Distribution assumptions

GARCH Models in Python

Chelsea Yang

Data Science Instructor

Why make assumptions

Volatility is not directly observable

GARCH model use residuals as volatility shocks $$ r_t = \mu_t + \epsilon_t $$

Volatility is related to the residuals: $$ \epsilon_t = \sigma_t * \zeta (WhiteNoise)$$

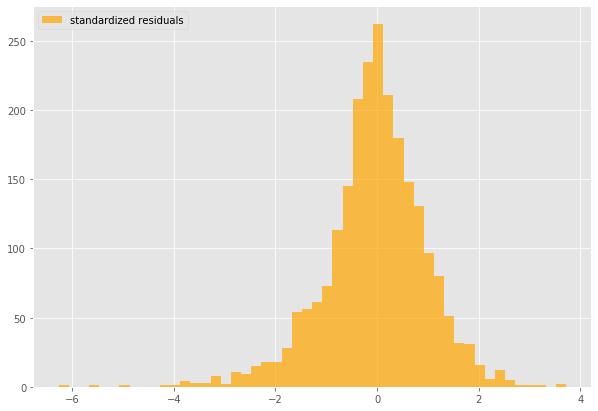

Standardized residuals

- Residual = predicted return - mean return $$ residuals = \epsilon_t = r_t - \mu_t $$

- Standardized residual = residual / return volatility $$ std\,Resid = \frac{\epsilon_t}{\sigma_t} $$

Residuals in GARCH

gm_std_resid = gm_result.resid / gm_result.conditional_volatility

plt.hist(gm_std_resid, facecolor = 'orange',label = 'standardized residuals')

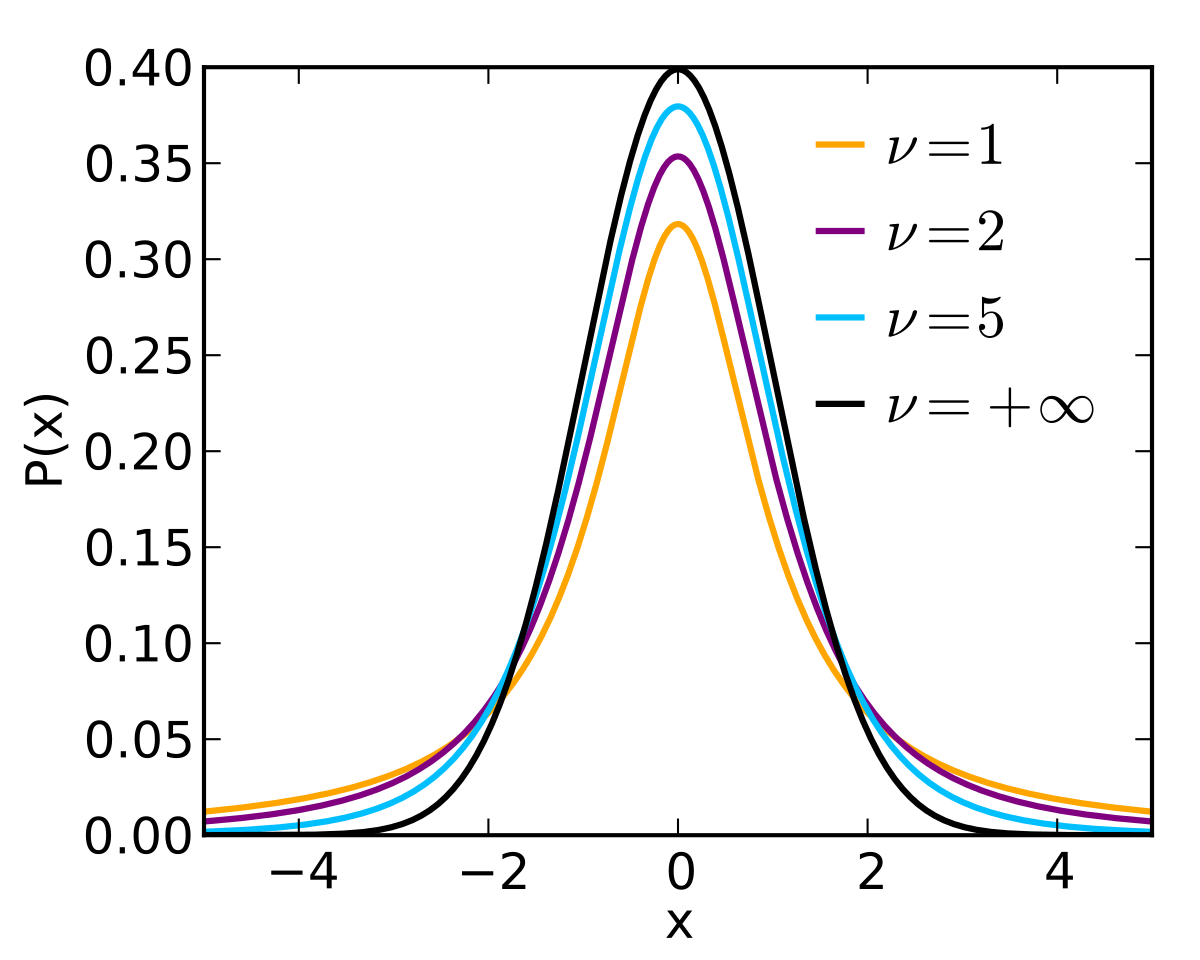

Fat tails

- Higher probability to observe large (positive or negative) returns than under a normal distribution

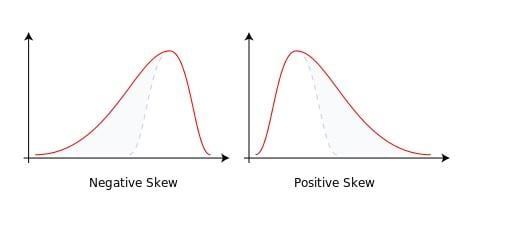

Skewness

- Measure of asymmetry of a probability distribution

Student's t-distribution

$\nu$ parameter of a Student's t-distribution indicates its shape

GARCH with t-distribution

arch_model(my_data, p = 1, q = 1,

mean = 'constant', vol = 'GARCH',

dist = 't')

Distribution

========================================================================

coef std err t P>|t| 95.0% Conf. Int.

.-----------------------------------------------------------------------

nu 4.9249 0.507 9.709 2.768e-22 [ 3.931, 5.919]

========================================================================

GARCH with skewed t-distribution

arch_model(my_data, p = 1, q = 1,

mean = 'constant', vol = 'GARCH',

dist = 'skewt')

Distribution

===========================================================================

coef std err t P>|t| 95.0% Conf. Int.

.--------------------------------------------------------------------------

nu 5.2437 0.575 9.118 7.681e-20 [ 4.117, 6.371]

lambda -0.0822 2.541e-02 -3.235 1.216e-03 [ -0.132,-3.241e-02]

===========================================================================

Let's practice!

GARCH Models in Python