Comparing against a benchmark

Introduction to Portfolio Analysis in Python

Charlotte Werger

Data Scientist

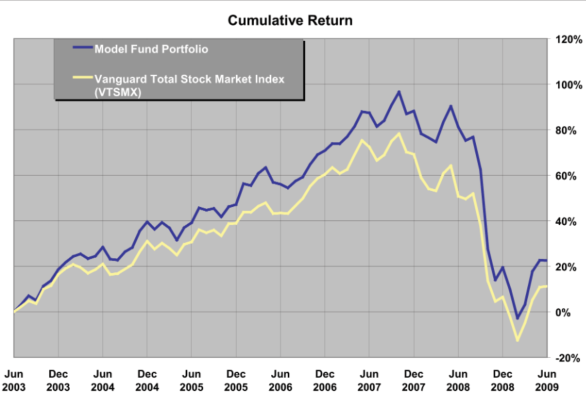

Active investing against a benchmark

Active return for an actively managed portfolio

$$

- Active return is the performance of an (active) investment, relative to the investment's benchmark.

- Calculated as the difference between the benchmark and the actual return.

- Active return is achieved by "active" investing, i.e. taking overweight and underweight positions from the benchmark.

Tracking error for an index tracker

$$

- Passive investment funds, or index trackers, don't use active return as a measure for performance.

- Tracking error is the name used for the difference in portfolio and benchmark for a passive investment fund.

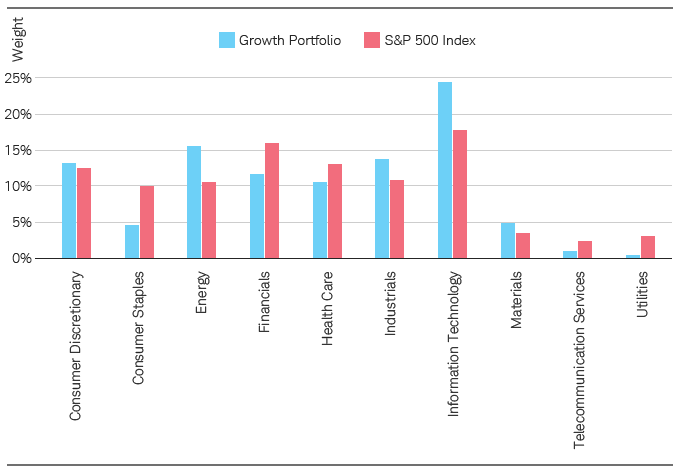

Active weights

1 Source: Schwab Center for Financial Research.

Active return in Python

# Inspect the data

portfolio_data.head()

mean_ret var pf_w bm_w GICS Sector

Ticker

A 0.146 0.035 0.002 0.005 Health Care

AAL 0.444 0.094 0.214 0.189 Industrials

AAP 0.242 0.029 0.000 0.000 Consumer Discretionary

AAPL 0.225 0.027 0.324 0.459 Information Technology

ABBV 0.182 0.029 0.026 0.010 Health Care

1 Global Industry Classification System (GICS)

Active return in Python

# Calculate mean portfolio return

total_return_pf = (pf_w*mean_ret).sum()

# Calculate mean benchmark return

total_return_bm = (bm_w*mean_ret).sum()

# Calculate active return

active_return = total_return_pf - total_return_bm

print ("Simple active return: ", active_return)

Simple active return: 6.5764

Active weights in Python

# Group dataframe by GICS sectors

grouped_df=portfolio_data.groupby('GICS Sector').sum()

# Calculate active weights of portfolio

grouped_df['active_weight']=grouped_df['pf_weights']-

grouped_df['bm_weights']

print (grouped_df['active_weight'])

GICS Sector

Consumer Discretionary 20.257

Financials -2.116

...etc

Let's practice!

Introduction to Portfolio Analysis in Python