Volatility models for asymmetric shocks

GARCH Models in Python

Chelsea Yang

Data Science Instructor

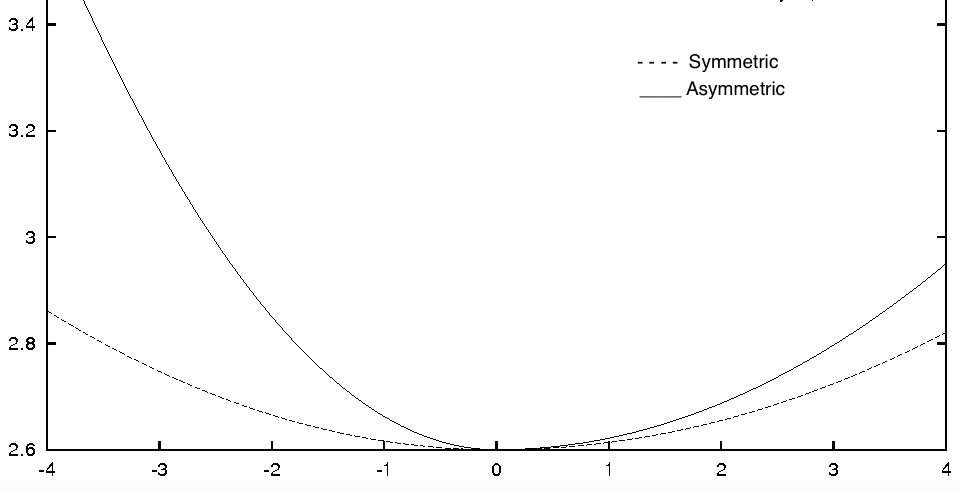

Asymmetric shocks in financial data

News impact curve:

Leverage effect

Debt-equity Ratio = Debt $/$ Equity

Stock price goes down, debt-equity ratio goes up

Riskier!

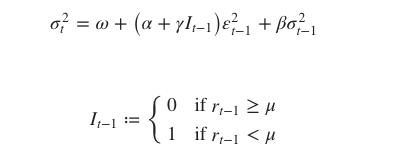

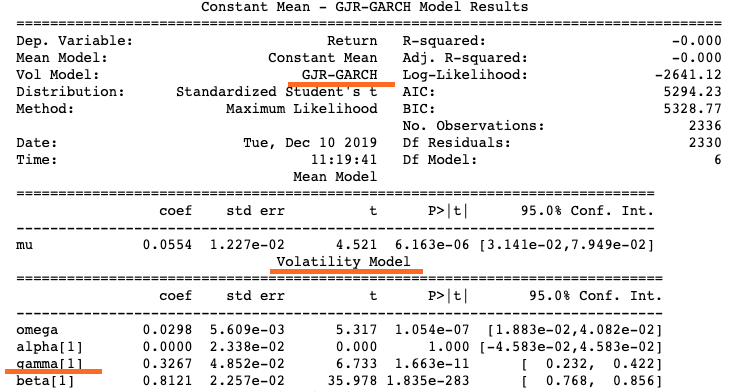

GJR-GARCH

GJR-GARCH in Python

arch_model(my_data, p = 1, q = 1, o = 1,

mean = 'constant', vol = 'GARCH')

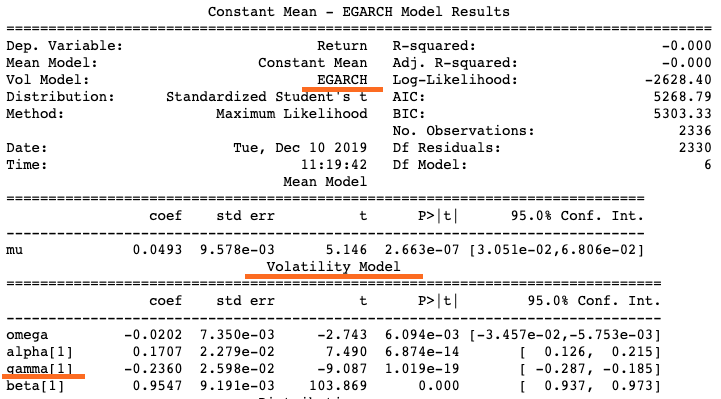

EGARCH

A popular option to model asymmetric shocks

Exponential GARCH

Add a conditional component to model the asymmetry in shocks similar to the GJR-GARCH

No non-negative constraints on alpha, beta so it runs faster

EGARCH in Python

arch_model(my_data, p = 1, q = 1, o = 1,

mean = 'constant', vol = 'EGARCH')

Which model to use

GJR-GARCH or EGARCH?

Which model is better depends on the data

Let's practice!

GARCH Models in Python