Modern portfolio theory

Introduction to Portfolio Analysis in Python

Charlotte Werger

Data Scientist

Creating optimal portfolios

What is Portfolio Optimization?

Meet Harry Markowitz

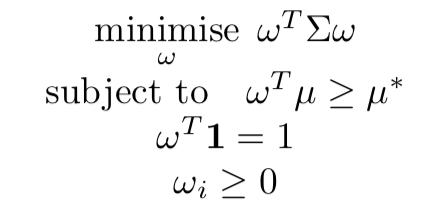

The optimization problem: finding optimal weights

$$

In words:

- Minimize the portfolio variance, subject to:

- The expected mean return is at least some target return

- The weights sum up to 100%

- At least some weights are positive

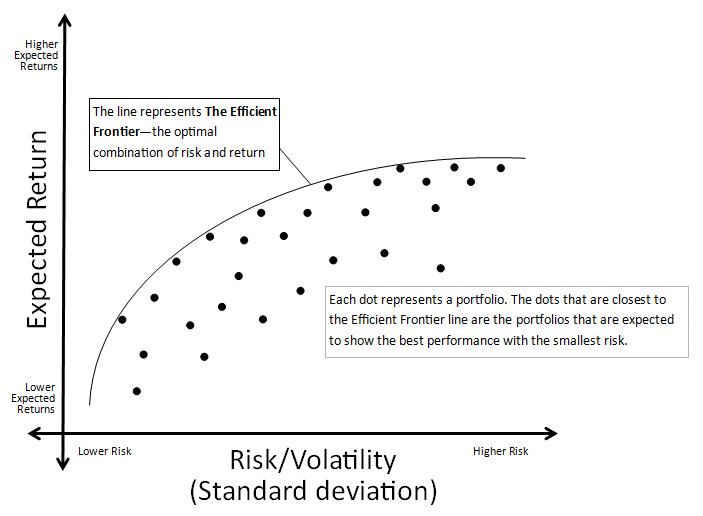

Varying target returns leads to the Efficient Frontier

PyPortfolioOpt for portfolio optimization

from pypfopt.efficient_frontier import EfficientFrontier

from pypfopt import risk_models

from pypfopt import expected_returns

df=pd.read_csv('portfolio.csv')

df.head(2)

XOM RRC BBY MA PFE

date

2010-01-04 54.068794 51.300568 32.524055 22.062426 13.940202

2010-01-05 54.279907 51.993038 33.349487 21.997149 13.741367

# Calculate expected annualized returns and sample covariance

mu = expected_returns.mean_historical_return(df)

Sigma = risk_models.sample_cov(df)

Get the Efficient Frontier and portfolio weights

# Calculate expected annualized returns and risk

mu = expected_returns.mean_historical_return(df)

Sigma = risk_models.sample_cov(df)

# Obtain the EfficientFrontier

ef = EfficientFrontier(mu, Sigma)

# Select a chosen optimal portfolio

ef.max_sharpe()

Different optimizations

# Select the maximum Sharpe portfolio

ef.max_sharpe()

# Select an optimal return for a target risk

ef.efficient_risk(2.3)

# Select a minimal risk for a target return

ef.efficient_return(1.5)

Calculate portfolio risk and performance

# Obtain the performance numbers

ef.portfolio_performance(verbose=True, risk_free_rate = 0.01)

Expected annual return: 21.3%

Annual volatility: 19.5%

Sharpe Ratio: 0.98

Let's optimize a portfolio!

Introduction to Portfolio Analysis in Python