Understanding credit risk

Credit Risk Modeling in Python

Michael Crabtree

Data Scientist, Ford Motor Company

What is credit risk?

- The possibility that someone who has borrowed money will not repay it all

- Calculated risk difference between lending someone money and a government bond

- When someone fails to repay a loan, it is said to be in default

- The likelihood that someone will default on a loan is the probability of default (PD)

What is credit risk?

- The possibility that someone who has borrowed money will not repay it all

- Calculated risk difference between lending someone money and a government bond

- When someone fails to repay a loan, it is said to be in default

- The likelihood that someone will default on a loan is the probability of default (PD)

| Payment | Payment Date | Loan Status |

|---|---|---|

| $100 | Jun 15 | Non-Default |

| $100 | Jul 15 | Non-Default |

| $0 | Aug 15 | Default |

Expected loss

- The dollar amount the firm loses as a result of loan default

- Three primary components:

- Probability of Default (PD)

- Exposure at Default (EAD)

- Loss Given Default (LGD)

Formula for expected loss:

expected_loss = PD * EAD * LGD

Types of data used

Two Primary types of data used:

- Application data

- Behavioral data

| Application | Behavioral |

|---|---|

| Interest Rate | Employment Length |

| Grade | Historical Default |

| Amount | Income |

Data columns

- Mix of behavioral and application

- Contain columns simulating credit bureau data

| Column | Column |

|---|---|

| Income | Loan grade |

| Age | Loan amount |

| Home ownership | Interest rate |

| Employment length | Loan status |

| Loan intent | Historical default |

| Percent Income | Credit history length |

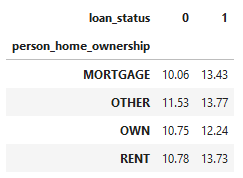

Exploring with cross tables

pd.crosstab(cr_loan['person_home_ownership'], cr_loan['loan_status'],

values=cr_loan['loan_int_rate'], aggfunc='mean').round(2)

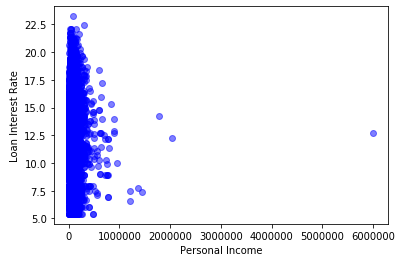

Exploring with visuals

plt.scatter(cr_loan['person_income'], cr_loan['loan_int_rate'],c='blue', alpha=0.5)

plt.xlabel("Personal Income")

plt.ylabel("Loan Interest Rate")

plt.show()

Let's practice!

Credit Risk Modeling in Python