Maximum Sharpe vs. minimum volatility

Introduction to Portfolio Analysis in Python

Charlotte Werger

Data Scientist

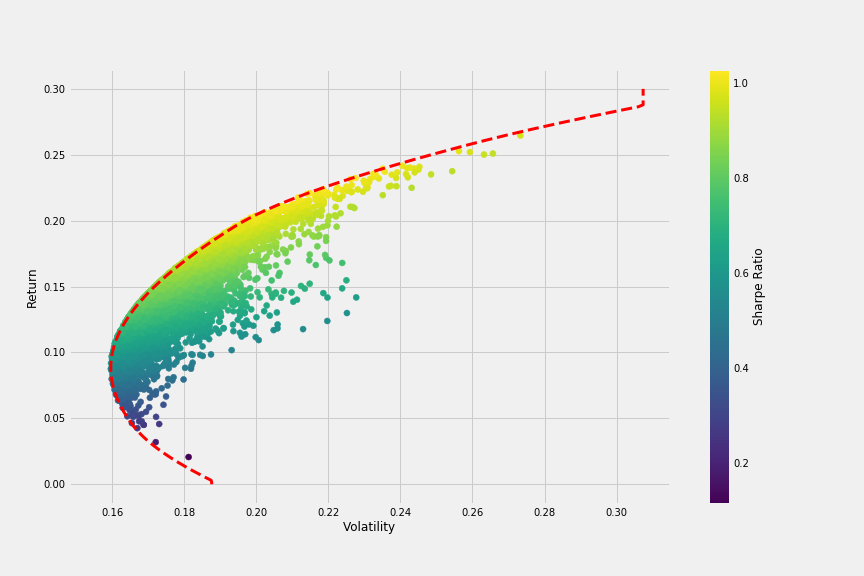

Remember the Efficient Frontier?

$$

- Efficient frontier: all portfolios with an optimal risk and return trade-off

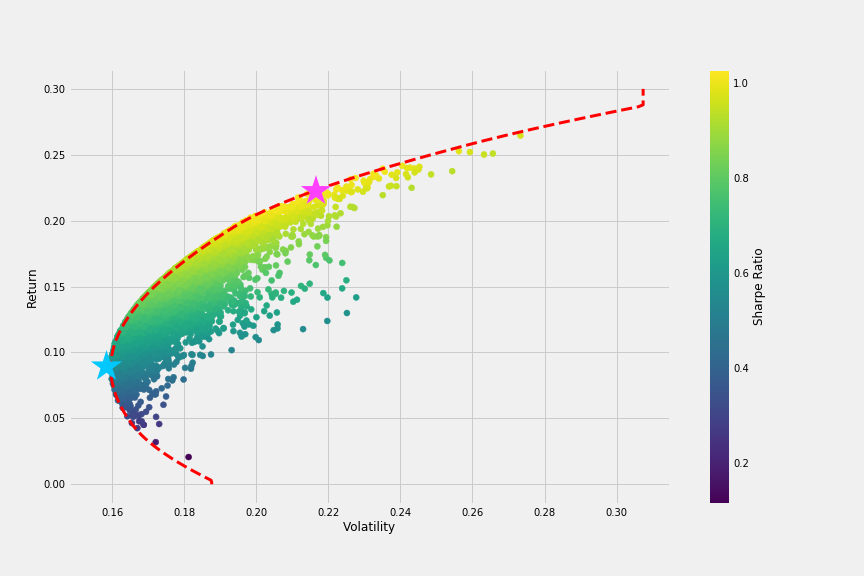

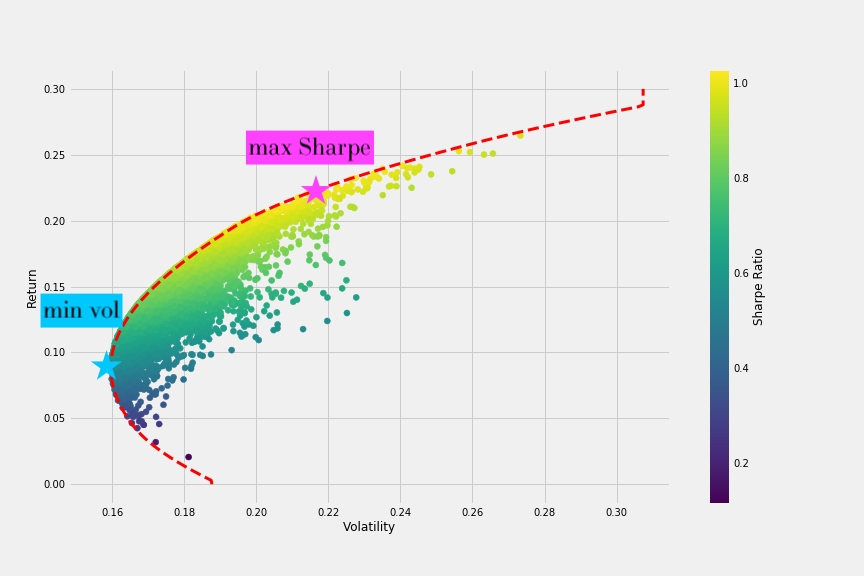

- Maximum Sharpe portfolio: the highest Sharpe ratio on the EF

- Minimum volatility portfolio: the lowest level of risk on the EF

$$

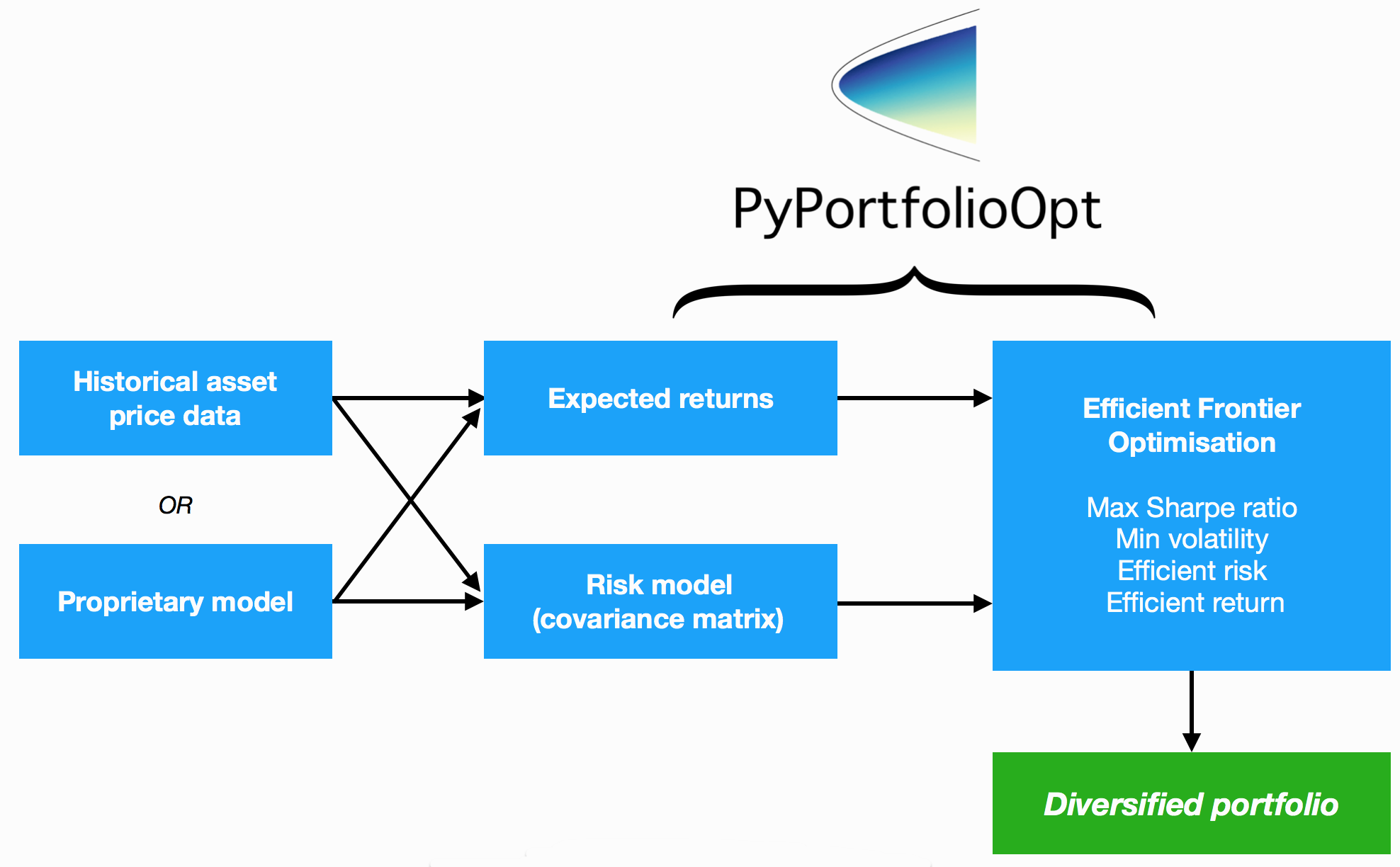

Adjusting PyPortfolioOpt optimization

Maximum Sharpe portfolio

Maximum Sharpe portfolio: the highest Sharpe ratio on the EF

from pypfopt.efficient_frontier import EfficientFrontier

# Calculate the Efficient Frontier with mu and S

ef = EfficientFrontier(mu, Sigma)

raw_weights = ef.max_sharpe()

# Get interpretable weights

cleaned_weights = ef.clean_weights()

{'GOOG': 0.01269,'AAPL': 0.09202,'FB': 0.19856,

'BABA': 0.09642,'AMZN': 0.07158,'GE': 0.02456,...}

Maximum Sharpe portfolio

# Get performance numbers

ef.portfolio_performance(verbose=True)

Expected annual return: 33.0%

Annual volatility: 21.7%

Sharpe Ratio: 1.43

Minimum Volatility Portfolio

Minimum volatility portfolio: the lowest level of risk on the EF

# Calculate the Efficient Frontier with mu and S

ef = EfficientFrontier(mu, Sigma)

raw_weights = ef.min_volatility()

# Get interpretable weights and performance numbers

cleaned_weights = ef.clean_weights()

{'GOOG': 0.05664, 'AAPL': 0.087, 'FB': 0.1591,

'BABA': 0.09784, 'AMZN': 0.06986, 'GE': 0.0123,...}

Minimum Volatility Portfolio

ef.portfolio_performance(verbose=True)

Expected annual return: 17.4%

Annual volatility: 13.2%

Sharpe Ratio: 1.28

Let's have another look at the Efficient Frontier

Maximum Sharpe versus Minimum Volatility

Let's practice!

Introduction to Portfolio Analysis in Python