Extreme value theory

Quantitative Risk Management in Python

Jamsheed Shorish

Computational Economist

Extreme values

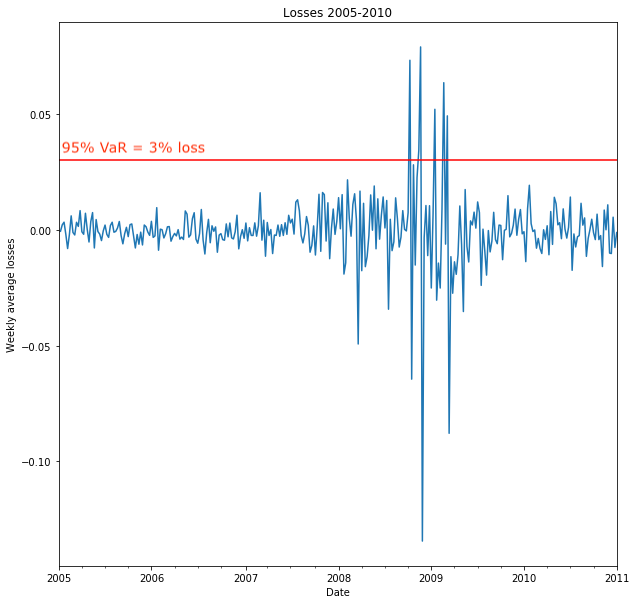

- Portfolio losses: extreme values

- Extreme values: from tail of distribution

- Tail losses: losses exceeding some value

- Model tail losses => better risk management

Extreme value theory

- Extreme value theory: statistical distribution of extreme values

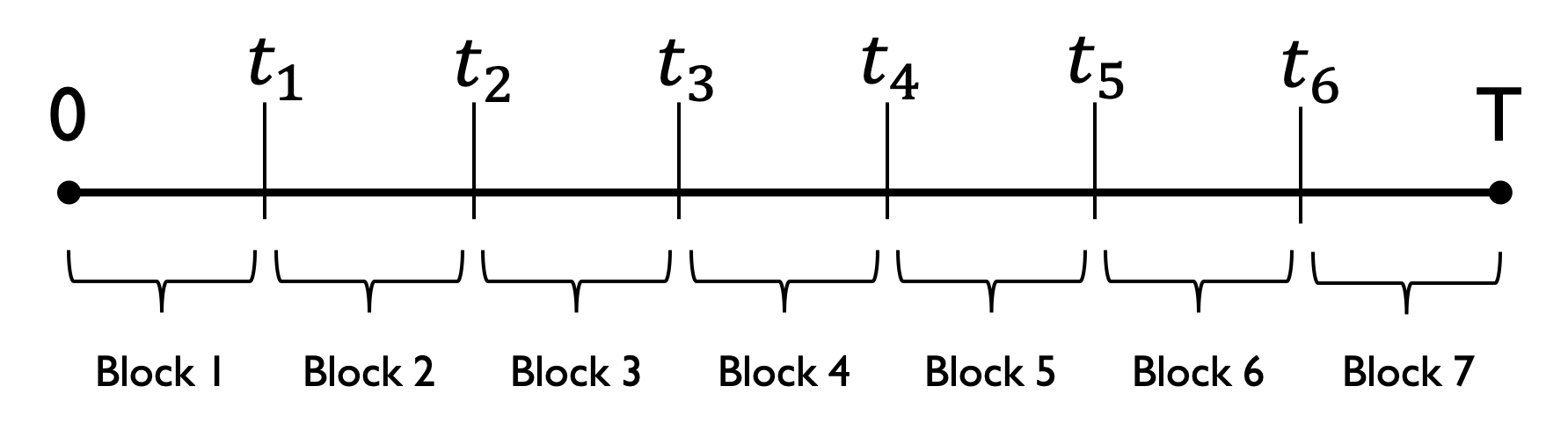

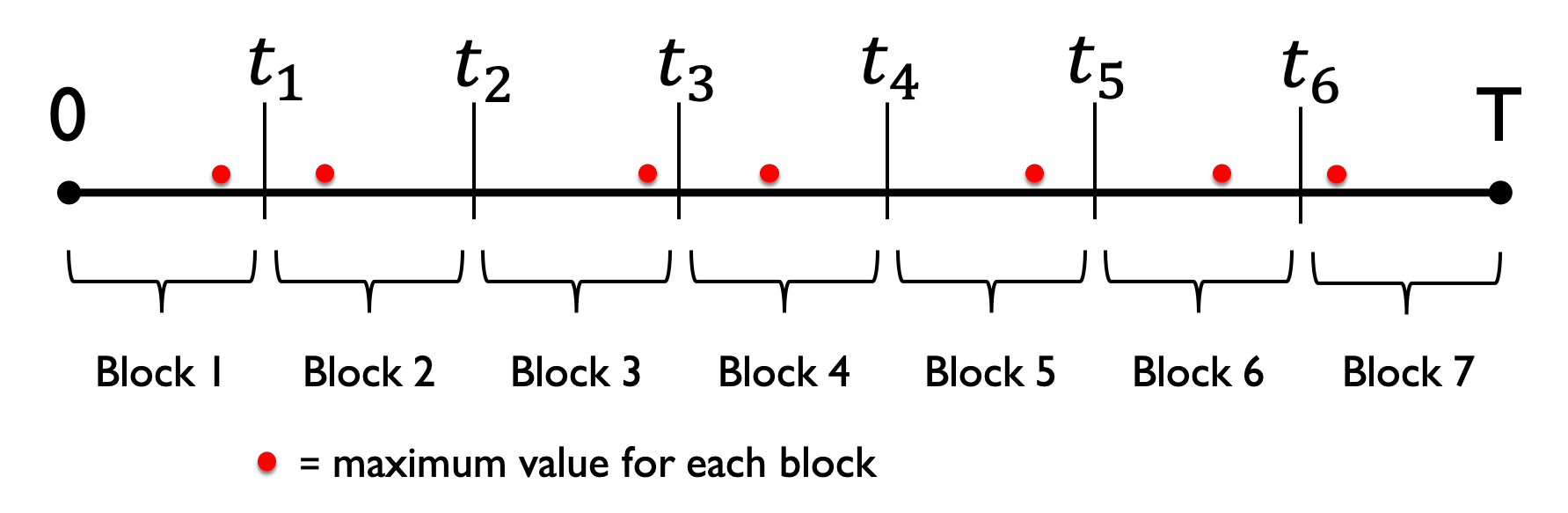

- Block maxima

Extreme value theory

- Extreme value theory: statistical distribution of extreme values

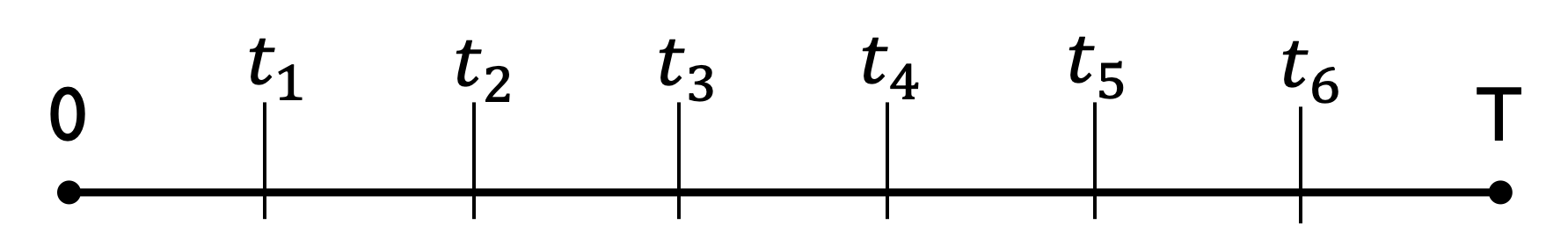

- Block maxima:

- Break period into sub-periods

Extreme value theory

- Extreme value theory: statistical distribution of extreme values

- Block maxima:

- Break period into sub-periods

- Form block from each sub-period

Extreme value theory

- Extreme value theory: statistical distribution of extreme values

- Block maxima:

- Break period into sub-periods

- Form blocks from each sub-period

- Set of block maxima = dataset

- Peak over threshold (POT):

- Find all losses over given level

- Set of such losses = dataset

Generalized Extreme Value Distribution

Example: Block maxima for 2007 - 2009

- Resample losses with desired period (e.g. weekly)

maxima = losses.resample("W").max()

- Resample losses with desired period (e.g. weekly)

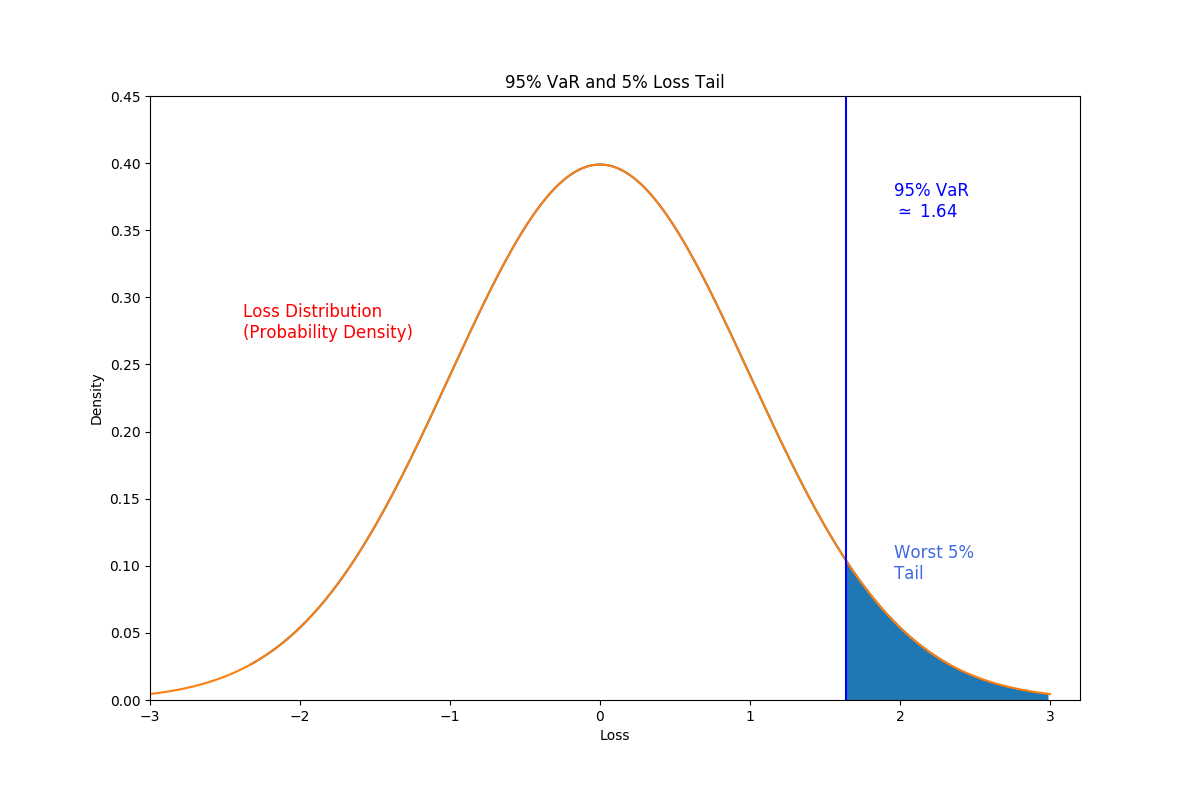

Generalized Extreme Value Distribution (GEV)

- Distribution of maxima of data

- Example: parametric estimation using

scipy.stats.genextremefrom scipy.stats import genextreme params = genextreme.fit(maxima)

VaR and CVaR from GEV distribution

- 99% VaR from GEV distribution

- Use

.ppf()percent point function to find 99% VaR - Requires

paramsfrom fitted GEV distribution - Finds maximum loss over one week period at 99% confidence

- Use

- 99% CVaR from GEV distribution

- CVaR is conditional expectation of loss given VaR as minimum loss

- Use

.expect()method to find expected value

VaR_99 = genextreme.ppf(0.99, *params)

CVar_99 = ( 1 / (1 - 0.99) ) * genextreme.expect(lambda x: x, *params, lb = VaR_99)

Covering losses

- Risk management: covering losses

- Regulatory requirement (banks, insurance)

- Reserves must be available to cover losses

- For a specified period (e.g. one week)

- At a specified confidence level (e.g. 99%)

- VaR from GEV distribution:

- estimates maximum loss

- given period

- given confidence level

- estimates maximum loss

Covering losses

- Example: Initial portfolio value = $1,000,000

- One week reserve requirement at 99% confidence

- $\text{VaR}_{99}$ from GEV distribution: maximum loss over one week at 99% confidence

- Reserve requirement: Portfolio value x $\text{VaR}_{99}$

- Suppose $\text{VaR}_{99}$ = 0.10, i.e. 10% maximum loss

- Reserve requirement = $100,000

- Portfolio value changes => reserve requirement changes

- Regulation sets frequency of reserve requirement updating

Let's practice!

Quantitative Risk Management in Python