Risk exposure and loss

Quantitative Risk Management in Python

Jamsheed Shorish

Computational Economist

A vacation analogy

Hotel reservations for vacation

Pay in advance, before stay

- Low room rate

- Non-refundable: cancellation fee = 100% of room rate

Pay after arrival

- High room rate

- Partially refundable: cancellation fee of 20% of room rate

Deciding between options

- What determines your decision?

- Chance of negative shock: illness, travel disruption, weather

- Probability of loss

- Loss associated with shock: amount or conditional amount

- e.g. VaR, CVaR

- Desire to avoid shock: personal feeling

- Risk tolerance

- Chance of negative shock: illness, travel disruption, weather

Risk exposure and VaR

- Risk exposure: probability of loss x loss measure

- Loss measure: e.g. VaR

- 10% chance of canceling vacation: P(Illness) = 0.10

- Non-refundable:

- Total non-refundable hotel cost: € 500

- VaR at 90% confidence level: € 500

- Partially refundable:

- Refundable hotel cost: € 550

- VaR at 90% confidence level: 20% cancellation fee x € 550 = € 110

Calculating risk exposure

- Non-refundable exposure ("$\text{nr}$"):

- P(illness) x $\text{VaR}_{0.90}^{\text{nr}}$ = 0.10 x € 500 = € 50.

- Partially refundable exposure ("$\text{pr}$"):

- P(illness) x $\text{VaR}_{0.90}^{\text{pr}}$ = 0.10 x € 110 = € 11.

- Difference in risk exposure: € 50 - € 11 = € 39.

- Total price difference between offers: € 550 - € 500 = € 50.

- Risk tolerance: is paying € 50 more worth avoiding € 39 of additional exposure?

Risk tolerance and risk appetite

- Risk-neutral: only expected values matter

- € 39 < € 50 $\Rightarrow$ prefer non-refundable option

- Risk-averse: uncertainty itself carries a cost

- € 39 < € 50 $\Rightarrow$ prefer partially refundable option

- Enterprise/institutional risk management: preferences as risk appetite

- Individual investors: preferences as risk tolerance

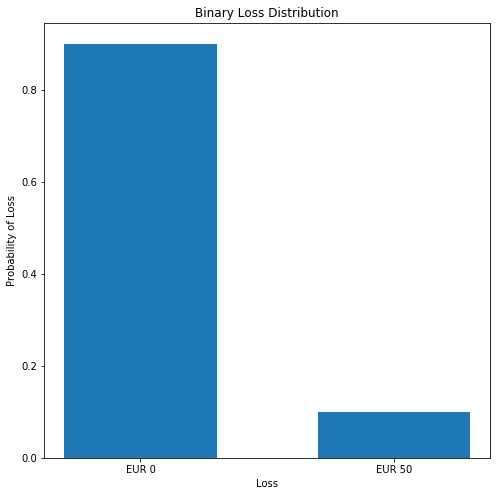

Loss distribution - discrete

- Risk exposure depends upon loss distribution (probability of loss)

- Vacation example: 2 outcomes from random risk factor

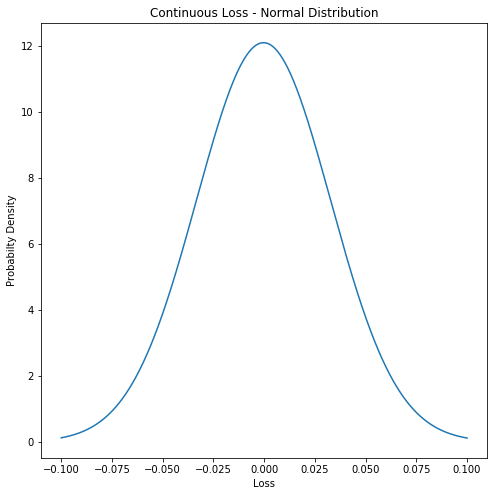

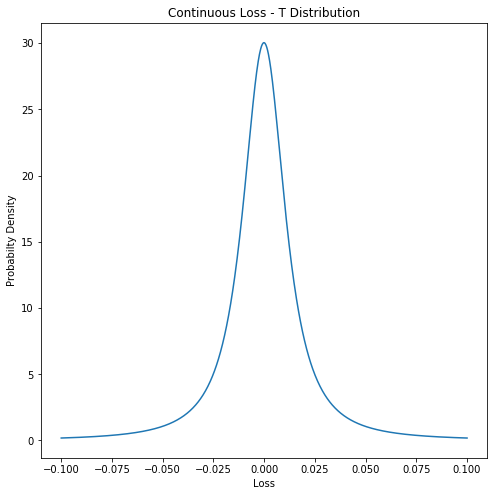

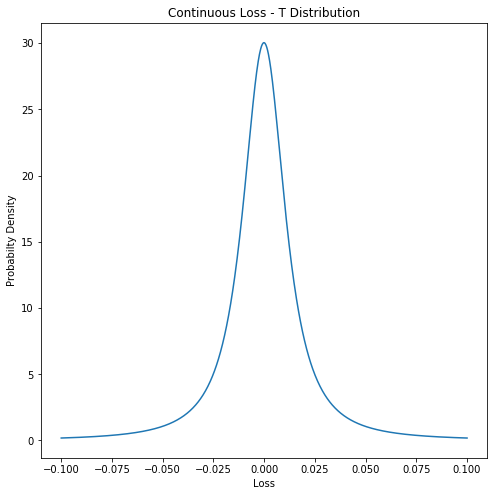

Loss distribution - continuous

- Risk exposure depends upon loss distribution (probability of loss)

- Vacation example: 2 outcomes from random risk factor

- More generally: continuous loss distribution

- Normal distribution: good for large samples

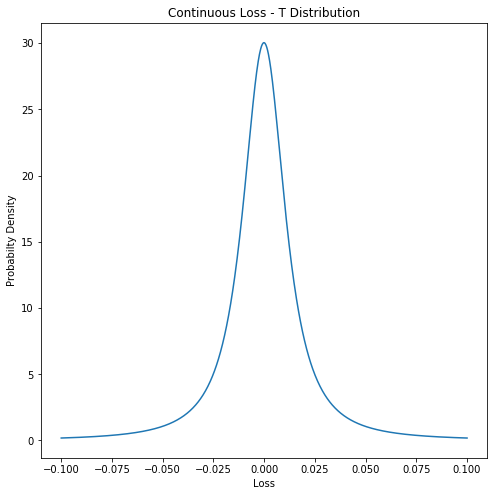

Loss distribution - continuous

- Risk exposure depends upon loss distribution (probability of loss)

- Vacation example: 2 outcomes from random risk factor

- More generally: continuous loss distribution

- Normal distribution: good for large samples

- Student's t-distribution: good for smaller samples

Primer: Student's t-distribution

- Also referred to as T distribution

- Has "fatter" tails than Normal for small samples

- Similar to portfolio returns/losses

- As sample size grows, T converges to Normal distribution

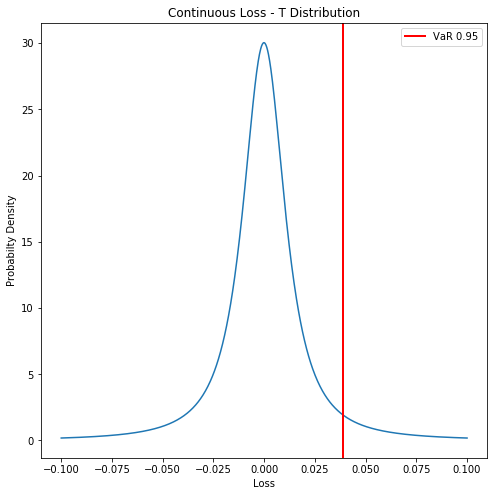

T distribution in Python

- Example: compute 95% VaR from T distribution

- Import

tdistribution fromscipy.stats - Fit

portfolio_lossdata usingt.fit()

- Import

from scipy.stats import tparams = t.fit(portfolio_losses)

T distribution in Python

- Example: compute 95% VaR from T distribution

- Import

tdistribution fromscipy.stats - Fit

portfolio_lossdata usingt.fit() - Compute percent point function with

.ppf()to find VaR

- Import

from scipy.stats import tparams = t.fit(portfolio_losses)VaR_95 = t.ppf(0.95, *params)

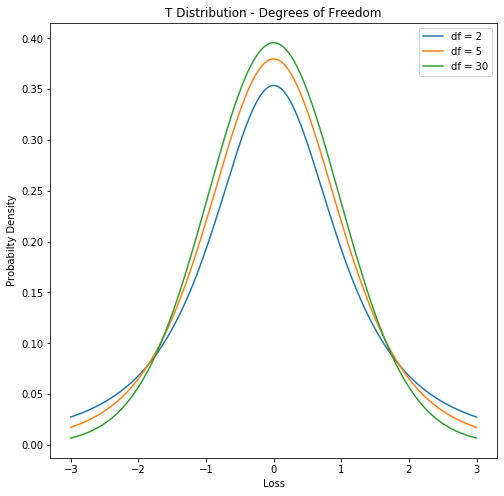

Degrees of freedom

- Degrees of freedom (df): number of independent observations

- Small df: "fat tailed" T distribution

- Large df: Normal distribution

x = np.linspace(-3, 3, 100)plt.plot(x, t.pdf(x, df = 2))plt.plot(x, t.pdf(x, df = 5))plt.plot(x, t.pdf(x, df = 30))

Let's practice!

Quantitative Risk Management in Python