Neural network risk management

Quantitative Risk Management in Python

Jamsheed Shorish

Computational Economist

Real-time portfolio updating

- Risk management

- Defined risk measures (VaR, CVaR)

- Estimated risk measures (parameteric, historical, Monte Carlo)

- Optimized portfolio (e.g. Modern Portfolio Theory)

- New market information => update portfolio weights

- Problem: portfolio optimization costly

- Solution: $\text{weights} = f(\text{prices})$

- Evaluate $f$ in real-time

- Update $f$ only occasionally

Neural networks

- Neural Network: $\text{output} = f(\text{input})$

- Neuron: interconnected processing node in function

- Initially developed 1940s-1950s

- Early 2000s: application of neural networks to "big data"

- Image recognition, processing

- Financial data

- Search engine data

- Deep Learning: neural networks as part of Machine Learning

- 2015: Google releases open-source Tensorflow deep learning library for Python

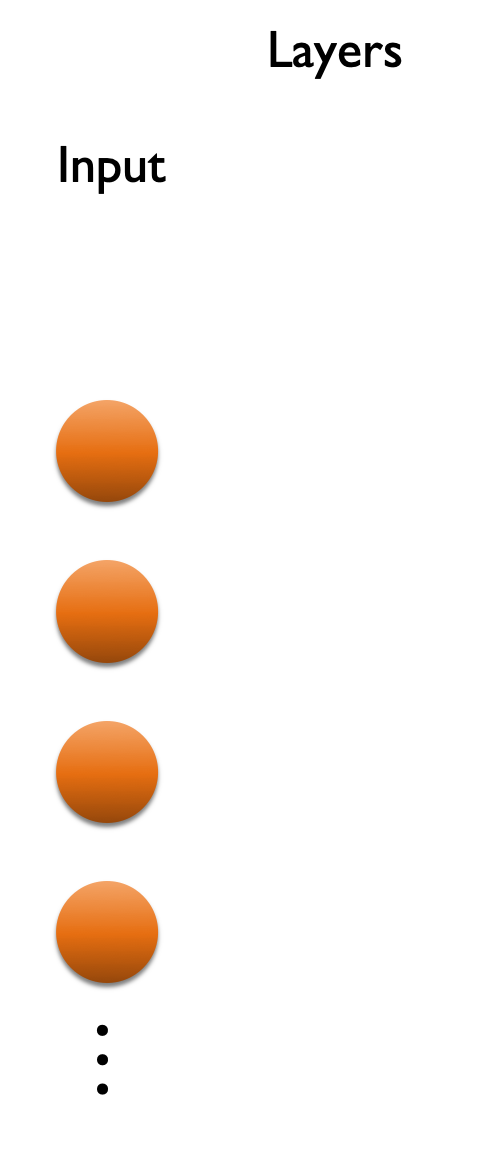

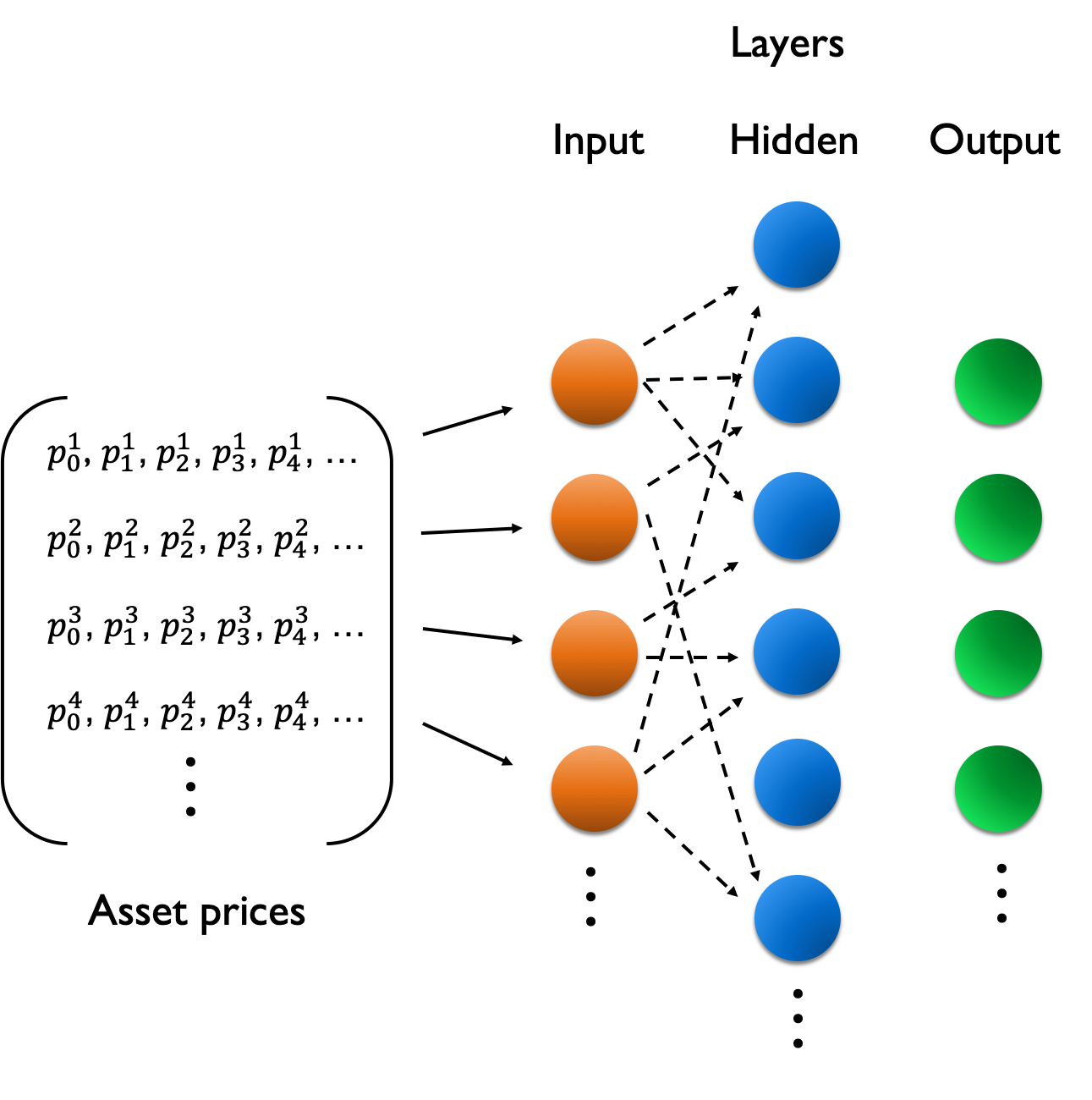

Neural network structure

- Layers: connected processing neurons

- Input layer

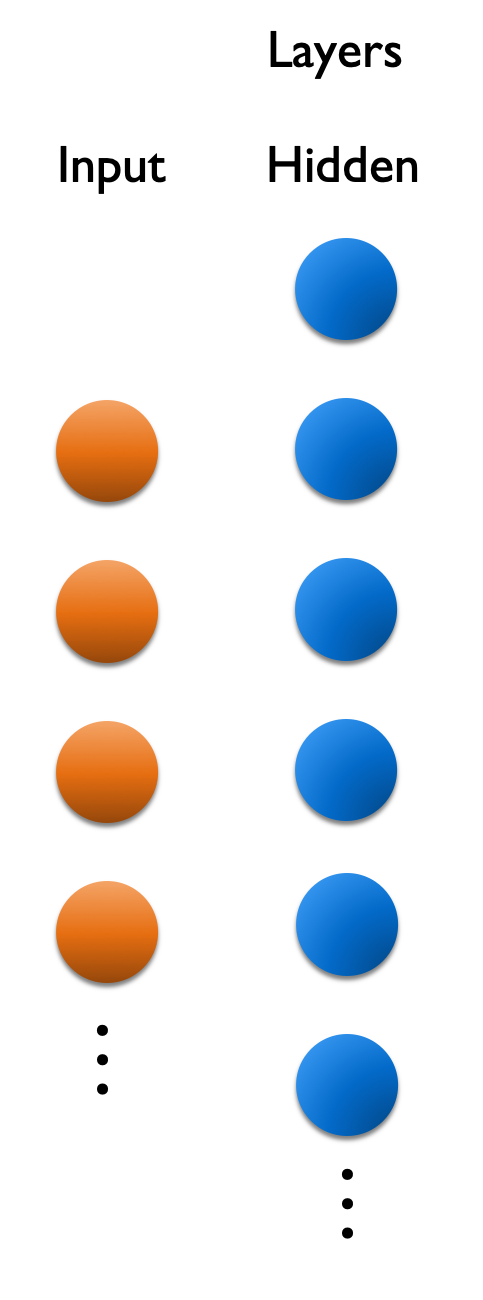

Neural network structure

- Neural network structure

- Input layer

- Hidden layer

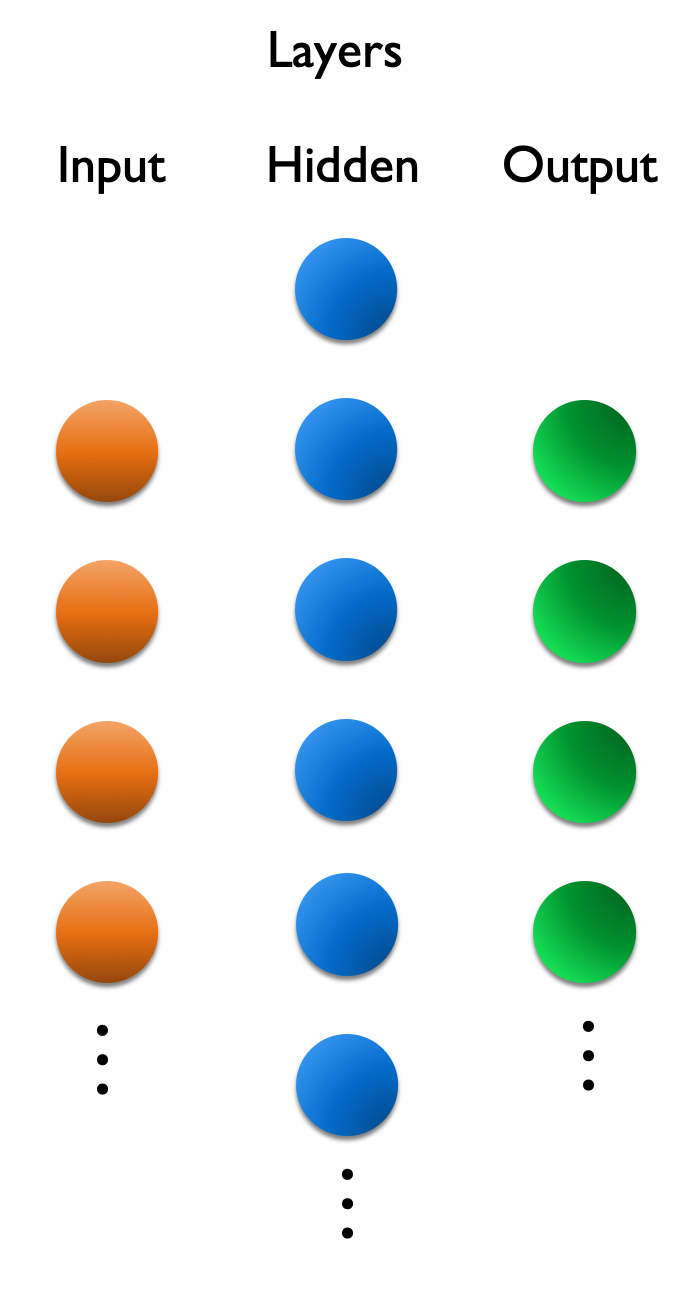

Neural network structure

- Neural network structure

- Input layer

- Hidden layer

- Output layer

- Training: learn relationship between input and output

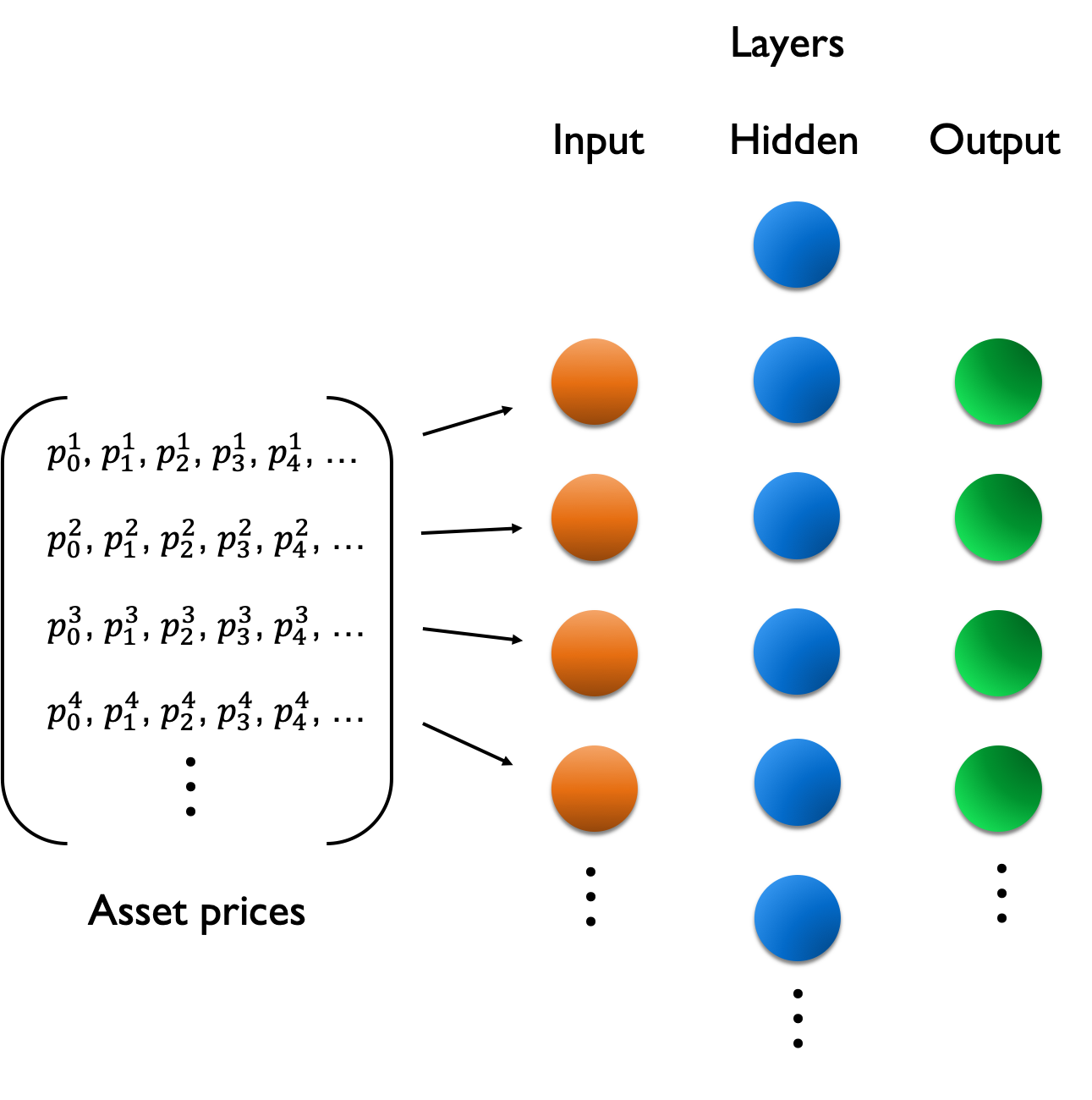

Neural network structure

- Neural network structure

- Input layer

- Hidden layer

- Output layer

- Training: learn relationship between input and output

- Asset prices => Input layer

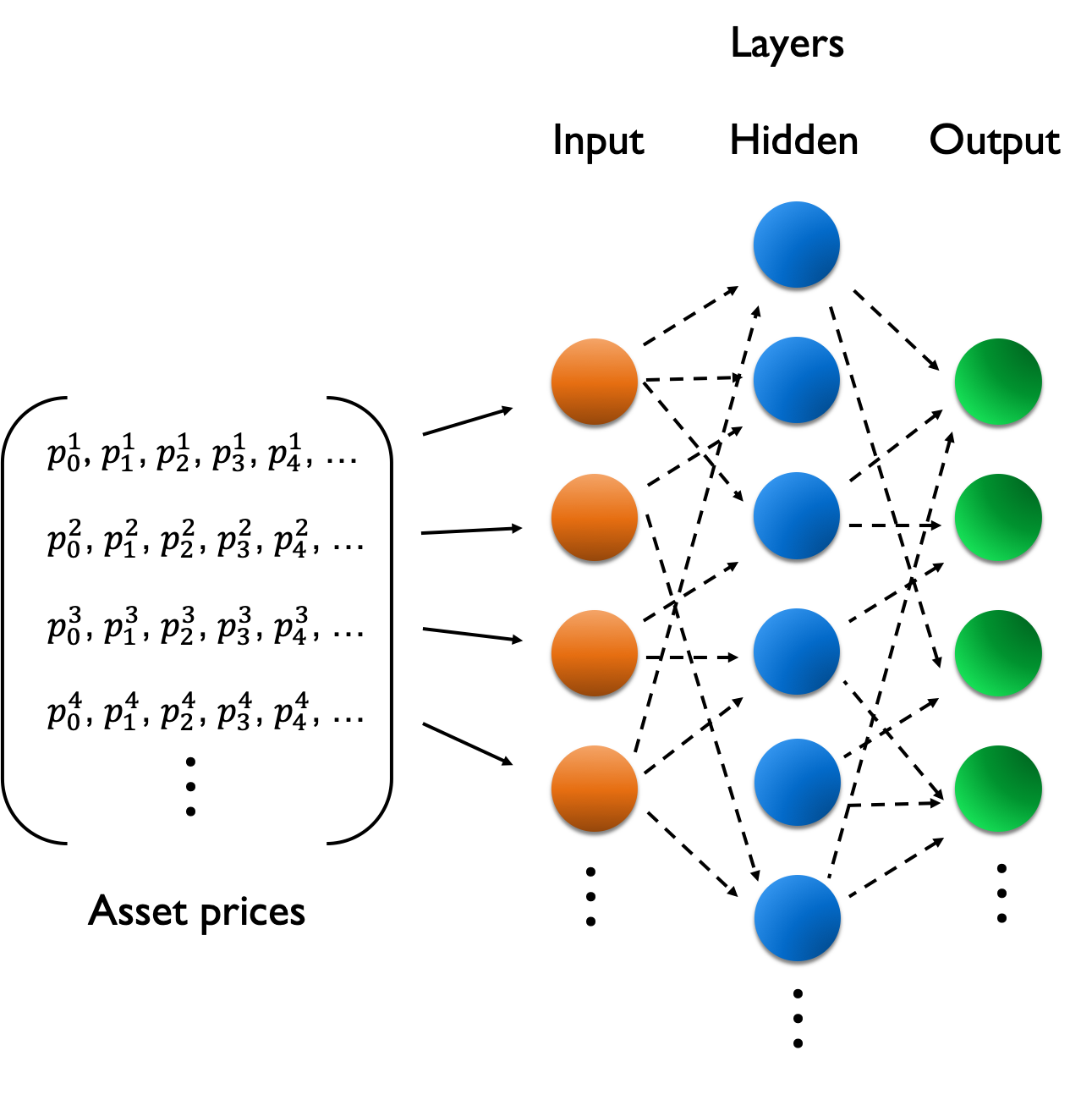

Neural network structure

- Neural network structure

- Input layer

- Hidden layer

- Output layer

- Training: learn relationship between input and output

- Asset prices => Input layer

- Input + hidden layer processing

Neural network structure

- Neural network structure

- Input layer

- Hidden layer

- Output layer

- Training: learn relationship between input and output

- Asset prices => Input layer

- Input + hidden layer processing

- Hidden + output layer processing

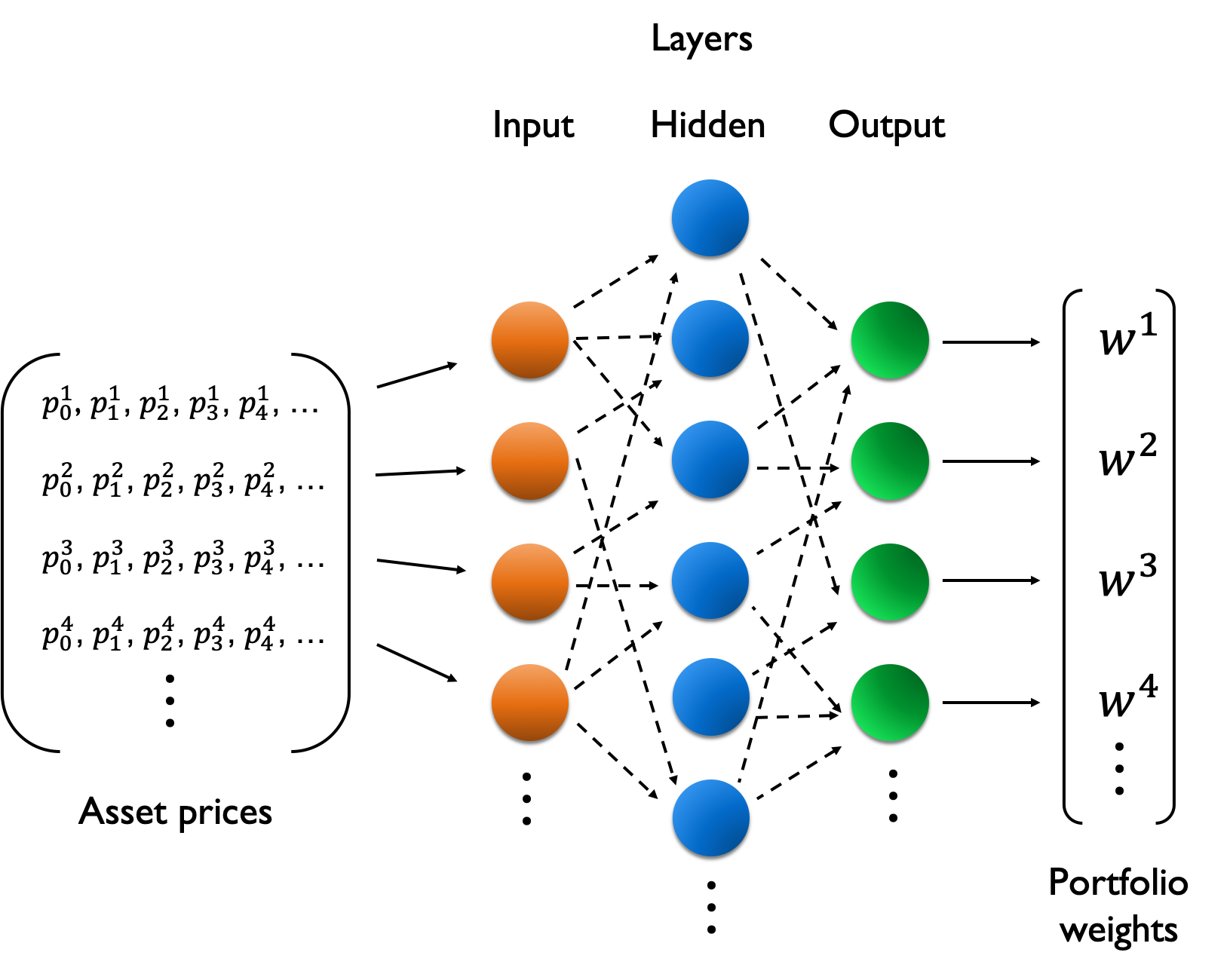

Neural network structure

- Neural network structure

- Input layer

- Hidden layer

- Output layer

- Training: learn relationship between input and output

- Asset prices => Input layer

- Input + hidden layer processing

- Hidden + output layer processing

- Output => portfolio weights

Using neural networks for portfolio optimization

- Training

- Compare output and pre-existing "best" portfolio weights

- Goal: minimize "error" between output and weights

- Small error => network is trained

- Usage

- Input: new, unseen asset prices

- Output: predicted "best" portfolio weights for new asset prices

- Best weights = risk management

Creating neural networks in Python

- Keras: high-level Python library for neural networks/deep learning

- Further info: Introduction to Deep Learning with Keras

from tensorflow.keras.models import Sequentialfrom tensorflow.keras.layers import Densemodel = Sequential() model.add(Dense(10, input_dim=4, activation='sigmoid')) model.add(Dense(4))

Training the network in Python

- Historical asset prices:

training_inputmatrix - Historical portfolio weights:

training_outputvector - Compile model with:

- given error minimization ('loss')

- given optimization algorithm ('optimizer')

- Fit model to training data

- epochs: number of training loops to update internal parameters

model.compile(loss='mean_squared_error', optimizer='rmsprop')model.fit(training_input, training_output, epochs=100)

Risk management in Python

- Usage: provide new (e.g. real-time) asset pricing data

- New vector

new_asset_pricesgiven to input layer

- New vector

- Evaluate network using

model.predict()on new prices- Result:

predictedportfolio weights

- Result:

- Accumulate enough data over time => re-train network

- Test network on previous data => backtesting

# new asset prices are in the vector new_asset_prices

predicted = model.predict(new_asset_prices)

Let's practice!

Quantitative Risk Management in Python