Risk management using VaR & CVaR

Quantitative Risk Management in Python

Jamsheed Shorish

Computational Economist

Risk management via modern portfolio theory

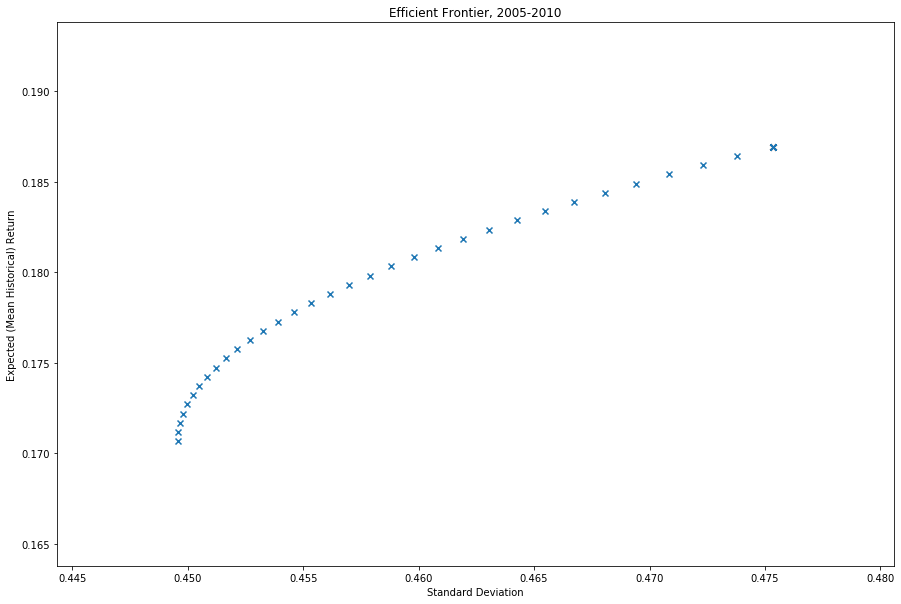

- Efficient Portfolio

- Portfolio weights maximize return given risk level

- Efficient Frontier: locus of (risk, return) points generated by different efficient portfolios

- Each point = portfolio weight optimization

- Creation of efficient portfolio/frontier: Modern Portfolio Theory

Incorporating Value at Risk into MPT

- Modern Portfolio Theory (MPT): "mean-variance" optimization

- Highest expected return

- Risk level (volatility) is given

- Objective function: expected return

- VaR/CVaR: measure risk over distribution of loss

- Adapt MPT to optimize over loss distribution vs. expected return

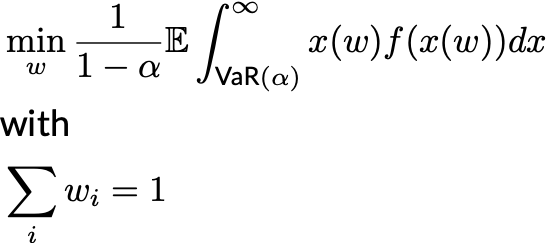

A new objective: minimize CVaR

- Change objective of portfolio optimization

- mean-variance objective: maximize expected mean return

- CVaR objective: minimize expected conditional loss at a given confidence level

- Example: Loss distribution

- VaR: maximum loss with 95% confidence

- Optimization: portfolio weights minimizing CVaR

- CVaR: expected loss given at least VaR loss (worst 5% of cases)

- Find lowest expected loss in worst 100% - 95% = 5% of possible outcomes

The risk management problem

- Select optimal portfolio weights $w^\star$ as solution to

Recall: $f(x)$ = probability density function of portfolio loss

PyPortfolioOpt: select minimization of CVaR as new objective

CVaR minimization using PyPortfolioOpt

- Create an

EfficientCVaRobject with asset returnsreturns - Compute optimal portfolio weights using

.min_cvar()method

ec = pypfopt.efficient_frontier.EfficientCVaR(None, returns)optimal_weights = ec.min_cvar()

Mean-variance vs. CVaR risk management

- Mean-variance minimum volatility portfolio, 2005-2010 investment bank assets

ef = EfficientFrontier(None, e_cov)min_vol_weights = ef.min_volatility()print(min_vol_weights)

{'Citibank': 0.0,

'Morgan Stanley': 5.0784330940519306e-18,

'Goldman Sachs': 0.6280157234640608,

'J.P. Morgan': 0.3719842765359393}

Mean-variance vs. CVaR risk management

- CVaR-minimizing portfolio, 2005-2010 investment bank assets

ec = pypfopt.efficient_frontier.EfficientCVaR(None, returns) min_cvar_weights = ec.min_cvar()print(min_cvar_weights)

{'Citibank': 0.0,

'Morgan Stanley': 0.0,

'Goldman Sachs': 0.669324359403484,

'J.P. Morgan': 0.3306756405965026}

Let's practice!

Quantitative Risk Management in Python