Alternative measures of risk

Introduction to Portfolio Analysis in Python

Charlotte Werger

Data Scientist

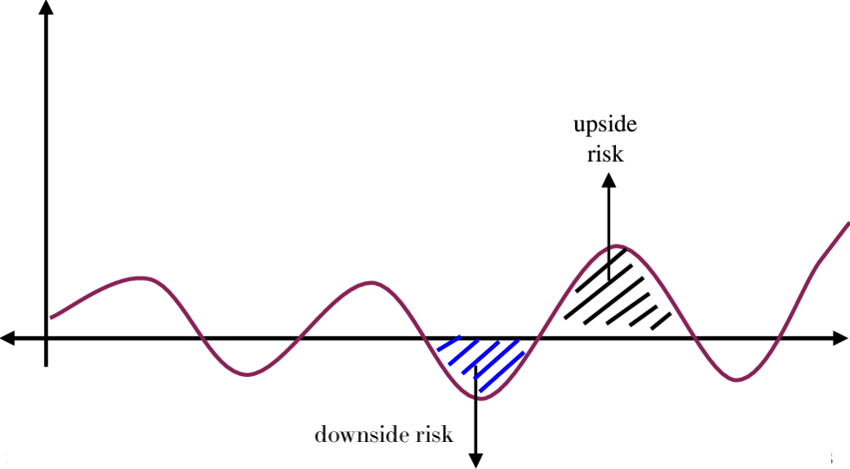

Looking at downside risk

- A good risk measure should focus on potential losses i.e. downside risk

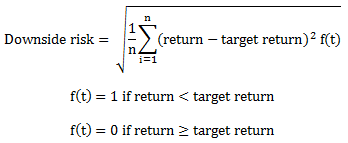

Sortino ratio

$$

- Similar to the Sharpe ratio, just with a different standard deviation

- $ Sortino \; Ratio = \frac{R_p - R_f}{\sigma_d}$

- $\sigma_d$ is the standard deviation of the downside.

$$

Sortino ratio in python

# Define risk free rate and target return of 0

rfr = 0

target_return = 0

# Calcualte the daily returns from price data

apple_returns=pd.DataFrame(apple_price.pct_change())

# Select the negative returns only

negative_returns = apple_returns.loc[apple_returns['AAPL'] < target]

# Calculate expected return and std dev of downside returns

expected_return = apple_returns['AAPL'].mean()

down_stdev = negative_returns.std()

# Calculate the sortino ratio

sortino_ratio = (expected_return - rfr)/down_stdev

print(sortino_ratio)

0.07887683763760528

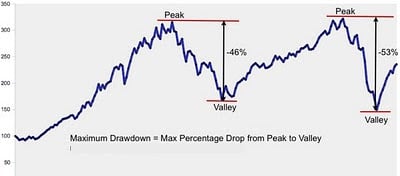

Maximum draw-down

- The largest percentage loss from a market peak to trough

- Dependent on the chosen time window

- The recovery time: time it takes to get back to break-even

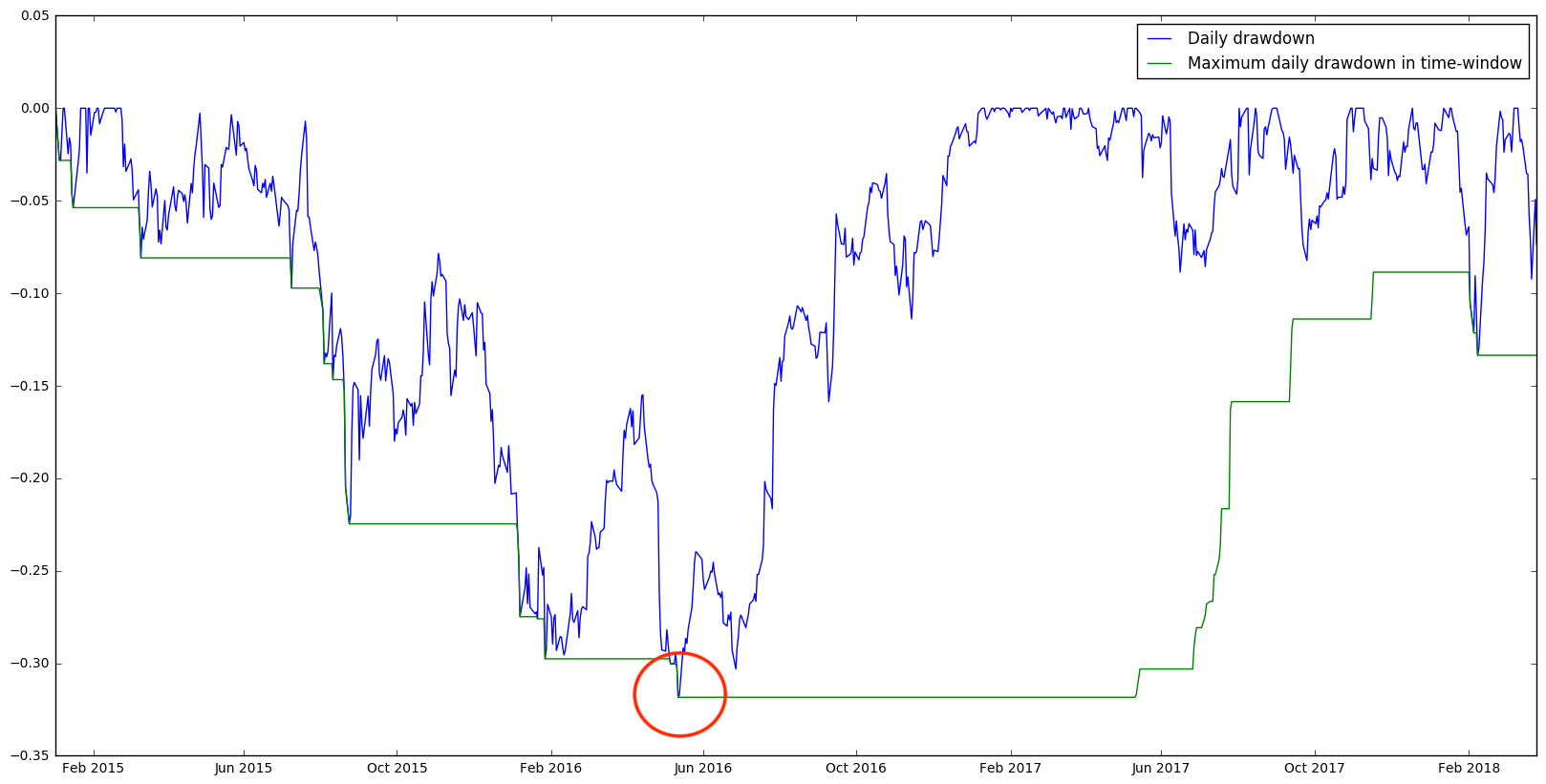

Maximum daily draw-down in Python

# Calculate the maximum value of returns using rolling().max() roll_max = apple_price.rolling(min_periods=1,window=250).max()# Calculate daily draw-down from rolling max daily_drawdown = apple_price/roll_max - 1.0# Calculate maximum daily draw-down max_daily_drawdown = daily_drawdown.rolling(min_periods=1,window=250).min()# Plot the results daily_drawdown.plot() max_daily_drawdown.plot() plt.show()

Maximum draw-down of Apple

Let's practice!

Introduction to Portfolio Analysis in Python