Time value of money

Bond Valuation and Analysis in R

Clifford Ang

Senior Vice President, Compass Lexecon

Time value of money (TVM)

- $\$1$ today is worth more than $\$1$ tomorrow

- Suppose you won $10,000 in a game, what would you choose?

- Receive the $10,000 today?

- Receive the $10,000 one year from now?

Future value

- The future value is the value of $1 at some point in the future

- Prefer $1 today, so would have to be compensated to agree to receive the cash flow in the future

- Future value (

fv) one and two years from now can be calculated as:

fv1 <- pv * (1 + r)

fv2 <- pv * (1 + r) * (1 + r)

r - interest rate

pv - present value

Present value

- Reverse logic of future values

- The value of $1 in the future is worth less today

- So you will be willing to take less than $\$1$ today instead of waiting to receive $1 one or two years from now

- This can be calculated as follows:

pv <- fv1 / (1 + r)

pv <- fv2 / ((1 + r) * (1 + r))

r - interest rate

fv1 - future value 1 year from now, fv2 - future value 2 years from now

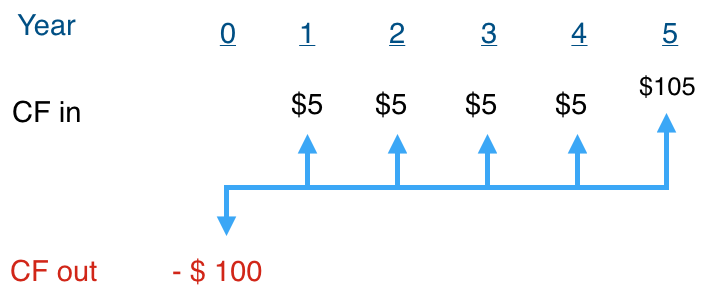

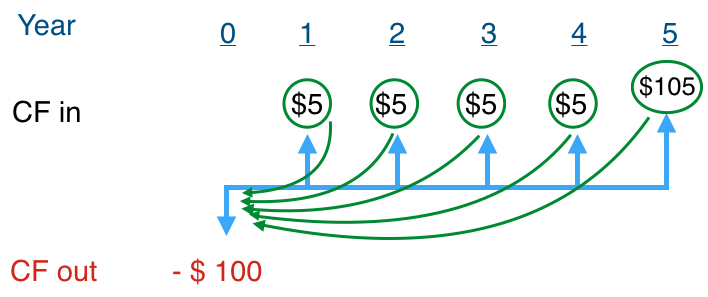

TVM applied to bonds

- We can apply this time value of money concept to bonds

- Example:

- $100 par value, 5% coupon rate (= $5), 5 years to maturity

- Price = $100 today

Bond investor's trade-off

Comparing cash flows

Let's practice!

Bond Valuation and Analysis in R