Floating rates

Loan Amortization in Google Sheets

Brent Allen

Instructor

What are floating rates?

- Interest rates are not fixed throughout the term of the loan.

- Rates are based on a central index, such as US Federal Reserve Prime or LIBOR.

- May be quoted as Prime + 1.5% or similar.

- Index rates change over time, with central banks meeting quarterly.

- Rates can change on fixed dates - reset dates.

Floating vs. fixed rates

Floating rates

- Interest rate not fixed.

- Payments fixed for term of loan unless interest exceeds payments.

- Amortization period can change based on rates.

Fixed rates

- Interest rate fixed for term of loan.

- Payments fixed for term of loan.

- Amortization period cannot change.

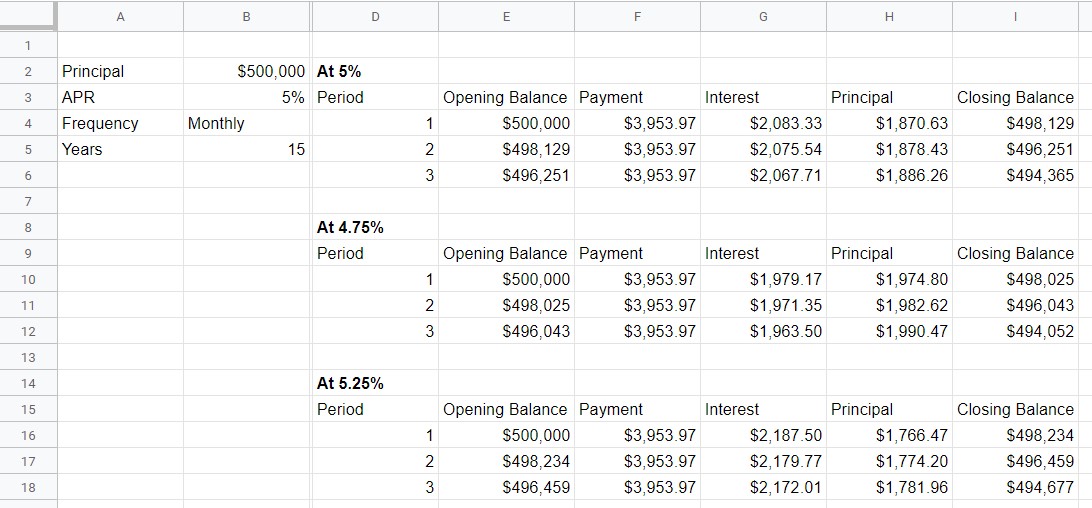

Rate reset example

Loan Terms

- $500,000 15 year floating rate loan starting at 5% APR amortized monthly.

Time to Maturity

- At 5% - 180 months

- At 5.25% - 185 months

- At 4.75% - 176 months

- At 0% - 127 months

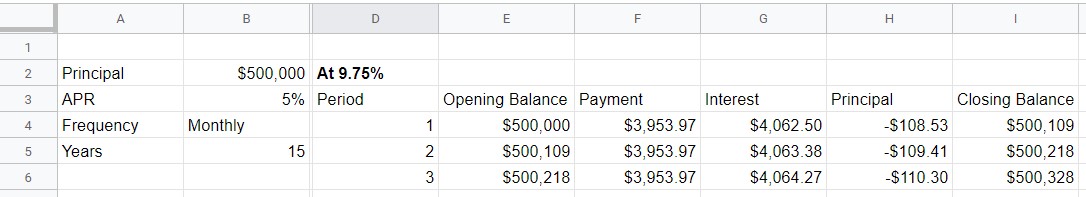

- At 9.5% - Infinite

Negative amortization

- Increasing rates cause interest to exceed payment.

- Negative principal increases balance owing at end of period.

- Balance never reaches zero.

Maximum interest rate

Maximum interest rate

- Highest possible rate that a loan can reach before negative amortization.

- Payment fixed at start of loan.

Maximum interest rate = Balance / Payment * Payment frequency

Example: $500,000 loan, 5% APR, paid monthly.

=500000 / 3953.97 * 12

9.48952%

Time for floating interest!

Loan Amortization in Google Sheets