Measuring risk of a portfolio

Introduction to Portfolio Analysis in Python

Charlotte Werger

Data Scientist

Risk of a portfolio

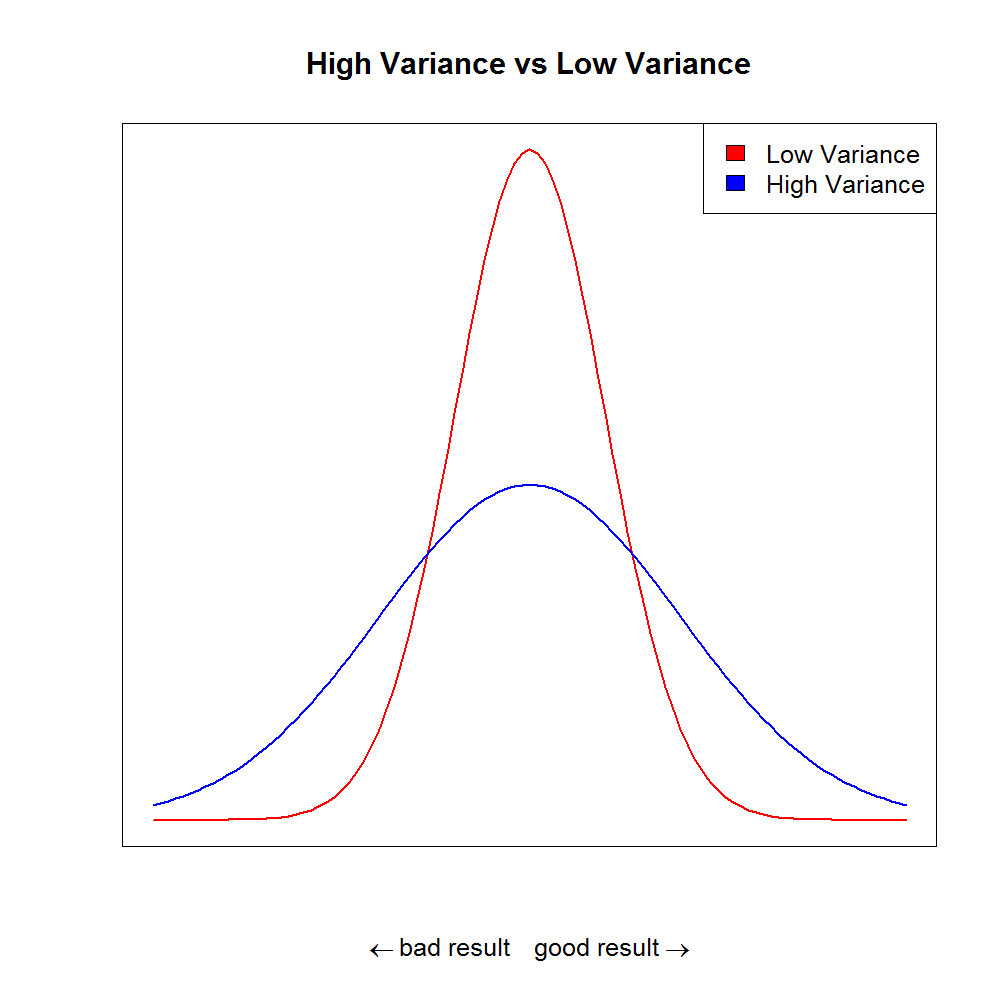

- Investing is risky: individual assets will go up or down

- Expected return is a random variable

- Returns spread around the mean is measured by the variance $\sigma^2$ and is a common measure of volatility

- $\sigma^2 = \frac{\sum\limits_{i=1}^N (X -\mu)^2}{N}$

Variance

$$

- Variance of an individual asset varies: some have more or less spread around the mean

- Variance of the portfolio is not simply the weighted variances of the underlying assets

- Because returns of assets are correlated, it becomes complex

How do variance and correlation relate to portfolio risk?

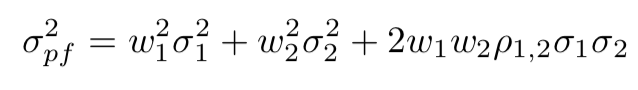

$$

- The correlation between asset 1 and 2 is denoted by $\rho_{1,2}$, and tells us to which extend assets move together

- The portfolio variance takes into account the individual assets' variances ($\sigma_1^2, \sigma_2^2, etc$), the weights of the assets in the portfolio ($w_1, w_2$), as well as their correlation to each other

- The standard deviation ($\sigma$) is equal to the square root of variance ($\sigma^2$), both are a measure of volatility

Calculating portfolio variance

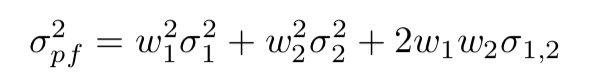

$$

- $\rho_{1,2} \sigma_1 \sigma_2$ is called the covariance between asset 1 and 2

- The covariance can also be written as $ \sigma_{1,2} $

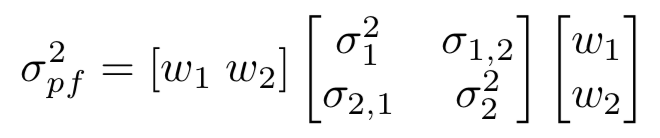

- This let's us write:

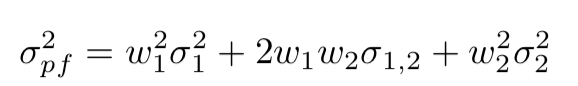

Re-writing the portfolio variance shorter

- This can be re-written in matrix notation, which you can use more easily in code:

In words, what we need to calculate in python is:

Portfolio variance = Weights transposed x (Covariance matrix x Weights)

Portfolio variance in python

price_data.head(2)

ticker AAPL FB GE GM WMT

date

2018-03-21 171.270 169.39 13.88 37.58 88.18

2018-03-22 168.845 164.89 13.35 36.35 87.14

# Calculate daily returns from prices

daily_returns = df.pct_change()

# Construct a covariance matrix for the daily returns data

cov_matrix_d = daily_returns.cov()

Portfolio variance in python

# Construct a covariance matrix from the daily_returns

cov_matrix_d = (daily_returns.cov())*250

print (cov_matrix_d)

AAPL FB GE GM WMT

AAPL 0.053569 0.026822 0.013466 0.018119 0.010798

FB 0.026822 0.062351 0.015298 0.017250 0.008765

GE 0.013466 0.015298 0.045987 0.021315 0.009513

GM 0.018119 0.017250 0.021315 0.058651 0.011894

WMT 0.010798 0.008765 0.009513 0.011894 0.041520

weights = np.array([0.2, 0.2, 0.2, 0.2, 0.2])

Portfolio variance in python

# Calculate the variance with the formula

port_variance = np.dot(weights.T, np.dot(cov_matrix_a, weights))

print (port_variance)

0.022742232726360567

# Just converting the variance float into a percentage

print(str(np.round(port_variance, 3) * 100) + '%')

2.3%

port_stddev = np.sqrt(np.dot(weights.T, np.dot(cov_matrix_a, weights)))

print(str(np.round(port_stddev, 3) * 100) + '%')

15.1%

Let's practice!

Introduction to Portfolio Analysis in Python