Welcome to Portfolio Analysis!

Introduction to Portfolio Analysis in Python

Charlotte Werger

Data Scientist

Hi! My name is Charlotte

What is a portfolio

Why do we need portfolio analysis

Portfolio versus fund versus index

Portfolio: a collection of investments (stocks, bonds, commodities, other funds) often owned by an individual

Fund: a pool of investments that is managed by a professional fund manager. Individual investors buy "units" of the fund and the manager invests the money

Index: A smaller sample of the market that is representative of the whole, e.g. S&P500, Nasdaq, Russell 2000, MSCI World Index

Active versus passive investing

- Passive investing: following a benchmark as closely as possible

- Active investing: taking active "bets" that are different from a benchmark

- Long only strategies: small deviations from a benchmark

- Hedgefunds: no benchmark but 'total return strategies'

$$ $$

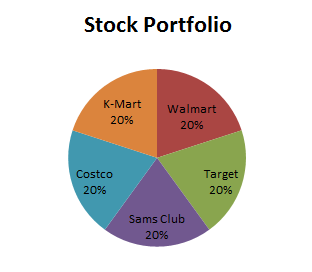

Diversification

- Single stock investments expose you to: a sudden change in management, disappointing financial performance, weak economy, an industry slump, etc

- Good diversification means combining stocks that are different: risk, cyclical, counter-cyclical, industry, country

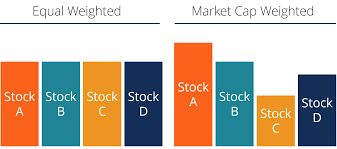

Typical portfolio strategies

- Equal weighted portfolios

- Market-cap weighted portfolios

- Risk-return optimized portfolios

Let's practice!

Introduction to Portfolio Analysis in Python