Analyzing optimization results

Intermediate Portfolio Analysis in R

Ross Bennett

Instructor

Workflow: analyze results

| Visualization | Data Extraction |

|---|---|

plot() |

extractObjectiveMeasures() |

chart.Concentration() |

extractStats() |

chart.EfficientFrontier() |

extractWeights() |

chart.RiskReward() |

print() |

chart.RiskBudget() |

summary() |

chart.Weights() |

Example: extract weights

# Extract the optimal weights

extractWeights(opt)

Convertible Arbitrage CTA Global Distressed Securities

0.000000e+00 6.515184e-02 5.840055e-18

Emerging Markets Equity Market Neutral Event Driven

-8.501425e-18 9.348482e-01 4.105887e-18

Example: extract weights

head(extractWeights(opt_rebal), n = 3)

Convertible Arbitrage CTA Global Distressed Securities

2001-12-31 0.12986589 0.06849445 0.00000000

2002-12-31 0.08738164 0.08645814 0.00000000

2003-12-31 0.09177469 0.03192720 0.02419038?

Emerging Markets Equity Market Neutral Event Driven

2001-12-31 7.113112e-18 0.8016397 -1.608927e-16

2002-12-31 -2.553006e-19 0.8261602 -3.837233e-17

2003-12-31 0.000000e+00 0.8521077 2.991493e-19

Example: extract weights

# Extract the optimal weights

extractWeights(opt)

Convertible Arbitrage CTA Global Distressed Securities

0.000000e+00 6.515184e-02 5.840055e-18

Emerging Markets Equity Market Neutral Event Driven

-8.501425e-18 9.348482e-01 4.105887e-18

Example: extract weights

head(extractWeights(opt_rebal), n = 3)

Convertible Arbitrage CTA Global

Convertible Arbitrage CTA Global Distressed Securities

2001-12-31 0.12986589 0.06849445 0.00000000

2002-12-31 0.08738164 0.08645814 0.00000000

2003-12-31 0.09177469 0.03192720 0.02419038?

Emerging Markets Equity Market Neutral Event Driven

2001-12-31 7.113112e-18 0.8016397 -1.608927e-16

2002-12-31 -2.553006e-19 0.8261602 -3.837233e-17

2003-12-31 0.000000e+00 0.8521077 2.991493e-19

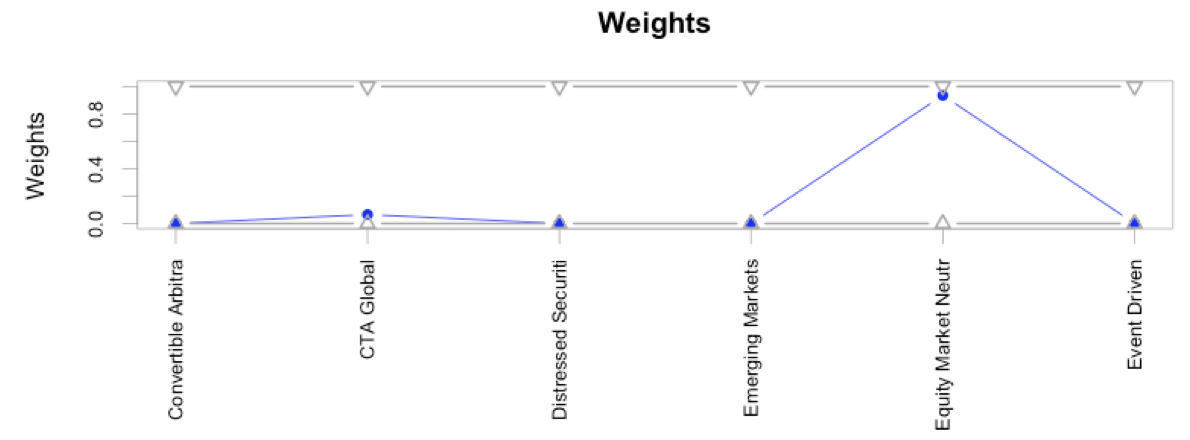

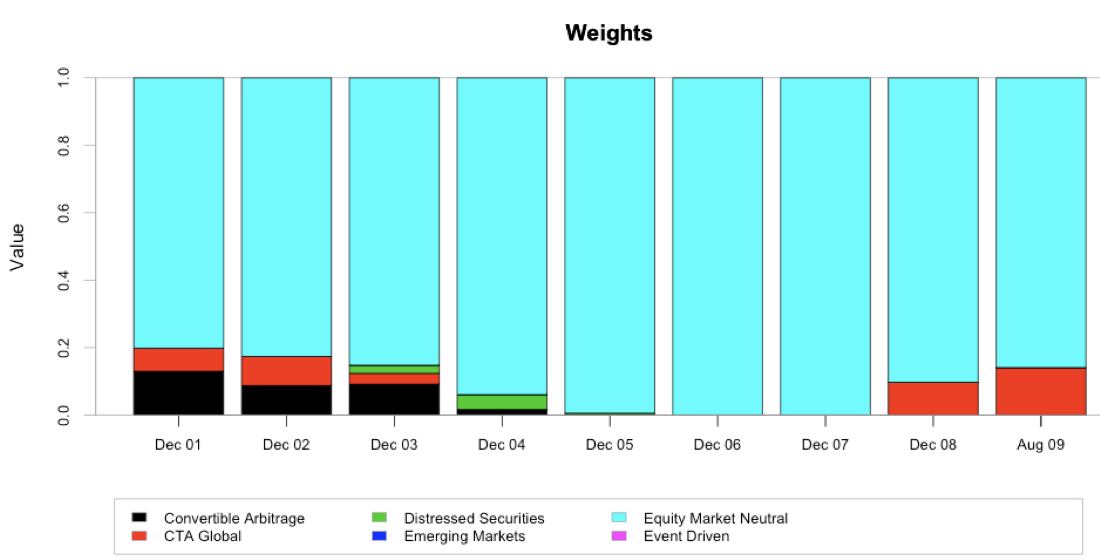

Example: chart weights

# Chart the weights

chart.Weights(opt)

chart.Weights(opt_rebal)

Example: chart weights

# Chart the weights

chart.Weights(opt)

chart.Weights(opt_rebal)

# Extract the objective measures

extractObjectiveMeasures(opt)

$StdDev

StdDev

0.008855401

head(extractObjectiveMeasures(opt_rebal))

StdDev

2001-12-31 0.006521328

2002-12-31 0.005886103

2003-12-31 0.005656744

2004-12-31 0.005855993

2005-12-31 0.004308911

2006-12-31 0.004198900

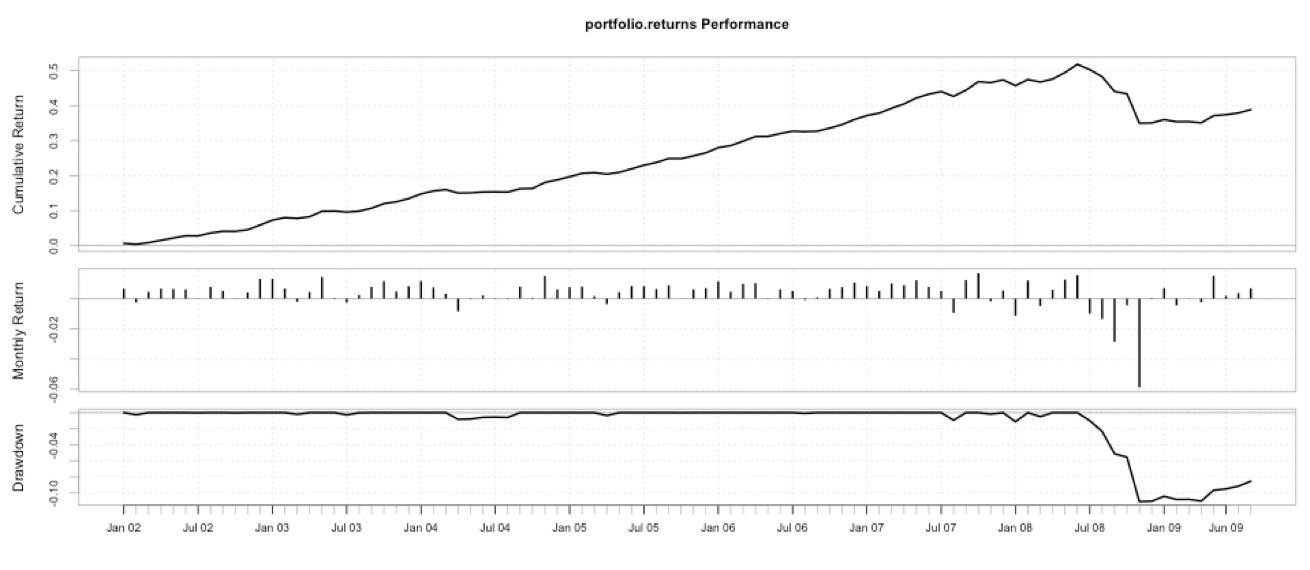

Example: optimization analysis

# Compute the rebalancing returns

rr <- Return.portfolio(ret, weights = extractWeights(opt_rebal))

charts.PerformanceSummary(rr)

Let's practice!

Intermediate Portfolio Analysis in R