Portfolio returns

Introduction to Portfolio Analysis in Python

Charlotte Werger

Data Scientist

What are portfolio weights?

- Weight is the percentage composition of a particular asset in a portfolio

- All weights together have to sum up to 100%

- Weights and diversification (few large investments versus many small investments)

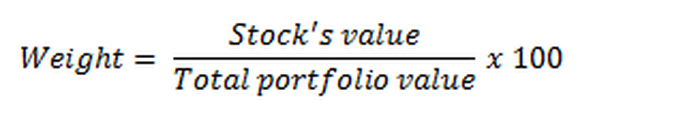

Calculating portfolio weights

$$

- Calculate by dividing the value of a security by total value of the portfolio

- Equal weighted portfolio, or market cap weighted portfolio

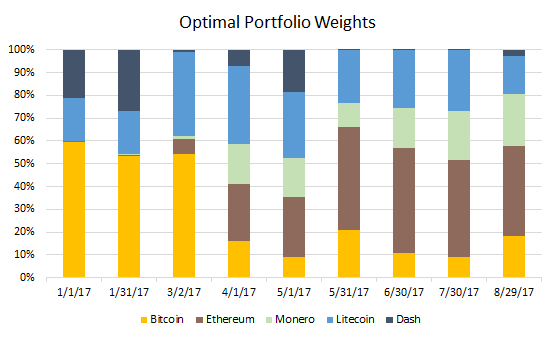

- Weights determine your investment strategy, and can be set to optimize risk and expected return

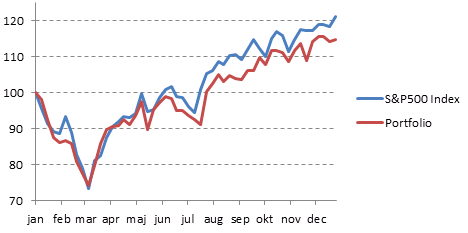

Portfolio returns

Changes in value over time

$ Return_t = \frac{V_t - V_{t-1}}{V_{t-1}} $

Portfolio returns

$$

- $ Return_t = \frac{V_t - V_{t-1}}{V_{t-1}} $

- Historic average returns often used to calculate expected return

- Warning for confusion: average return, cumulative return, active return, and annualized return

Calculating returns from pricing data

df.head(2)

AAPL AMZN TSLA

date

2018-03-25 13.88 114.74 92.48

2018-03-26 13.35 109.95 89.79

# Calculate returns over each day

returns = df.pct_change()

returns.head(2)

AAPL AMZN TSLA

date

2018-03-25 NaN NaN NaN

2018-03-26 -0.013772 0.030838 0.075705

Calculating returns from pricing data

weights = np.array([0, 0.50, 0.25])

# Calculate average return for each stock

meanDailyReturns = returns.mean()

# Calculate portfolio return

portReturn = np.sum(meanDailyReturns*weights)

print (portReturn)

0.05752375881537723

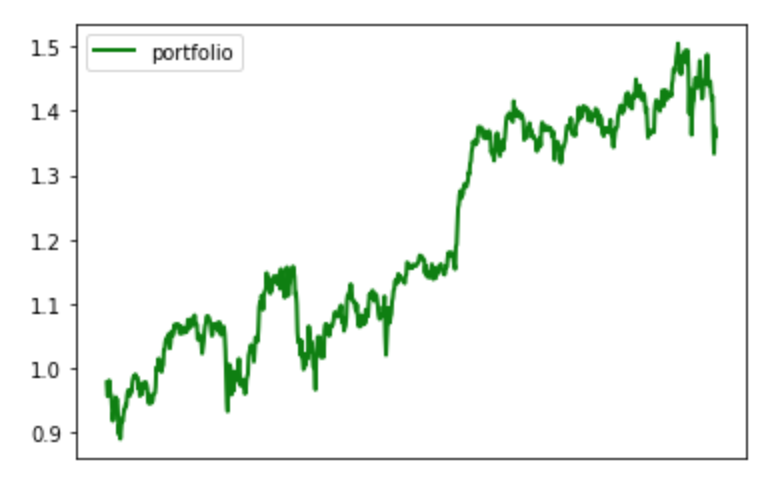

Calculating cumulative returns

# Calculate daily portfolio returns

returns['Portfolio']= returns.dot(weights)

# Let's see what it looks like

returns.head(3)

AAPL AMZN TSLA Portfolio

date

2018-03-23 -0.020974 -0.026739 -0.029068 -0.025880

2018-03-26 -0.013772 0.030838 0.075705 0.030902

Calculating cumulative returns

# Compound the percentage returns over time

daily_cum_ret=(1+returns).cumprod()

# Plot your cumulative return

daily_cum_ret.Portfolio.plot()

Cumulative return plot

Let's practice!

Introduction to Portfolio Analysis in Python