GARCH rolling window forecast

GARCH Models in Python

Chelsea Yang

Data Science Instructor

Rolling window for out-of-sample forecast

An exciting part of financial modeling: predict the unknown

Rolling window forecast: repeatedly perform model fitting and forecast as time rolls forward

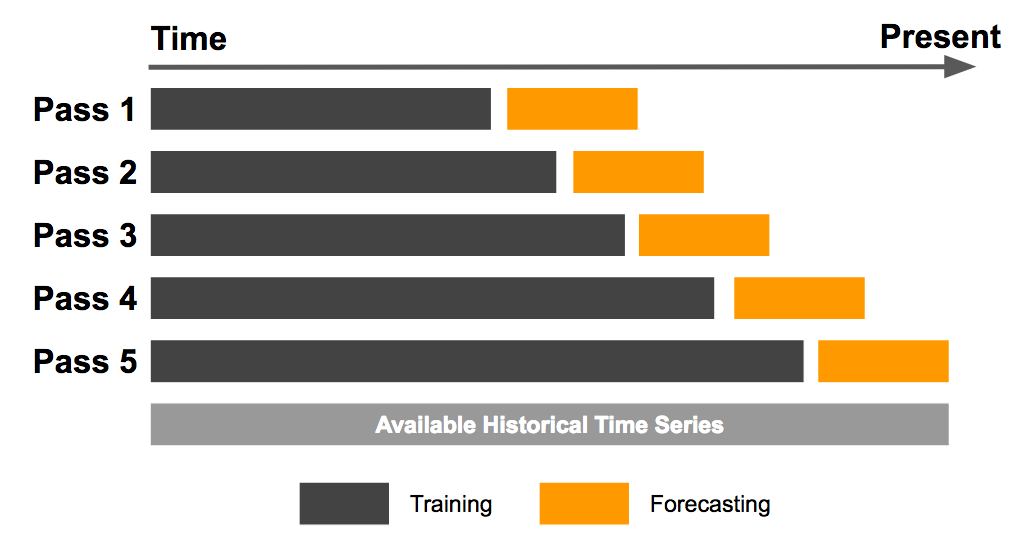

Expanding window forecast

Continuously add new data points to the sample

Motivations of rolling window forecast

- Avoid lookback bias

- Less subject to overfitting

- Adapt forecast to new observations

Implement expanding window forecast

Expanding window forecast:

for i in range(120):

gm_result = basic_gm.fit(first_obs = start_loc,

last_obs = i + end_loc, disp = 'off')

temp_result = gm_result.forecast(horizon = 1).variance

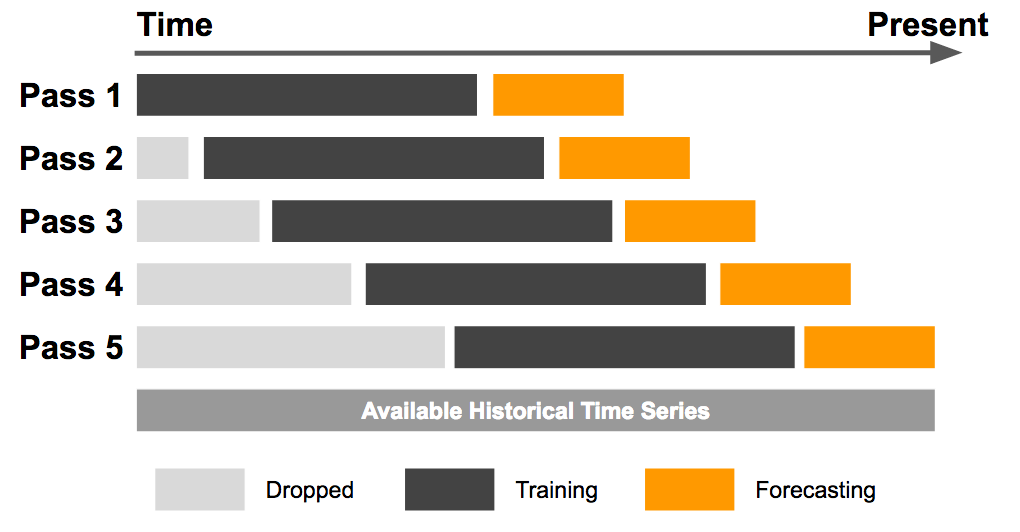

Fixed rolling window forecast

New data points are added while old ones are dropped from the sample

Implement fixed rolling window forecast

Fixed rolling window forecast:

for i in range(120):

# Specify rolling window range for model fitting

gm_result = basic_gm.fit(first_obs = i + start_loc,

last_obs = i + end_loc, disp = 'off')

temp_result = gm_result.forecast(horizon = 1).variance

How to determine window size

Usually determined on a case-by-case basis

Too wide window size: include obsolete data that may lead to higher variance

Too narrow window size: exclude relevant data that may lead to higher bias

The optimal window size: trade-off to balance bias and variance

Let's practice!

GARCH Models in Python