First things first

ARIMA Models in R

David Stoffer

Professor of Statistics at the University of Pittsburgh

About Me

- Professor of Statistics

About Me

- Professor of Statistics

- Co-author of two texts on time series

astsapackage

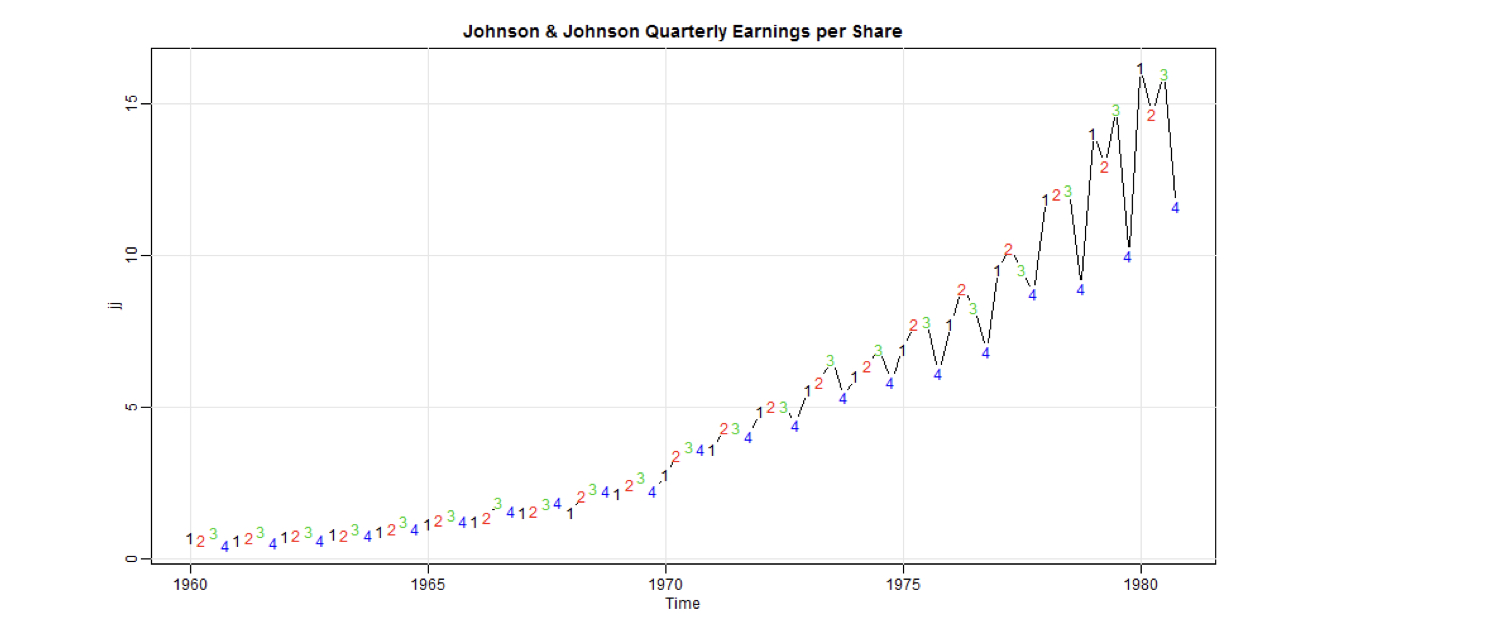

Time Series Data - I

library(astsa)

plot(jj, main = "Johnson & Johnson Quarterly Earnings per Share", type = "c")

text(jj, labels = 1:4, col = 1:4)

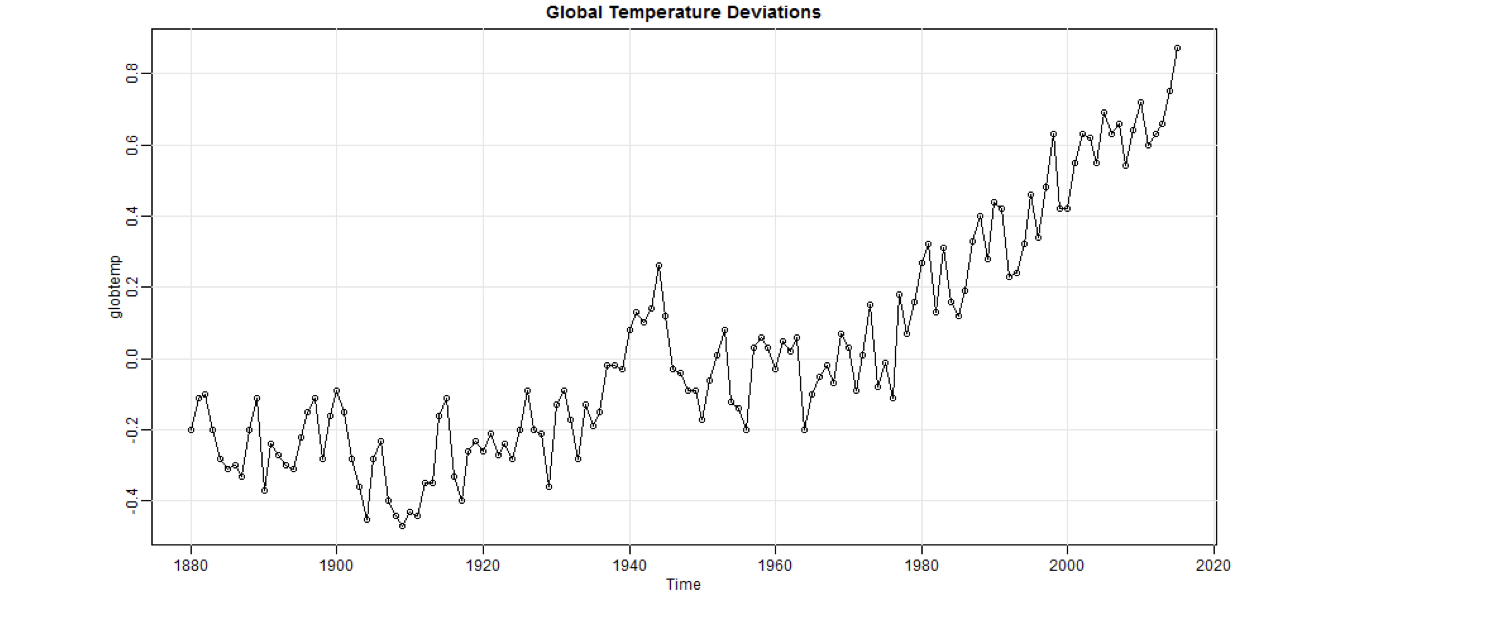

Time Series Data - II

library(astsa)

plot(globtemp, main = "Global Temperature Deviations", type= "o")

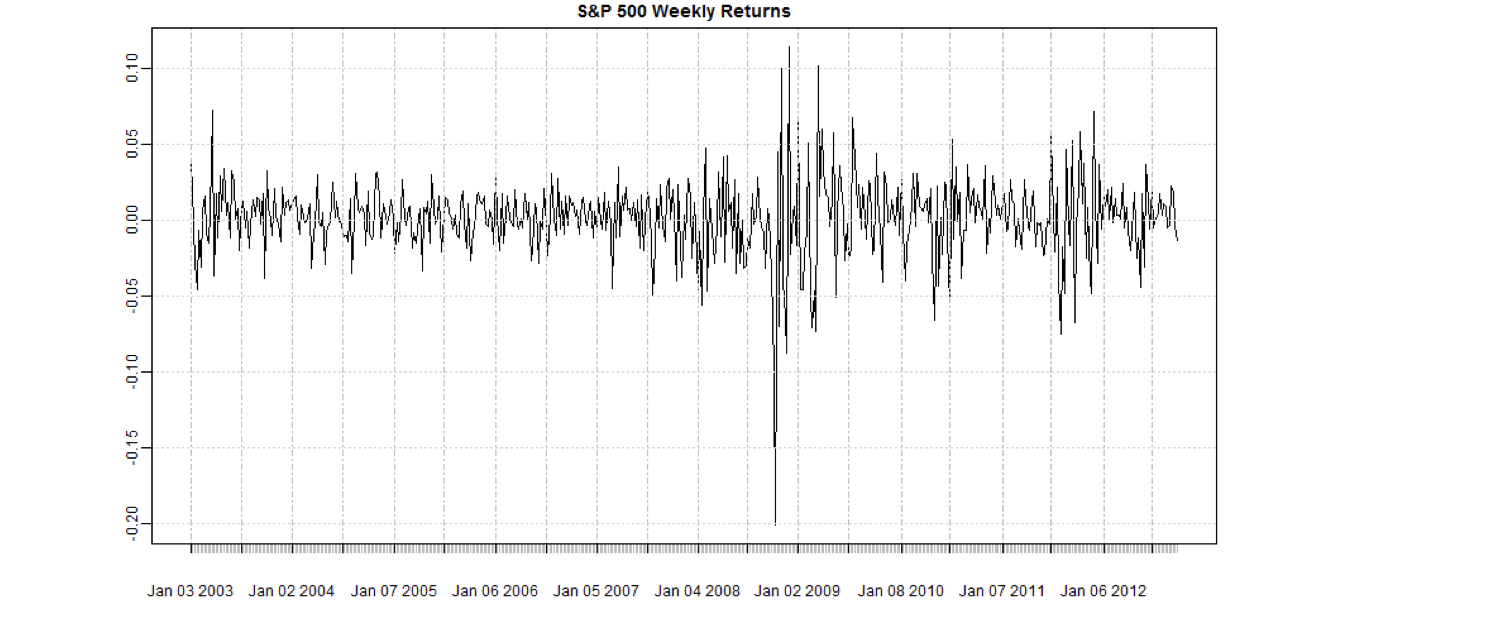

Time Series Data - III

library(xts)

plot(sp500w, main = "S&P 500 Weekly Returns")

Time Series Regression Models

Regression: $Y_i = \beta X_i + \epsilon_i$, where $\epsilon_i$ is white noise

White Noise:

- independent normals with common variance

- is basic building block of time series

AutoRegression: $X_t = \phi X_{t-1} + \epsilon_t \ $ ($\epsilon_t$ is white noise)

Moving Average: $\epsilon_t = W_t + \theta W_{t-1} \ $ ($W_t$ is white noise)

ARMA: $X_t = \phi X_{t-1} + W_t + \theta W_{t-1} \ $

Let's practice!

ARIMA Models in R