Optimization backtest

Intermediate Portfolio Analysis in R

Ross Bennett

Instructor

Optimization backtest: execution

# Run the optimization with periodic rebalancing opt_base <- optimize.portfolio.rebalancing(R = returns, optimize_method = "ROI", portfolio = base_port_spec, rebalance_on = "quarters", training_period = 60, rolling_window = 60)# Calculate portfolio returns base_returns <- Return.portfolio(returns, extractWeights(opt_base)) colnames(base_returns) <- "base"

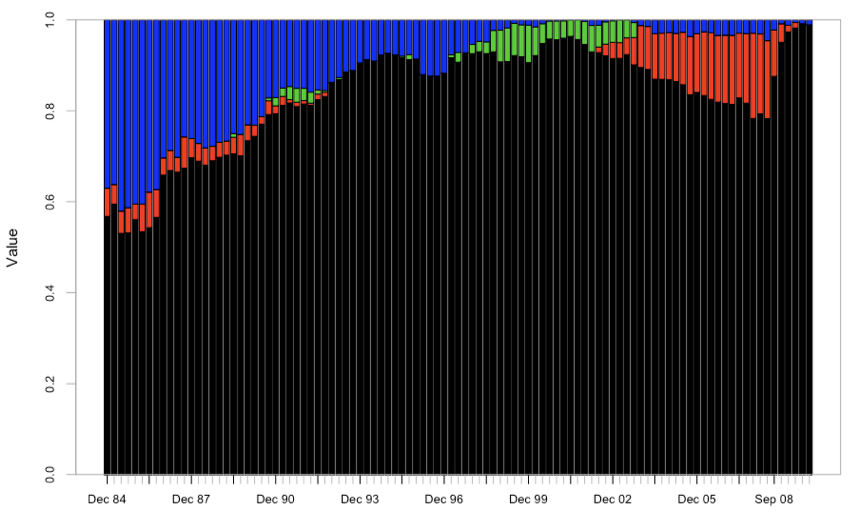

Optimization backtest: analysis

# Chart the optimal weights

chart.Weights(opt_base)

Optimization backtest: analysis

# Merge benchmark and portfolio returns

ret <- cbind(benchmark_returns, base_returns)

# Annualized performance

table.AnnualizedReturns(ret)

benchmark base

Annualized Return 0.0775 0.0772

Annualized Std Dev 0.1032 0.0436

Annualized Sharpe (Rf=0%) 0.7509 1.7714

Optimization backtest: refine constraints

# Make a copy of the portfolio specification box_port_spec <- base_port_spec# Update the constraint box_port_spec <- add.constraint(portfolio = box_port_spec, type = "box", min = 0.05, max = 0.4, indexnum = 2)# Backtest opt_box <- optimize.portfolio.rebalancing(R = returns, optimize_method = "ROI", portfolio = box_port_spec, rebalance_on = "quarters", training_period = 60, rolling_window = 60)# Calculate portfolio returns box_returns <- Return.portfolio(returns, extractWeights(opt_box)) colnames(box_returns) <- "box"

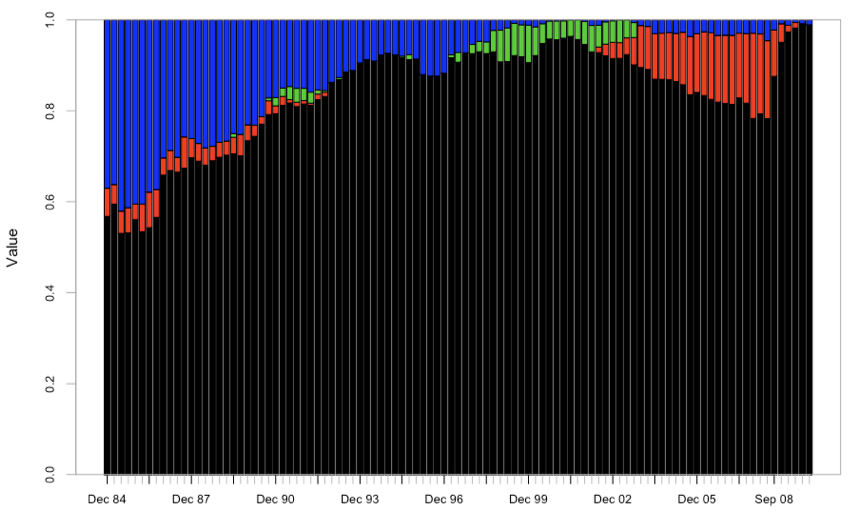

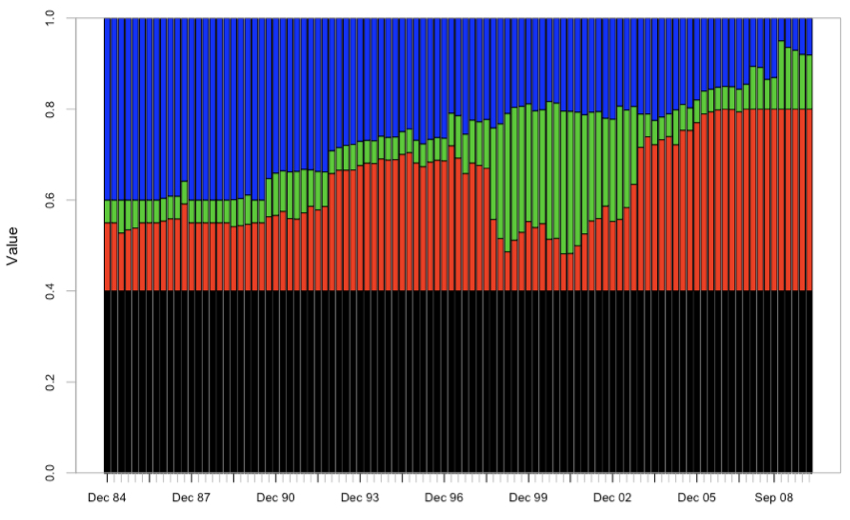

Optimization backtest: analysis refined constraints

# Chart the optimal weights

chart.Weights(opt_box)

Optimization backtest: analysis refined constraints

# Merge box portfolio returns ret <- cbind(ret, box_returns)# Annualized performance table.AnnualizedReturns(ret)

benchmark base box

Annualized Return 0.0775 0.0772 0.0760

Annualized Std Dev 0.1032 0.0436 0.0819

Annualized Sharpe (Rf=0%) 0.7509 1.7714 0.9282

Let's practice!

Intermediate Portfolio Analysis in R