Annualized returns

Introduction to Portfolio Analysis in Python

Charlotte Werger

Data Scientist

Comparing returns

Annual Return: Total return earned over a period of one calendar year

Annualized return: Yearly rate of return inferred from any time period

Average Return: Total return realized over a longer period, spread out evenly over the (shorter) periods.

Cumulative (compounding) return: A return that includes the compounded results of re-investing interest, dividends, and capital gains.

Why annualize returns?

$$

$$

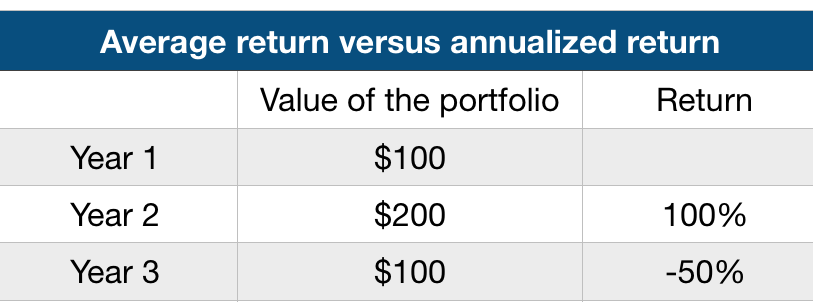

- Average return = (100 - 50) / 2 = 25%

- Actual return = 0% so average return is not a good measure for performance!

- How to compare portfolios with different time lengths?

- How to account for compounding effects over time?

Calculating annualized returns

$$

N in years: $rate= (1 +Return)^{1/N} -1$

N in months: $rate= (1+Return)^{12/N} -1$

Convert any time length to an annual rate:

- Return is the total return you want to annualize.

- N is number of periods so far.

Annualized returns in python

# Check the start and end of timeseries

apple_price.head(1)

date

2015-01-06 105.05

Name: AAPL, dtype: float64

apple_price.tail(1)

date

2018-03-29 99.75

Name: AAPL, dtype: float64

# Assign the number of months

months = 38

Annualized returns in python

# Calculate the total return

total_return = (apple_price[-1] - apple_price[0]) /

apple_price[0]

print (total_return)

0.5397420653068692

Annualized returns in python

# Calculate the annualized returns over months

annualized_return=((1 + total_return)**(12/months))-1

print (annualized_return)

0.14602501482708763

# Select three year period

apple_price = apple_price.loc['2015-01-01':'2017-12-31']

apple_price.tail(3)

date

2017-12-27 170.60

2017-12-28 171.08

2017-12-29 169.23

Name: AAPL, dtype: float64

Annualized return in Python

# Calculate annualized return over 3 years

annualized_return = ((1 + total_return)**(1/3))-1

print (annualized_return)

0.1567672968419047

Let's practice!

Introduction to Portfolio Analysis in Python