Logistic regression for probability of default

Credit Risk Modeling in Python

Michael Crabtree

Data Scientist, Ford Motor Company

Probability of default

- The likelihood that someone will default on a loan is the probability of default

- A probability value between 0 and 1 like

0.86 loan_statusof1is a default or0for non-default

Probability of default

- The likelihood that someone will default on a loan is the probability of default

- A probability value between 0 and 1 like

0.86 loan_statusof1is a default or0for non-default

| Probability of Default | Interpretation | Predicted loan status |

|---|---|---|

| 0.4 | Unlikely to default | 0 |

| 0.90 | Very likely to default | 1 |

| 0.1 | Very unlikely to default | 0 |

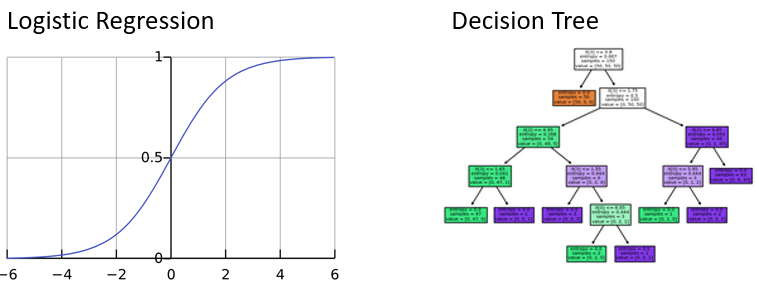

Predicting probabilities

- Probabilities of default as an outcome from machine learning

- Learn from data in columns (features)

- Classification models (default, non-default)

- Two most common models:

- Logistic regression

- Decision tree

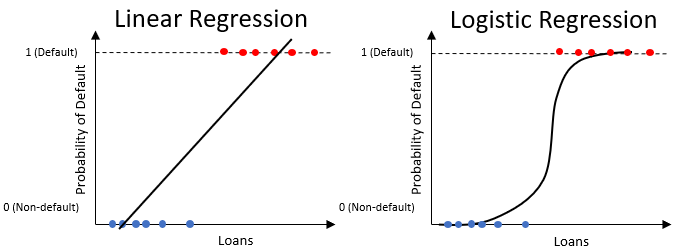

Logistic regression

- Similar to the linear regression, but only produces values between

0and1

Training a logistic regression

- Logistic regression available within the scikit-learn package

from sklearn.linear_model import LogisticRegression

- Called as a function with or without parameters

clf_logistic = LogisticRegression(solver='lbfgs')

- Uses the method

.fit()to train

clf_logistic.fit(training_columns, np.ravel(training_labels))

- Training Columns: all of the columns in our data except

loan_status - Labels:

loan_status(0,1)

Training and testing

- Entire data set is usually split into two parts

Training and testing

- Entire data set is usually split into two parts

| Data Subset | Usage | Portion |

|---|---|---|

| Train | Learn from the data to generate predictions | 60% |

| Test | Test learning on new unseen data | 40% |

Creating the training and test sets

- Separate the data into training columns and labels

X = cr_loan.drop('loan_status', axis = 1)

y = cr_loan[['loan_status']]

- Use

train_test_split()function already within sci-kit learn

X_train, X_test, y_train, y_test = train_test_split(X, y, test_size=.4, random_state=123)

test_size: percentage of data for test setrandom_state: a random seed value for reproducibility

Let's practice!

Credit Risk Modeling in Python