Risk factors

Introduction to Portfolio Analysis in Python

Charlotte Werger

Data Scientist

What is a factor?

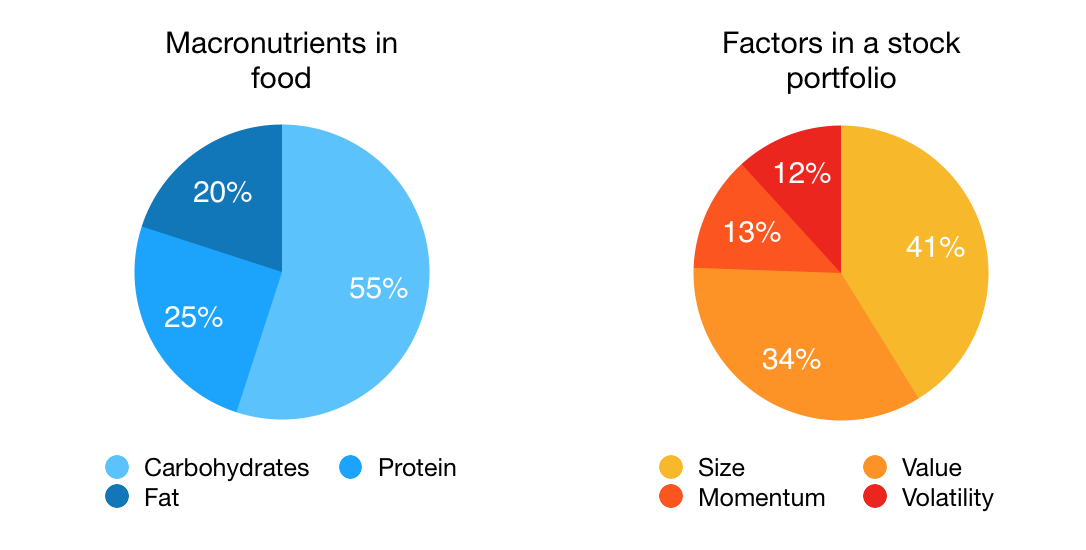

Factors in portfolios are like nutrients in food

Factors in portfolios

Different types of factors:

- Macro factors: interest rates, currency, country, industry

- Style factors: momentum, volatility, value and quality

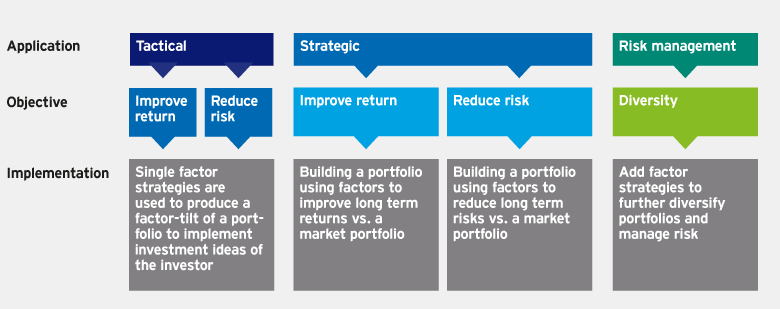

Using factor models to determine risk exposure

$$

1 Source: https://invesco.eu/investment-campus/educational-papers/factor-investing

Factor exposures

df.head()

date portfolio volatility quality

2015-01-05 -1.827811 1.02 -1.76

2015-01-06 -0.889347 0.41 -0.82

2015-01-07 1.162984 1.07 1.39

2015-01-08 1.788828 0.31 1.93

2015-01-09 -0.840381 0.28 -0.77

Factor exposures

df.corr()

portfolio volatility quality

portfolio 1.000000 0.056596 0.983416

volatility 0.056596 1.000000 0.092852

quality 0.983416 0.092852 1.000000

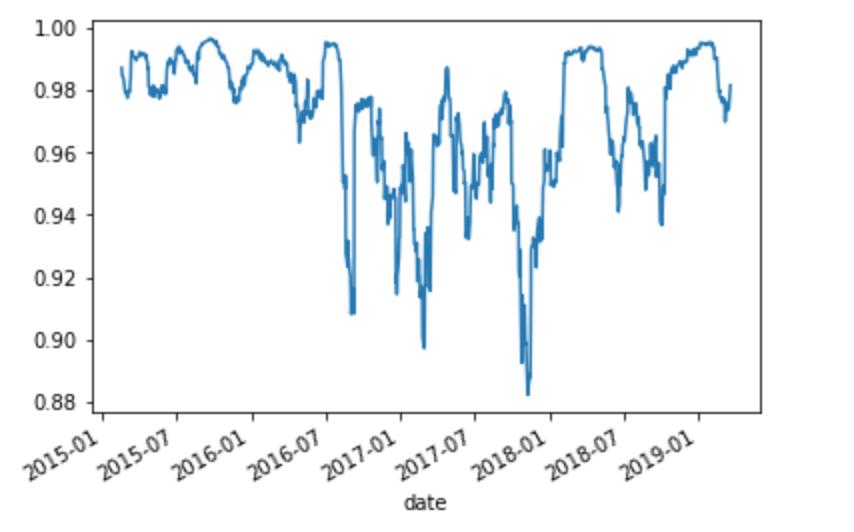

Correlations change over time

# Rolling correlation

df['corr']=df['portfolio'].rolling(30).corr(df['quality'])

# Plot results

df['corr'].plot()

Rolling correlation with quality

Let's practice!

Introduction to Portfolio Analysis in Python