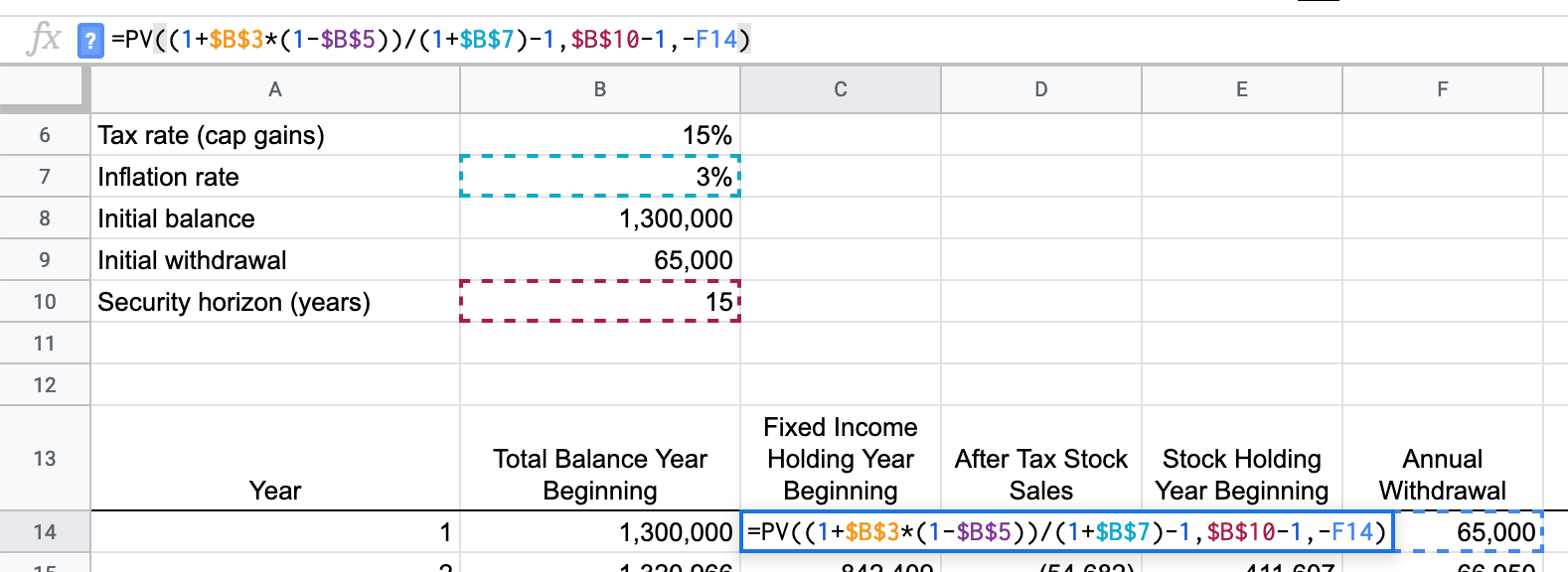

Fixed income pv() function

= pv(rate, number_of_periods, -payment_amount)

rate: $\frac{1 + Return on Income \times (1 - Ordinary Tax Rate)} { (1 + Inflation Rate)} - 1$number_of_periods: Security Horizon Years - 1payment_amount: Annual withdrawal (negative)

Fixed income in action

=PV((1+$B$3*(1-$B$5))/(1+$B$7)-1,$B$10-1,-F14)

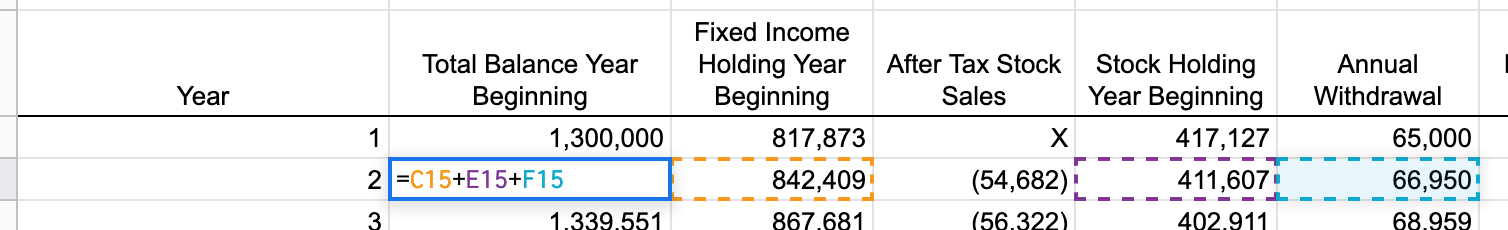

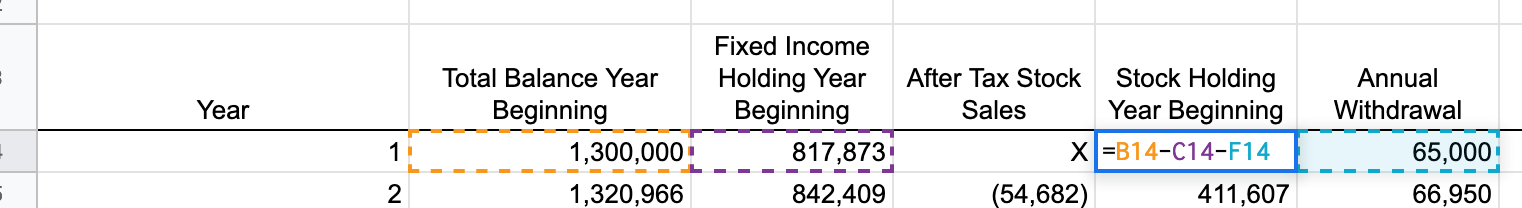

Stock sales after taxes

= End of Year Fixed Income - Begining of Year Fixed Income - Withdrawal Amount

Stock holdings

= Total Beginning Balance - Fixed Income Beginning Balance - Withdrawal

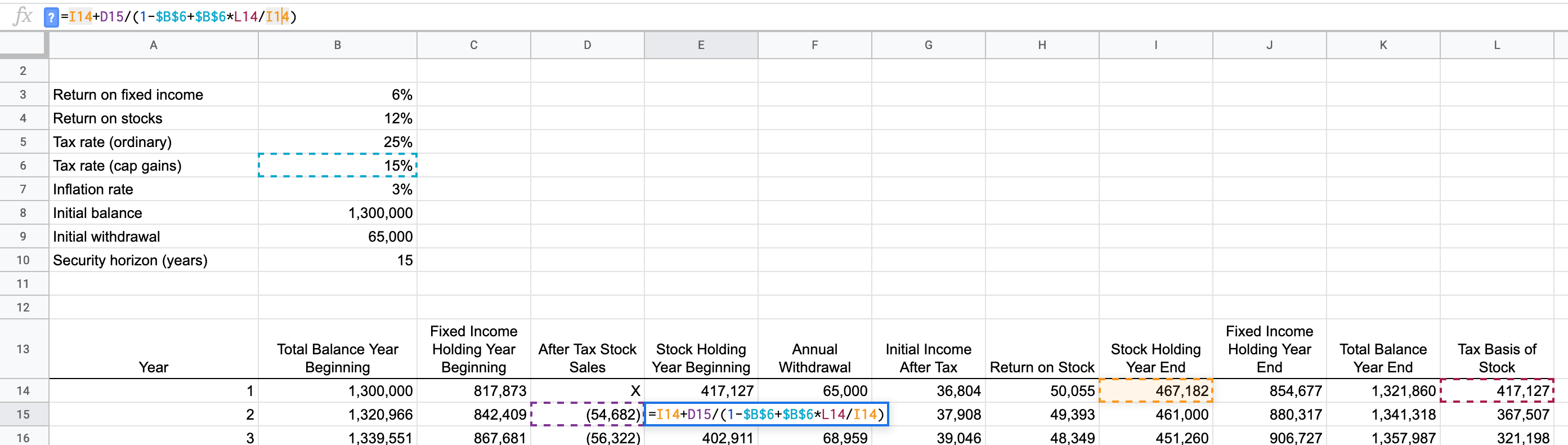

Stock holdings year 2 and on

= Year End Stock Holding + Stock Sales / (1 - Capital Gains Tax + Capital Gains Tax * Last Years Tax Basis / Last Years End Stock Holding)

=I14+D15/(1-$B$6+$B$6*L14/I14)

Try it yourself!

Financial Modeling in Google Sheets