Structural breaks

Quantitative Risk Management in Python

Jamsheed Shorish

Computational Economist

Risk and distribution

- Risk management toolkit

- Risk mitigation: MPT

- Risk measurement: VaR, CVaR

- Risk: dispersion, volatility

- Variance (standard deviation) as risk definition

- Connection between risk and distribution of risk factors as random variables

Stationarity

- Assumption: distribution is same over time

- Unchanging distribution = stationary

- Global financial crisis period efficient frontier

- Not stationary

- Estimation techniques require stationarity

- Historical: unknown stationary distribution from past data

- Parametric: assumed stationary distribution class

- Monte Carlo: assumed stationary distribution for random draws

Structural breaks

- Non-stationary => perhaps distribution changes over time

- Assume specific points in time for change

- Break up data into sub-periods

- Within each sub-period, assume stationarity

- Structural break(s): point(s) of change

- Change in 'trend' of average and/or volatility of data

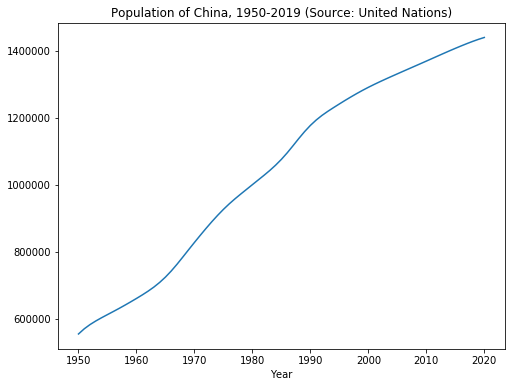

Example: China's population growth

- Examine period 1950 - 2019

- Trend is roughly linear...

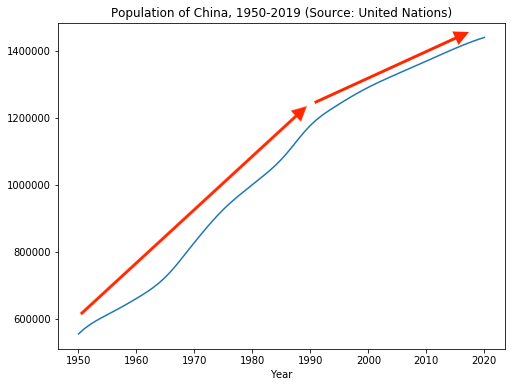

Example: China's population growth

- Examine period 1950 - 2019

- Trend is roughly linear...

- ...but seems to slow down from around 1990

- Possible structural break near 1990.

- Implies distribution of net population (births - deaths) changed

- Possible reasons: government policy, standard of living, etc.

The Chow test

- Previous example: visual evidence for structural break

- Quantification: statistical measure

- Chow Test:

- Test for existence of structural break given linear model

- Null hypothesis: no break

- Requires three OLS regressions

- Regression for entire period

- Two regressions, before and after break

- Collect sum-of-squared residuals

- Test statistic is distributed according to "F" distribution

The Chow test in Python

- Hypothesis: structural break in 1990 for China population

- Assume linear "factor model": $$\log(\text{Population}_t) = \alpha + \beta * \text{Year}_t + u_t$$

- OLS regression using

statsmodels'sOLSobject over full period 1950 - 2019- Retrieve sum-of-squared residual

res.ssr

- Retrieve sum-of-squared residual

import statsmodels.api as sm res = sm.OLS(log_pop, year).fit()print('SSR 1950-2019: ', res.ssr)

SSR 1950-2019: 0.29240576138055463

The Chow test in Python

- Break 1950 - 2019 into 1950 - 1989 and 1990 - 2019 sub-periods

- Perform OLS regressions on each sub-period

- Retrieve

res_before.ssrandres_after.ssr

- Retrieve

pop_before = log_pop.loc['1950':'1989']; year_before = year.loc['1950':'1989']; pop_after = log_pop.loc['1990':'2019']; year_after = year.loc['1990':'2019'];res_before = sm.OLS(pop_before, year_before).fit() res_after = sm.OLS(pop_after, year_after).fit()print('SSR 1950-1989: ', res_before.ssr) print('SSR 1990-2019: ', res_after.ssr)

SSR 1950-1989: 0.011741113017411783

SSR 1990-2019: 0.0013717593339608077

The Chow test in Python

- Compute the F-distributed Chow test statistic

- Compute the numerator

- k = 2 degrees of freedom = 2 OLS coefficients $\alpha$, $\beta$

- Compute the denominator

- 66 degrees of freedom = total number of data points (70) - 2*k

- Compute the numerator

numerator = (ssr_total - (ssr_before + ssr_after)) / 2denominator = (ssr_before + ssr_after) / 66chow_test = numerator / denominator print("Chow test statistic: ", chow_test, "; Critical value, 99.9%: ", 7.7)

Chow test statistic: 702.8715822890057; Critical value, 99.9%: 7.7

Let's practice!

Quantitative Risk Management in Python