Credit strategy and minimum expected loss

Credit Risk Modeling in Python

Michael Crabtree

Data Scientist, Ford Motor Company

Selecting acceptance rates

- First acceptance rate was set to 85%, but other rates might be selected as well

- Two options to test different rates:

- Calculate the threshold, bad rate, and losses manually

- Automatically create a table of these values and select an acceptance rate

- The table of all the possible values is called a strategy table

Setting up the strategy table

- Set up arrays or lists to store each value

# Set all the acceptance rates to test

accept_rates = [1.0, 0.95, 0.9, 0.85, 0.8, 0.75, 0.7, 0.65, 0.6, 0.55,

0.5, 0.45, 0.4, 0.35, 0.3, 0.25, 0.2, 0.15, 0.1, 0.05]

# Create lists to store thresholds and bad rates

thresholds = []

bad_rates = []

Calculating the table values

- Calculate the threshold and bad rate for all acceptance rates

for rate in accept_rates:

# Calculate threshold

threshold = np.quantile(preds_df['prob_default'], rate).round(3)

# Store threshold value in a list

thresholds.append(np.quantile(preds_gbt['prob_default'], rate).round(3))

# Apply the threshold to reassign loan_status

test_pred_df['pred_loan_status'] = \

test_pred_df['prob_default'].apply(lambda x: 1 if x > thresh else 0)

# Create accepted loans set of predicted non-defaults

accepted_loans = test_pred_df[test_pred_df['pred_loan_status'] == 0]

# Calculate and store bad rate

bad_rates.append(np.sum((accepted_loans['true_loan_status'])

/ accepted_loans['true_loan_status'].count()).round(3))

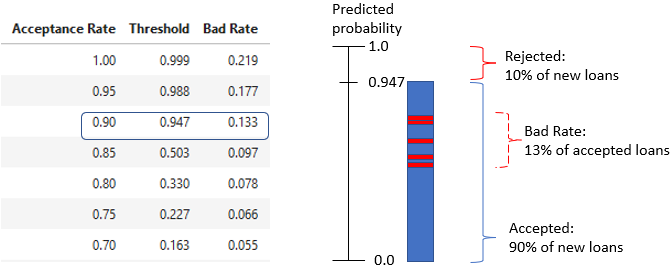

Strategy table interpretation

strat_df = pd.DataFrame(zip(accept_rates, thresholds, bad_rates),

columns = ['Acceptance Rate','Threshold','Bad Rate'])

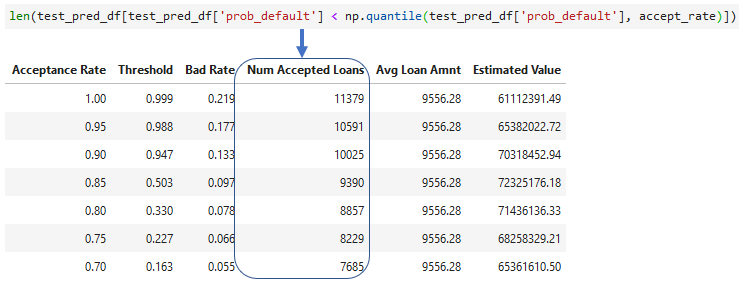

Adding accepted loans

- The number of loans accepted for each acceptance rate

- Can use

len()or.count()

- Can use

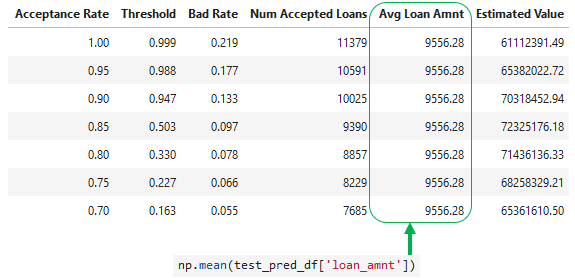

Adding average loan amount

- Average

loan_amntfrom the test set data

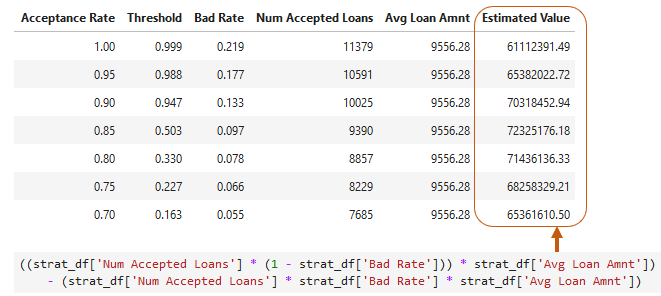

Estimating portfolio value

- Average value of accepted loan non-defaults minus average value of accepted defaults

- Assumes each default is a loss of the

loan_amnt

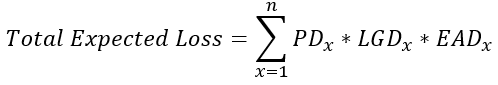

Total expected loss

- How much we expect to lose on the defaults in our portfolio

# Probability of default (PD)

test_pred_df['prob_default']

# Exposure at default = loan amount (EAD)

test_pred_df['loan_amnt']

# Loss given default = 1.0 for total loss (LGD)

test_pred_df['loss_given_default']

Let's practice!

Credit Risk Modeling in Python