Welcome to the course!

Intermediate Portfolio Analysis in R

Ross Bennett

Instructor

What you will learn

Build on fundamental concepts from "Introduction to Portfolio Analysis in R"

Explore advanced concepts in the portfolio optimization process

Use the R package

PortfolioAnalyticsto solve portfolio optimization problems that mirror real world problems

Modern Portfolio Theory

Modern Portfolio Theory (MPT) was introduced by Harry Markowitz in 1952.

MPT states that an investor's objective is to maximize portfolio expected return for a given amount of risk.

Common Objectives:

Maximize a measure of gain per unit measure of risk

Minimize a measure of risk

Mean - Standard Deviation Example: Setup

library(PortfolioAnalytics)

data(edhec)

data <- edhec[,1:8]

# Create the portfolio specification

port_spec <- portfolio.spec(colnames(data))

port_spec <- add.constraint(portfolio = port_spec, type = "full_investment")

port_spec <- add.constraint(portfolio = port_spec, type = "long_only")

port_spec <- add.objective(portfolio = port_spec, type = "return", name = "mean")

port_spec <- add.objective(portfolio = port_spec, type = "risk", name = "StdDev")

**************************************************

PortfolioAnalytics Portfolio Specification

**************************************************

Call:

portfolio.spec(assets = colnames(data))

Number of assets: 8

Asset Names

[1] "Convertible Arbitrage" "CTA Global" "Distressed Securities"

[4] "Emerging Markets" "Equity Market Neutral" "Event Driven"

[7] "Fixed Income Arbitrage" "Global Macro"

Constraints

Enabled constraint types

- full_investment

- long_only

Objectives:

Enabled objective names

- mean

- StdDev

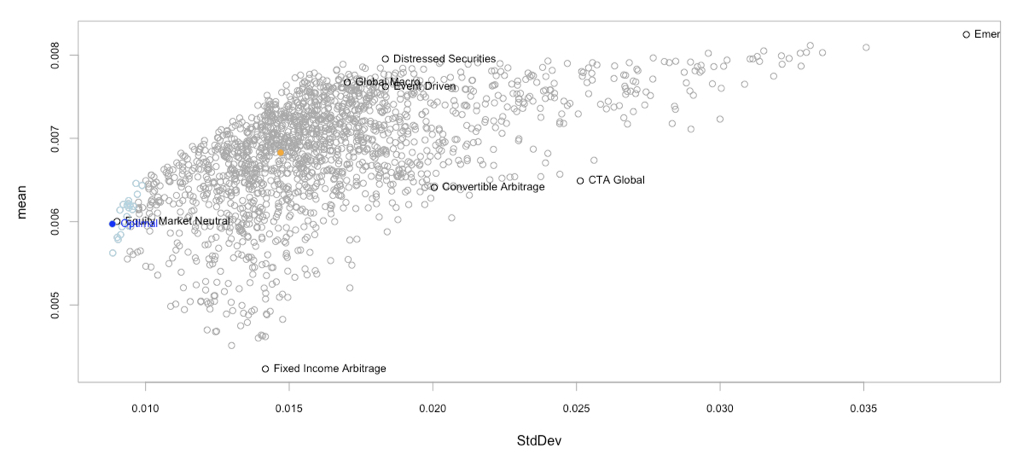

Mean - Standard Deviation Example: Optimize

# Run optimization and chart results in risk-reward space

opt <- optimize.portfolio(data,

portfolio = port_spec,

optimize_method = "random",

trace = TRUE)

chart.RiskReward(opt,

risk.col = "StdDev",

return.col = "mean",

chart.assets = TRUE)

Mean - Standard Deviation Example: Optimize

Let's practice!

Intermediate Portfolio Analysis in R