Risk with missing data in loan data

Credit Risk Modeling in Python

Michael Crabtree

Data Scientist, Ford Motor Company

What is missing data?

- NULLs in a row instead of an actual value

- An empty string

'' - Not an entirely empty row

- Can occur in any column in the data

Similarities with outliers

- Negatively affect machine learning model performance

- May bias models in unanticipated ways

- May cause errors for some machine learning models

Similarities with outliers

- Negatively affect machine learning model performance

- May bias models in unanticipated ways

- May cause errors for some machine learning models

| Missing Data Type | Possible Result |

|---|---|

| NULL in numeric column | Error |

| NULL in string column | Error |

How to handle missing data

- Generally three ways to handle missing data

- Replace values where the data is missing

- Remove the rows containing missing data

- Leave the rows with missing data unchanged

- Understanding the data determines the course of action

How to handle missing data

- Generally three ways to handle missing data

- Replace values where the data is missing

- Remove the rows containing missing data

- Leave the rows with missing data unchanged

- Understanding the data determines the course of action

| Missing Data | Interpretation | Action |

|---|---|---|

NULL in loan_status |

Loan recently approved | Remove from prediction data |

NULL in person_age |

Age not recorded or disclosed | Replace with median |

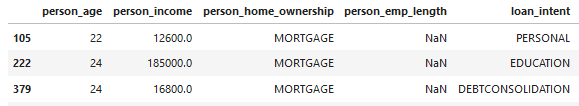

Finding missing data

- Null values are easily found by using the

isnull()function - Null records can easily be counted with the

sum()function .any()method checks all columns

null_columns = cr_loan.columns[cr_loan.isnull().any()]

cr_loan[null_columns].isnull().sum()

# Total number of null values per column

person_home_ownership 25

person_emp_length 895

loan_intent 25

loan_int_rate 3140

cb_person_default_on_file 15

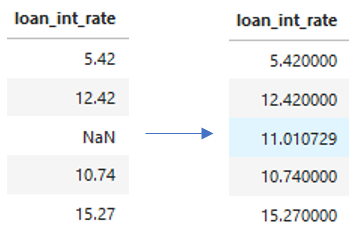

Replacing Missing data

- Replace the missing data using methods like

.fillna()with aggregate functions and methods

cr_loan['loan_int_rate'].fillna((cr_loan['loan_int_rate'].mean()), inplace = True)

Dropping missing data

- Uses indices to identify records the same as with outliers

- Remove the records entirely using the

.drop()method

indices = cr_loan[cr_loan['person_emp_length'].isnull()].index

cr_loan.drop(indices, inplace=True)

Let's practice!

Credit Risk Modeling in Python