A simple life insurance

Life Insurance Products Valuation in R

Roel Verbelen, Ph.D.

Statistician, Finity Consulting

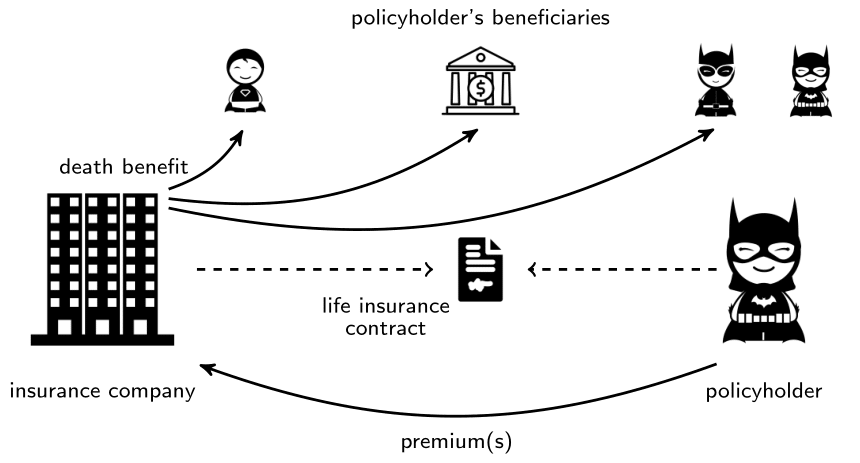

The life insurance

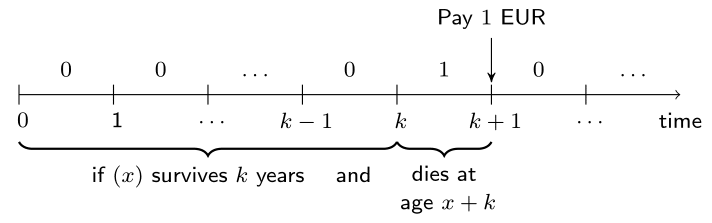

A simple life insurance

- The product is sold to $(x)$ at time 0.

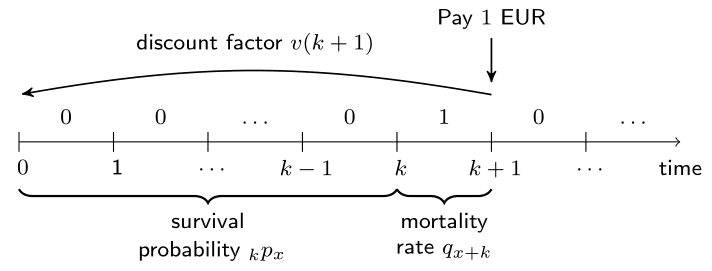

A simple life insurance

- Expected Present Value:

$\quad \,$ The EPV is

$$ {}_{k|1}A_{x} = 1 \cdot \ v(k+1) \cdot \ {}_kp_x \cdot \ q_{x+k} = 1 \cdot \ v(k+1) \cdot \ {}_{k|}q_{x} \, . $$

A simple life insurance in R

Compute ${}_{5|1}A_{65} = 1 \cdot \ v(6) \cdot \ {}_{5|}q_{65} = 1 \cdot \ v(6) \cdot \ {}_5p_{65} \cdot \ q_{70} $ for constant $i = 3\%$.

# Mortality rates and one-year survival probabilities

qx <- life_table$qx

px <- 1 - qx

# 5-year deferred mortality probability of (65)

kpx <- prod(px[(65 + 1):(69 + 1)])

kqx <- kpx * qx[70 + 1]

kqx

0.02086664

A simple life insurance in R (cont.)

# Discount factor

discount_factor <- (1 + 0.03) ^ - 6

discount_factor

0.8374843

# EPV of the simple life insurance

1 * discount_factor * kqx

0.01747548

Let's practice!

Life Insurance Products Valuation in R