Parametric Estimation

Quantitative Risk Management in Python

Jamsheed Shorish

Computational Economist

A class of distributions

- Loss distribution: not known with certainty

- Class of possible distributions?

- Suppose class of distributions $f(x; \theta)$

- $x$ is loss (random variable)

- $\theta$ is vector of unknown parameters

- Example: Normal distribution

- Parameters: $\theta = (\mu, \sigma)$, mean $\mu$ and standard deviation $\sigma$

- Parametric estimation: find 'best' $\theta^\star$ given data

- Loss distribution: $f(x,\theta^\star)$

Fitting a distribution

- Fit distribution according to error-minimizing criteria

- Example:

scipy.stats.norm.fit(), fitting Normal distribution to data- Result: optimally fitted mean and standard deviation

- Example:

- Advantages:

- Can visualize difference between data and estimate using histogram

- Can provide goodness-of-fit tests

Goodness of fit

- How well does an estimated distribution fit the data?

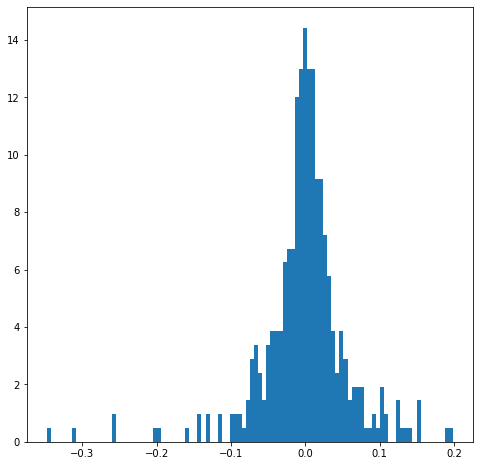

- Visualize: plot histogram of portfolio losses

Goodness of fit

- How well does an estimated distribution fit the data?

- Visualize: plot histogram of portfolio losses

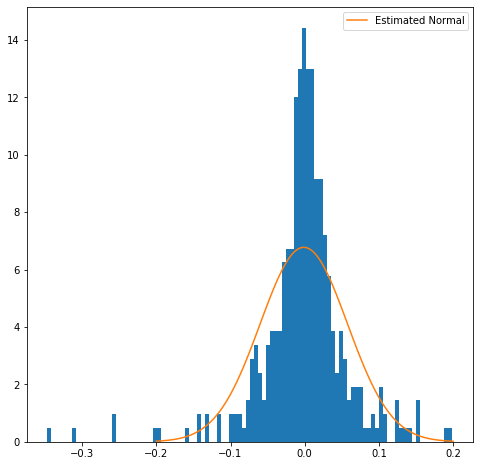

- Normal distribution with

norm.fit()

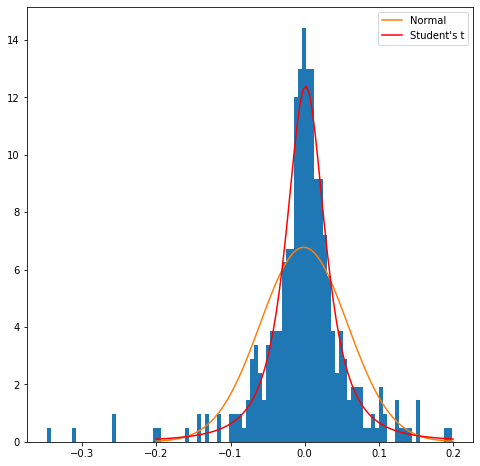

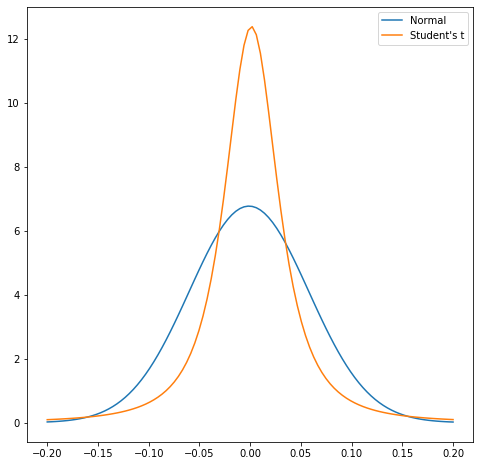

Goodness of fit

- How well does an estimated distribution fit the data?

- Visualize: plot histogram of portfolio losses

- Example:

- Normal distribution with

norm.fit() - Student's t-distribution with

t.fit() - Asymmetrical histogram?

- Normal distribution with

Anderson-Darling test

- Statistical test of goodness of fit

- Test null hypothesis: data are Normally distributed

- Test statistic rejects Normal distribution if larger than

critical_values

- Import

scipy.stats.anderson - Compute test result using

lossdata

from scipy.stats import andersonanderson(loss)

AndersonResult(statistic=11.048641503898523,

critical_values=array([0.57 , 0.649, 0.779, 0.909, 1.081]),

significance_level=array([15. , 10. , 5. , 2.5, 1. ]))

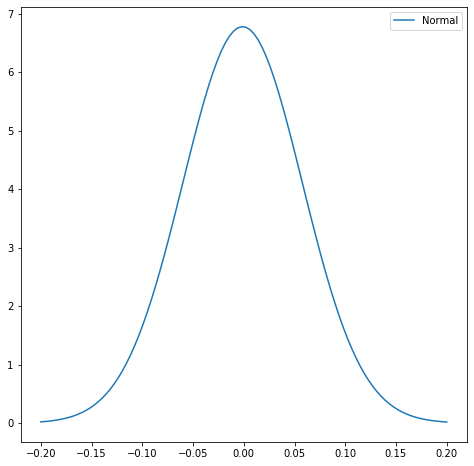

Skewness

- Skewness: degree to which data is non-symmetrically distributed

- Normal distribution: symmetric

Skewness

- Skewness: degree to which data is non-symmetrically distributed

- Normal distribution: symmetric

- Student's t-distribution: symmetric

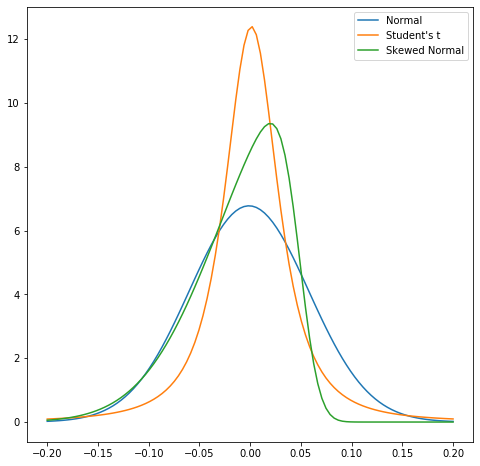

Skewness

- Skewness: degree to which data is non-symmetrically distributed

- Normal distribution: symmetric

- Student's t-distribution: symmetric

- Skewed Normal distribution: asymmetric

- Contains Normal as special case

- Useful for portfolio data, where e.g. losses more frequent than gains

- Available in

scipy.statsasskewnorm

Testing for skewness

- Test how far data is from symmetric distribution:

scipy.stats.skewtest - Null hypothesis: no skewness

- Import

skewtestfromscipy.stats - Compute test result on

lossdata- Statistically significant => use distribution class with skewness

from scipy.stats import skewtestskewtest(loss)

SkewtestResult(statistic=-7.786120875514511,

pvalue=6.90978472959861e-15)

Let's practice!

Quantitative Risk Management in Python