Risk factors and the financial crisis

Quantitative Risk Management in Python

Jamsheed Shorish

Computational Economist

Risk factors

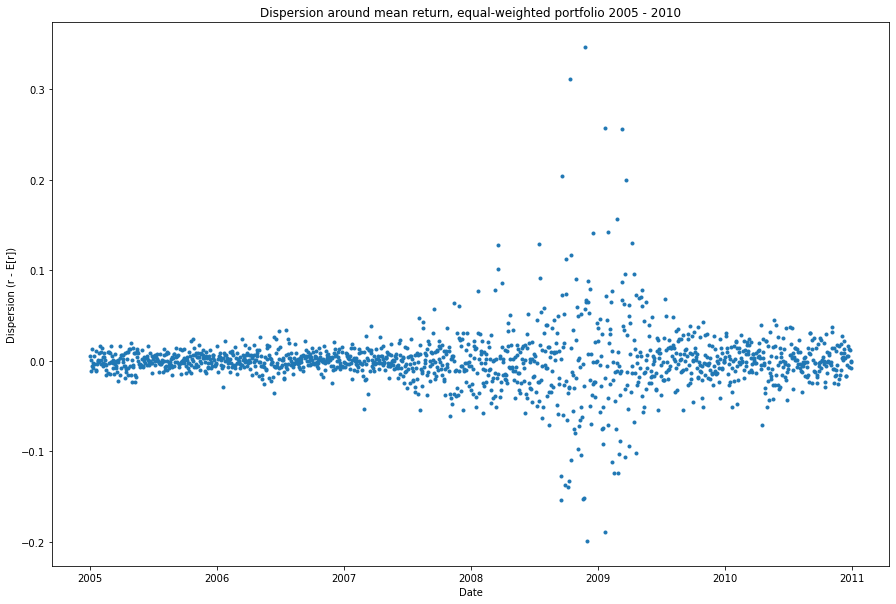

- Volatility: measure of dispersion of returns around expected value

- Time series: expected value = sample average

- What drives expectation and dispersion?

- Risk factors: variables or events driving portfolio return and volatility

Risk exposure

Risk exposure: measure of possible portfolio loss

- Risk factors determine risk exposure

Example: Flood Insurance

- Deductible: out-of-pocket payment regardless of loss

- 100% coverage still leaves deductible to be paid

- So deductible is risk exposure

- Frequent flooding => more volatile flood outcome

- Frequent flooding => higher risk exposure

Systematic risk

Systematic risk: risk factor(s) affecting volatility of all portfolio assets

- Market risk: systematic risk from general financial market movements

Airplane engine failure: systematic risk!

Examples of financial systematic risk factors:

- Price level changes, i.e. inflation

- Interest rate changes

- Economic climate changes

Idiosyncratic risk

Idiosyncratic risk: risk specific to a particular asset/asset class.

Turbulence and the unfastened seatbelt: idiosyncratic risk!

Examples of idiosyncratic risk:

- Bond portfolio: issuer risk of default

- Firm/sector characteristics

- Firm size (market capitalization)

- Book-to-market ratio

- Sector shocks

Factor models

- Factor model: assessment of risk factors affecting portfolio return

- Statistical regression, e.g. Ordinary Least Squares (OLS):

- dependent variable: returns (or volatility)

- independent variable(s): systemic and/or idiosyncratic risk factors

- Fama-French factor model: combination of

- market risk and

- idiosyncratic risk (firm size, firm value)

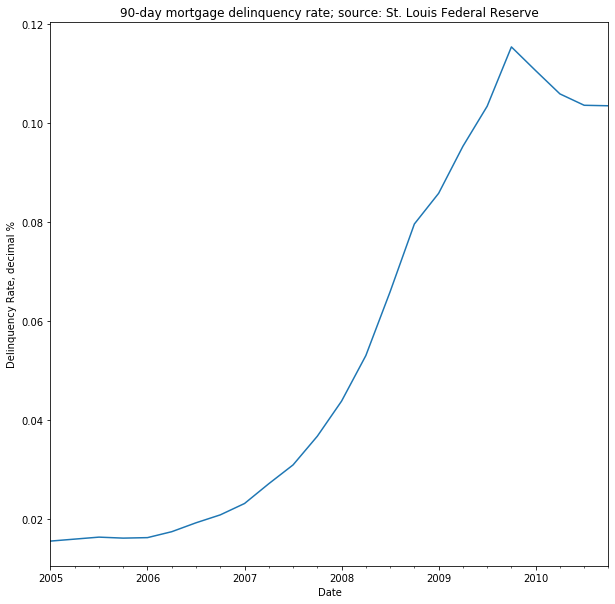

Crisis risk factor: mortgage-backed securities

- Investment banks: borrowed heavily just before the crisis

- Collateral: mortgage-backed securities (MBS)

- MBS: supposed to diversify risk by holding many mortgages of different characteristics

- Flaw: mortgage default risk in fact was highly correlated

- Avalanche of delinquencies/default destroyed collateral value

- 90-day mortgage delinquency: risk factor for investment bank portfolio during the crisis

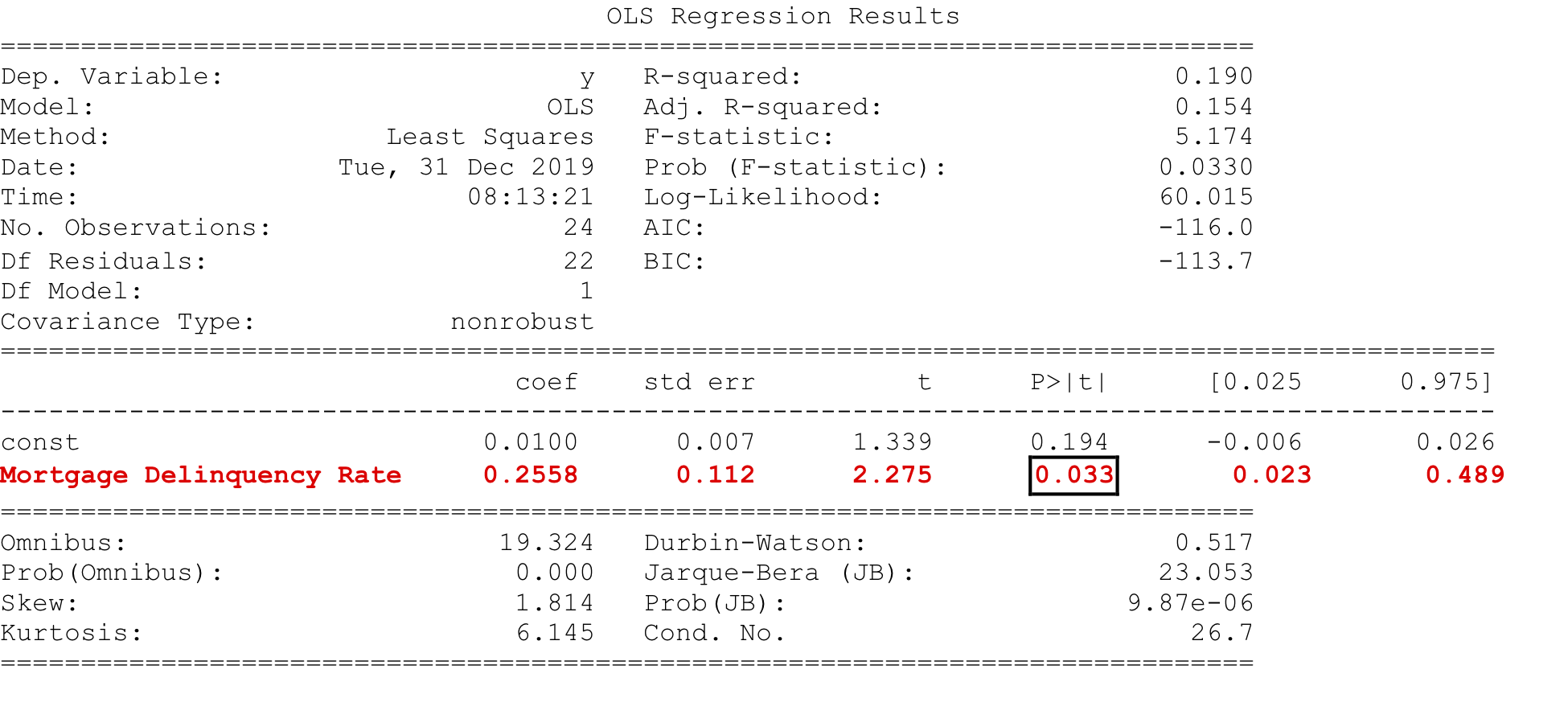

Crisis factor model

- Factor model regression: portfolio returns vs. mortgage delinquency

- Import

statsmodels.apilibrary for regression tools - Fit regression using

.OLS()object and its.fit()method - Display results using regression's

.summary()method

import statsmodels.api as smregression = sm.OLS(returns, delinquencies).fit()print(regression.summary())

Regression .summary() results

Let's practice!

Quantitative Risk Management in Python