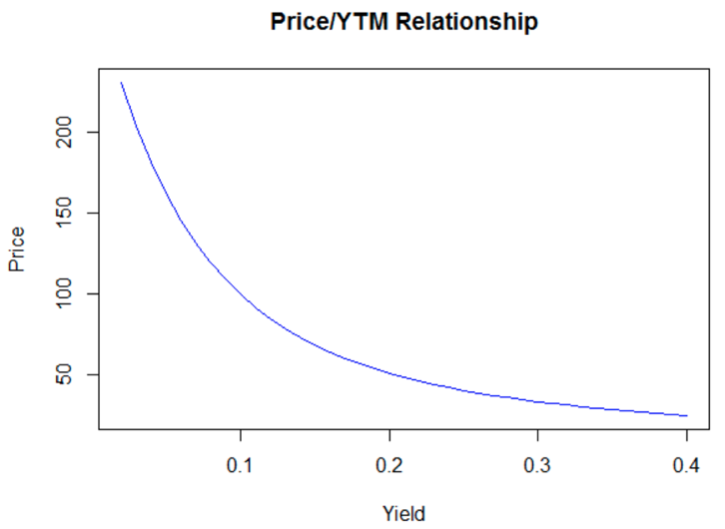

Price-yield relationship

Bond Valuation and Analysis in R

Clifford Ang

Senior Vice President, Compass Lexecon

Inverse relationship

Credit ratings

| S&P | Fitch | Moody's | |

|---|---|---|---|

| Investment grade | AAA | AAA | Aaa |

| AA | AA | Aa | |

| A | A | A | |

| BBB | BBB | Baa | |

| High yield | BB | BB | Ba |

| B | B | B | |

| CCC-Lower | CCC-Lower | Caa-Lower |

Determining a bond's yield

- Use yields of bonds with same credit rating

- If we want to value a Baa-rated bond, we can get the data from

quantmod

library(quantmod)

baa <- getSymbols("DBAA", src = "FRED", auto.assign = FALSE)

yield <- baa["2024"]

head(yield)

DBAA

2024-01-01 NA

2024-01-02 5.57

2024-01-03 5.57

2024-01-04 5.64

2024-01-05 5.70

2024-01-08 5.66

Let's practice!

Bond Valuation and Analysis in R